South Korea Pressure Sensor Market Size, Share, Trends and Forecast by Product, Type, Technology, Application, and Region, 2026-2034

South Korea Pressure Sensor Market Summary:

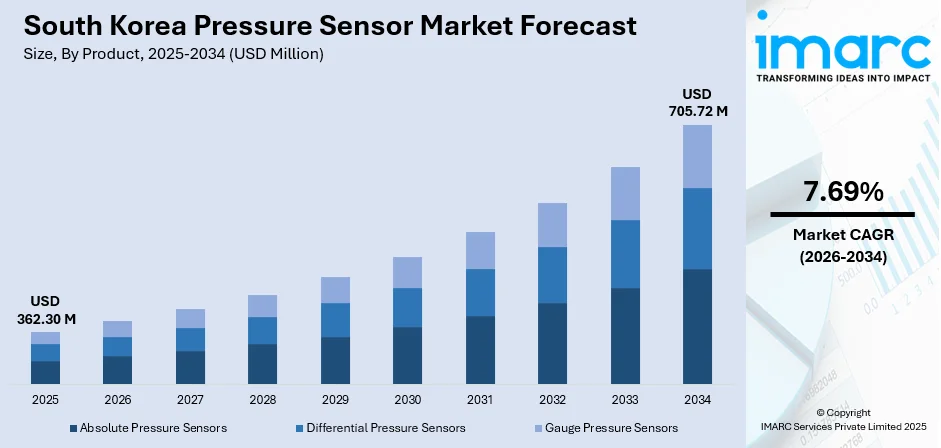

The South Korea pressure sensor market size was valued at USD 362.30 Million in 2025 and is projected to reach USD 705.72 Million by 2034, growing at a compound annual growth rate of 7.69% from 2026-2034.

The South Korea pressure sensor market is experiencing growth driven by the nation's accelerated industrial digitization, expanding automotive electrification initiatives, and strengthening smart city infrastructure development. The convergence of advanced manufacturing technologies, stringent safety regulations, and increasing adoption of Industry 4.0 solutions is fundamentally transforming demand patterns across industrial, automotive, and healthcare sectors. Rising investments in semiconductor fabrication facilities, coupled with government-backed smart factory programs, are creating substantial opportunities for pressure sensor manufacturers to grow.

Key Takeaways and Insights:

- By Product: Absolute pressure sensors dominate the market with a share of 45.2% in 2025, because of their critical applications in automotive systems, industrial process control, and medical devices requiring precise atmospheric reference measurements.

- By Type: Wired leads the market with a share of 82.15% in 2025, owing to its reliability, cost-effectiveness, and established integration within existing industrial automation infrastructure across manufacturing facilities.

- By Technology: Piezoresistive represents the largest segment with a market share of 27.23% in 2025, driven by its superior accuracy, compact form factor, and cost-efficient manufacturing processes suitable for high-volume automotive and consumer electronics applications.

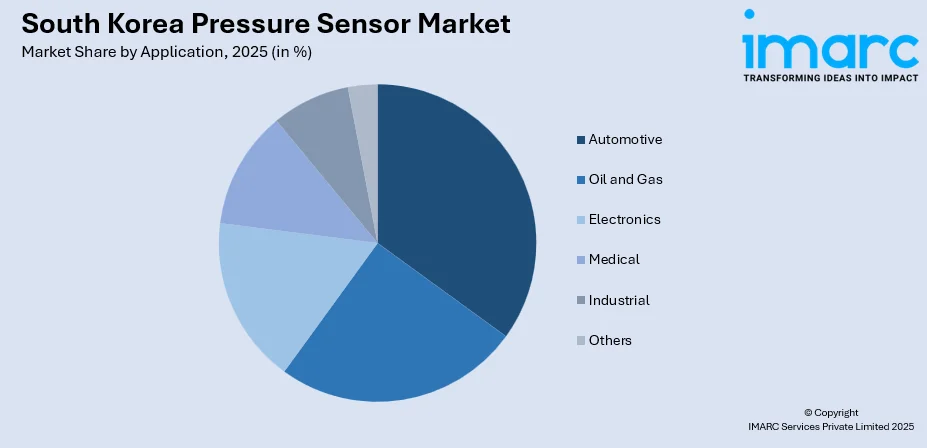

- By Application: Automotive dominates the market with a share of 30.3% in 2025, due to the increasing electric vehicle (EV) production, advanced driver assistance systems deployment, and stringent vehicle safety regulations mandating comprehensive pressure monitoring.

- By Region: Seoul Capital Area leads the market with a share of 38.5% in 2025, supported by concentrated headquarters of major electronics conglomerates, extensive research and development (R&D) infrastructure, and proximity to semiconductor manufacturing clusters.

- Key Players: The South Korea pressure sensor market exhibits competitive dynamics characterized by multinational sensor manufacturers establishing regional operations alongside domestic electronics companies developing indigenous sensing technologies for automotive and industrial applications.

To get more information on this market Request Sample

The growth of South Korea pressure sensor market is strongly supported by accelerating automation, expanding semiconductor production, and rising integration of sensing technologies across automotive, healthcare, and industrial systems. Demand continues to increase as manufacturers prioritize precision, reliability, and real-time monitoring to enhance operational efficiency and meet tightening performance standards. This momentum is reinforced by developments in advanced vehicle technologies, highlighted in 2024 when Valeo opened a new plant in Daegu dedicated to producing ADAS components, including ultrasound sensors, radars, cameras, and LiDARs for autonomous vehicles. Such investments strengthen the country’s position as a hub for next-generation mobility and electronics, driving broader adoption of high-accuracy pressure sensors across interconnected applications. As industries transition toward smarter, more efficient systems, pressure sensors remain essential for safety, quality control, and system optimization, ensuring steady market growth.

South Korea Pressure Sensor Market Trends:

Expansion of Smart Industrial Automation and Factory Digitization

South Korea’s pressure sensor market is growing as national Industry 4.0 initiatives accelerate the digital transformation of manufacturing. Pressure sensors play a central role in smart factory environments by enabling precise monitoring, real-time process control, and improved safety management across automated production lines. Their integration supports predictive maintenance, reduces operational disruptions, and enhances efficiency in fluid control and material-handling systems. This direction is reinforced by government-backed programs promoting industrial automation, including the 2025 smart factory initiative that allocates 3 billion won to help small and medium-sized food manufacturers adopt digital systems. Supported by the Ministry of SMEs and Startups and Samsung Electronics, the program strengthens productivity and competitiveness, further catalyzing the demand for advanced sensing technologies nationwide.

Infrastructure Modernization and Smart City Development

South Korea’s municipal infrastructure modernization is increasing the role of pressure sensors beyond industrial use, as cities adopt smarter systems to improve safety, resource efficiency, and operational reliability. Pressure sensors support critical functions in water management, waste systems, transportation networks, and environmental monitoring, enabling real-time oversight and automated control across urban services. This shift aligns with national initiatives to integrate advanced technologies into city planning, highlighted by the 2025 Smart City Creation and Expansion Project, which allocates 16 billion won to deploy AI-enabled solutions across hub-type cities, small urban zones, and specialized districts. As smart city development accelerates, there is a rise in the demand for high-precision pressure sensing technologies to ensure real-time monitoring, efficient resource management, and reliable automation across critical urban infrastructure systems.

Integration in Electric Mobility and Advanced Transportation Systems

South Korea’s transition toward electric mobility is expanding opportunities for pressure sensor adoption across both private and public transportation systems. Pressure sensors are becoming essential for real-time diagnostics, battery safety management, thermal regulation, and predictive maintenance in EVs and fleet vehicles. This trend aligns with rapid industry growth, as noted by the ITA, which stated that South Korea’s EV and charging infrastructure market grew at an annual rate of 19% from 2020 to 2024, and the country produced 407,009 EVs in 2025, representing 11% of total vehicle output. As electric and connected mobility platforms evolve, continuous pressure monitoring strengthens operational reliability, enhances safety, and supports national goals for a modern, data-driven transportation ecosystem.

Market Outlook 2026-2034:

The South Korea pressure sensor market is positioned for growth, supported by rapid technological advancement and rising adoption of automation across automotive, electronics, healthcare, and industrial sectors. Increasing demand for precise monitoring, energy efficiency, and safety systems further strengthens the market growth. The market generated a revenue of USD 362.30 Million in 2025 and is projected to reach a revenue of USD 705.72 Million by 2034, growing at a compound annual growth rate of 7.69% from 2026-2034.

South Korea Pressure Sensor Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Absolute Pressure Sensors | 45.2% |

| Type | Wired | 82.15% |

| Technology | Piezoresistive | 27.23% |

| Application | Automotive | 30.3% |

| Region | Seoul Capital Area | 38.5% |

Product Insights:

- Absolute Pressure Sensors

- Differential Pressure Sensors

- Gauge Pressure Sensors

Absolute pressure sensors dominate with a market share of 45.2% of the total South Korea pressure sensor market in 2025.

Absolute pressure sensors lead the market, as they provide precise, reference-based measurements essential for applications requiring stable and accurate pressure readings. Their reliability under fluctuating environmental conditions makes them suitable for advanced automotive, industrial, and semiconductor processes.

Their strong position is further supported by the growing demand for high-precision monitoring in vacuum systems, engine management, and cleanroom environments. As industries tighten performance standards and expand automation, absolute pressure sensors remain vital for ensuring consistent measurement accuracy and operational control.

Type Insights:

- Wired

- Wireless

Wired leads with a market share of 82.15% of the total South Korea pressure sensor market in 2025.

Wired represents the largest segment, driven by its ability to offer stable signal transmission, high accuracy, and minimal interference, making it suitable for critical industrial, automotive, and manufacturing applications that require dependable real-time monitoring and control.

Its widespread adoption is also supported by easier integration with existing infrastructure, lower long-term maintenance needs, and strong compatibility with traditional automation systems. As many facilities prioritize reliability over mobility, wired remains the preferred option for consistent operational performance.

Technology Insights:

- Piezoresistive

- Electromagnetic

- Capacitive

- Resonant Solid-State

- Optical

- Others

Piezoresistive exhibits a clear dominance with a 27.23% share of the total South Korea pressure sensor market in 2025.

Piezoresistive holds the biggest market share owing to its ability to deliver high accuracy, stable output, and strong performance across a wide pressure range. Its reliability under varying temperatures and harsh conditions makes it suitable for demanding industrial and automotive applications.

The technology is also favored for its compatibility with micro-electromechanical systems (MEMS) manufacturing, enabling compact designs and cost-efficient mass production. As sectors such as automotive, healthcare, and electronics pursue precise monitoring capabilities, piezoresistive remain the preferred choice for consistent and repeatable measurement.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Oil and Gas

- Electronics

- Medical

- Industrial

- Others

Automotive represents the largest segment with a 30.3% share of the total South Korea pressure sensor market in 2025.

Automotive leads the market, as modern vehicles require precise sensing technologies for engine control, braking systems, emissions management, and safety functions. The growing adoption of advanced driver-assistance systems is driving the need for reliable, high-accuracy pressure monitoring components.

The sector’s strong manufacturing base and continuous shift toward electric and connected vehicles further drives the demand for sensors that support battery management, thermal regulation, and enhanced vehicle diagnostics. With the South Korea’s EV market set to reach 20% of total vehicle sales by the end of 2025, sensors remain vital for supporting safe, efficient vehicle performance.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Seoul Capital Area leads with a market share of 38.5% of the total South Korea pressure sensor market in 2025.

Seoul Capital Area dominates the market due to its concentration of major electronics manufacturers, advanced industrial facilities, and strong investment in sensor-driven automation. High technological readiness and widespread adoption of smart manufacturing strengthen regional demand.

The region also benefits from dense automotive, semiconductor, and healthcare clusters that rely on precise sensing technologies for quality control and safety. Continuous R&D activity, skilled workforce availability, and robust infrastructure further support its dominant share in the national pressure sensor market.

Market Dynamics:

Growth Drivers:

Why is the South Korea Pressure Sensor Market Growing?

Expanding Healthcare and Medical Device Sector Requirements

South Korea’s healthcare sector is increasingly integrating precision pressure sensors as demand grows for advanced monitoring and medical device technologies that support accurate blood-pressure measurement, respiratory assessment, and controlled infusion systems. This need is intensifying as the population ages, which 2024 Statistics on the Aged reported that individuals aged 65 and above represent 19.2% of the population, a share projected to exceed 20% by 2025 and reach 30% by 2036. With rising chronic disease prevalence and expanding adoption of wearable and home-based monitoring devices that rely on miniaturized sensing components, pressure sensors are becoming essential to delivering reliable, continuous healthcare support.

Increasing Adoption of Renewable Energy Systems

South Korea’s transition toward renewable energy is driving the need for advanced pressure sensors across wind systems, hydrogen infrastructure, energy storage units, and smart grid networks. These sensors support safe operation by monitoring pressure levels, gas flow, and thermal stability while enabling predictive maintenance and efficient energy generation. This direction aligns with national modernization efforts, exemplified in 2025 by the launch of a task force focused on creating an AI-enabled next-generation power grid designed to enhance power generation, storage, and consumption. As renewable installations expand and digital grid management advances, pressure sensors remain critical to sustaining reliable, secure, and high-performance energy systems.

Rising Adoption of IoT and Connected Devices

South Korea’s expanding IoT ecosystem is catalyzing the demand for compact, power-efficient, and highly accurate pressure sensors that support continuous data collection across smart homes, wearables, infrastructure, and building management systems. This trend is strengthened by the growing interoperability between devices, as exemplified in 2025, when Hyundai Motor Group and Samsung Electronics announced a collaboration to create an integrated IoT ecosystem linking homes and vehicles through the SmartThings platform. As connected networks evolve across residential, commercial, and industrial settings, pressure sensors become essential for monitoring airflow, water flow, gas levels, and environmental variations, requiring long-term stability, digital connectivity, and smooth integration with analytics systems.

Market Restraints:

What Challenges the South Korea Pressure Sensor Market is Facing?

High Implementation Costs

Initial investment requirements for deploying pressure sensors and integrating them into existing manufacturing environments significantly constrain adoption among small and medium-sized firms. These firms often lack the financial capacity to support full automation upgrades, as expenses extend beyond sensor acquisition to include system redesign, advanced software platforms, workforce training, and ongoing maintenance. The cumulative cost burden slows digital transformation and limits SME participation in Industry 4.0 initiatives.

Technical Integration Complexity across Legacy Industrial Systems

Integration of advanced pressure sensors into legacy manufacturing systems is often hindered by diverse communication protocols, outdated interfaces, and incompatible automation architectures. Such complexity requires extensive system modifications, prolonging implementation timelines and elevating overall project costs. Manufacturers must invest in middleware, engineering support, and validation processes to achieve seamless connectivity, delaying operational benefits and extending the time needed to realize returns on technology investments.

Supply Chain Dependencies and Component Availability Constraints

Manufacturers face challenges due to reliance on imported components and specialized materials essential for pressure sensor production. Global semiconductor shortages and periodic disruptions in MEMS-based component supply can affect delivery schedules and raise procurement costs. These uncertainties force companies to maintain higher inventory levels, negotiate alternative sourcing agreements, and adjust production planning to safeguard continuity, ultimately influencing pricing stability and long-term operational resilience.

Competitive Landscape:

The South Korea pressure sensor market exhibits dynamic competitive characteristics with multinational sensor manufacturers establishing regional manufacturing and research operations alongside domestic electronics companies developing indigenous sensing technologies. Market participants are adopting strategies encompassing partnerships, mergers, technological innovations, and capacity investments to enhance product offerings and secure sustainable competitive advantages. Competition intensity is shaped by technological differentiation in MEMS fabrication capabilities, automotive qualification certifications, and established relationships with major Korean conglomerates across electronics and automotive sectors. Companies are focusing on developing application-specific solutions tailored to Korean manufacturing requirements while expanding product portfolios to address emerging opportunities in EVs, smart factories, and connected healthcare applications.

Recent Developments:

- In October 2024, MICROSENSOR announced that its MDM7000 Smart Pressure Transmitters received certification from the Korean Register (KR). This certification highlighted the company's achievements in the global marine engineering and shipbuilding sectors.

South Korea Pressure Sensor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Absolute Pressure Sensors, Differential Pressure Sensors, Gauge Pressure Sensors |

| Types Covered | Wired, Wireless |

| Technologies Covered | Piezoresistive, Electromagnetic, Capacitive, Resonant Solid-State, Optical, Others |

| Applications Covered | Automotive, Oil and Gas, Electronics, Medical, Industrial, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea pressure sensor market size was valued at USD 362.30 Million in 2025.

The South Korea pressure sensor market is expected to grow at a compound annual growth rate of 7.69% from 2026-2034 to reach USD 705.72 Million by 2034.

Seoul Capital Area dominates the market with a share of 38.5% in 2025, driven by concentrated electronics headquarters, extensive R&D infrastructure, and proximity to semiconductor manufacturing clusters across Gyeonggi Province.

Key factors driving the South Korea pressure sensor market include the rapid expansion of electric mobility, supported by a 19% annual growth rate in the EV and charging sector from 2020 to 2024 and the production of 407,009 EVs in 2025, driving the demand for precise pressure monitoring in advanced vehicle systems.

Major challenges include high implementation costs constraining SME adoption, technical integration complexity across legacy industrial systems, supply chain dependencies on imported components, and workforce training requirements for advanced sensor technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)