South Korea Network Automation Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Network Type, End Use Industry, and Region, 2025-2033

South Korea Network Automation Market Overview:

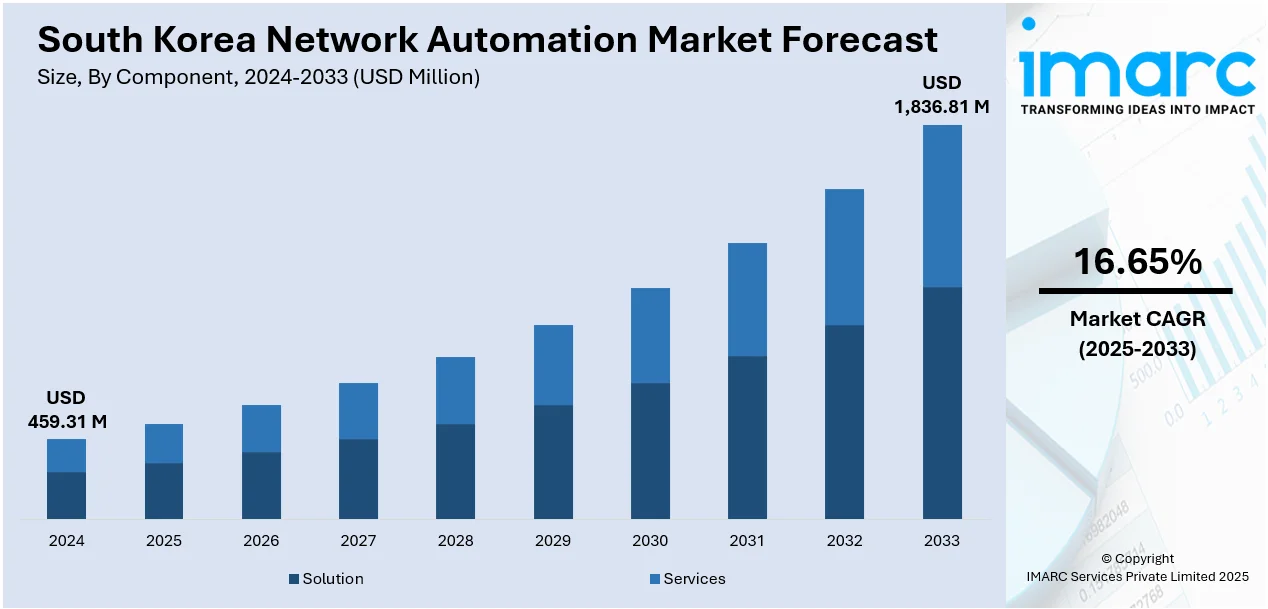

The South Korea network automation market size reached USD 459.31 Million in 2024. The market is projected to reach USD 1,836.81 Million by 2033, exhibiting a growth rate (CAGR) of 16.65% during 2025-2033. The market is fueled by the increasing demand for operational efficiency and the need to reduce manual network management across the telecom and enterprise sectors. Moreover, the nation's strong 5G rollout and investments in smart infrastructure are accelerating the adoption of network automation tools. Additionally, the country's advanced IT ecosystem and government-led digital initiatives support the rapid deployment of AI-driven network solutions, which are significantly augmenting the South Korea network automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 459.31 Million |

| Market Forecast in 2033 | USD 1,836.81 Million |

| Market Growth Rate 2025-2033 | 16.65% |

South Korea Network Automation Market Trends:

Accelerated 5G Deployment Fueling Automation

South Korea's deployment of 5G infrastructure has had a considerable effect on the speed and scale of network automation. As per industry reports, in the third quarter of 2024, over 70% of mobile devices in South Korea were 5G-capable, signifying the broad adoption of next-gen connectivity nationwide. Also, the country plans to launch 6G service across the nation by 2028. With one of the highest 5G penetration rates in the world, telecom operators are under pressure to manage increasingly dense and complex network environments. Traditional human-driven network operations are not adequate to manage enormous amounts of real-time data, ultra-low latency expectations, and the dynamic user demands of 5G. Automation is thus being infused at all layers, ranging from core and transport to edge and access networks. Moreover, network slicing, one of the main 5G features, needs end-to-end automation and orchestration tools in order to reliably work in various service environments. Also, 5G integration with edge computing requires more self-managing systems that are able to handle local resources independent of central control. Besides this, telecommunication providers are deploying AI-based automation to track network health, anticipate failures, and distribute resources dynamically. The scale and complexity introduced by nationwide 5G deployment are pushing operators to adopt self-optimizing and self-healing networks, marking a significant shift toward fully automated infrastructure.

To get more information on this market, Request Sample

Government-Led Digital Initiatives Supporting Infrastructure Modernization

The government continues to drive digital transformation through strategic infrastructure investments, significantly contributing to the South Korea network automation market growth. National programs targeting smart cities, digital governance, and intelligent transportation systems increasingly rely on high-performance, automated network backbones to ensure seamless connectivity and real-time data exchange. These initiatives are accelerating demand for software-defined networking (SDN), network function virtualization (NFV), and intelligent traffic management systems. Notably, on July 7, 2025, the Ministry of Oceans and Fisheries announced a government investment of 31 Billion Won (approximately USD 22.7 Million) to develop smart port technologies by 2028. This investment will necessitate the deployment of autonomous network infrastructure to support automated cargo handling, IoT integration, and AI-driven port operations. Also, state-sponsored telecom research initiatives and pilots engender cooperation between industry, academia, and government institutions, promoting quicker testing and roll-out of automated solutions. In addition to this, regulators and ministers also collaborate with network operators to enable common standards and interoperability approaches, minimizing fragmentation and ease of automation at scale. These initiatives create an environment where automation is not just beneficial but necessary to meet performance, security, and scalability expectations in public services. Moreover, pressure from the government to enhance cyber resilience and digital competitiveness further drives the introduction of remotely controlled and autonomous network systems in the private and public sectors.

South Korea Network Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, network type, and end use industry.

Component Insights:

- Solution

- Network Automation Tools

- SD-WAN and Network

- Virtualization

- Internet-Based Networking

- Services

- Professional Service

- Managed Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (network automation tools, SD-WAN and network, virtualization, and internet-based networking) and services (professional service and managed service).

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

Network Type Insights:

- Physical

- Virtual

- Hybrid

A detailed breakup and analysis of the market based on the network type have also been provided in the report. This includes physical, virtual, and hybrid.

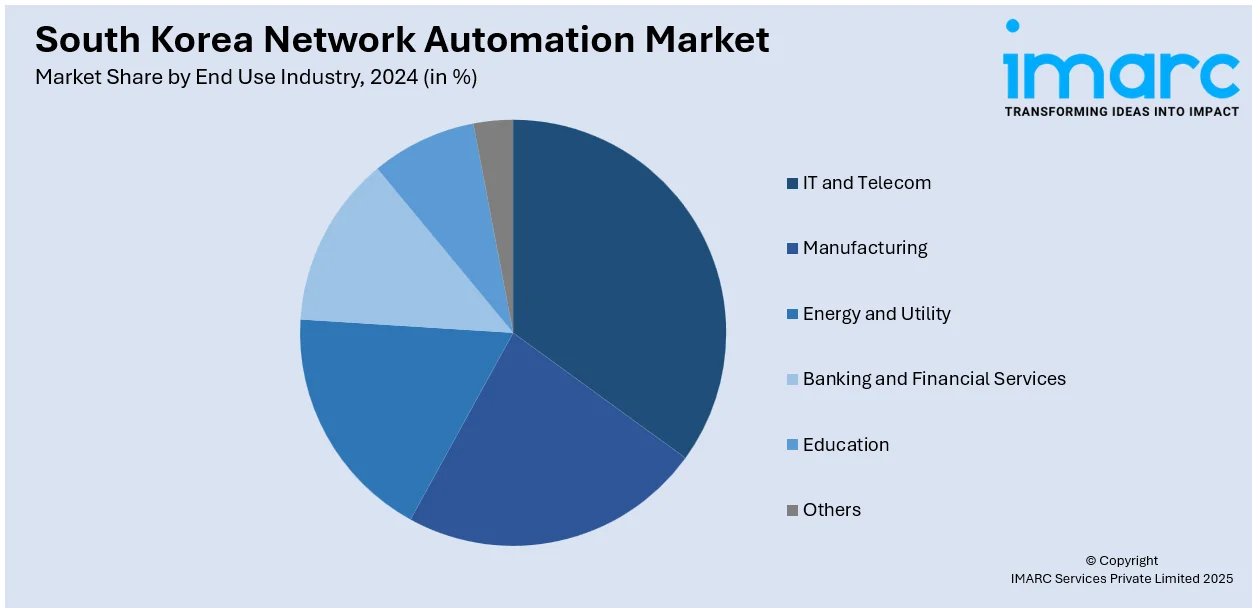

End Use Industry Insights:

- IT and Telecom

- Manufacturing

- Energy and Utility

- Banking and Financial Services

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes IT and telecom, manufacturing, energy and utility, banking and financial services, education, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Network Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-size Enterprises |

| Network Types Covered | Physical, Virtual, Hybrid |

| End Use Industries Covered | IT and Telecom, Manufacturing, Energy and Utility, Banking and Financial Services, Education, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea network automation market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea network automation market on the basis of component?

- What is the breakup of the South Korea network automation market on the basis of deployment mode?

- What is the breakup of the South Korea network automation market on the basis of organization size?

- What is the breakup of the South Korea network automation market on the basis of network type?

- What is the breakup of the South Korea network automation market on the basis of end use industry?

- What is the breakup of the South Korea network automation market on the basis of region?

- What are the various stages in the value chain of the South Korea network automation market?

- What are the key driving factors and challenges in the South Korea network automation market?

- What is the structure of the South Korea network automation market and who are the key players?

- What is the degree of competition in the South Korea network automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea network automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea network automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea network automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)