South Korea Plasma Fractionation Market Size, Share, Trends and Forecast by Product, Sector, Application, End User, and Region, 2025-2033

South Korea Plasma Fractionation Market Overview:

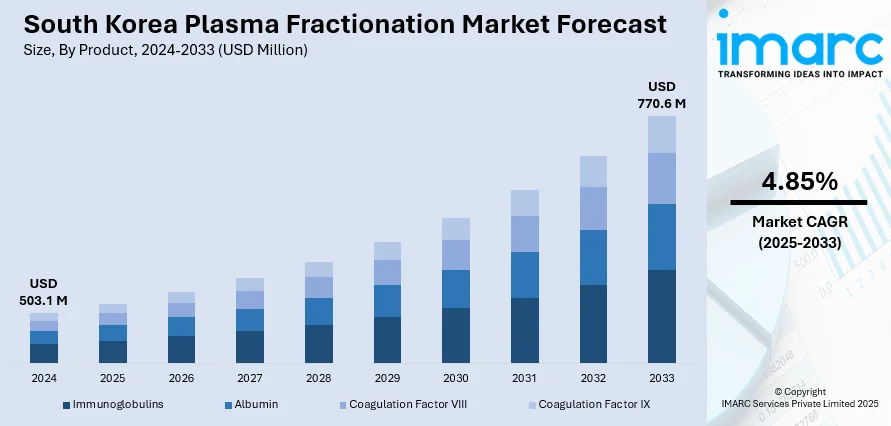

The South Korea plasma fractionation market size reached USD 503.1 Million in 2024. The market is projected to reach USD 770.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033. The market is fueled by the increased demand for immunoglobulins and the rise in chronic disease prevalence. In addition, improvements in healthcare infrastructure and biotechnology are propelling innovations in plasma-based therapies. Also, the government support through policy initiatives to enhance blood collection and fractionation processes is providing improved accessibility of plasma-derived products to healthcare practitioners and patients, further augmenting the South Korea plasma fractionation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 503.1 Million |

| Market Forecast in 2033 | USD 770.6 Million |

| Market Growth Rate 2025-2033 | 4.85% |

South Korea Plasma Fractionation Market Trends:

Growing Clinical Demand for Plasma-Derived Therapies

The market is experiencing sustained growth, primarily driven by increasing clinical demand for plasma-derived medicinal products (PDMPs), particularly immunoglobulins, albumin, and coagulation factors. This demand correlates with rising incidence rates of autoimmune diseases, immunodeficiency disorders, and rare bleeding conditions, which require lifelong treatment and regular administration of fractionated plasma components. According to industry reports, South Korea has now reached the status of a "super-aged society," with citizens aged 65 and above accounting for 20% of the population. This demographic shift is intensifying demand within the market, as elderly individuals are more susceptible to immunological disorders and chronic illnesses, requiring ongoing medical intervention and plasma-derived therapies. Furthermore, as physicians and specialists increasingly adopt PDMPs in standard treatment protocols, hospitals and health systems are emphasizing consistent access to these biologics. Additionally, greater awareness and earlier diagnosis of immune-related and hematological disorders are expanding the eligible patient pool. Besides, public and private insurers are progressively including plasma-derived treatments in reimbursement programs, which improves accessibility and drives consumption. These factors collectively establish a sustained base of therapeutic demand, which is significantly contributing to the South Korea plasma fractionation market growth.

To get more information on this market, Request Sample

Regulatory Advancements and Quality Standardization

The regulatory environment in South Korea has undergone considerable evolution to support the growing complexity of the market. As per a nationwide South Korean study published on May 11, 2025, people diagnosed with multiple sclerosis (MS) and neuromyelitis optica spectrum disorder (NMOSD) are found to have a substantially higher likelihood of developing autoimmune rheumatic diseases (ARDs), with risk levels elevated by factors of 5.35 and 9.13, respectively. This growing clinical association highlights an expanding patient base requiring long-term immunological support, thereby amplifying the demand for plasma-derived medicinal products. In response to such evolving healthcare needs, South Korea's regulatory authorities have intensified support for the plasma fractionation sector by streamlining approval pathways, reinforcing safety standards, and prioritizing therapies targeting autoimmune and immunodeficiency disorders. Moreover, the Ministry of Food and Drug Safety (MFDS) has implemented stringent quality and safety standards for both plasma collection and downstream processing, reflecting global best practices and aligning with international pharmacopoeias. These regulatory measures encompass viral inactivation, donor screening, and traceability protocols, enhancing overall product integrity. Also, the shift towards harmonized and science-based regulation fosters greater trust among healthcare providers and end users, encouraging the adoption of locally produced fractionated products. In addition, the increased engagement between regulators, manufacturers, and healthcare institutions also enables early risk identification and rapid response to safety concerns. In this way, South Korea's regulatory framework is not only safeguarding public health but also enhancing the global competitiveness of its plasma fractionation sector through predictable, transparent, and innovation-supportive oversight.

South Korea Plasma Fractionation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, sector, application, and end user.

Product Insights:

- Immunoglobulins

- Albumin

- Coagulation Factor VIII

- Coagulation Factor IX

The report has provided a detailed breakup and analysis of the market based on the product. This Includes immunoglobulins, albumin, coagulation factor VIII, and coagulation factor IX.

Sector Insights:

- Private Sector

- Public Sector

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes private sector and public sector.

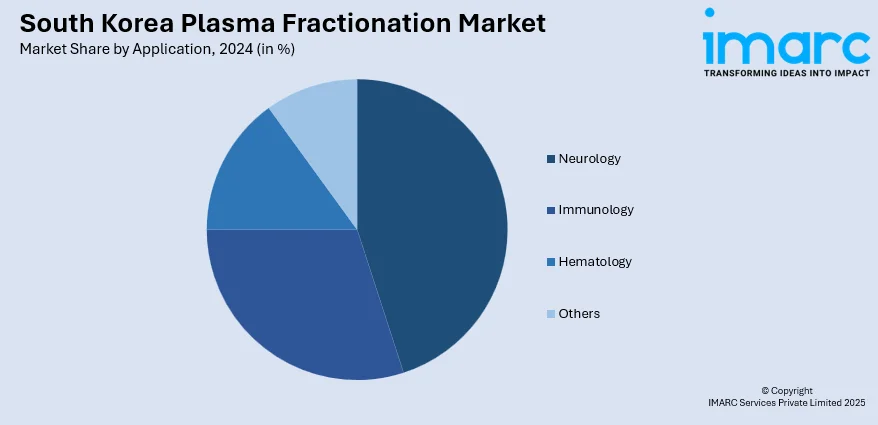

Application Insights:

- Neurology

- Immunology

- Hematology

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes neurology, immunology, hematology, and others.

End User Insights:

- Hospitals and Clinics

- Clinical Research Laboratories

- Academic Institutes

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, clinical research laboratories, and academic institutes.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Plasma Fractionation Market News:

- On April 10, 2025, SK Plasma confirmed that the first shipment of plasma collected from Indonesian donors had arrived at its Andong facility in South Korea under a contract-manufacturing‑only (CMO) agreement. This import marks the inaugural transfer of Indonesia-origin plasma into Korea, a preliminary stage in a 2023‑launched initiative to secure domestic self‑sufficiency in plasma‑derived medicinal products (PDMPs). The long‑term strategy also includes the construction of a fractionation plant in Karawang, Indonesia.

South Korea Plasma Fractionation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Immunoglobulins, Albumin, Coagulation factor VIII, Coagulation factor IX |

| Sectors Covered | Private Sector, Public Sector |

| Applications Covered | Neurology, Immunology, Hematology, Others |

| End Users Covered | Hospitals and Clinics, Clinical Research Laboratories, Academic Institutes |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea plasma fractionation market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea plasma fractionation market on the basis of product?

- What is the breakup of the South Korea plasma fractionation market on the basis of sector?

- What is the breakup of the South Korea plasma fractionation market on the basis of application?

- What is the breakup of the South Korea plasma fractionation market on the basis of end user?

- What is the breakup of the South Korea plasma fractionation market on the basis of region?

- What are the various stages in the value chain of the South Korea plasma fractionation market?

- What are the key driving factors and challenges in the South Korea plasma fractionation market?

- What is the structure of the South Korea plasma fractionation market and who are the key players?

- What is the degree of competition in the South Korea plasma fractionation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea plasma fractionation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea plasma fractionation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea plasma fractionation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)