South Korea Lime Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

South Korea Lime Market Overview:

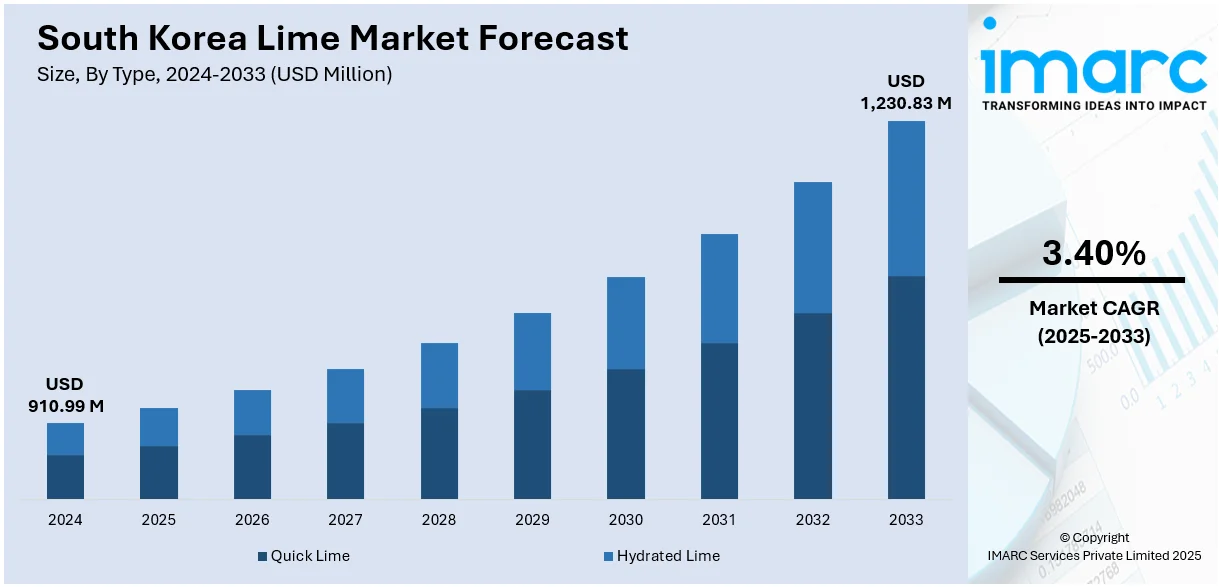

The South Korea lime market size reached USD 910.99 Million in 2024. The market is projected to reach USD 1,230.83 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. Rising demand from the construction, steel, and environmental sectors is driving the South Korea lime market. Infrastructure development, wastewater treatment needs, and the increasing use of lime in flue gas desulfurization are major growth catalysts. Additionally, advancements in agriculture and chemical manufacturing further boost consumption. Government support for sustainable industrial practices also plays a role in market expansion, contributing to the steady rise in South Korea lime market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 910.99 Million |

| Market Forecast in 2033 | USD 1,230.83 Million |

| Market Growth Rate 2025-2033 | 3.40% |

South Korea Lime Market Trends:

Steady Base in Construction Use

In July 2024, South Korea’s lime output held steady from the previous year, providing a reliable foundation for construction materials like mortar and plaster. That consistent production reflects stable quarry operations and processing plants, keeping mortar, masonry, plastering, and soil‑stabilization supplies flowing smoothly. With lime renowned for improving workability, adhesion, and soil properties, this steady supply supports infrastructure projects especially road building and foundation groundwork. Quarry operators have used this stable baseline to modernize kilns and adopt more efficient processing while maintaining consistent output levels. As environmental guidelines tighten, these improvements are vital for maintaining both product quality and compliance. For developers and contractors, dependable delivery and uniform quality simplify project planning, reducing risks related to material availability. Ultimately, this consistency in production not only assures current needs in construction and soil treatment but also sets a sound platform for expansion into emerging areas like water treatment or remediation though these segments remain in early development. All told, this steady momentum highlights long-term South Korea lime market growth.

To get more information on this market, Request Sample

Strategic Sourcing for Water Treatment

South Korea continues to supplement its domestic lime supply with targeted imports to meet high‑purity needs in water treatment and soil stabilization. In late 2024, sources confirmed a steady increase in imports of slaked lime tailored for water‑purification systems and municipal effluent management. These shipments sourced by government agencies and environmental authorities ensure water treatment plants receive lime with consistent reactivity and particle size. Relying on imports reduces the pressure on domestic producers to invest heavily in specialized lines while meeting strict regulatory requirements. Meanwhile, domestic producers are enhancing kiln operations and implementing better quality-control systems to gradually supply some of these niche demands. This blended approach balances flexibility and cost-efficiency, supporting reliable supply for construction, infrastructure, and environmental projects. The result is a more resilient supply framework that caters to standard construction-grade lime as well as advanced technical needs. Together, these sourcing practices underscore evolving South Korea lime market trends.

Regulation-Driven Environmental Quality

In April 2024, South Korea’s Ministry of Environment issued new guidelines encouraging the use of low-lime alternatives in cement production to reduce CO₂ and particulate emissions, highlighting the environmental impact of lime-based materials in built infrastructure. Even though the shift targets blended cement, it creates spillover effects across the lime industry prompting producers to modernize kiln systems, adopt improved dust-collection measures, and invest in cleaner production processes. The changes also appeal to water treatment and soil remediation sectors, where endotoxin-free, fine-grade lime offers both regulatory compliance and quality assurance. With greater demand from municipal and environmental agencies for responsibly sourced lime, suppliers are now emphasizing traceable supply chains, emission monitoring, and transparency in production. These practices help ensure that lime used in public-sector projects meets higher environmental standards, not just technical ones. As regulations tighten, lime is transitioning from a basic industrial commodity to a certified eco-conscious material. This reader-friendly approach, a combination of policy and consumer demand, positions the lime market to adapt smoothly while supporting sustainable development priorities.

South Korea Lime Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Quick Lime

- Hydrated Lime

The report has provided a detailed breakup and analysis of the market based on the type. This includes quick lime and hydrated lime.

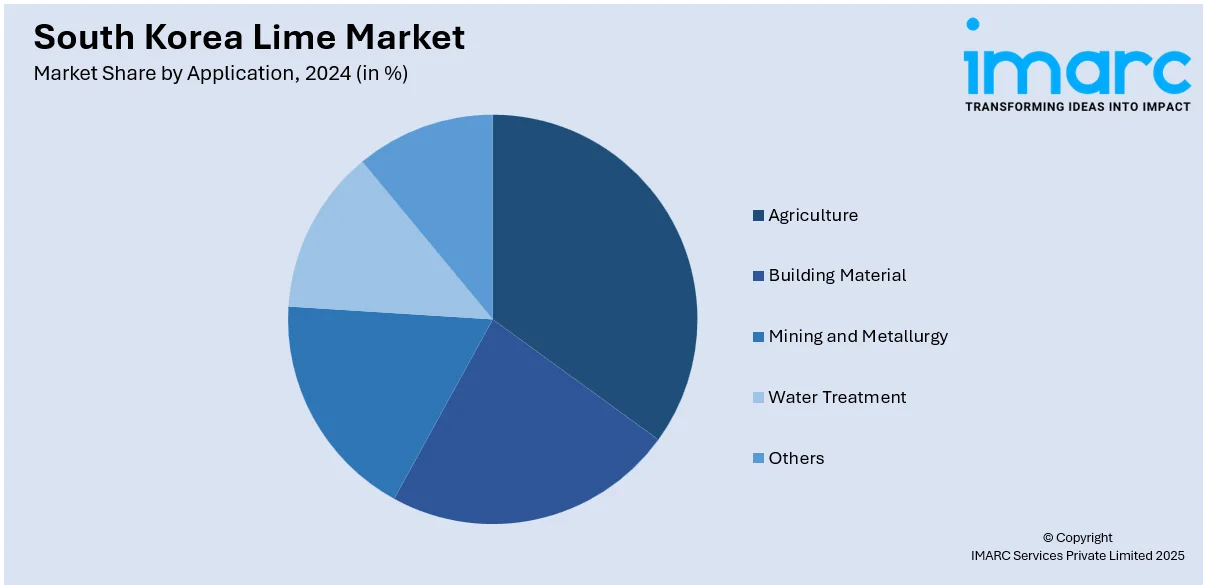

Application Insights:

- Agriculture

- Building Material

- Mining and Metallurgy

- Water Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agriculture, building material, mining and metallurgy, water treatment, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Lime Market News:

- August 2024: South Korea’s Ssangyong C&E has exported its first eco-friendly limestone cement to the United States, marking a significant milestone for the country’s sustainable manufacturing efforts. The innovative product, developed after extensive research, reduces traditional clinker content by incorporating limestone powder maintaining equivalent performance while lowering carbon intensity. This achievement underscores South Korea’s commitment to green building materials and supports the nation’s ambition to expand its presence in the global eco-friendly construction sector. Ssangyong C&E plans to further build on this pioneering export initiative.

South Korea Lime Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quick Lime, Hydrated Lime |

| Applications Covered | Agriculture, Building Material, Mining and Metallurgy, Water Treatment, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea lime market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea lime market on the basis of type?

- What is the breakup of the South Korea lime market on the basis of application?

- What is the breakup of the South Korea lime market on the basis of region?

- What are the various stages in the value chain of the South Korea lime market?

- What are the key driving factors and challenges in the South Korea lime market?

- What is the structure of the South Korea lime market and who are the key players?

- What is the degree of competition in the South Korea lime market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea lime market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea lime market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea lime industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)