South Korea Microgrid Market Size, Share, Trends and Forecast by Energy Source, Application, and Region, 2025-2033

South Korea Microgrid Market Overview:

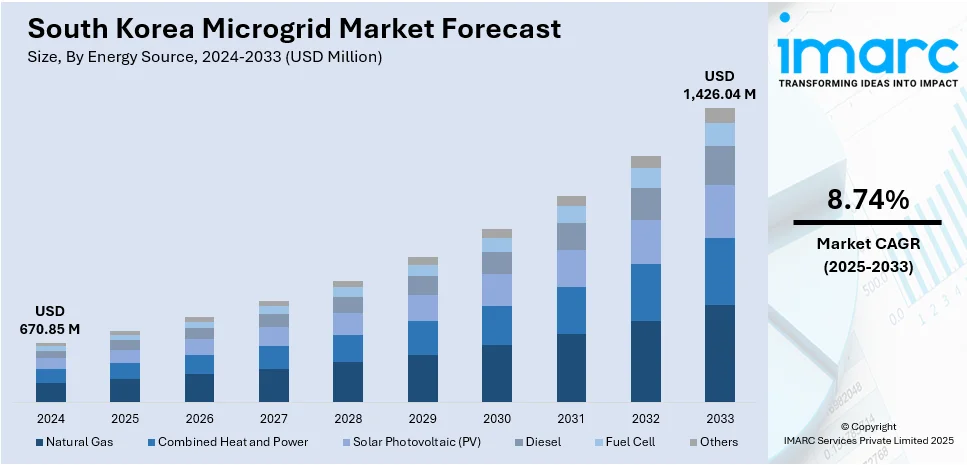

The South Korea microgrid market size reached USD 670.85 Million in 2024. Looking forward, the market is projected to reach USD 1,426.04 Million by 2033, exhibiting a growth rate (CAGR) of 8.74% during 2025-2033. The market is driven by proactive government policies and renewable energy mandates, which underpin financing and infrastructure development. Energy security needs and resilience concerns in urban centers and critical installations stimulate deployment of islanded microgrid systems. Meanwhile, progress in energy storage, AI based controllers, IoT integration and innovative business models enhances operational capability and cost effectiveness, further augmenting the South Korea microgrid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 670.85 Million |

| Market Forecast in 2033 | USD 1,426.04 Million |

| Market Growth Rate 2025-2033 | 8.74% |

South Korea Microgrid Market Trends:

Government Policy and Renewable Energy Targets

South Korea’s national strategy emphasizes energy independence and decarbonization through initiatives such as the Green New Deal and the Renewable Energy 3020 Plan. Integration of renewable sources—including solar, wind, hydrogen and bioenergy—is being strongly supported through subsidies, tax incentives, and pilot program funding. The Smart Grid Roadmap 2030 furthers modernization of grid infrastructure, enabling connectivity for microgrids and embedding energy storage systems into energy planning. In 2025, South Korea initiated a 540 MW (3,240 MWh) battery energy storage system (BESS) procurement, 500 MW on the mainland and 40 MW on Jeju Island, as part of its broader strategy to manage grid volatility and integrate renewables. The move aligns with national plans to raise installed renewable capacity from 30 GW in 2023 to 121.9 GW by 2038, including interim targets of 55.7 GW solar and 18.3 GW wind by 2030. BESS installations under this tender are designed for 4- to 6-hour duration, addressing curtailment issues during off-peak demand and supporting scalable microgrid applications. As municipalities and utilities pursue smart grid upgrades, microgrid projects become easier to deploy. Korea Electric Power Corporation and municipal governments actively sponsor campus and district-level demonstration projects on Jeju Island and within university campuses to test solar-plus-storage configurations. Private sector players such as Hyundai Energy Solutions and SK ecoplant partner with public agencies to deliver energy resilience solutions. These aligned policy and investment pipelines create an ecosystem that catalyzes market activity. After more than eighty words into this discussion, it becomes evident that coordinated policy support and renewable energy mandates are a key contributor to South Korea microgrid market growth.

To get more information on this market, Request Sample

Technological Innovation and Advanced Energy Management Systems

Advances in battery storage, IoT control platforms, AI‑driven energy management and grid-edge analytics are enhancing microgrid feasibility. Lithium‑ion and next‑generation battery technologies reduce costs and increase system efficiency. Smart controllers, metering and predictive algorithms enable dynamic balancing between generation, storage and consumption. On July 10, 2025, FuelCell Energy and South Korea-based Inuverse signed an MoU to explore deploying up to 100 MW of fuel cell power at the upcoming AI Daegu Data Center. The phased project, beginning in 2027, aims to support energy-intensive AI operations with clean baseload power, leveraging FuelCell’s thermal energy for data center cooling. As the system can be configured for microgrid applications, the initiative highlights growing interest in resilient, low-emission power solutions within South Korea’s evolving microgrid infrastructure. Virtual power plant frameworks and blockchain-based trading platforms support energy-as-a-service models and two-way grid interaction. These digital tools improve fault tolerance and enable self‑healing operation under islanding scenarios. Private sector innovation led by companies such as Greenergenic, Elecseed and EIPGRID Inc. incorporates machine learning for energy forecasting and load optimization. Emerging hydrogen and fuel cell microgrids further diversify generation options. This convergence of hardware and software improvements is steadily lowering technical barriers and scaling adoption of microgrids across commercial, education and industrial sectors.

South Korea Microgrid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on energy source and application.

Energy Source Insights:

- Natural Gas

- Combined Heat and Power

- Solar Photovoltaic (PV)

- Diesel

- Fuel Cell

- Others

The report has provided a detailed breakup and analysis of the market based on the energy source. This includes natural gas, combined heat and power, solar photovoltaic (PV), diesel, fuel cell, and others.

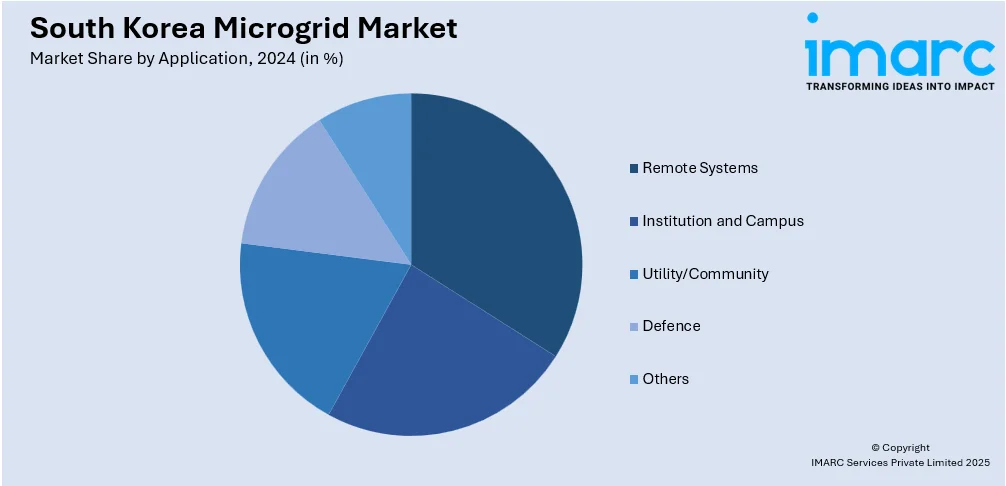

Application Insights:

- Remote Systems

- Institution and Campus

- Utility/Community

- Defence

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes remote systems, institution and campus, utility/community, defence, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Microgrid Market News:

- On January 31, 2025, researchers at Incheon National University in South Korea introduced a scalable microgrid optimization model to address unpredictable changes in power supply and demand. The new approach reduces computational load by using simplified scenarios and adaptive replanning, enabling more efficient and resilient microgrid operations. This development supports South Korea's growing focus on grid stability and smart energy systems, especially in regions facing unreliable power or renewable integration challenges.

- On August 28, 2024, KEPCO and ABB signed an MoU to install South Korea’s first high-inertia flywheel synchronous condenser on Jeju Island, supporting grid stability amid rising renewable energy integration. The 50 Mvar system, with nearly 500 MWs of inertia, will stabilize frequency and voltage as fossil-fuel sources are phased out, helping Jeju achieve its net-zero target by 2035. This project reflects South Korea's strategic shift toward resilient microgrid infrastructure in renewable-powered island and isolated grid environments.

South Korea Microgrid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Energy Sources Covered | Natural Gas, Combined Heat and Power, Solar Photovoltaic (PV), Diesel, Fuel Cell, Others |

| Applications Covered | Remote Systems, Institution and Campus, Utility/Community, Defence, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea microgrid market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea microgrid market on the basis of energy source?

- What is the breakup of the South Korea microgrid market on the basis of application?

- What is the breakup of the South Korea microgrid market on the basis of region?

- What are the various stages in the value chain of the South Korea microgrid market?

- What are the key driving factors and challenges in the South Korea microgrid market?

- What is the structure of the South Korea microgrid market and who are the key players?

- What is the degree of competition in the South Korea microgrid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea microgrid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea microgrid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea microgrid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)