South Korea Pet Insurance Market Size, Share, Trends and Forecast by Policy, Animal, Provider, and Region, 2026-2034

South Korea Pet Insurance Market Overview:

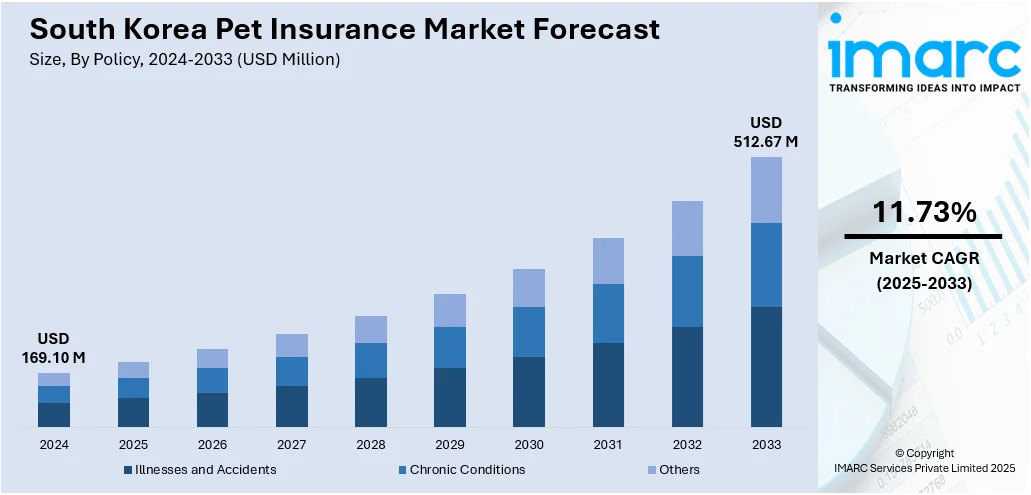

The South Korea pet insurance size reached USD 169.10 Million in 2025. The market is projected to reach USD 512.67 Million by 2034, exhibiting a growth rate (CAGR) of 11.73% during 2026-2034. The market is witnessing consistent growth in increasing pet ownership and growing realization of veterinary care. Market forces are influenced by changing consumer behavior, complex insurance schemes, and the extension of covers for cats and dogs alike. Providers are enriching their portfolios through online channels and customized schemes. Regional growth is backed by urban demand and enhanced pet care facilities. These are likely to have an impact on the overall growth of the South Korea pet insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 169.10 Million |

| Market Forecast in 2034 | USD 512.67 Million |

| Market Growth Rate 2026-2034 | 11.73% |

South Korea Pet Insurance Market Trends:

Insurance Adoption Rises Among Pet Owners

In October 2024, a report from South Korean financial authorities highlighted the sharp rise in pet insurance policies sold by leading non-life insurers. The trend is indicative of a notable shift in the attitudes of South Korean pet owners in seeking veterinary treatment by moving voluntarily towards having financial cover against accidents, operations, and increasing treatment expenses. As people become increasingly conscious of their pets' health and the uncertainty of accidents, ever more families are regarding insurance as anything but a luxury, but as part of the responsible ownership approach. Insurers have streamlined their enrollment processes, implemented mobile-based claims management, and fashioned their policies to fit the contemporary practice of pet care. Coverage for diagnostic imaging, wellness checkups, and even behavior modification is also on the rise, adding additional value. As pet ownership continues to rise, insurance engagement is close behind, signaling a new era of preparedness and preventive healthcare. Such shifts are a primary catalyst for South Korea pet insurance market growth.

To get more information on this market, Request Sample

Customized Coverage Fuels Insurance Innovation

In August 2024, sources reported a significant upturn in new pet insurance policies in the first half of the year, indicating increasing consumer demand for customized pet care. Pet owners are now looking for flexible policies that include diagnostics, dental care, and wellness services rather than limiting coverage to traditional accident-only plans. This trend is a sign of an industry maturing as policy holders appreciate tailoring coverage to their pet's specific health requirements whether it is multi-pet discounts, age-related coverage, or add-ons such as behavior therapy. This trend had led insurers to redesign their offerings with modular products, simplified terms, and tiered premiums that incentivize responsible pet ownership. Digital platform integration has also enhanced customer experience, streamlining comparison of plan benefits, filing claims, and monitoring veterinary visits. Such innovations facilitate increased customer engagement and retention, as well as the mainstreaming of pet insurance as an expected expense. As personalization takes hold, pet insurance is transforming from bare-bones protection to a method of pet wellness planning. This strategic move reflects larger South Korea pet insurance market trends.

Strengthening Fraud Prevention Measures

In July 2025, national data revealed significant growth in pet insurance subscriptions highlighting both rising adoption and emerging challenges in claim integrity. As more households secure coverage for their pets, instances of fraud such as inflated or fabricated veterinary claims have also surfaced, prompting industry-wide concern. To address this, South Korean authorities and insurers are implementing stronger fraud prevention protocols. Efforts include standardizing veterinary billing codes, integrating digital claim management systems, and enhancing collaboration between insurance providers and veterinary associations. These changes aim to streamline genuine claims while curbing dishonest practices, without compromising service efficiency. Efforts are also being made to educate policyholders about ethical claims behavior, reinforcing that fraudulent behavior harms both providers and honest consumers. As the pet insurance sector continues to mature, these frameworks will be essential for maintaining consumer trust and ensuring financial sustainability. By proactively strengthening fraud detection and transparency, the market is laying solid foundations for long-term confidence and resilience in South Korea’s evolving pet insurance ecosystem.

South Korea Pet Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on policy, animal, and provider.

Policy Insights:

- Illnesses and Accidents

- Chronic Conditions

- Others

The report has provided a detailed breakup and analysis of the market based on the policy. This includes illnesses and accidents, chronic conditions, and others.

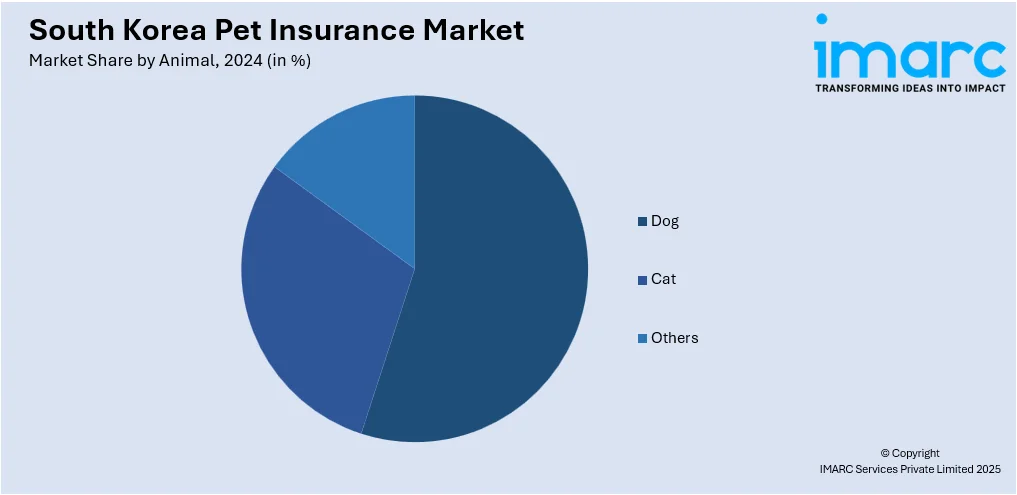

Animal Insights:

- Dog

- Cat

- Others

A detailed breakup and analysis of the market based on the animal have also been provided in the report. This includes dog, cat, and others.

Provider Insights:

- Public

- Private

The report has provided a detailed breakup and analysis of the market based on the provider. This includes public and private.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Pet Insurance Market News:

- July 2025: MyBrown, South Korea’s first dedicated pet insurance company, has officially launched its brand, marking a key development in the domestic pet care industry. As a pioneering provider, MyBrown is addressing the growing demand for comprehensive veterinary insurance among Korean pet owners. The company aims to offer tailored policies that support responsible pet ownership and promote animal welfare. Positioned as a specialist in Korea’s emerging pet insurance sector, MyBrown’s entry highlights the increasing professionalization and market maturity of the industry.

South Korea Pet Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Policies Covered | Illnesses and Accidents, Chronic Conditions, Others |

| Animals Covered | Dogs, Cats, Others |

| Providers Covered | Public, Private |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea pet insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea pet insurance market on the basis of policy?

- What is the breakup of the South Korea pet insurance market on the basis of animal?

- What is the breakup of the South Korea pet insurance market on the basis of provider?

- What is the breakup of the South Korea pet insurance market on the basis of region?

- What are the various stages in the value chain of the South Korea pet insurance market?

- What are the key driving factors and challenges in the South Korea pet insurance market?

- What is the structure of the South Korea pet insurance market and who are the key players?

- What is the degree of competition in the South Korea pet insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea pet insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea pet insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea pet insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)