South Korea Plant-Based Meat Market Size, Share, Trends and Forecast by Product Type, Source, Meat Type, Distribution Channel, and Region, 2026-2034

South Korea Plant-Based Meat Market Summary:

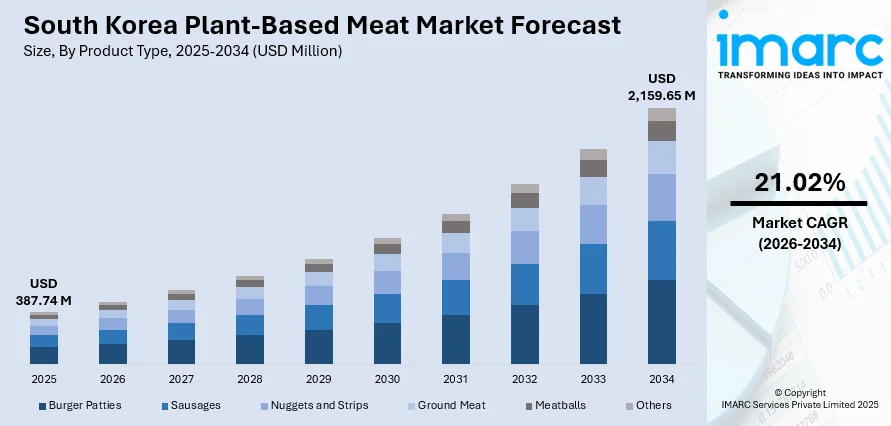

The South Korea plant-based meat market size was valued at USD 387.74 Million in 2025 and is projected to reach USD 2,159.65 Million by 2034, growing at a compound annual growth rate of 21.02% from 2026-2034.

The South Korea plant-based meat market is experiencing strong momentum as health consciousness rises and sustainability concerns reshape consumer preferences. Growing flexitarian adoption, innovative product launches tailored as per Korean culinary traditions, and expanding retail presence are accelerating mainstream acceptance. Advancements in food technology, strategic investments by domestic and international players, and government support for alternative protein development are strengthening the market ecosystem. These converging factors position the country as a dynamic hub for plant-based protein innovation, contributing to significant South Korea plant-based meat market share expansion.

Key Takeaways and Insights:

- By Product Type: Burger patties hold the largest market share at 31.82% in 2025, establishing themselves as the leading product format in South Korea's plant-based meat landscape due to strong consumer familiarity and widespread foodservice integration.

- By Source: Soy dominates the market with a 33.21% share in 2025, reflecting South Korea's deep-rooted familiarity with soy-based proteins and their established presence in traditional cuisine.

- By Meat Type: Beef alternatives command the largest share at 35.83% in 2025, driven by consumer preference for replicating the taste and texture of premium beef products in plant-based formats.

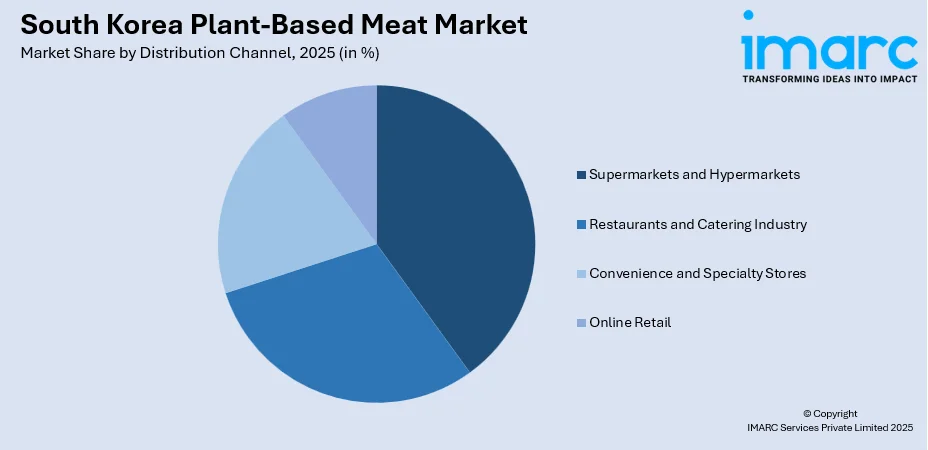

- By Distribution Channel: Supermarkets and hypermarkets lead with a 36.94% share in 2025, benefiting from extensive retail networks, competitive pricing, and enhanced product visibility through dedicated plant-based sections.

- Key Players: The South Korea plant-based meat market is moderately fragmented with domestic manufacturers and international brands competing through product innovation, strategic partnerships, and expansion of distribution networks to strengthen market positioning and capture growing consumer demand.

To get more information on this market Request Sample

The South Korea plant-based meat market is advancing as manufacturers embrace cutting-edge food technologies to improve taste, texture, and nutritional profiles. Companies are developing products that closely mimic traditional meat experiences while catering to local preferences for Korean-style dishes. In April 2024, Innohas launched the world's largest plant-based food facility in Jecheon, producing Korean-style plant-based foods including Bulgogi and Kimbap under the Sunlit Foods brand. The growing retail and foodservice expansion is normalizing plant-based consumption, with major hypermarket chains allocating dedicated shelf space to these products. Rising awareness of environmental sustainability, health benefits, and ethical considerations is driving adoption among millennials and Gen Z consumers, who represent a significant portion of flexitarian and vegan populations.

South Korea Plant-Based Meat Market Trends:

Rising Health Consciousness and Flexitarian Adoption

South Korean consumers are increasingly prioritizing health and wellness in their dietary choices, fueling demand for plant-based protein alternatives. The MZ generation is driving this shift toward vegetarian and flexitarian lifestyles, seeking clean-label products with lower saturated fat content and fewer artificial additives. Growing concerns about chronic health conditions such as heart disease, obesity, and high cholesterol are encouraging consumers to explore meat-free options. This trend is reshaping purchasing behavior across retail channels and prompting manufacturers to enhance nutritional profiles and develop healthier formulations.

Innovation in Traditional Korean Plant-Based Dishes

Manufacturers are localizing plant-based meat offerings by incorporating traditional Korean flavors and dish formats, supporting South Korea plant-based meat market growth. Products such as plant-based bulgogi, mandu, and Korean BBQ alternatives are gaining traction among consumers seeking familiar taste experiences. Technological advancements in high-moisture extrusion and fermentation are enabling closer replication of meat texture and marbling. In November 2024, Millennial Flavor Town launched marbled Wagyu steak and shredded beef products using traditional fermentation techniques, targeting both domestic and international markets.

Strategic Partnerships and International Market Expansion

South Korean plant-based meat companies are forging strategic alliances to expand production capacity and global reach. In August 2024, SUJIS LINK secured a USD 2.5 Million (approximately) investment from Samyang Foods to scale its high-moisture meat analog technology, with distribution planned across more than 90 countries through Samyang's network. International brand expansion is also accelerating, with UNLIMEAT achieving success across numerous stores in the United States. These partnerships are driving technological advancement and market accessibility.

Market Outlook 2026-2034:

The South Korea plant-based meat market generated a revenue of USD 387.74 Million in 2025 and is projected to reach a revenue of USD 2,159.65 Million by 2034, growing at a compound annual growth rate of 21.02% from 2026-2034. Continued innovation in taste and texture, expansion of retail availability, and growing environmental consciousness will sustain growth momentum. Government initiatives supporting alternative protein research and regulatory frameworks for novel foods will further accelerate commercialization efforts, positioning South Korea as a regional leader in plant-based protein innovation.

South Korea Plant-Based Meat Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Burger Patties | 31.82% |

| Source | Soy | 33.21% |

| Meat Type | Beef | 35.83% |

| Distribution Channel | Supermarkets and Hypermarkets | 36.94% |

Product Type Insights:

- Burger Patties

- Sausages

- Nuggets and Strips

- Ground Meat

- Meatballs

- Others

Burger patties lead the South Korea plant-based meat market, commanding a 31.82% share in 2025.

Burger patties have achieved significant market penetration due to their versatility and alignment with Western-influenced dining trends in South Korea. The format is well-suited for quick-service restaurants, food delivery platforms, and home cooking applications. In November 2024, Infinite Roots launched its first mycelium-based meat products in collaboration with Pulmuone, introducing burger patties and meatballs under the Earth Diet brand. Major foodservice chains are expanding plant-based burger offerings to cater to health-conscious consumers and flexitarians seeking convenient meal options. The familiar format reduces barriers to trial adoption among mainstream consumers.

Source Insights:

- Soy

- Wheat

- Peas

- Others

Soy dominates with 33.21% of South Korea plant-base meat market share in 2025.

Soy protein remains the preferred source for plant-based meat production in South Korea, benefiting from established supply chains and consumer familiarity with soy-based foods such as tofu and tempeh. Pulmuone, a leading soy-based food manufacturer, has opened plant-based restaurants and continues developing soy-based meat alternatives that currently comprise the majority of the meat alternative market. The excellent amino acid profile and protein content of approximately 40% per 100 grams make soy an ideal base for meat analog formulations. High-moisture extrusion technology applied to soy proteins enables manufacturers to achieve meat-like textures and fibrous structures that appeal to consumers.

Meat Type Insights:

- Chicken

- Beef

- Pork

- Others

Beef alternatives hold 35.83% of the South Korea plant-based meat market share in 2025.

Beef alternatives dominate the meat type segment as consumers seek plant-based versions of popular beef dishes including Korean BBQ, bulgogi, and hamburger patties. The emphasis on replicating beef's distinctive flavor, texture, and marbling has driven significant R&D investments. UNLIMEAT products process soy and pea proteins using patented extrusion methods to mimic beef and pork textures, achieving strong market acceptance across domestic and international channels. Premium positioning and association with sustainability messaging resonate with environmentally conscious consumers willing to pay premium prices for beef alternatives.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Restaurants and Catering Industry

- Supermarkets and Hypermarkets

- Convenience and Specialty Stores

- Online Retail

Supermarkets and hypermarkets account 36.94% of the South Korea plant-based market share in 2025.

Supermarkets and hypermarkets serve as the primary distribution channel for plant-based meat products, offering consumers convenient access to diverse product selections. Major retail chains including E-Mart, Lotte Mart, and Homeplus have expanded dedicated plant-based sections, enhancing product visibility and accessibility. The one-stop shopping experience, competitive pricing, and promotional activities make these outlets the preferred choice for plant-based meat purchases.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Seoul Capital Area represents the dominant regional market for plant-based meat products due to high population density, urbanization, and greater purchasing power. Major cities including Seoul and Incheon serve as key commercial hubs driving substantial demand. The region's advanced retail infrastructure, with a high concentration of hypermarkets, supermarkets, and online platforms, ensures widespread product availability. The affluent consumer base and strong distribution networks position Seoul Capital Area as the leading market segment. Yeongnam and other regions are witnessing growing adoption as awareness expands and retail penetration increases.

Market Dynamics:

Growth Drivers:

Why is the South Korea Plant-Based Meat Market Growing?

Rising Environmental and Ethical Awareness

Growing concerns regarding environmental sustainability and animal welfare are significantly influencing consumer purchasing decisions across South Korea. Increasing public awareness of climate change impacts, particularly carbon emissions associated with livestock farming, coupled with ethical considerations around animal treatment, is actively driving consumers toward choosing sustainable protein alternatives. This shift is especially pronounced among eco-conscious younger generations. Media coverage and advocacy efforts by environmental organizations serve to reinforce these concerns, positioning plant-based consumption as a choice that aligns with their core ethical and environmental values. Consequently, manufacturers are responding to this market demand by accelerating innovation in the alternative protein sector.

Government Support and Regulatory Initiatives

The South Korean government is actively supporting the alternative protein sector through policy initiatives and research funding. In May 2024, South Korea established a regulation-free special zone in Gyeongsangbuk-do province to accelerate innovation in cultivated meat, with a USD 14 Million project involving 10 food tech companies. The Ministry of Food and Drug Safety has established frameworks for regulatory approval of novel proteins, with procedural guidelines issued in early 2024. Additionally, the Ministry of Oceans and Fisheries announced USD 21 Million in research funding for plant-based and cultivated seafood technologies. These initiatives enhance South Korea's position as an advanced food technology ecosystem.

Advancements in Food Technology and Production

South Korean manufacturers are heavily investing in technological innovation to formulate plant-based meat alternatives. These products feature significantly improved taste, texture, and nutritional profiles, making them closer approximations of conventional meat. This strong focus on technological advancements is key to reducing production costs, enhancing scalability across the industry, and greatly broadening consumer appeal. Furthermore, strategic partnerships are boosting progress, aiming to accelerate alternative protein research, strengthen policy coordination, and foster international collaboration to support the growth of this vital sector.

Market Restraints:

What Challenges the South Korea Plant-Based Meat Market is Facing?

High Product Pricing Relative to Conventional Meat

Plant-based meat products carry a significant price premium compared to their animal-based counterparts, limiting adoption among price-sensitive consumers. Production costs remain elevated due to advanced manufacturing technologies and premium raw materials required for quality formulations, restricting market expansion beyond affluent households.

Taste and Texture Perception Gaps

Korean consumers prefer traditional beef over plant-based alternatives, primarily due to taste preferences. Replicating the exact flavor profile, mouthfeel, and texture of conventional meat remains challenging despite technological advances. Some consumers perceive plant-based products as overprocessed with too many preservatives and additives, creating hesitation among health-focused buyers.

Limited Consumer Awareness and Education

Consumer knowledge about plant-based meat remains limited, particularly regarding nutritional composition and health impacts. Many consumers lack understanding of the environmental benefits and protein quality of plant-based alternatives. Overcoming perceptions of overprocessing and addressing concerns about ingredient transparency require sustained consumer education efforts from manufacturers and industry stakeholders.

Competitive Landscape:

The South Korea plant-based meat market exhibits moderate fragmentation with both established food conglomerates and innovative startups competing for market share. Major domestic players are expanding their plant-based portfolios alongside specialized companies. International brands have also entered the market through retail partnerships. Competition is driven by product innovation, strategic partnerships, pricing strategies, and distribution network expansion. Companies are investing in R&D to improve taste and texture while localizing products to Korean culinary preferences.

South Korea Plant-Based Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Burger Patties, Sausages, Nuggets and Strips, Ground Meat, Meatballs, Others |

| Sources Covered | Soy, Wheat, Peas, Others |

| Meat Types Covered | Chicken, Beef, Pork, Others |

| Distribution Channels Covered | Restaurants and Catering Industry, Supermarkets and Hypermarkets, Convenience and Specialty Stores, Online Retail |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea plant-based meat market size was valued at USD 387.74 Million in 2025.

The South Korea plant-based meat market is expected to grow at a compound annual growth rate of 21.02% from 2026-2034 to reach USD 2,159.65 Million by 2034.

Burger patties, commanding a 31.82% share, lead the market due to their versatility, integration into foodservice channels, and alignment with consumer familiarity with burger formats.

Key growth drivers include rising health consciousness among consumers, growing environmental and ethical awareness, government support for alternative proteins, technological advancements in food production, and expanding retail and foodservice distribution channels.

Major challenges include high product pricing compared to conventional meat, taste and texture perception gaps among consumers, limited awareness about nutritional benefits, and concerns about overprocessing and ingredient transparency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)