South Korea Managed Security Services Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprises Size, Vertical, and Region, 2025-2033

South Korea Managed Security Services Market Overview:

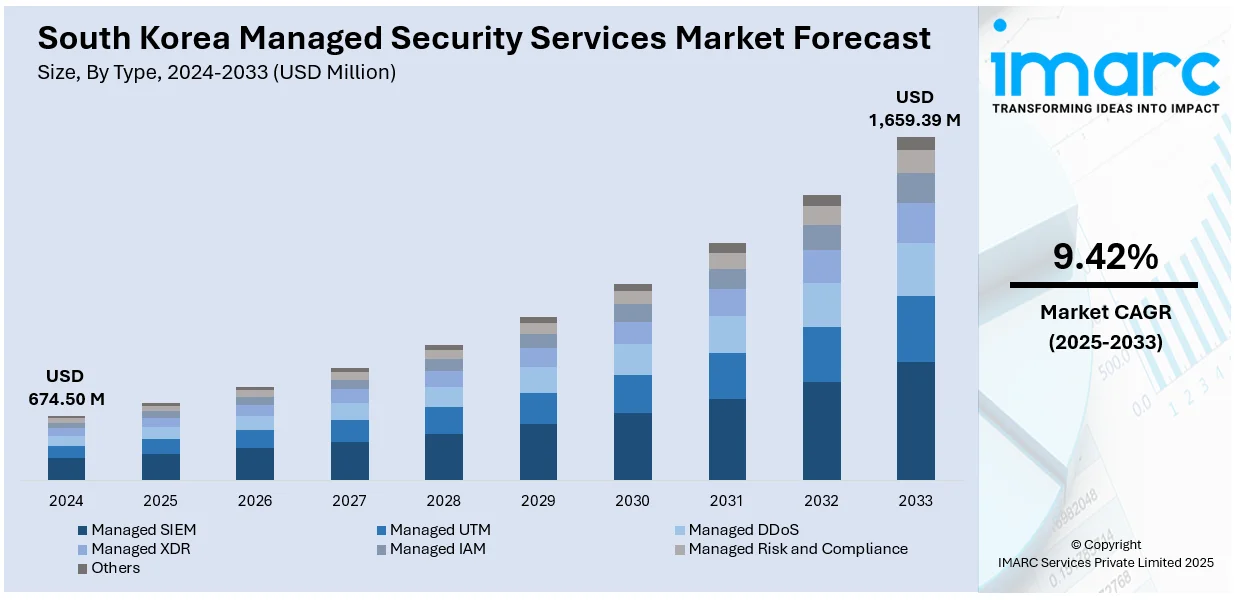

The South Korea managed security services market size reached USD 674.50 Million in 2024. The market is projected to reach USD 1,659.39 Million by 2033, exhibiting a growth rate (CAGR) of 9.42% during 2025-2033. At present, rising adoption of Industry 4.0 is creating the need for strong, round-the-clock cybersecurity solutions across interconnected systems. Besides this, the growing adoption of cloud computing is catalyzing the demand for expert-led cybersecurity protection, which is expanding the South Korea managed security services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 674.50 Million |

| Market Forecast in 2033 | USD 1,659.39 Million |

| Market Growth Rate 2025-2033 | 9.42% |

South Korea Managed Security Services Market Trends:

Growing adoption of Industry 4.0

Rising employment of Industry 4.0 is impelling the market growth in South Korea. According to the IMARC Group, the South Korea industry 4.0 market size reached USD 3,138.9 Million in 2024. As factories and industries in South Korea are adopting smart technologies, such as automation, robotics, artificial intelligence (AI), and the Internet of Things (IoT), their networks are becoming complex and more exposed to cyber threats. These digital systems often connect machinery, supply chains, and managed security services through cloud platforms, which creates more entry points for hackers. Managed security services providers help protect these digital environments by offering continuous monitoring, threat detection, and quick response solutions. With the shift towards Industry 4.0, traditional security tools are no longer enough to defend against advanced cyberattacks. South Korean industries rely on managed security services for expert protection, especially as cyber threats are growing more targeted and damaging. These services also ensure compliance with local and international security standards, which is critical for industries working with sensitive data. As companies continue to focus on boosting productivity and efficiency through smart systems, they are turning to managed security services to protect their operations without interrupting performance. The rising complexity of digital infrastructure is making managed security services a key partner in South Korea’s Industry 4.0 journey.

To get more information on this market, Request Sample

Increasing utilization of cloud computing

Rising employment of cloud computing is fueling the South Korea managed security services market growth. According to industry reports, the South Korea cloud computing market size reached USD 3.9 Billion in 2024. As more businesses in the country are moving their operations, applications, and data storage to cloud environments, they are facing new challenges in securing sensitive information against increasingly sophisticated cyber threats. Cloud platforms, while being flexible and scalable, are also introducing vulnerabilities, such as data breaches, unauthorized access, and misconfigurations. Many organizations lack the in-house expertise and resources to manage complex cloud security on their own, leading them to turn to managed security services providers for comprehensive solutions. These providers offer live observation, danger identification, incident reaction, and regulatory assistance tailored to cloud-based systems. As hybrid work environments and digital services are expanding, the need for securing cloud infrastructure is becoming more critical. Managed security services help businesses maintain operational continuity, protect customer data, and meet regulatory requirements. Additionally, the scalable nature of managed security services aligns well with cloud computing, allowing companies to adjust their security needs as they grow.

South Korea Managed Security Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, deployment mode, enterprises size, and vertical.

Type Insights:

- Managed SIEM

- Managed UTM

- Managed DDoS

- Managed XDR

- Managed IAM

- Managed Risk and Compliance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes managed SIEM, managed UTM, managed DDoS, managed XDR, managed IAM, managed risk and compliance, and others.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprises Size Insights:

- Small and Medium-Sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprises size. This includes small and medium-sized enterprises and large enterprises.

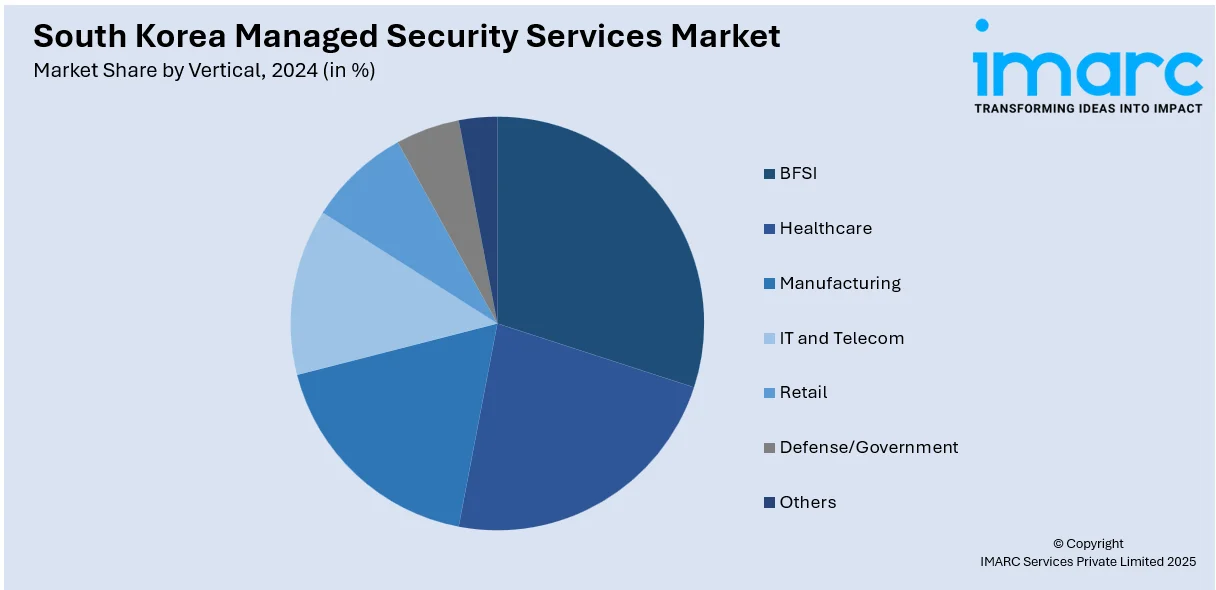

Vertical Insights:

- BFSI

- Healthcare

- Manufacturing

- IT and Telecom

- Retail

- Defense/Government

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, healthcare, manufacturing, IT and telecom, retail, defense/government, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Managed Security Services Market News:

- In December 2024, KDSys Co., Ltd. revealed its collaboration with SIGA to introduce the SigaML2 Multi-Layer OT Cybersecurity Suite in Korea. This signified a major achievement in delivering top-tier OT cybersecurity solutions to Korean industries, meeting the increasing demand for immediate detection and response to cyber threats in essential infrastructure areas. SigaML2 was SIGA's innovative ‘Multi-Layer Machine Learning Process-Oriented OT Cybersecurity’ platform, aimed at equipping CISOs with timely notifications and essential incident response (IR) resources for managing OT cyberattacks.

South Korea Managed Security Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed SIEM, Managed UTM, Managed DDoS, Managed XDR, Managed IAM, Managed Risk and Compliance, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprises Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Healthcare, Manufacturing, IT and Telecom, Retail, Defense/Government, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea managed security services market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea managed security services market on the basis of type?

- What is the breakup of the South Korea managed security services market on the basis of deployment mode?

- What is the breakup of the South Korea managed security services market on the basis of enterprises size?

- What is the breakup of the South Korea managed security services market on the basis of vertical?

- What is the breakup of the South Korea managed security services market on the basis of region?

- What are the various stages in the value chain of the South Korea managed security services market?

- What are the key driving factors and challenges in the South Korea managed security services market?

- What is the structure of the South Korea managed security services market and who are the key players?

- What is the degree of competition in the South Korea managed security services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea managed security services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea managed security services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea managed security services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)