South Korea Procurement Software Market Size, Share, Trends and Forecast by Software Type, Deployment, Organization Size, Vertical, and Region, 2025-2033

South Korea Procurement Software Market Overview:

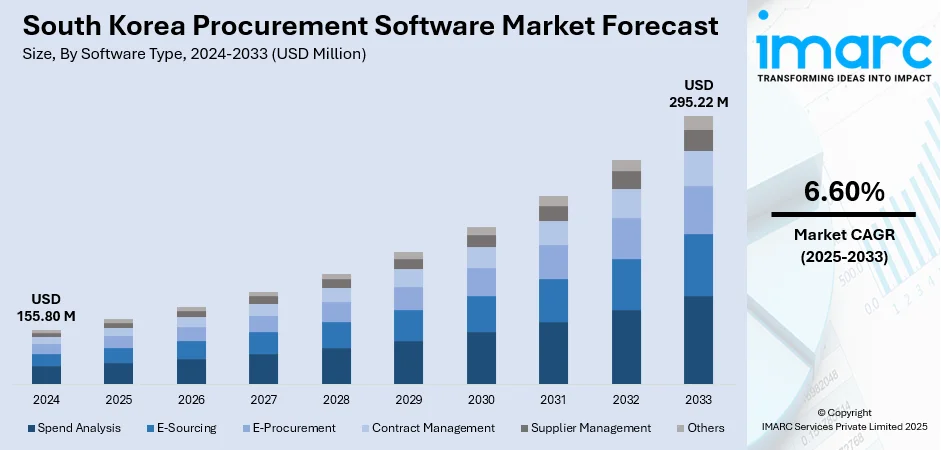

The South Korea procurement software market size reached USD 155.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 295.22 Million by 2033, exhibiting a growth rate (CAGR) of 6.60% during 2025-2033. Rising digital transformation initiatives, increased public sector IT investments, growing demand for efficient vendor management, adoption of e-procurement platforms, cloud-based deployment preferences, and government efforts to improve procurement transparency and efficiency are some of the factors contributing to South Korea procurement software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 155.80 Million |

| Market Forecast in 2033 | USD 295.22 Million |

| Market Growth Rate 2025-2033 | 6.60% |

South Korea Procurement Software Market Trends:

Cloud-Based Procurement Tools Gaining Ground in SMEs

South Korean SMEs are shifting away from traditional procurement systems and turning to cloud-based platforms. These businesses want quicker implementation, less dependence on IT teams, and more flexible pricing structures. Cloud solutions make it easier for them to manage approvals, supplier records, and purchase orders in one place. The tools that offer Korean language support and work well with domestic tax and ERP systems are getting the most attention. Many SMEs are also choosing providers that package procurement with inventory and accounting features, all accessible online. This shift isn’t driven just by budget concerns but also by a need for speed and better control. Companies want to avoid complex software and prefer clean, modular setups that can grow with them. As Korean SaaS providers become more competitive, foreign vendors are starting to localize more aggressively to keep up. The overall growth here is steady and coming from firms that are using structured procurement software for the first time. These factors are intensifying the South Korea procurement software market growth.

To get more information on this market, Request Sample

Large Enterprises Using AI for Spend Visibility and Risk Control

Major companies in South Korea are now using procurement software equipped with AI features to better understand spending and monitor suppliers. This trend is especially strong in sectors like automotive, electronics, and heavy industry, where vendor performance directly affects timelines and margins. Traditional procurement tools used with ERP systems aren’t enough anymore. These companies want automated insights, real-time alerts on contract issues, and clear vendor risk signals. AI tools are being used to flag pricing irregularities, show spending patterns by division or category, and suggest areas for renegotiation. Some platforms even combine internal data with external sources, like market prices or vendor credit ratings, to give procurement teams a better picture of what's ahead. The goal isn’t to replace teams but to give them tools that help with quicker decisions and fewer surprises. Many of these companies are piloting AI features through local software firms or specialized analytics vendors rather than changing their entire procurement system at once. This targeted approach keeps disruption low while still improving visibility.

South Korea Procurement Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on software type, deployment, organization size, and vertical.

Software Type Insights:

- Spend Analysis

- E-Sourcing

- E-Procurement

- Contract Management

- Supplier Management

- Others

The report has provided a detailed breakup and analysis of the market based on the software type. This includes spend analysis, e-sourcing, e-procurement, contract management, supplier management, and others.

Deployment Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud-based and on-premises.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

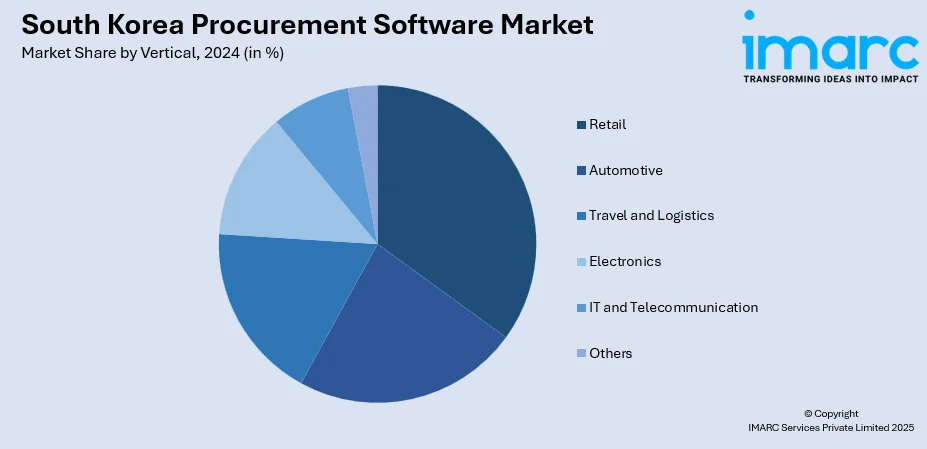

Vertical Insights:

- Retail

- Automotive

- Travel and Logistics

- Electronics

- IT and Telecommunication

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes retail, automotive, travel and logistics, electronics, IT and telecommunication, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Procurement Software Market News:

- In May 2025, South Korea’s Ministry of Science and ICT launched a KRW 1.46 Trillion initiative to procure 10,000 advanced GPUs, starting in October. Cloud service providers must submit detailed procurement and deployment plans, driving demand for efficient procurement software. The strategy emphasizes structured vendor evaluation, budget compliance, and phased execution, highlighting the growing role of digital procurement tools in managing large-scale, public-sector technology acquisitions across South Korea’s expanding AI infrastructure ecosystem.

South Korea Procurement Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Types Covered | Spend Analysis, E-Sourcing, E-Procurement, Contract Management, Supplier Management, Others |

| Deployments Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | Retail, Automotive, Travel and Logistics, Electronics, IT and Telecommunication, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea procurement software market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea procurement software market on the basis of software type?

- What is the breakup of the South Korea procurement software market on the basis of deployment?

- What is the breakup of the South Korea procurement software market on the basis of organization size?

- What is the breakup of the South Korea procurement software market on the basis of verticals ?

- What is the breakup of the South Korea procurement software market on the basis of region?

- What are the various stages in the value chain of the South Korea procurement software market?

- What are the key driving factors and challenges in the South Korea procurement software market?

- What is the structure of the South Korea procurement software market and who are the key players?

- What is the degree of competition in the South Korea procurement software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea procurement software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea procurement software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea procurement software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)