South Korea Power Rental Market Size, Share, Trends and Forecast by Fuel Type, Equipment Type, Power Rating, Application, End Use Industry, and Region, 2025-2033

South Korea Power Rental Market Overview:

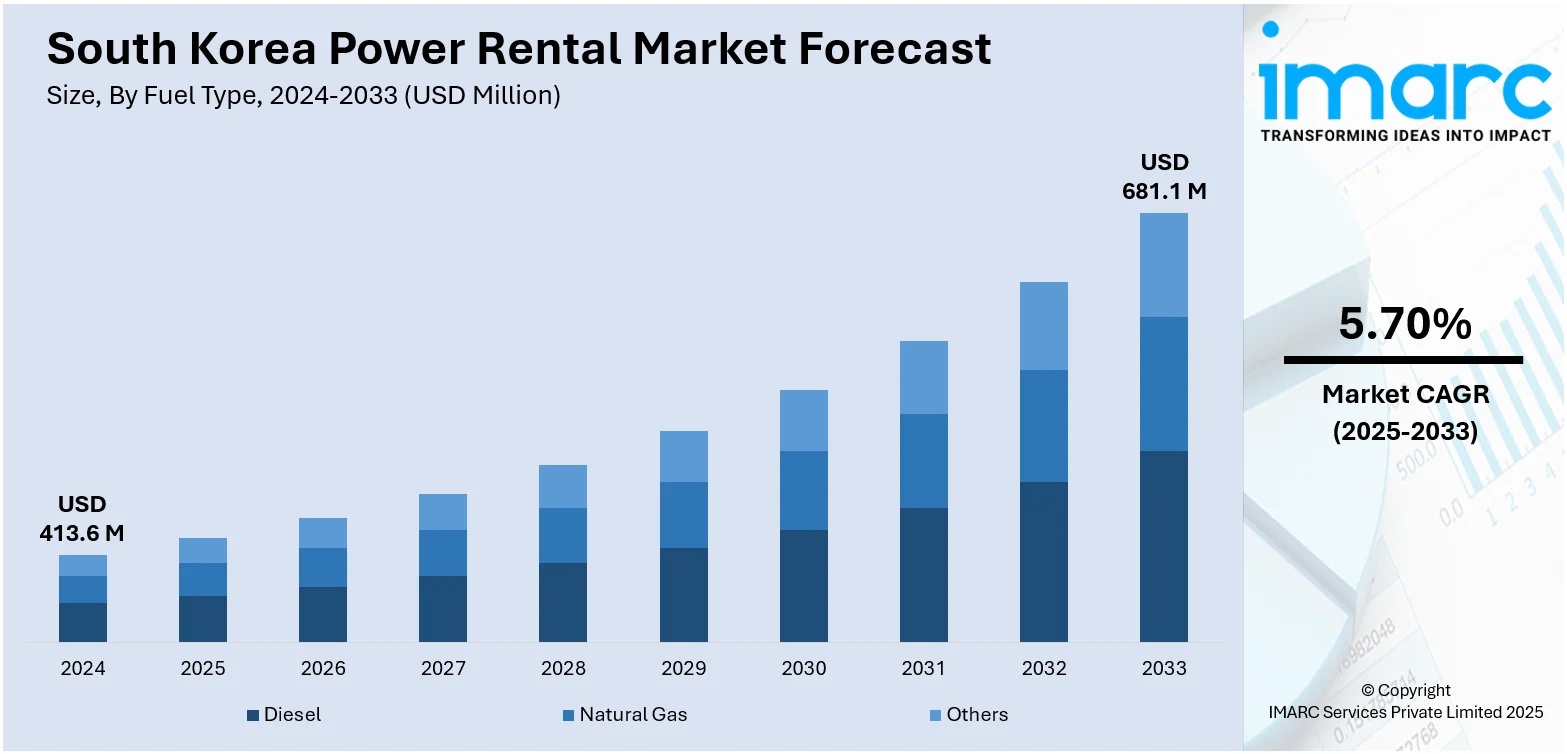

The South Korea power rental market size reached USD 413.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 681.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is driven by consistent demand from infrastructure, construction, and large-scale events for temporary power solutions. Critical industries, including manufacturing, healthcare, and data, lease backup power for resilience and regulatory compliance. Government policies encouraging flexible, low-emission power systems are further augmenting the South Korea power rental market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 413.6 Million |

| Market Forecast in 2033 | USD 681.1 Million |

| Market Growth Rate 2025-2033 | 5.70% |

South Korea Power Rental Market Trends:

Infrastructure Projects and Event-Driven Demand

South Korea’s ongoing investments in large-scale infrastructure, such as construction sites, public works, stadiums, and film sets, create robust demand for temporary power rental services. These projects often span multiple months and require tailored power solutions, from diesel generators to hybrid and grid‑support units. On May 31, 2024, South Korea outlined plans to generate 70% of its electricity from carbon-free sources, including nuclear and renewables, by 2038, up from less than 40% in 2023. The country intends to increase solar and wind power capacity to 72 gigawatts by 2030, up from 23 gigawatts in 2022, and expand its nuclear fleet by adding four plants by 2038. Additionally, South Korea will replace aging coal plants with carbon-free alternatives like hydrogen and pumped-storage hydroelectricity. Construction codes and event safety regulations mandate resilient power backup, prompting contractors and organizers to rely on rental providers rather than capitalizing on inflexibility-limited ownership. For festivals, outdoor exhibitions, and emergency response drills, power rentals offer scalability, timely deployment, and maintenance support. Providers specialize in delivering turnkey solutions that include load analysis, compliance assurance, and on-site technical assistance. Recent developments in modular generator technology enable quieter, more fuel-efficient operations, essential for residential zones, hospitals, and educational facilities. These capabilities reduce downtime and operational uncertainty during peak demand periods. The combination of evolving civil projects and a dynamic event calendar ensures that power rental remains a strategic enabler of South Korea power rental market growth, supporting continuous market specialization.

To get more information on this market, Request Sample

Policy Push Toward Flexible Energy and Green Power Integration

South Korea’s energy policies are encouraging diversification of power supply and promoting flexible energy systems, offering new opportunities for the rental sector. Regulatory frameworks incentivize the use of low-emission and renewable-compatible generators, such as biogas-fueled engines and solar-hybrid units, which can be deployed temporarily for peak shaving, site testing, or grid support. On February 21, 2025, South Korea unveiled a new energy strategy that includes the construction of two large-scale nuclear reactors by 2038 and aims to expand renewable energy by an average of 7 gigawatts annually by 2030. The country plans to reduce its coal power share from 31.4% in 2023 to 10.1% by 2038, while boosting carbon-free power sources, including nuclear and renewables, to reach 70% of its energy mix by 2038. Additionally, South Korea is targeting a significant rise in renewable energy generation from 49.4 terawatt-hours (TWh) in 2023 to 205.7 TWh by 2038. Disaster preparedness plans also include rapid-deployment rental power systems capable of operating in decentralized or off-grid scenarios. The Ministry of Trade, Industry and Energy (MOTIE) and civic authorities support rental providers through equipment certification, safety standards, and subsidies for greener power solutions. Demonstration projects in remote areas and islands increasingly leverage rental units equipped with solar arrays and battery storage to evaluate energy resilience models. As smart grid and microgrid deployments expand, power rental services are evolving to support transitional power configurations during grid upgrades or outages. This policy-driven encouragement of adaptable, lower-emission energy solutions is helping to evolve the South Korea power rental market toward more customizable, sustainable offerings.

South Korea Power Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on fuel type, equipment type, power rating, application, and end use industry.

Fuel Type Insights:

- Diesel

- Natural Gas

- Others

The report has provided a detailed breakup and analysis of the market based on fuel type. This includes diesel, natural gas, and others.

Equipment Type Insights:

- Generator

- Transformer

- Load Bank

- Others

The report has provided a detailed breakup and analysis of the market based on equipment type. This includes generator, transformer, load bank, and others.

Power Rating Insights:

- Up to 50 kW

- 51 -500 kW

- 501 -2,500 kW

- Above 2,500 kW

The report has provided a detailed breakup and analysis of the market based on power rating. This includes up to 50 kW, 51 -500 kW, 501 -2,500 kW, and above 2,500 kW.

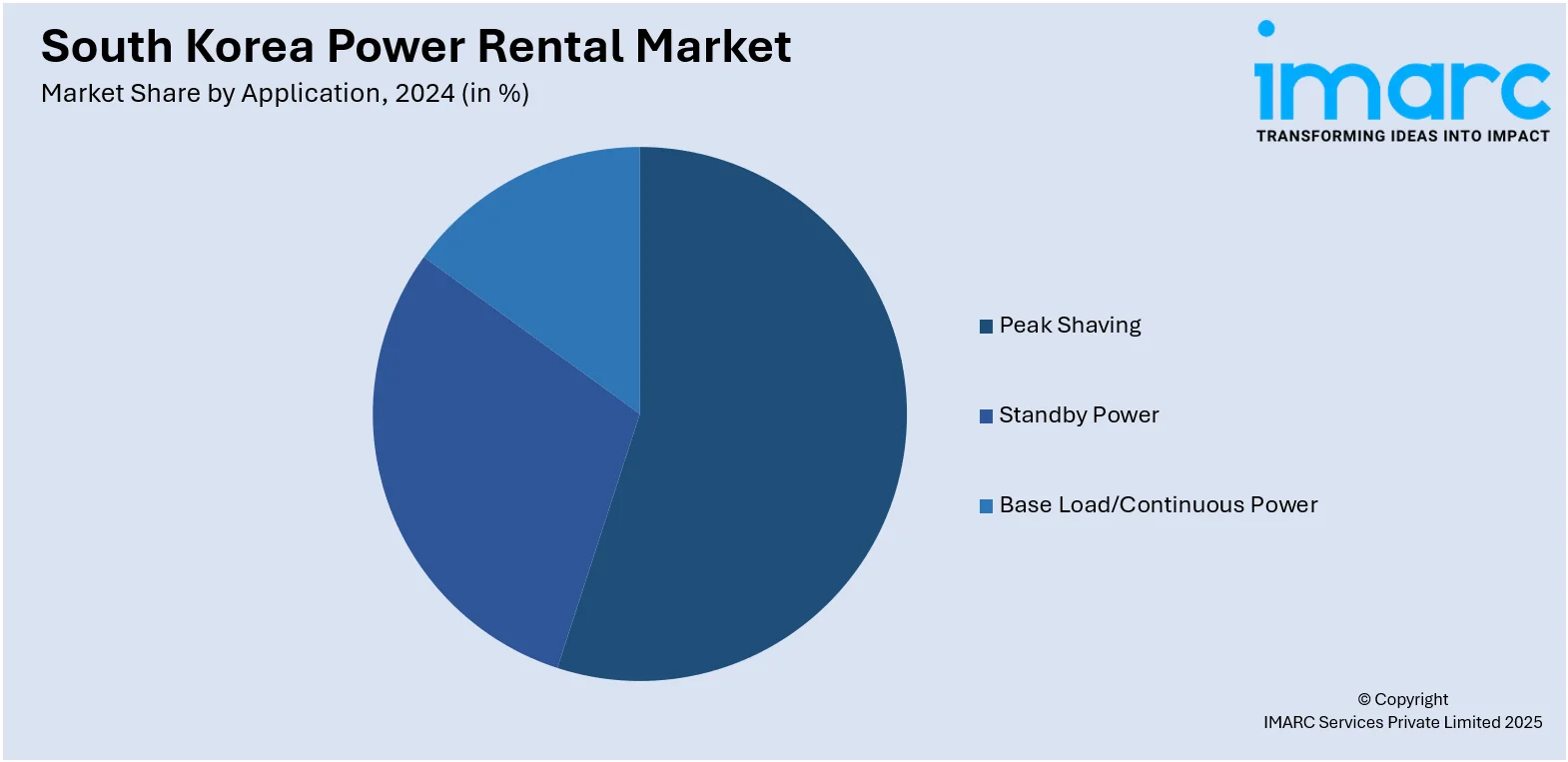

Application Insights:

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

The report has provided a detailed breakup and analysis of the market based on application. This includes peak shaving, standby power, and base load/continuous power.

End Use Industry Insights:

- Utilities

- Oil and Gas

- Events

- Construction

- Mining

- Data Centers

- Others

The report has provided a detailed breakup and analysis of the market based on end use industry. This includes utilities, oil and gas, events, construction, mining, data centers, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Power Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Power Ratings Covered | Up to 50 kW, 51 -500 kW, 501 -2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil and Gas, Events, Construction, Mining, Data Centers, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea power rental market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea power rental market on the basis of fuel type?

- What is the breakup of the South Korea power rental market on the basis of equipment type?

- What is the breakup of the South Korea power rental market on the basis of power rating?

- What is the breakup of the South Korea power rental market on the basis of application?

- What is the breakup of the South Korea power rental market on the basis of end use industry?

- What is the breakup of the South Korea power rental market on the basis of region?

- What are the various stages in the value chain of the South Korea power rental market?

- What are the key driving factors and challenges in the South Korea power rental?

- What is the structure of the South Korea power rental market and who are the key players?

- What is the degree of competition in the South Korea power rental market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea power rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea power rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea power rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)