South Korea IoT Security Market Size, Share, Trends and Forecast by Component, Security Type, Vertical, and Region, 2025-2033

South Korea IoT Security Market Overview:

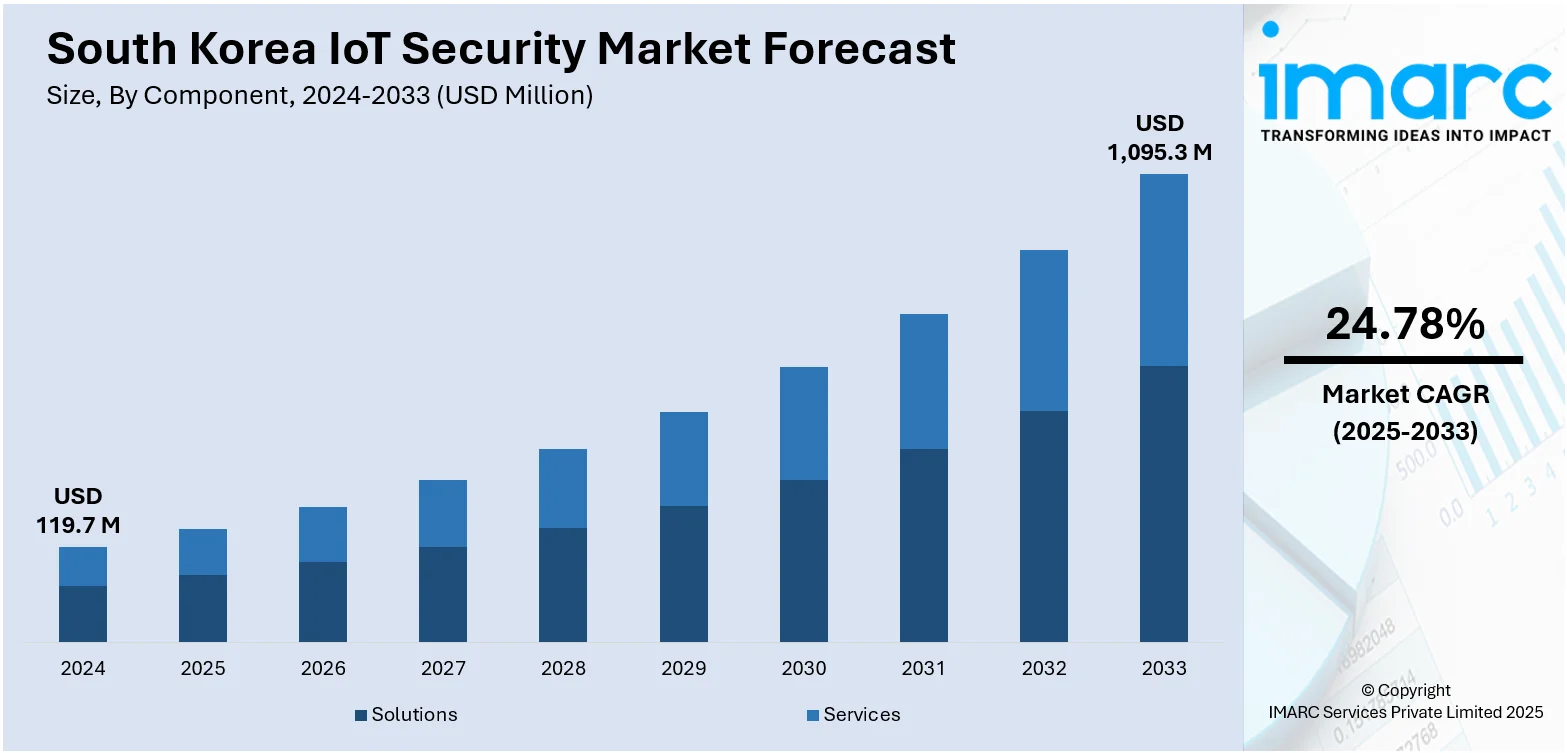

The South Korea IoT security market size reached USD 119.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,095.3 Million by 2033, exhibiting a growth rate (CAGR) of 24.78% during 2025-2033. The market is driven by strict national regulations that enforce security-by-design practices in IoT systems. Expanding deployment of connected devices across smart factories, healthcare, and energy infrastructure intensifies the need for robust, scalable protection. Rising sophistication of cyber threats is pushing businesses toward proactive risk frameworks, further augmenting the South Korea IoT security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 119.7 Million |

| Market Forecast in 2033 | USD 1,095.3 Million |

| Market Growth Rate 2025-2033 | 24.78% |

South Korea IoT Security Market Trends:

Proliferation of Connected Devices Across Industries

South Korea’s rapid industrial digitization and smart infrastructure development are leading to unprecedented deployment of connected devices across numerous end-use sectors. For instance, on July 8, 2025, South Korea's government unveiled a KRW 27.3 Billion (USD 19.9 Million) initiative to build micro data centers (MDCs) powered by domestically developed AI chips. These MDCs will provide low-latency, cost-effective AI services to SMEs, hospitals, and public institutions, with a focus on regions outside metropolitan areas. Connected healthcare platforms as well as smart systems depend on real-time data flow, making them vulnerable to cyber intrusions. Each connected node, whether a machine sensor, wearable device, or control system, represents a potential entry point for malicious actors. The increasing density of these endpoints creates a pressing need for endpoint detection and response (EDR), identity verification protocols, and encrypted data pathways. Businesses now recognize that IoT security is not a modular add-on, but a critical foundation of digital resilience. Manufacturers are embedding secure chipsets and cryptographic modules into devices at the design phase. In the energy and logistics sectors, where system disruption has far-reaching consequences, multi-layered security solutions are being prioritized. These include network segmentation, access control policies, and device monitoring tools. As enterprises scale up automation and data integration across value chains, the exposure to cyber risk grows proportionally. The resulting demand for security solutions tailored to complex, heterogeneous IoT environments is a defining trend of South Korea’s cybersecurity landscape and a major contributor to South Korea IoT security market growth.

To get more information on this market, Request Sample

Evolving Threat Landscape and Strategic Risk Management

The frequency and complexity of cyber threats targeting IoT ecosystems in South Korea have intensified, prompting a shift from reactive defense to proactive risk management. Sophisticated attacks, including ransomware on industrial systems, data interception on consumer devices, and coordinated assaults on public infrastructure, have raised alarm across industries. In response, organizations are moving beyond conventional firewalls and adopting adaptive security strategies involving behavioral analytics, zero-trust frameworks, and continuous authentication. In line with this growing need for advanced security, recent developments highlight the increasing focus on enhancing IoT security infrastructure. On June 22, 2025, SK Group and AWS announced a 15-year partnership to build an AI data center in Ulsan, South Korea, which will strengthen the country’s AI and IoT ecosystem. The project is expected to generate up to 78,000 direct and indirect jobs and forms part of AWS's USD 5.88 Billion (approx. 7.85 Trillion won) investment in South Korea by 2027, reflecting a broader industry push toward robust, secure, and scalable cloud infrastructure. There is also increasing adoption of blockchain for securing device identities and AI-driven threat intelligence for anticipating breaches before they occur. Enterprises are developing dedicated IoT security teams and collaborating with external security service providers to design end-to-end protocols that cover device, network, and application layers. Insurance firms have begun linking cyber insurance premiums to the strength of an organization’s IoT security posture, further incentivizing investment. Within national defense and telecom sectors, emphasis on cyber hardening has led to increased deployment of quantum-resistant algorithms and advanced anomaly detection systems. This evolving threat environment is no longer a backdrop but a central factor in organizational decision-making. Heightened awareness of strategic risk is transforming IoT security from a technical requirement into a boardroom priority, accelerating momentum in the market.

South Korea IoT Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, security type, and vertical.

Component Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions and services.

Security Type Insights:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

The report has provided a detailed breakup and analysis of the market based on the security type. This includes network security, endpoint security, application security, cloud security, and others.

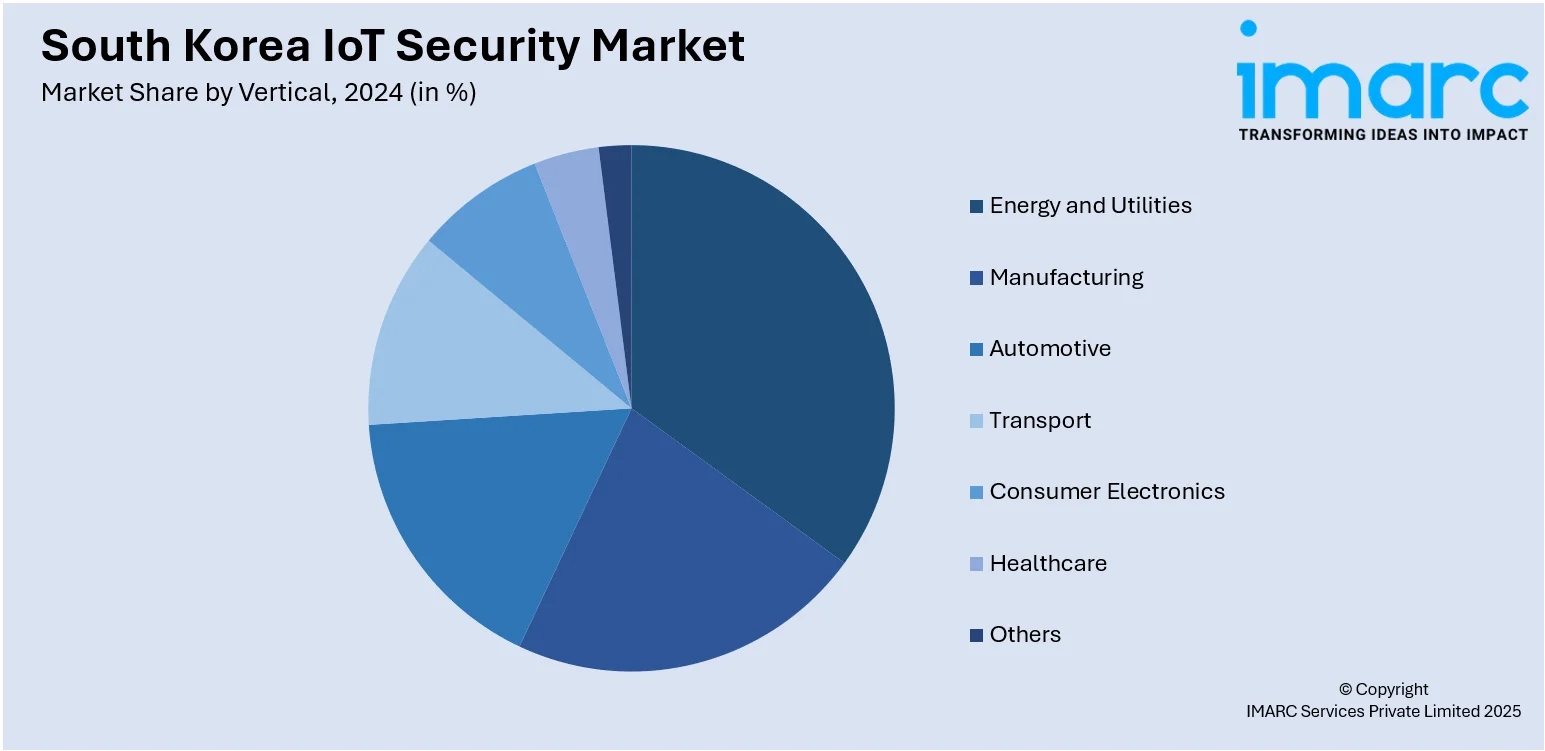

Vertical Insights:

- Energy and Utilities

- Manufacturing

- Automotive

- Transport

- Consumer Electronics

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes energy and utilities, manufacturing, automotive, transport, consumer electronics, healthcare, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea IoT Security Market News:

- On July 9, 2025, Trimble and KT Corporation announced a collaboration to deliver precise positioning services across South Korea using Trimble RTX Fast. This partnership will offer real-time, centimeter-level positioning to automotive OEMs and IoT companies, improving applications in smart cities, field robotics, and connected vehicles. With a network covering over 7 million square miles (18 million square kilometers), this partnership will ensure secure, accurate positioning data for IoT systems, supporting the development of secure IoT networks and applications in South Korea.

- On December 14, 2023, South Korea's Ministry of Science and ICT (MSIT) and the Korea Internet & Security Agency (KISA) signed a Memorandum of Understanding (MoU) with Singapore's Cyber Security Agency (CSA) to mutually recognize their Internet of Things (IoT) security certification systems. This agreement aims to enhance the international credibility of South Korean IoT products, particularly in sectors such as home appliances, transportation, smart cities, and healthcare.

South Korea IoT Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Security Types Covered | Network Security, Endpoint Security, Application Security, Cloud Security, Others |

| Verticals Covered | Energy and Utilities, Manufacturing, Automotive, Transport, Consumer Electronics, Healthcare, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea IoT security market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea IoT security market on the basis of component?

- What is the breakup of the South Korea IoT security market on the basis of security type?

- What is the breakup of the South Korea IoT security market on the basis of vertical?

- What is the breakup of the South Korea IoT security market on the basis of region?

- What are the various stages in the value chain of the South Korea IoT security market?

- What are the key driving factors and challenges in the South Korea IoT security?

- What is the structure of the South Korea IoT security market and who are the key players?

- What is the degree of competition in the South Korea IoT security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea IoT security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea IoT security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea IoT security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)