South Korea Life and Non-Life Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, and Region, 2026-2034

South Korea Life and Non-Life Insurance Market Overview:

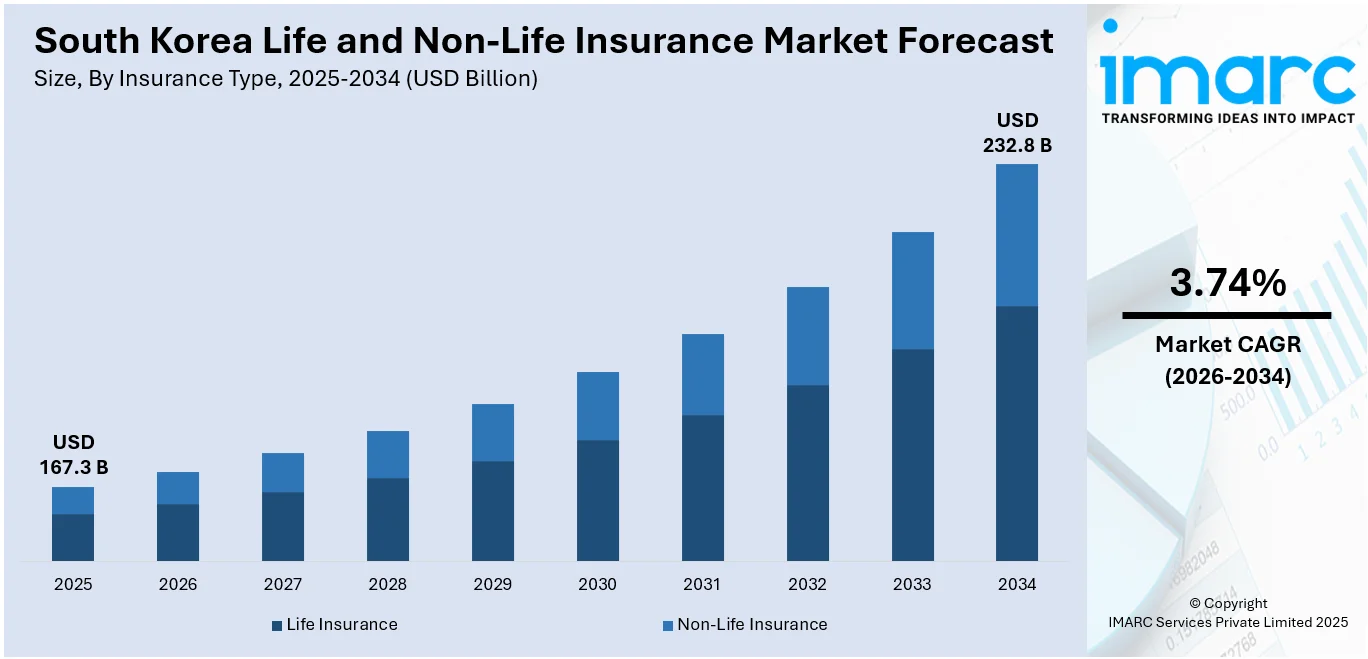

The South Korea life and non-life insurance market size reached USD 167.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 232.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. The market growth is being driven by government reforms and aging population, along with the rising use of advanced technologies such artificial intelligence (AI), big data analytics, and the internet of things (IoT).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 167.3 Billion |

| Market Forecast in 2034 | USD 232.8 Billion |

| Market Growth Rate 2026-2034 | 3.74% |

To get more information on the regional analysis of this market, Request Sample

South Korea Life and Non-Life Insurance Market Trends:

Favorable Demographics and Economic Factors

South Korea has a high insurance penetration rate, ranking among the highest in the world. For instance, the total premium income exceeded USD 86 Billion in H1 2024, a 4% year-on-year increase from H1 2023, as per industry reports. The aging population and declining fertility rates in the country are influencing the demand for insurance products, especially health and annuity products. Based on data from Statistics Korea, the Life expectancy at birth was 83.5 years in 2023, whereas the median age is projected to exceed 60 years in 2052. The South Korea life and non-life insurance market growth is further augmented by the stable economic growth in the country. Regulatory reforms such as the implementation of new accounting rules IFRS 17 and 9 and Korean Insurance Capital Standard (K-ICS) are further projected to enhance solvency standards and increase transparency.

To get more information on this market, Request Sample

Rise of InsurTech and Digitization

The insurance sector in South Korea is undergoing a digital transformation driven by technologies like Big Data, AI, and IoT to provide efficient and innovative services. Insurers are increasingly utilizing these technologies to assess risk more accurately, streamline underwriting processes, and improve claims management. This data-driven approach allows for more tailored insurance products that align with consumer behavior. For example, Carrot General Insurance Corp., a full-stack digital insurance platform based in Korea, was granted exclusive rights to use behavioral-based insurance (BBI) for six months for auto insurance. The BBI employs data from 1.5 million customers and offers up to 20% discount to drivers exhibiting safe behavior, which has led to reduced accident rates among users.

South Korea Life and Non-Life Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on insurance type and distribution channel.

Insurance Type Insights:

- Life Insurance

- Individual

- Group

- Non-Life Insurance

- Home

- Motor

- Health

- Rest of Non-Life Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes life insurance (individual, and group), and non-life insurance (home, motor, health, and rest of non-life insurance).

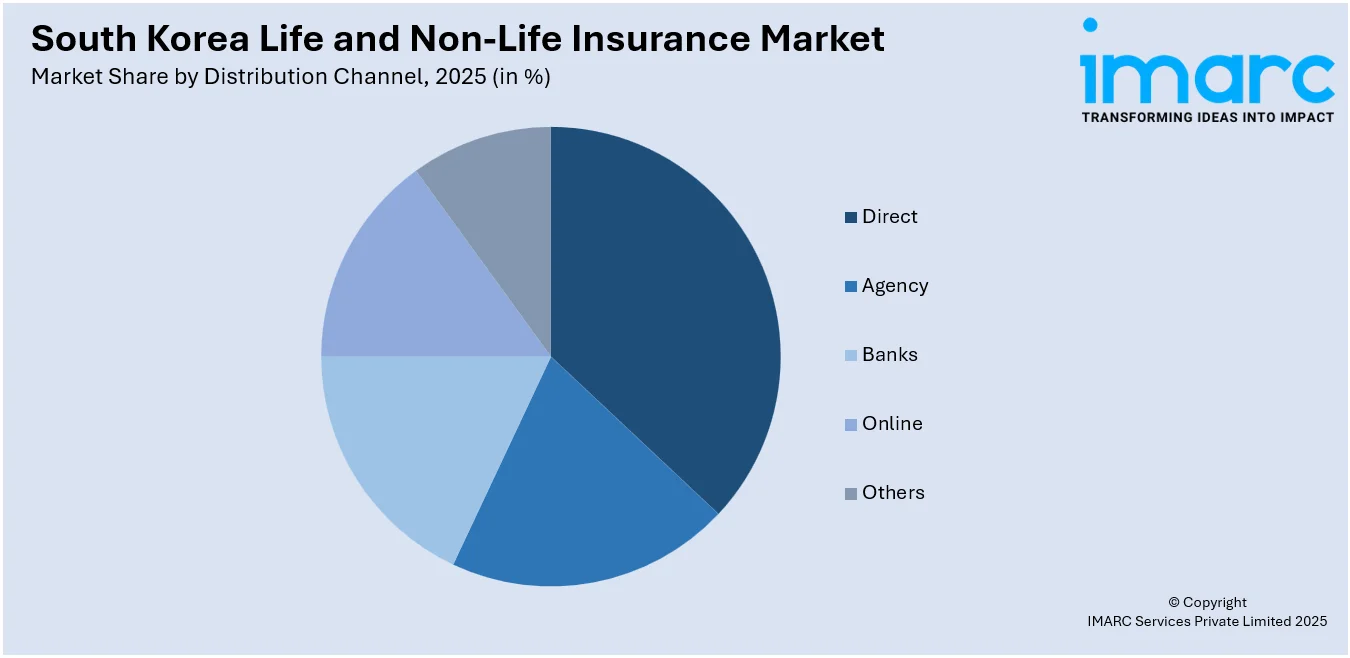

Distribution Channel Insights:

Access the comprehensive market breakdown, Request Sample

- Direct

- Agency

- Banks

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct, agency, banks, online, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Life and Non-Life Insurance Market News:

- November 2024: Hanwha Life, a top insurance provider in South Korea, has acquired 75% holdings in a United States-based global financial services company, Velocity Clearing. The deal will enable Hanwha to establish a presence in the United States' financial services industry, as well as gain greater access to investment opportunities in the country.

- October 2024: Starr International Insurance (Singapore) Pte. Ltd. was granted a license by South Korea's Financial Services Commission to conduct a branch operation in Seoul and sell commercial property/casualty insurance nationwide in Korea.

South Korea Life and Non-Life Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered |

|

| Distribution Channels Covered | Direct, Agency, Banks, Online, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea life and non-life insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea life and non-life insurance market on the basis of insurance type?

- What is the breakup of the South Korea life and non-life insurance market on the basis of distribution channel?

- What is the breakup of the South Korea life and non-life insurance market on the basis of region?

- What are the various stages in the value chain of the South Korea life and non-life insurance market?

- What are the key driving factors and challenges in the South Korea life and non-life insurance market?

- What is the structure of the South Korea life and non-life insurance market and who are the key players?

- What is the degree of competition in the South Korea life and non-life insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea life and non-life insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea life and non-life insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea life and non-life insurance market industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)