South Korea Medical Tubing Market Size, Share, Trends and Forecast by Product, Structure, Application, End User, and Region, 2025-2033

South Korea Medical Tubing Market Overview:

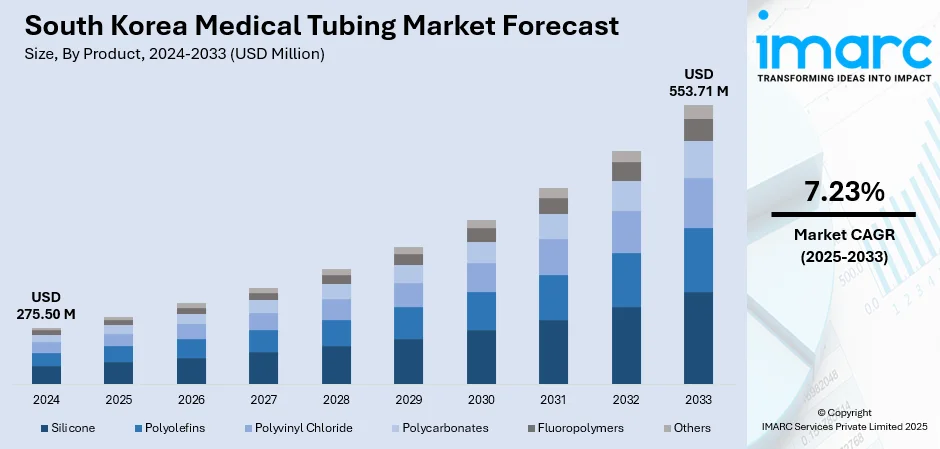

The South Korea medical tubing market size reached USD 275.50 Million in 2024. Looking forward, the market is projected to reach USD 553.71 Million by 2033, exhibiting a growth rate (CAGR) of 7.23% during 2025-2033. The market is expanding steadily, driven by increased demand for minimally invasive devices, rising healthcare infrastructure, and growing adoption of catheter-based and diagnostic technologies. Local and international manufacturers are investing in high-performance materials such as silicone, TPU, and PTFE to meet stringent medical standards. As innovation in medical devices continues and healthcare delivery evolves, the sector’s footprint widens, enhancing South Korea medical tubing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 275.50 Million |

| Market Forecast in 2033 | USD 553.71 Million |

| Market Growth Rate 2025-2033 | 7.23% |

South Korea Medical Tubing Market Trends:

Integrated Device Solutions

In South Korea’s evolving medical landscape, tubing is increasingly viewed not simply as a separate part but rather as an essential component of integrated medical systems. More and more, medical tubing is being incorporated into catheters, infusion sets, diagnostic devices, and surgical kits to develop comprehensive solutions for hospitals and healthcare providers. This integration boosts device performance, simplifies assembly, and decreases treatment durations advantages that are highly regarded in clinical environments. In response, medical device manufacturers are collaborating with tubing specialists to co-develop systems that guarantee compatibility, sterility, and adherence to regulatory standards. For instance, in May 2025, Researchers at South Korea’s Asan Medical Center developed a new photodynamic therapy catheter for treating esophageal cancer. The catheter features a stent coated with the photosensitizer Al-PcS4 and includes a laser delivery channel for optimal light distribution. It is designed for immediate removal post-treatment, reducing complication risks. This trend complements the movement toward minimally invasive procedures, where tubing is required to fulfill multiple roles within a streamlined design. The rising demand for system-ready components is spurring innovation and fostering partnerships within the supply chain, significantly aiding in South Korea medical tubing market growth across various applications.

To get more information on this market, Request Sample

Quality & Regulatory Compliance

In South Korea's medical tubing market, regulatory compliance has become a core driver of innovation and operational excellence. With an increasing focus on adhering to rigorous domestic (KFDA) and international (ISO, FDA) standards, manufacturers are enhancing their production capabilities through state-of-the-art sterilization methods, controlled cleanroom settings, and traceable production processes. In April 2025, South Korea's MFDS has updated K-GMP regulations for medical devices and IVDs through MFDS Notice No. 2025-22. Key changes include new "excellent quality control" standards, allowing desktop audits for compliant manufacturers, and updated provisions for Class 3 devices and minor non-conformities, enhancing quality management oversight. These practices, centered around quality, are crucial for ensuring patient safety, especially in areas such as implantable devices, infusion therapy, and diagnostic systems. Regulatory compliance not only enhances product credibility but also facilitates opportunities for global exports, positioning compliance as a strategic necessity. Companies are also allocating resources to quality management systems, engaging in third-party audits, and implementing process automation to ensure consistency and transparency. As healthcare providers and OEMs seek greater reliability and safety from components, this increased regulatory scrutiny is building trust and driving technological progress, which in turn further reinforces South Korea’s status in the global medical tubing market.

South Korea Medical Tubing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, structure, application, and end user.

Product Insights:

- Silicone

- Polyolefins

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes silicone, polyolefins, polyvinyl chloride, polycarbonates, fluoropolymers, and others.

Structure Insights:

- Single-Lumen

- Co-Extruded

- Multi-Lumen

- Tapered or Bump Tubing

- Braided Tubing

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes single-lumen, co-extruded, multi-lumen, tapered or bump tubing, and braided tubing.

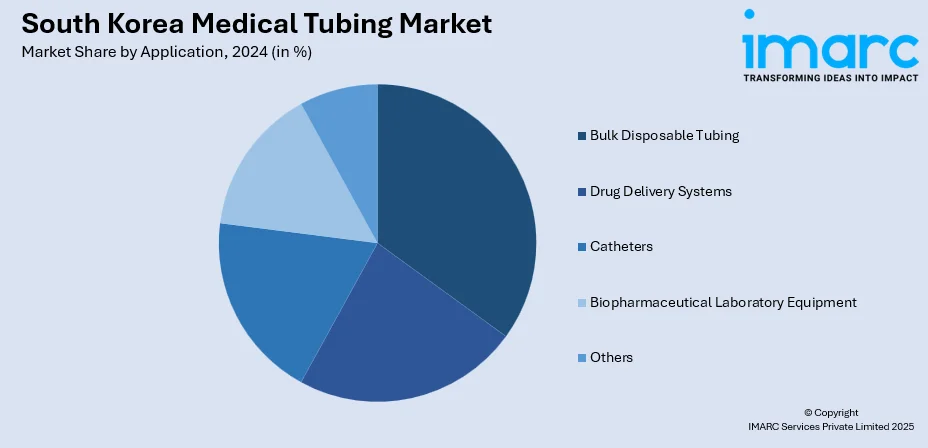

Application Insights:

- Bulk Disposable Tubing

- Drug Delivery Systems

- Catheters

- Biopharmaceutical Laboratory Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes bulk disposable tubing, drug delivery systems, catheters, biopharmaceutical laboratory equipment, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Medical Labs

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, medical labs, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Medical Tubing Market News:

- In December 2024, MicroPort CardioFlow's VitaFlow Liberty Transcatheter Aortic Valve and Retrievable Delivery System received marketing approval from South Korea's Ministry of Food and Drug Safety. This cutting-edge TAVI solution incorporates an electric retrieval mechanism, which enhances surgical accuracy and benefits more than 10,000 patients across 700 hospitals globally.

- In December 2024, WSI announced its plans to supply central venous and peripherally inserted central catheters to over 50 hospitals in South Korea, including Seoul National University Hospital. Following successful sales collaborations, WSI projects over 3 billion won in sales next year.

South Korea Medical Tubing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Silicone, Polyolefins, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, Others |

| Structures Covered | Single-Lumen, Co-Extruded, Multi-Lumen, Tapered or Bump Tubing, Braided Tubing |

| Applications Covered | Bulk Disposable Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Medical Labs, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea medical tubing market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea medical tubing market on the basis of product?

- What is the breakup of the South Korea medical tubing market on the basis of structure?

- What is the breakup of the South Korea medical tubing market on the basis of application?

- What is the breakup of the South Korea medical tubing market on the basis of end user?

- What is the breakup of the South Korea medical tubing market on the basis of region?

- What are the various stages in the value chain of the South Korea medical tubing market?

- What are the key driving factors and challenges in the South Korea medical tubing market?

- What is the structure of the South Korea medical tubing market and who are the key players?

- What is the degree of competition in the South Korea medical tubing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea medical tubing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea medical tubing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea medical tubing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)