South Korea Nickel Market Size, Share, Trends and Forecast by Product Type, Application, End-Use Industry, and Region, 2025-2033

South Korea Nickel Market Overview:

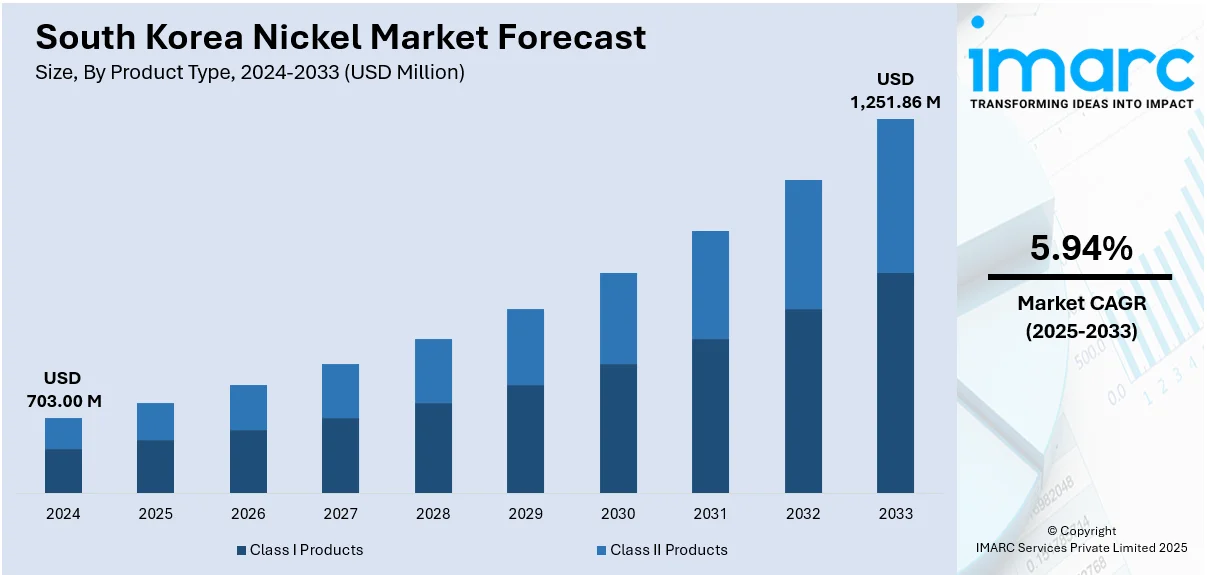

The South Korea nickel market size reached USD 703.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,251.86 Million by 2033, exhibiting a growth rate (CAGR) of 5.94% during 2025-2033. The government of South Korea is implementing policies and strategic approaches to ensure a stable supply of the metal. Furthermore, the development of electric vehicles (EVs) is driving the demand for nickel in South Korea. Apart from this, the improvements in battery technology are expanding the South Korea nickel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 703.00 Million |

| Market Forecast in 2033 | USD 1,251.86 Million |

| Market Growth Rate 2025-2033 | 5.94% |

South Korea Nickel Market Trends:

Growing Demand from Electric Vehicle (EV) Industry

The development of electric vehicles (EVs) is driving the demand for nickel in South Korea. Nickel is a vital element in lithium-ion batteries, which are used to power EVs. South Korea, where some of the largest car manufacturers are located, is witnessing an increase in the production of EVs, which is driving the demand for high-grade nickel. The move toward greener and sustainable modes of transportation, coupled with government policies in South Korea that encourage the use of EVs, is also catalyzing this demand. As car manufacturers are making a shift to manufacture more EVs, the need for nickel used in the manufacture of batteries is growing. Besides this, South Korea's strategic drive to dominate the world EV market and the increasing popularity of EVs internationally imply that nickel demand is supporting the market growth. IMARC Group predicts that the South Korea electric car market size is projected to attain USD 39,773.4 Million by 2033.

To get more information on this market, Request Sample

Technology Advancements

Improvements in battery technology, especially in the creation of high-nickel cathodes for lithium-ion batteries, are strengthening the South Korea nickel market growth. Battery manufacturing companies are investing in research and development (R&D) to improve the performance of batteries, something that translates to increasing the concentration of nickel in battery chemistry. Nickel-rich batteries provide higher energy density, extended battery life, and better performance, all of which are essential in consumer electronics and EVs. Increasing demand for high-performance batteries, particularly in the case of energy storage systems (ESS) and EVs, is driving the demand for nickel as a fundamental material. This is encouraging various key players to constantly upgrade their offerings. For instance, in 2024, South Korea's L&F Co. announced plans of mass producing ultrahigh-nickel NCM battery cathodes for EVs.

Government Initiatives and Strategic Reserves

The government of South Korea is implementing policies and strategic approaches to ensure a stable supply of the metal. Having identified the necessity of nickel for its high-tech sectors, especially in EVs and battery production, South Korea has taken steps to establish long-term nickel supply chains. This involves creating alliances with nickel-endowed nations like Indonesia and the Philippines, as well as investing in international mining ventures. Moreover, South Korea's initiatives toward strategic nickel reserves prepare the nation to respond to future demand. These policies of the government, combined with South Korea's strong industrial base and adherence to energy transition targets, create favorable conditions for the development of the nickel market. With a growing need for the automobile and energy industries, such projects are essential in making the nation competitive and sustainable in the international market.

South Korea Nickel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, and end-use industry.

Product Type Insights:

- Class I Products

- Class II Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes class I products and class II products.

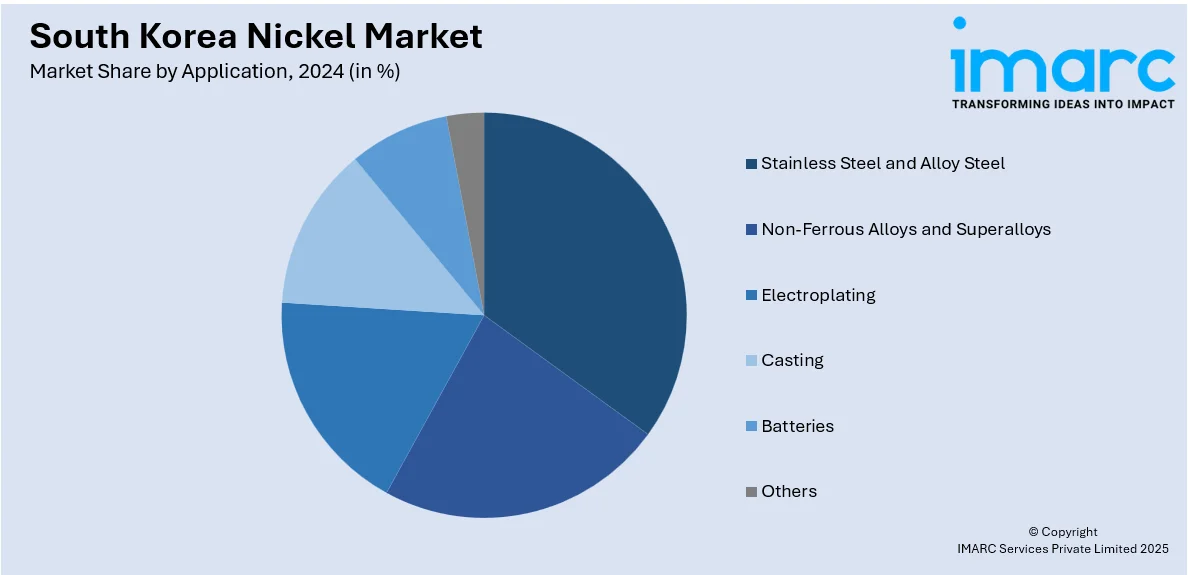

Application Insights:

- Stainless Steel and Alloy Steel

- Non-Ferrous Alloys and Superalloys

- Electroplating

- Casting

- Batteries

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes stainless steel and alloy steel, non-ferrous alloys and superalloys, electroplating, casting, batteries, and others.

End-Use Industry Insights:

- Transportation and Defense

- Fabricated Metal Products

- Electrical and Electronics

- Chemical

- Petrochemical

- Construction

- Consumer Durables

- Industrial Machinery

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes transportation and defense, fabricated metal products, electrical and electronics, chemical, petrochemical, construction, consumer durables, industrial machinery, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Nickel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Class I Products, Class II Products |

| Applications Covered | Stainless Steel and Alloy Steel, Non-Ferrous Alloys and Superalloys, Electroplating, Casting, Batteries, Others |

| End-Use Industries Covered | Transportation And Defense, Fabricated Metal Products, Electrical and Electronics, Chemical, Petrochemical, Construction, Consumer Durables, Industrial Machinery, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea nickel market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea nickel market on the basis of product type?

- What is the breakup of the South Korea nickel market on the basis of application?

- What is the breakup of the South Korea nickel market on the basis of end-use industry?

- What is the breakup of the South Korea nickel market on the basis of region?

- What are the various stages in the value chain of the South Korea nickel market?

- What are the key driving factors and challenges in the South Korea nickel market?

- What is the structure of the South Korea nickel market and who are the key players?

- What is the degree of competition in the South Korea nickel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea nickel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea nickel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea nickel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)