South Korea Power Electronics Market Size, Share, Trends and Forecast by Device, Material, Application, Voltage, End Use Industry, and Region, 2025-2033

South Korea Power Electronics Market Overview:

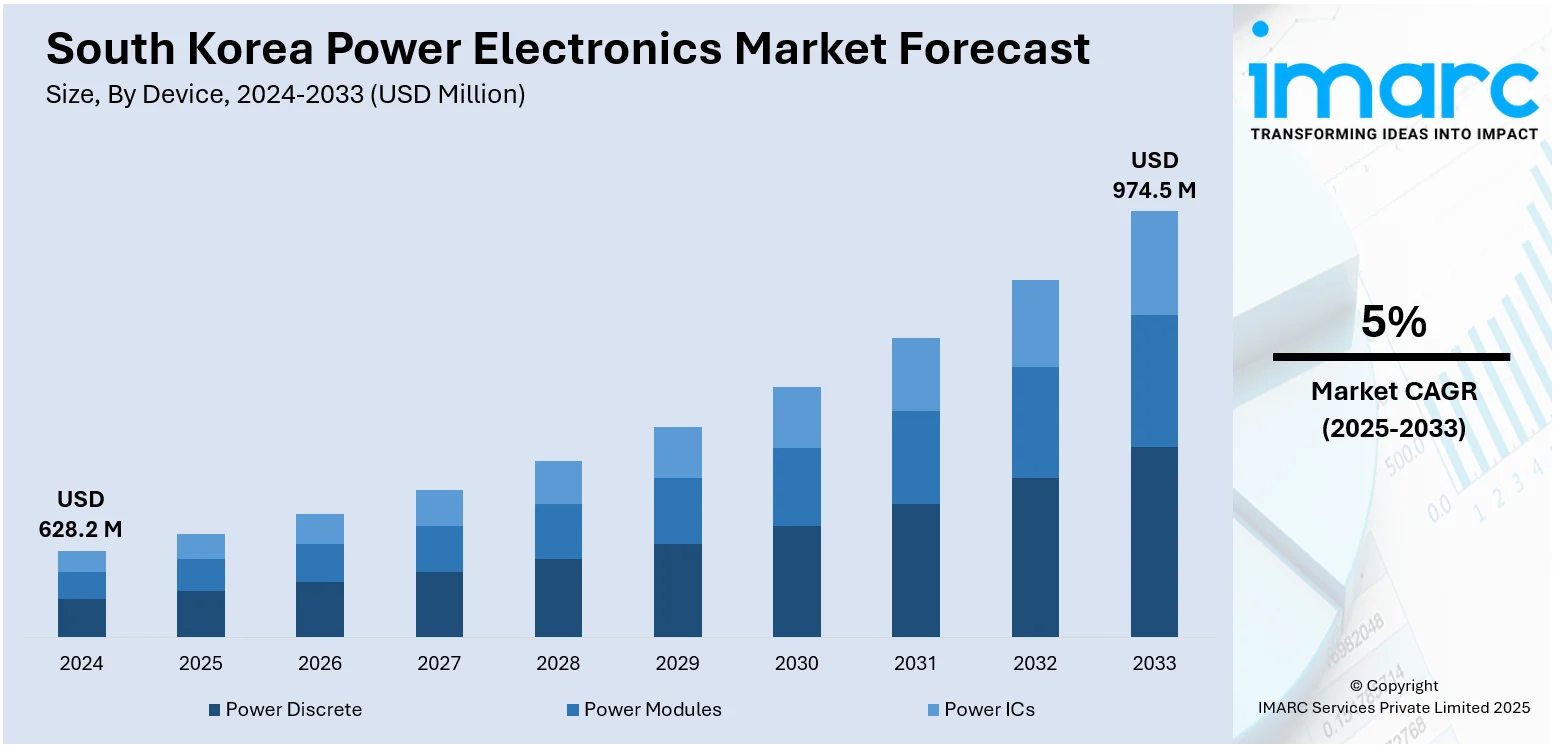

The South Korea power electronics market size reached USD 628.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 974.5 Million by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. Rising demand for electric vehicles, government push for renewable energy, expanding semiconductor production, strong investments in smart grids, industrial automation upgrades, and growing need for efficient power management are some of the factors contributing to South Korea power electronics market share, strengthening local manufacturing and boosting advanced energy-saving solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 628.2 Million |

| Market Forecast in 2033 | USD 974.5 Million |

| Market Growth Rate 2025-2033 | 5% |

South Korea Power Electronics Market Trends:

Hydrogen Vehicles Fueling Demand for Advanced Electronics

South Korea’s push for hydrogen mobility is boosting demand for cutting-edge power electronics. New fuel cell SUVs with long driving ranges rely on high-efficiency converters, inverters, and controllers to manage energy flow between hydrogen stacks, batteries, and electric motors. Local suppliers are ramping up R&D to deliver smaller, lighter, and more efficient systems that can handle high power loads while maintaining safety. This focus supports growth in components like power semiconductors and thermal management tech. As clean transport adoption expands, so does the need for smart power management to improve performance and extend vehicle life. With strong government backing and steady product launches, the country’s power electronics suppliers are well placed to lead regional innovation in next-gen mobility systems. These factors are intensifying the South Korea power electronics market growth. For example, in April 2025, Hyundai Motor unveiled the new NEXO fuel cell electric SUV at the Seoul Mobility Show, reinforcing South Korea’s power electronics market leadership. The second-generation NEXO features advanced fuel cell systems with over 700 km range and zero tailpipe emissions. This launch highlights Hyundai’s push for hydrogen mobility and broad electrification, supporting the nation’s growth in clean transport technologies and power conversion innovation.

To get more information on this market, Request Sample

HVDC Expansion Strengthening Grid Electronics

South Korea’s adoption of voltage source converter HVDC systems signals bigger strides in grid modernization and power electronics. New subsea installations deliver flexible, stable energy transmission to regions with growing demand, like island provinces with seasonal population surges. Advanced converters balance variable loads and enable higher efficiency in moving electricity over long distances. Local suppliers and engineers are working on smarter control modules, better semiconductors, and durable converter stations to handle fluctuating renewable inputs. This push aligns with national goals for cleaner, more resilient energy infrastructure. As large-scale HVDC projects gain momentum, opportunities grow for next-generation power modules, cooling solutions, and digital monitoring tools. South Korea’s focus on reliable, efficient grids keeps its power electronics sector competitive and ready for wider export potential. For instance, in December 2024, Hitachi Energy and KEPCO launched South Korea’s first Voltage Source Converter (VSC) HVDC technology on Jeju Island. The Wando-Dongjeju #3 project injects 200 MW, boosting power flow stability through subsea cables. This upgrade supports Jeju’s rising electricity needs and helps secure reliable energy for its heavy tourist traffic, marking a step forward for South Korea’s power electronics sector and grid modernization goals.

South Korea Power Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device, material, application, voltage, and end use industry.

Device Insights:

- Power Discrete

- Diode

- Transistors

- Thyristor

- Power Modules

- Intelligent Power Module

- Power Integrated Module

- Power ICs

- Power Management Integrated Circuit

- Application-Specific Integrated Circuit

The report has provided a detailed breakup and analysis of the market based on the device. This includes power discrete (diode, transistors, and thyristor), power modules (intelligent power module and power integrated module), and power ICs (power management integrated circuit and application-specific integrated circuit).

Material Insights:

- Silicon

- Sapphire

- Silicon Carbide

- Gallium Nitride

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes silicon, sapphire, silicon carbide, gallium nitride, and others.

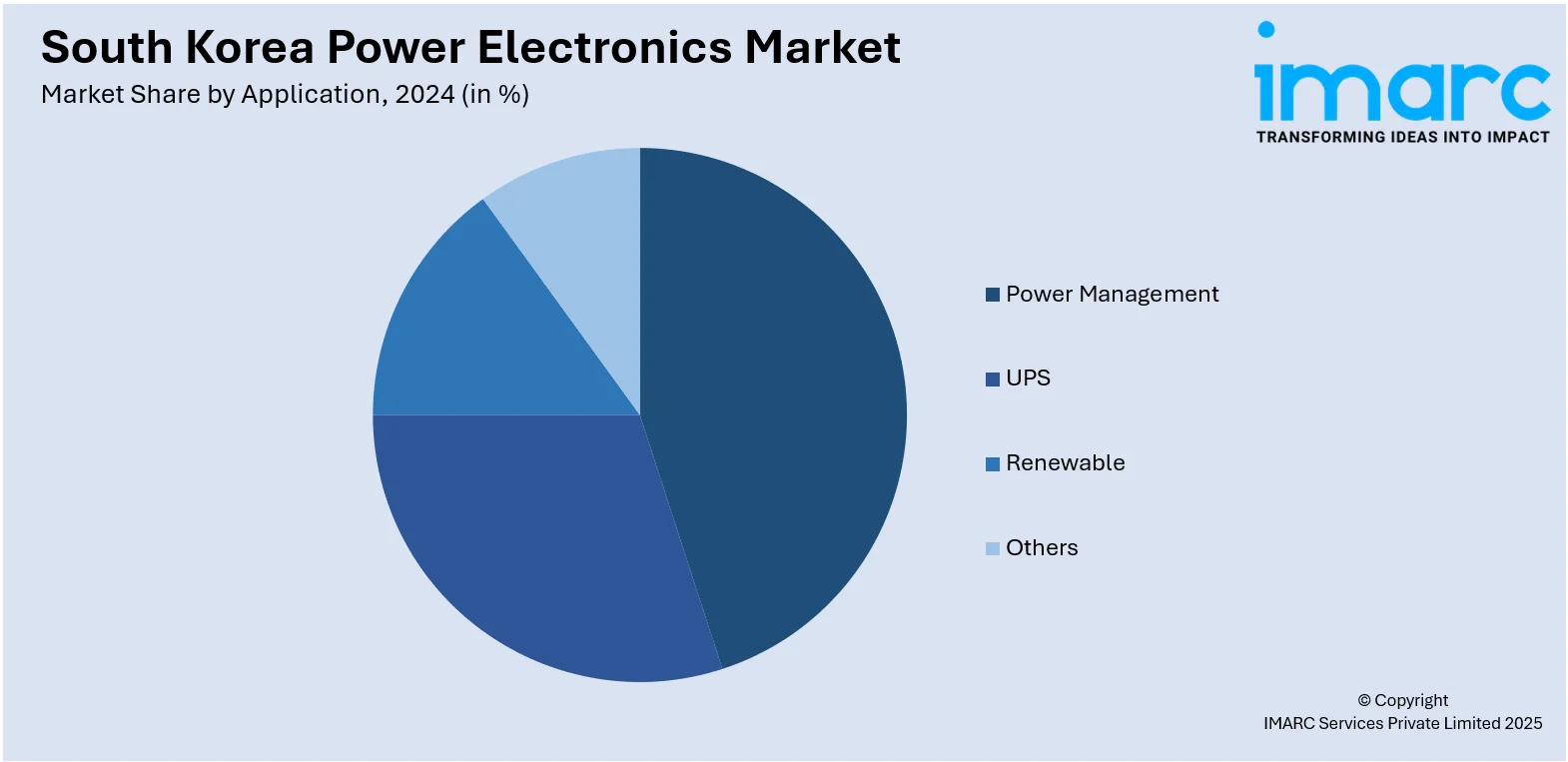

Application Insights:

- Power Management

- UPS

- Renewable

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power management, UPS, renewable, and others.

Voltage Insights:

- Low Voltage

- Medium Voltage

- High Voltage

The report has provided a detailed breakup and analysis of the market based on the voltage. This includes low voltage, medium voltage, and high voltage.

End Use Industry Insights:

- Automotive

- Military and Aerospace

- Energy and Power

- IT and Telecommunication

- Consumer Electronics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, military and aerospace, energy and power, IT and telecommunication, consumer electronics, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Edge Data Center Market News:

- In June 2025, LS Electric signed an MOU with Spain’s Power Electronics to grow its energy storage system business worldwide. LS Electric would integrate Power Electronics’ power conversion systems into its ESS products for North America and Asia. In exchange, Power Electronics would adopt LS Electric’s power solutions, like distribution transformers, for future renewable energy projects, strengthening South Korea’s position in the global power electronics market.

South Korea Power Electronics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered |

|

| Materials Covered | Silicon, Sapphire, Silicon Carbide, Gallium Nitride, Others |

| Applications Covered | Power Management, UPS, Renewable, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Use Industries Covered | Automotive, Military and Aerospace, Energy and Power, IT and Telecommunication, Consumer Electronics, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea power electronics market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea power electronics market on the basis of device?

- What is the breakup of the South Korea power electronics market on the basis of material?

- What is the breakup of the South Korea power electronics market on the basis of application?

- What is the breakup of the South Korea power electronics market on the basis of voltage?

- What is the breakup of the South Korea power electronics market on the basis of end use industry?

- What is the breakup of the South Korea power electronics market on the basis of region?

- What are the various stages in the value chain of the South Korea power electronics market?

- What are the key driving factors and challenges in the South Korea power electronics market?

- What is the structure of the South Korea power electronics market and who are the key players?

- What is the degree of competition in the South Korea power electronics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea power electronics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea power electronics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea power electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)