South Korea Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

South Korea Peanut Butter Market Summary:

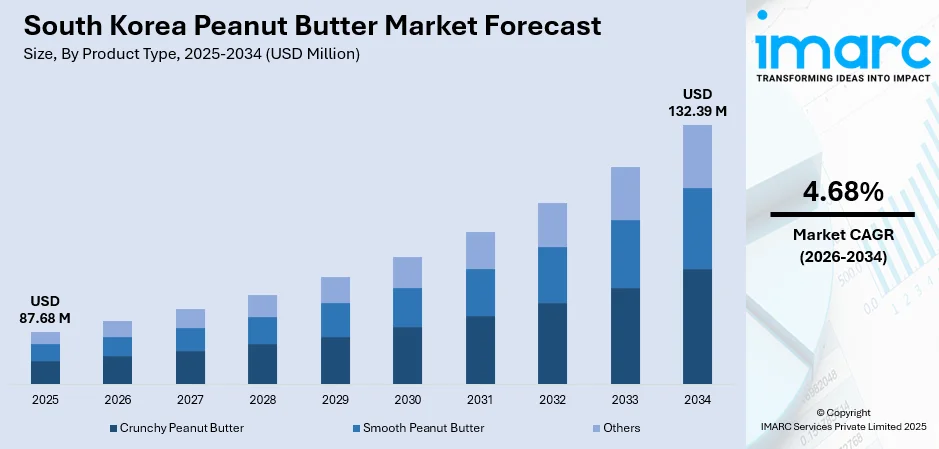

The South Korea peanut butter market size was valued at USD 87.68 Million in 2025 and is projected to reach USD 132.39 Million by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034.

The South Korea peanut butter market is experiencing substantial growth driven by the rising health consciousness among Korean consumers who increasingly recognize peanut butter as a nutritious source of plant-based protein and healthy fats. The growing adoption of Western dietary habits, particularly among younger demographics in urban areas, is accelerating product penetration. Social media influence and celebrity endorsements have significantly boosted peanut butter's image as a health-conscious food choice, transforming it from a relatively unfamiliar product to a kitchen staple in many Korean households, thereby enhancing overall peanut butter market share.

Key Takeaways and Insights:

- By Product Type: Smooth peanut butter dominates the market with a share of 58.16% in 2025, driven by its creamy texture appeal, versatile culinary applications, and consumer preference for easy-to-spread consistency across various food preparations.

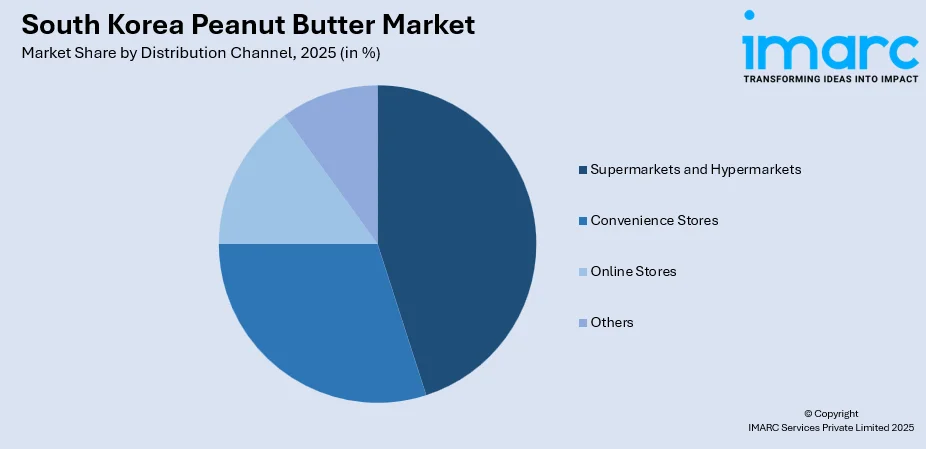

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 45.08% in 2025. This dominance is driven by extensive product variety, competitive pricing strategies, and convenient one-stop shopping experiences offered by major retail chains.

- Key Players: The South Korea peanut butter market exhibits moderate competitive intensity, with multinational food corporations competing alongside domestic manufacturers. Market players are focusing on product innovation, including natural and additive-free variants, to capture health-conscious consumer segments.

To get more information on this market, Request Sample

The South Korea peanut butter market is witnessing transformative growth as consumer perceptions shift toward recognizing peanut butter as a health-conscious food choice rather than a high-calorie indulgence. The emergence of the "healthy pleasure" lifestyle trend, popularized through social media platforms and influencer content, has propelled demand for natural peanut butter products. In fact, a specialty café in Seoul recently reported that sales of peanut butter in 2024 were about five times higher than in the previous year, reflecting a sharp surge in popularity. Korean consumers increasingly incorporate peanut butter into diverse culinary applications, from traditional breakfast spreads to innovative fusion dishes combining local ingredients like gochujang and doenjang. The market benefits from rising disposable incomes, urbanization trends, and growing interest in convenient, protein-rich food options among busy professionals and health-focused millennials.

South Korea Peanut Butter Market Trends:

Rising Health Consciousness and Plant-Based Protein Demand

Korean consumers are increasingly prioritizing health and wellness in their dietary choices, driving demand for peanut butter as a convenient source of plant-based protein. A 2024 Korean cohort study found that individuals who consumed two or more servings of nuts per week had a 12 % lower risk of all-cause mortality compared with those who did not — highlighting a potential long-term health benefit of regular nut (including peanut) intake. The growing awareness of peanut butter's nutritional benefits, including its potential to regulate blood sugar levels and provide essential fatty acids, is reshaping consumer perceptions and expanding market adoption across demographic segments.

Social Media Influence and Culinary Innovation

Social media platforms are playing a transformative role in popularizing peanut butter consumption in South Korea. For example, according to reports, peanut butter has exploded in popularity on SNS and in cafés: people are now blending it into smoothies and coffees, or mixing it with traditional Korean staples like soybean paste (“doenjang”) and chilli paste (“gochujang”), a fusion trend that rose after influencers and users started sharing creative recipes. Consumers are experimenting with innovative applications, incorporating peanut butter into smoothies, coffee beverages, and fusion dishes that blend Western products with traditional Korean culinary elements.

Premium Natural Product Proliferation

The market is witnessing a significant shift toward premium, natural peanut butter products without additives or preservatives. For example, in September 2025, Ottogi, a major food company in South Korea, launched “100% Peanut Butter Crunchy·Smooth,” marketed as “zero additives” and made solely from high‑oleic peanuts. Health-conscious consumers are willing to pay higher prices for products made from pure peanuts, driving manufacturers to expand their natural and organic product portfolios. This premiumization trend aligns with broader consumer preferences for clean-label and minimally processed food options.

Market Outlook 2026-2034:

The South Korea peanut butter market demonstrates promising growth potential as health-conscious consumption patterns continue strengthening across urban populations. Rising disposable incomes, expanding retail infrastructure, and growing e-commerce penetration are expected to enhance product accessibility and market reach. The integration of peanut butter into mainstream Korean cuisine and the continued influence of social media trends will sustain consumer interest. The market generated a revenue of USD 87.68 Million in 2025 and is projected to reach a revenue of USD 132.39 Million by 2034, growing at a compound annual growth rate of 4.68% from 2026-2034.

South Korea Peanut Butter Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Smooth Peanut Butter | 58.16% |

| Distribution Channel | Supermarkets and Hypermarkets | 45.08% |

Product Type Insights:

- Crunchy Peanut Butter

- Smooth Peanut Butter

- Others

Smooth peanut butter dominates with a market share of 58.16% of the total South Korea peanut butter market in 2025.

The smooth peanut butter segment leads the South Korea market owing to its creamy texture and versatile application possibilities that appeal to Korean consumers. The product's easy spreadability makes it ideal for various culinary uses, from traditional toast applications to incorporation into smoothies and desserts. Korean consumers particularly favor smooth varieties for their ability to blend seamlessly with other ingredients, supporting the growing trend of peanut butter fusion cuisine.

In addition, major brands such as Orion and Haitai are actively introducing limited-edition smooth peanut butter flavors, catering to adventurous taste preferences. These innovations have further strengthened consumer engagement, driving repeat purchases and reinforcing the segment’s dominance in South Korea.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead with a share of 45.08% of the total South Korea peanut butter market in 2025.

Supermarkets and hypermarkets maintain their dominant position in the South Korea peanut butter distribution landscape through extensive product assortments and competitive pricing strategies. Major retail chains including Emart, Lotte Mart, and Homeplus offer comprehensive peanut butter selections spanning domestic and imported brands, enabling consumers to compare products and make informed purchasing decisions. In 2024, the government amended the Distribution Industry Development Act to scrap the mandatory holiday‑closure requirement for large supermarkets and allow them to open on weekends and offer online delivery during previously restricted hours — a move aimed at giving consumers more flexibility.

They continue to play an important role in the South Korea peanut butter market by combining wide product availability with strategic in-store marketing. Their extensive shelf space allows for prominent displays of both domestic and imported peanut butter brands, while bundle offers, discounts, and loyalty programs attract price-sensitive consumers and encourage bulk purchases, further consolidating their market leadership.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area dominates the South Korea peanut butter market, accounting for the largest revenue share. This densely populated metropolitan region, encompassing Seoul, Incheon, and Gyeonggi Province, represents approximately half of the national population and leads in retail market turnover. Higher disposable incomes, concentrated urban lifestyles, and strong exposure to Western dietary trends drive consumption patterns in this region.

The Yeongnam region, comprising Busan, Daegu, Ulsan, and the Gyeongsang provinces, represents a significant peanut butter market driven by its industrial economic base and substantial urban population. Major port cities and manufacturing centers support strong retail infrastructure, while export-oriented industries provide stable consumer purchasing power. Traditional markets and modern retail formats coexist, offering diverse distribution channels.

The Honam region, including Gwangju and the Jeolla provinces, contributes to the peanut butter market with its agricultural heritage and emerging urban consumer base. Known as South Korea's breadbasket with fertile plains supporting rice and agricultural production, the region demonstrates growing adoption of Western food products among younger consumers in metropolitan Gwangju and expanding retail networks.

The Hoseo region, encompassing Daejeon and the Chungcheong provinces, benefits from its strategic central location connecting major transportation corridors between Seoul and southern regions. Rapid economic growth driven by semiconductor and technology industries has increased disposable incomes and adoption of modern retail formats. The region's agricultural specialization in dairy and grains supports diverse food product distribution networks.

Other regions, including Gangwon and Jeju, contribute modestly to the South Korea peanut butter market. These areas feature smaller populations and distinct economic characteristics, with tourism-driven consumption in Jeju and outdoor recreation-oriented demand in Gangwon. Improving logistics networks are gradually enhancing product accessibility and market penetration across these geographically diverse territories.

Market Dynamics:

Growth Drivers:

Why is the South Korea Peanut Butter Market Growing?

Rising Health Consciousness and Wellness Trends

The South Korea peanut butter market is experiencing robust growth driven by increasing health awareness among Korean consumers who are actively seeking nutritious food alternatives. In fact, recent data from Ministry of Food and Drug Safety (MFDS) shows that production of “high‑protein” foods in South Korea rose by about 24% in the most recent year — a sign that consumers are increasingly embracing protein‑rich options. Peanut butter is gaining recognition as a valuable source of plant-based protein, healthy unsaturated fats, and essential vitamins that support overall wellness. The emergence of the new lifestyle trends, which emphasize enjoying nutritious foods without compromising taste, has significantly elevated peanut butter's market positioning. Consumers are increasingly incorporating peanut butter into daily diets as part of blood sugar management regimes and protein supplementation strategies, driving sustained demand growth.

Westernization of Dietary Habits and Urbanization

The progressive adoption of Western dietary patterns, particularly among younger demographics and urban populations, is accelerating peanut butter market expansion. In fact, a recent long-term dietary survey in South Korea shows a significant rise over the past two decades in consumption of flour-based foods and sweets, particularly among urban residents and young adults, reflecting a growing preference for bread, bakery items, and Western-style meals over traditional rice-based breakfasts. Korean consumers are increasingly embracing breakfast cultures centered around toast and spreads, creating natural demand opportunities. Urbanization trends have concentrated populations in metropolitan areas with higher exposure to international food products and modern retail channels. Busy professional lifestyles are driving demand for convenient, ready-to-eat protein sources, positioning peanut butter favorably against traditional meal preparation requirements.

Social Media Influence and Celebrity Endorsements

Social media platforms have emerged as powerful catalysts for peanut butter market growth in South Korea, with influencer content and viral food trends driving rapid consumer adoption. For example, a 2024 campaign by Emart promoted peanut butter with apples, a combination popularized on social media as a healthy snack, offering discounts under its private label brand. Celebrity endorsements and lifestyle content showcasing creative peanut butter applications have transformed product perception from unfamiliar Western import to desirable kitchen staple. The digital dissemination of recipes combining peanut butter with traditional Korean ingredients has sparked culinary innovation, expanding consumption occasions beyond conventional breakfast applications and attracting adventurous food enthusiasts seeking novel taste experiences.

Market Restraints:

What Challenges the South Korea Peanut Butter Market is Facing?

Peanut Allergy Concerns and Dietary Restrictions

Growing awareness of peanut allergies presents a significant challenge to market expansion, limiting potential consumer base and creating barriers in institutional food service settings. Regulatory requirements for allergen labeling and workplace restrictions on peanut products constrain consumption occasions, particularly in educational and corporate environments.

Competition from Alternative Spreads and Butters

The peanut butter market faces intensifying competition from alternative nut butters and spreads including almond butter, cashew butter, and traditional Korean products. These alternatives appeal to consumers seeking variety or specific nutritional profiles, fragmenting market share and compelling manufacturers to invest in product differentiation strategies.

Price Sensitivity and Import Dependency

South Korea's significant reliance on imported peanuts and finished peanut butter products exposes the market to international commodity price fluctuations and currency exchange volatility. Premium pricing of natural and imported products may limit adoption among price-sensitive consumer segments, constraining market penetration beyond affluent urban demographics.

Competitive Landscape:

The South Korea peanut butter market exhibits a moderately competitive landscape characterized by the presence of multinational food corporations alongside domestic manufacturers and emerging specialty brands. Major players compete on product quality, brand recognition, and distribution network strength. The market is witnessing increased investment in product innovation, with manufacturers expanding portfolios to include natural, organic, and functional variants targeting health-conscious consumers. Strategic partnerships with retail chains and e-commerce platforms are intensifying as companies seek to enhance market reach. Premium positioning and clean-label propositions are emerging as key competitive differentiators in capturing growing wellness-oriented consumer segments.

Recent Developments:

- In September 2025, Ottogi launched two new peanut butter products in South Korea — 100 % peanut butter in “Crunchy” and “Smooth” versions, made from high-oleic peanuts with no additives.

- In November 2024, Daesang Corporation introduced Skippy “No Sugar Added” peanut butter in South Korea, launching Creamy and Chunky varieties made with about 95% peanuts and no added sugar or artificial sweeteners.

South Korea Peanut Butter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Crunchy Peanut Butter, Smooth Peanut Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea peanut butter market size was valued at USD 87.68 Million in 2025.

The South Korea peanut butter market is expected to grow at a compound annual growth rate of 4.68% from 2026-2034 to reach USD 132.39 Million by 2034.

Smooth peanut butter dominated the market with approximately 58.16% share, driven by consumer preference for creamy texture and versatile culinary applications.

Key factors driving the South Korea peanut butter market include rising health consciousness, adoption of Western dietary habits, social media influence, and growing demand for plant-based protein sources.

Major challenges include peanut allergy concerns, competition from alternative nut butters and spreads, price sensitivity among consumers, and import dependency creating vulnerability to international commodity price fluctuations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)