South Korea Lobster Market Size, Share, Trends and Forecast by Species, Weight, Product Type, Distribution Channel, and Region, 2026-2034

South Korea Lobster Market Overview:

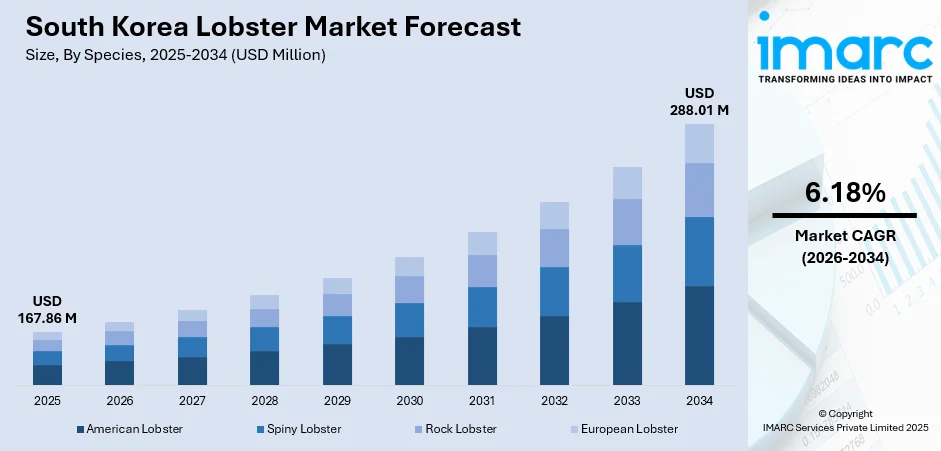

The South Korea lobster market size was valued at USD 167.86 Million in 2025 and is projected to reach USD 288.01 Million by 2034, growing at a compound annual growth rate of 6.18% from 2026-2034.

The South Korea lobster market is experiencing steady growth as demand for premium seafood continues to rise across high-end restaurants, luxury hotels, and evolving retail channels. Favorable trade agreements with major lobster-exporting nations, particularly Canada and the United States, have strengthened import volumes and product availability. Increasing health consciousness among Korean consumers seeking protein-rich, omega-3 fatty acid-rich foods is further accelerating adoption. Meanwhile, the expansion of e-commerce platforms and online grocery services is reshaping distribution dynamics, supporting convenient access to live and frozen lobster products and expanding South Korea lobster market share.

Key Takeaways and Insights:

- By Species: American lobster dominates the market with a share of 43.32% in 2025, attributed to its superior taste profile, widespread availability from North American Atlantic waters, and established trade relationships with Canadian and American suppliers.

- By Weight: The 0.5-0.75 lbs segment leads the market with a share of 42.44% in 2025, driven by consumer preferences for portion-controlled servings ideal for individual dining experiences and restaurant menu standardization.

- By Product Type: Whole lobster represents the largest segment with a market share of 72.83% in 2025, reflecting Korean consumer preferences for fresh, live products that symbolize quality and authenticity in premium dining settings.

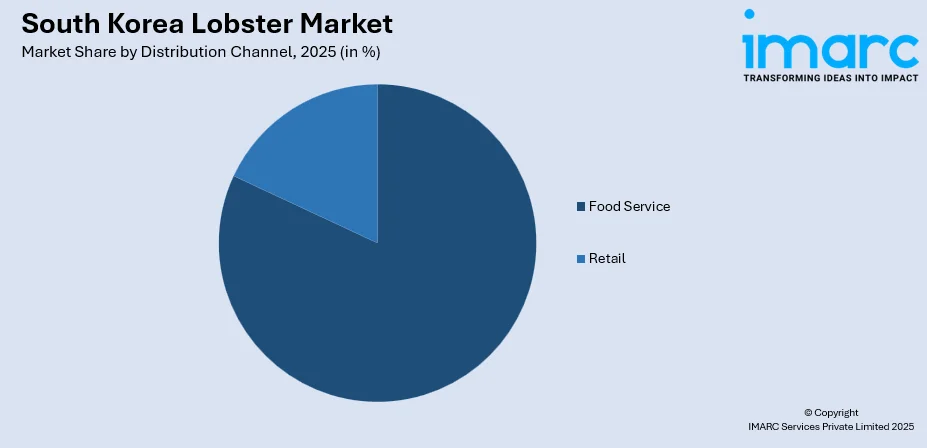

- By Distribution Channel: Food service accounts for the largest revenue share of 81.71% in 2025, propelled by the flourishing hotel industry, specialty seafood restaurants, and luxury dining establishments across major metropolitan areas.

- Key Players: The South Korea lobster market exhibits moderate competitive intensity, characterized by a diverse mix of international seafood importers and domestic distributors. Major participants include global seafood corporations, regional trading companies, and specialized premium seafood suppliers operating across import, wholesale, and retail segments.

To get more information on this market Request Sample

South Korea's lobster market reflects the nation's sophisticated culinary culture and growing appetite for luxury seafood experiences. The country's status as a leading seafood consumer in Asia Pacific, combined with rising disposable incomes among urban populations, has elevated lobster from an occasional delicacy to a mainstream premium offering. Seoul, Busan, and Incheon serve as primary distribution hubs, leveraging their strategic port locations and advanced logistics infrastructure to facilitate efficient supply chains. The integration of temperature-controlled air freight services has reduced transit times from North American fishing grounds, ensuring live lobster arrives in optimal condition for discerning Korean consumers. In November 2024, NOAA Sea Grant's American Lobster Initiative awarded USD 5.4 million to support fifteen research projects addressing lobster growth, distribution dynamics, and ecosystem changes, demonstrating continued investment in sustainable fishery management that benefits global supply chains including Korean importers.

South Korea Lobster Market Trends:

Premiumization of Dining Experiences Across Hospitality Sector

South Korea's hospitality industry continues embracing premium seafood offerings as centerpieces of elevated dining experiences. Michelin-starred restaurants in Seoul increasingly feature lobster prominently on seasonal tasting menus, while luxury hotel buffets showcase whole lobsters as signature attractions. The country welcomed over 20 million international visitors in 2024 through inbound tourism growth, with hotels reporting peak occupancy rates and heightened demand for gourmet seafood presentations. This convergence of domestic affluence and inbound tourism sustains robust demand for premium lobster products across foodservice channels.

Digital Transformation of Seafood Retail Distribution

E-commerce platforms are revolutionizing how Korean consumers access premium seafood products. South Korea's e-commerce market reached USD 510 Billion in 2024 and is projected to reach USD 3,810 Billion by 2033, exhibiting a growth rate (CAGR) of 22.3% during 2025-2033, with food and beverages emerging as leading online shopping categories. Platforms like Coupang, which achieved USD 30 billion in sales during 2024, offer rapid delivery services that maintain product freshness through sophisticated cold chain networks. The proliferation of online grocery services has expanded retail lobster accessibility beyond traditional wet markets and specialty seafood retailers to mainstream consumer households.

Advanced Cold Chain Infrastructure Development

Investment in temperature-controlled logistics infrastructure continues strengthening South Korea's capacity to handle premium perishable imports. The South Korean government has implemented stringent temperature control standards for food transportation, enhancing product safety and quality assurance throughout distribution networks. These infrastructure advancements enable efficient handling of live and frozen lobster products from international suppliers.

Market Outlook 2026-2034:

The South Korea lobster market demonstrates promising growth trajectories supported by favorable demographic trends, expanding hospitality infrastructure, and strengthening international trade relationships. Continued urbanization and rising affluence among younger consumer segments are expected to sustain demand for premium dining experiences featuring lobster. The integration of artificial intelligence and Internet of Things technologies within cold chain logistics networks promises enhanced operational efficiency and reduced product spoilage. Strategic trade agreements with major lobster-producing nations ensure stable supply access. The market generated a revenue of USD 167.86 Million in 2025 and is projected to reach a revenue of USD 288.01 Million by 2034, growing at a compound annual growth rate of 6.18% from 2026-2034.

South Korea Lobster Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Species | American Lobster | 43.32% |

| Weight | 0.5-0.75 lbs | 42.44% |

| Product Type | Whole Lobster | 72.83% |

| Distribution Channel | Food Service | 81.71% |

Species Insights:

- American Lobster

- Spiny Lobster

- Rock Lobster

- European Lobster

The American lobster dominates with a market share of 43.32% of the total South Korea lobster market in 2025.

American lobster maintains dominant positioning within South Korea's premium seafood market due to its exceptional flavor profile, consistent quality, and reliable supply from North Atlantic fishing grounds. The species is extensively harvested along the Atlantic coast from Maine to North Carolina, with sustainable fisheries management practices ensuring stable production volumes. According to the National Oceanic and Atmospheric Administration, American lobster exports reached significant valuations, demonstrating strong international demand. Canadian lobster exports to South Korea have strengthened through enhanced trade relationships, with frozen lobster valued at CAD 65.4 Million and live lobster at CAD 43.3 Million in 2024.

Korean consumers particularly favor American lobster for celebratory occasions and premium dining experiences, associating the species with quality and authenticity. The KORUS Free Trade Agreement has facilitated reduced tariff barriers, enhancing price competitiveness of American lobster imports compared to regional alternatives. Luxury hotels and fine dining establishments in Seoul consistently feature American lobster on seasonal menus, capitalizing on its reputation for superior taste and texture. The species' adaptability to various culinary preparations, from traditional steaming to contemporary fusion interpretations, sustains its appeal across diverse foodservice segments.

Weight Insights:

- 0.5-0.75 lbs

- 0.76-3.0 lbs

- Over 3 lbs

The 0.5-0.75 lbs segment leads the market with a share of 42.44% of the total South Korea lobster market in 2025.

Smaller lobster weight categories demonstrate strong consumer acceptance within South Korea's restaurant and retail sectors. This size range offers optimal portion control for individual dining experiences while maintaining attractive price points accessible to broader consumer demographics. Restaurants favor this weight category for menu standardization, enabling consistent pricing strategies and predictable plate presentations. The balance between meat yield and cost efficiency makes this segment particularly attractive for commercial foodservice operations managing inventory and portion costs.

Air freight logistics systems are optimized for handling smaller lobster sizes, with transportation survival rates demonstrating favorable outcomes for this weight category. Korean consumers increasingly appreciate portion-appropriate servings that align with contemporary dining preferences emphasizing quality over quantity. The 0.5-0.75 lbs segment effectively addresses these evolving consumption patterns while supporting sustainable harvesting practices that protect juvenile lobster populations. Retail channels benefit from consumer willingness to purchase smaller sizes for home preparation, expanding market accessibility beyond traditional foodservice-dominated distribution.

Product Type Insights:

- Whole Lobster

- Lobster Tail

- Lobster Meat

- Lobster Claw

The whole lobster segment holds the largest share at 72.83% of the total South Korea lobster market in 2025.

Whole lobster products command overwhelming market preference reflecting Korean cultural associations between freshness, quality, and live seafood selection. Traditional wet markets like Noryangjin Fish Market in Seoul showcase live lobsters as premium offerings, enabling consumers to personally select specimens before preparation. This transparent purchasing experience builds consumer trust and justifies premium pricing for live products. Restaurants emphasize whole lobster presentations as theatrical dining experiences, with tableside preparation enhancing perceived value and customer satisfaction.

Advances in live lobster transportation technology have dramatically improved survival rates during international shipping, ensuring products arrive in optimal condition for immediate sale or preparation. Korean seafood importers have invested substantially in specialized holding facilities maintaining precise temperature and salinity conditions. The visual appeal of whole lobsters makes them particularly suitable for hotel buffets and banquet presentations where aesthetic impact influences consumer perceptions.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Food Service

- Retail

The food service channel exhibits clear dominance with 81.71% share of the total South Korea lobster market in 2025.

Foodservice channels maintain commanding market presence due to South Korea's vibrant dining culture and the complexity involved in live lobster preparation. High-end restaurants, luxury hotels, and specialty seafood establishments serve as primary consumption venues where trained culinary professionals maximize product quality through expert handling and preparation techniques. Seoul's concentration of Michelin-starred restaurants and five-star hotels creates sustained demand for premium lobster products positioned as signature menu offerings. Seasonal promotions during major holidays and celebratory occasions drive concentrated demand spikes within foodservice channels.

The Korean foodservice sector's recovery following pandemic disruptions has reinvigorated demand for premium seafood experiences. South Korea foodservice market is projected to exhibit a growth rate (CAGR) of 18.80% during 2024-2032, supported by domestic tourism and international visitor arrivals exceeding twenty million. Seafood buffets have emerged as particularly popular formats, offering consumers access to premium products including lobster within all-inclusive dining experiences. The growing presence of international hotel brands operating properties in major Korean cities has introduced standardized quality expectations that favor established premium lobster suppliers.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Seoul Capital Area dominates lobster consumption driven by concentration of luxury hotels, Michelin-starred restaurants, and affluent urban consumers seeking premium dining experiences. Major distribution hubs and advanced cold chain infrastructure facilitate efficient product delivery.

Yeongnam region demonstrates significant market presence anchored by Busan's strategic port facilities enabling direct seafood imports. The area's thriving tourism industry and coastal dining culture sustain robust demand for premium lobster products.

Honam region contributes to market growth through its established seafood trading traditions and expanding hospitality sector. Coastal communities maintain strong culinary preferences for fresh marine products including premium imported lobster varieties.

Hoseo region exhibits growing lobster consumption supported by expanding urban development and rising middle-class populations. The area's strategic location facilitates efficient distribution connections between major metropolitan centers and regional markets.

Market Dynamics:

Growth Drivers:

Why is the South Korea Lobster Market Growing?

Strong Food Service and Premium Dining Sector

The South Korea lobster market benefits significantly from a thriving food service industry characterized by high-end restaurants, luxury hotels, specialty seafood establishments, and experiential dining concepts. Korean dining culture emphasizes quality ingredients and fresh preparation, creating sustained demand for imported lobster products. Major establishments operating Asia's first unlimited lobster buffet with lobsters imported from the USA and Canada, exemplify the market's appetite for premium lobster experiences. According to Agriculture and Agri-Food Canada, South Korea's consumer foodservice market reached US$ 78,909.6 Million in 2024 and is projected to grow at a 2.9% CAGR to reach US$ 90,935.6 Million by 2029, with full-service restaurants leading growth driven by strong consumer preference for premium dining experiences and authentic cuisines.

Favorable Trade Agreements with Major Lobster Exporters

South Korea benefits from comprehensive free trade agreements with leading lobster-producing nations, creating preferential market access and competitive pricing advantages. The Canada-Korea Free Trade Agreement (CKFTA) eliminated duties of up to 20% on frozen and live lobster imports, while the Korea-US Free Trade Agreement (KORUS) provides similar tariff benefits for American lobster products. These bilateral trade frameworks reduce import costs, streamline customs procedures, and enhance supply chain efficiency, making premium lobster more accessible to Korean consumers and foodservice operators while strengthening long-term trade relationships with North American suppliers.

Rising Health Consciousness and High-Protein Diet Preferences

Growing awareness about health and nutrition is driving demand for protein-rich seafood including lobster. Korean consumers are increasingly attracted to seafood for its high protein content, omega-3 fatty acids, and perceived health benefits. Per capita fish and shellfish consumption has held steady over the last decade despite shifting dietary preferences among younger demographics. The Korean seafood industry has successfully promoted seafood as a healthy protein source, with consumption increased from 3.61 Million Metric Tons in 2022 to 3.68 Million Metric Tons in 2023, supporting sustained interest in premium products like lobster.

Market Restraints:

What Challenges the South Korea Lobster Market is Facing?

Shifting Consumer Preferences Toward Meat Consumption

Per capita meat consumption has surpassed seafood consumption in South Korea in recent years, a trend driven primarily by younger consumer preferences. This generational shift presents challenges for seafood market growth, including lobster, as dining habits evolve toward meat-based proteins. The changing dietary landscape requires market participants to adapt strategies to attract younger demographics through innovative product formats and dining experiences.

Supply Chain and Import Dependency

South Korea remains a net importer of seafood with a persistent trade deficit. The total value of seafood imports has declined in recent years, reflecting economic pressures and currency fluctuations. Heavy reliance on imported lobster exposes the market to supply chain disruptions, international price volatility, and trade policy uncertainties that can impact product availability and pricing stability.

Climate Change Impact on Domestic Fisheries

Rising water temperatures are affecting South Korea's coastal waters, with increases significantly exceeding the global average over recent decades. Ocean warming is displacing traditional fishing zones northward and depleting catches in adjacent waters. While this primarily impacts domestic fisheries rather than imported lobster, broader environmental pressures on global lobster populations and supply chains may affect long-term market stability.

Competitive Landscape:

The South Korea lobster market demonstrates moderately concentrated competitive dynamics with participation from multinational seafood corporations, regional trading companies, and specialized premium importers. International suppliers including major North American processors maintain established relationships with Korean distributors through direct representation or partnership arrangements. Domestic participants leverage local market knowledge and established retail relationships to serve both foodservice and consumer channels effectively. Competition intensifies around product freshness guarantees, delivery reliability, and value-added services including portion processing and custom specifications. Strategic investments in cold chain infrastructure and logistics capabilities differentiate leading participants while creating barriers for new market entrants. Vertical integration strategies connecting international sourcing with domestic distribution provide competitive advantages through enhanced supply chain control and margin optimization.

Recent Developments:

- December 2024: South Korea earmarked USD 38 billion to fortify critical supply chains, channeling funds into ports, rail infrastructure, and digital logistics platforms. This investment supports cold chain modernization essential for premium seafood imports including lobster.

South Korea Lobster Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | American Lobster, Spiny Lobster, Rock Lobster, European Lobster |

| Weights Covered | 0.5 – 0.75 lbs, 0.76 – 3.0 lbs, Over 3 lbs |

| Products Covered | Whole Lobster, Lobster Tail, Lobster Meat, Lobster Claw |

| Distribution Channels Covered | Food Service, Retail |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea lobster market size was valued at USD 167.86 Million in 2025.

The South Korea lobster market is expected to grow at a compound annual growth rate of 6.18% from 2026-2034 to reach USD 288.01 Million by 2034.

American lobster leads the market with a 43.32% share, driven by strong import relationships with Canada and the United States, and its popularity in premium dining establishments.

Key factors driving the South Korea lobster market include strong food service sector demand, favorable trade agreements with major exporting nations, rising health consciousness among consumers, expansion of e-commerce distribution channels, and growing premium dining culture.

Major challenges include shifting consumer preferences toward meat consumption among younger demographics, heavy reliance on imports creating supply chain vulnerabilities, currency fluctuations affecting import costs, and broader environmental pressures on global lobster populations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)