South Korea Pigments Market Size, Share, Trends and Forecast by Product Type, Color Index, Application, and Region, 2025-2033

South Korea Pigments Market Overview:

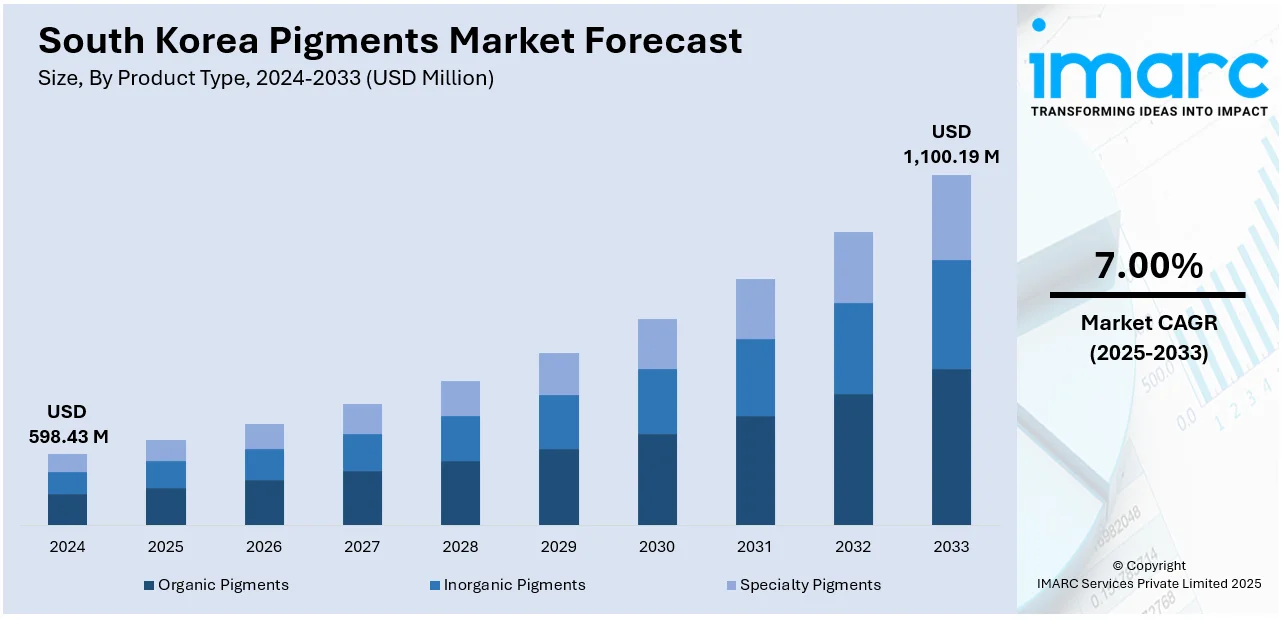

The South Korea Pigments market size reached USD 598.43 Million in 2024. The market is projected to reach USD 1,100.19 Million by 2033, exhibiting a growth rate (CAGR) of 7.00% during 2025-2033. The market is expanding steadily, driven by diverse applications across industries like the automotive, coatings, plastics, and printing sectors. The demand for sustainable and high-performance pigments is driving innovations in product manufacturing and manufacturing processes. Market growth is also supplemented by investments in research, along with growing consumer realization of using sustainable materials. Improvements in regional infrastructure and initiatives by the government also support market development. All these factors together are solidifying the South Korea pigments market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 598.43 Million |

| Market Forecast in 2033 | USD 1,100.19 Million |

| Market Growth Rate 2025-2033 | 7.00% |

South Korea Pigments Market Trends:

Eco-Friendly Pigments in Coatings

In August 2024, the South Korean government announced a major housing initiative tied to new construction, creating demand for sustainable paints and coatings. This push has increased demand for low‑VOC and bio‑based pigments that minimize environmental impact. Regulatory emphasis on air quality and indoor safety is prompting manufacturers to adopt eco‑friendly pigment formulations. Waterborne coatings using biodegradable pigments are becoming mainstream, as they align with both public health goals and environmental standards. The expanding building sector now relies on pigments that retain durability and color stability without heavy metals. As policymakers support greener construction materials, pigment producers are accelerating the transition toward sustainable raw materials and processes. This shift is influencing purchasing decisions among coatings producers in residential and commercial construction. By emphasizing greener pigment use in construction and industrial coatings, the sector is strengthening demand patterns that support long‑term South Korea pigments market growth.

To get more information on this market, Request Sample

Durable Pigments for Plastics & Construction

South Korea is increasingly adopting high-performance pigments designed for plastics and building products. These pigments offer excellent UV resistance, high heat, and chemical corrosion resistance, which is particularly important for plastic composites employed in construction infrastructure and exterior building elements. The Trade, Industry and Energy Ministry has highlighted the importance of these new pigment technologies to boost the competitiveness of domestic manufacturing, particularly in industries such as precast concrete panels and exterior systems based on plastics. These long-lasting pigments allow materials to maintain color stability and structural integrity over extended periods, essentially reducing maintenance and replacement costs. Parallel to that, regulations by the government favor pigments that combine performance with environmentally responsible attributes, including lower ecological impact and enhanced recyclability. This blend of robustness and sustainability is remodeling the selection of pigments for plastics, sealants, and building composites. These trends are an indication of wider South Korea pigments market tendencies with a distinct emphasis by the industry on innovation, long-term product performance, and sustainability in various uses.

Safe Pigments in Printing Inks

South Korea is increasingly focusing on non-toxic and safe pigments in the printing inks industry, particularly for packaging and special coatings. In the early 2025, the Ministry of Environment implemented more stringent regulations to cut down on harmful chemicals in printing ink used in recyclable packaging products with the goal of enhancing environmental safety and enabling circular economic objectives. This has led manufacturers to move towards mineral and plant-derived pigments that meet emerging standards for safety, particularly in food-contact and medical package applications. Safer pigments enable both domestic and international regulatory compliance while delivering high color vibrancy and durability performance. New technologies now enable environmentally friendly pigments to provide consistent ink performance, while mitigating toxicity and environmental impact concerns. The regulatory environment, in addition to increasing consumer demand for transparency and sustainability, is driving the adoption of clean pigments in printing inks. The trend highlights the changing landscape of South Korea’s pigments market, driven by innovation and sustainable production methods.

South Korea Pigments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, color index, and application.

Product Type Insights:

- Organic Pigments

- Azo Pigments

- Phthalocyanine Pigment

- Quinacridone Pigment

- Others

- Inorganic Pigments

- Titanium Dioxide Pigments

- Iron Oxide Pigments

- Cadmium Pigments

- Carbon Black Pigments

- Chromium Oxide Pigments

- Complex Inorganic Pigments

- Others

- Specialty Pigments

- Classic Organic Pigments

- Metallic Pigments

- High-Performance Pigments

- Light Interference Pigments

- Fluorescent Pigment

- Luminescent Pigments

- Thermo-Chromic Pigments

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic pigments (azo pigments, phthalocyanine pigment, quinacridone pigment, and others), inorganic pigments (titanium dioxide pigments, iron oxide pigments, cadmium pigments, carbon black pigments, chromium oxide pigments, complex inorganic pigments, and others), and specialty pigments (classic organic pigments, metallic pigments, high-performance pigments, light interference pigments, fluorescent pigment, luminescent pigments, and thermo-chromic pigments).

Color Index Insights:

- Red

- Orange

- Yellow

- Blue

- Green

- Brown

- Others

A detailed breakup and analysis of the market based on the color index have also been provided in the report. This includes red, orange, yellow, blue, green, brown, and others.

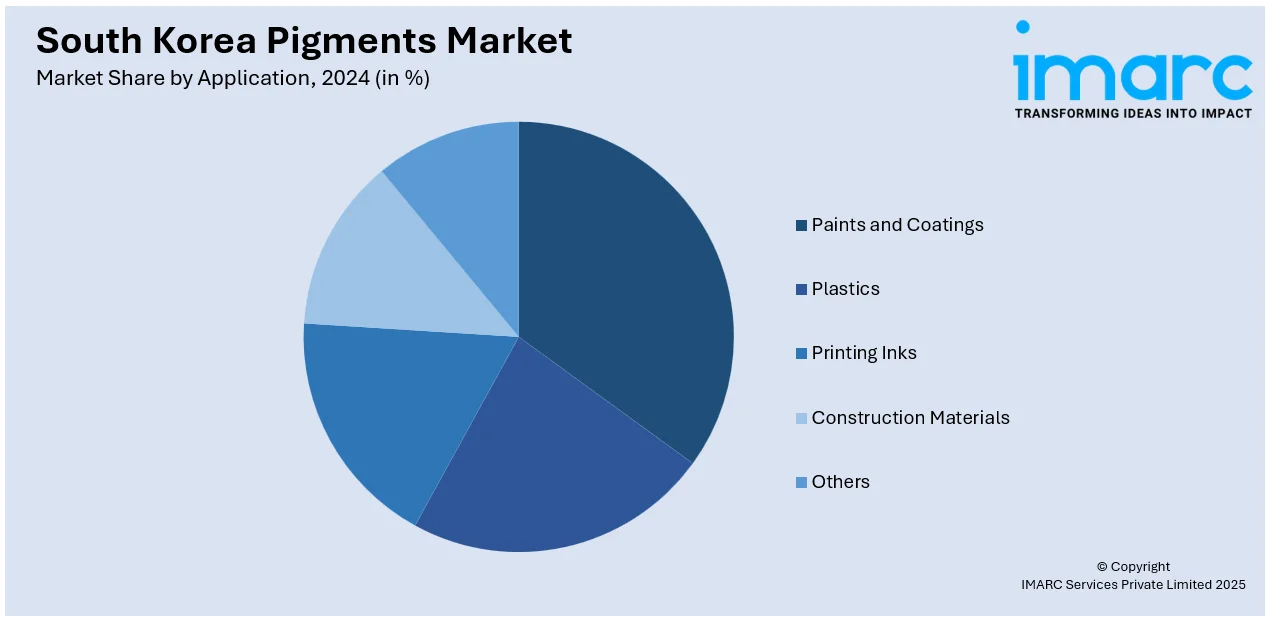

Application Insights:

- Paints and Coatings

- Plastics

- Printing Inks

- Construction Materials

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes paints and coatings, plastics, printing inks, construction materials, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Pigments Market News:

- April 2025: DuPont showcased its advanced silver nanowire products at Electronics Manufacturing Korea and Automotive World Korea exhibitions in Seoul. The company introduced innovations like Activegrid ink and film, designed for applications including transparent heaters, smart surfaces, advanced driver assistance systems (ADAS), in-mold electronics, electromagnetic interference shielding, and infrared reflection. These technologies aim to enhance the performance, safety, and efficiency of electric vehicles, autonomous driving systems, and other emerging e-mobility solutions, reinforcing DuPont’s commitment to innovation in South Korea’s rapidly evolving automotive sector.

- April 2025: Wooshin Pigment, a leading South Korean green colorant company, has been awarded the EY Entrepreneur of the Year. The firm was the first mover in water-based liquid pigments and created non-toxic organic-inorganic hybrid pigments, placing it at the forefront of the green pigment industry. Wooshin Pigment now has a substantial share in South Korea's market for eco-friendly liquid pigments. Wooshin, under the helm of CEO Jang Sung Sook, continues to be innovative in advancing sustainable methods in the world pigment industry.

South Korea Pigments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Color Indexes Covered | Red, Orange, Yellow, Blue, Green, Brown, Others |

| Applications Covered | Paints and Coatings, Plastics, Printing Inks, Construction Materials, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea pigments market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea pigments market on the basis of product type?

- What is the breakup of the South Korea pigments market on the basis of color index?

- What is the breakup of the South Korea pigments market on the basis of application?

- What is the breakup of the South Korea pigments market on the basis of region?

- What are the various stages in the value chain of the South Korea pigments market?

- What are the key driving factors and challenges in the South Korea pigments market?

- What is the structure of the South Korea pigments market and who are the key players?

- What is the degree of competition in the South Korea pigments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea pigments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea pigments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea pigments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)