South Korea Refrigerated Transport Market Size, Share, Trends and Forecast by Mode of Transportation, Technology, Temperature, Application, and Region, 2025-2033

South Korea Refrigerated Transport Market Overview:

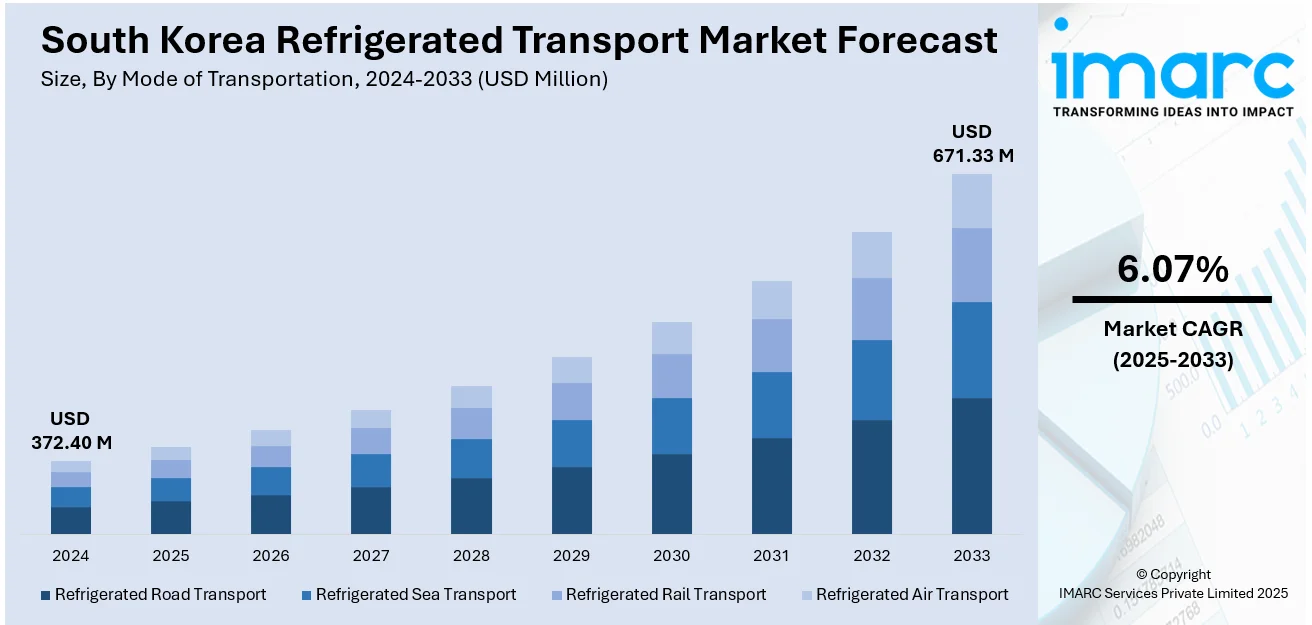

The South Korea refrigerated transport market size reached USD 372.40 Million in 2024. Looking forward, the market is projected to reach USD 671.33 Million by 2033, exhibiting a growth rate (CAGR) of 6.07% during 2025-2033. The market is witnessing steady growth, driven by increasing demand for safe and temperature-controlled logistics for perishable goods such as food, pharmaceuticals, and biotechnology products. Rising consumer expectations for fresh and quality products, alongside expanding cold chain networks, are also fueling the market. Advancements in vehicle refrigeration technologies are enhancing efficiency and reliability, further contributing to the expanding South Korea refrigerated transport market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 372.40 Million |

| Market Forecast in 2033 | USD 671.33 Million |

| Market Growth Rate 2025-2033 | 6.07% |

South Korea Refrigerated Transport Market Trends:

Electrification of Refrigerated Trucks

A prominent trend affecting the refrigerated transport market in South Korea is the increasing adoption of electric and hybrid refrigerated trucks. With tightening environmental regulations and a national focus on sustainability, logistics companies are moving away from diesel-powered vehicles in favor of eco-friendly alternatives. Electric refrigerated trucks provide benefits such as reduced greenhouse gas emissions, lower noise levels, and improved energy efficiency, making them ideal for urban deliveries and cold-chain logistics. For instance, in June 2024, GS Global Corp. launched BYD's T4K electric refrigerated truck, featuring an 82-kWh battery that allows a range of 205 km. The eco-friendly design operates the refrigerator independently from the engine, achieving -18°C in 69 minutes, while being 20 cm taller for improved cargo capacity. These trucks are also being equipped with advanced electric refrigeration units that maintain steady temperatures without the use of fossil fuels. This transition is further supported by improvements in battery technology, government incentives, and the growth of EV infrastructure. Businesses recognize that electrification advances environmental objectives and decreases long-term operational expenses. This momentum towards cleaner transport solutions is anticipated to significantly drive South Korea refrigerated transport market growth in the years ahead.

To get more information on this market, Request Sample

Expansion of Cold Chain Infrastructure

The enhancement of cold chain infrastructure plays a vital role in improving the performance of South Korea’s refrigerated transport sector. Companies are making significant investments in temperature-controlled distribution centers, cross-docking facilities, and local warehouses to address the increasing need for perishable products. These infrastructure advancements allow for better control over product conditions throughout transportation, minimizing spoilage and waste. Contemporary cold storage systems incorporate digital monitoring and automation to maintain ideal conditions in real time. With the growth of e-commerce and food delivery services, the demand for quicker, localized cold storage solutions has become increasingly clear. This strategic investment boosts operational efficiency and fortifies supply chain stability, ensuring that products reach their destinations fresh and safe across various sectors.

Data-Driven Route Optimization

Data-driven route optimization is revolutionizing logistics efficiency in South Korea’s refrigerated transport industry. By utilizing advanced analytics, GPS tracking, and AI-enhanced fleet management systems, companies can shorten delivery times, lower fuel consumption, and reduce spoilage risks. These technologies enable real-time adjustments to routes based on traffic patterns, weather conditions, and customer availability. Automated systems ensure that temperature-sensitive items remain within designated limits throughout transportation. The combination of telematics with route planning provides complete visibility and improved coordination among drivers, dispatchers, and warehouse teams. This level of precision in logistics not only increases customer satisfaction but also enhances cost efficiency and sustainability. As logistics become more time- and temperature-sensitive, data-driven optimization is becoming a key element of competitive strategies within the cold chain.

South Korea Refrigerated Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on mode of transportation, technology, temperature, and application.

Mode of Transportation Insights:

- Refrigerated Road Transport

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

The report has provided a detailed breakup and analysis of the market based on the mode of transportation. This includes refrigerated road transport, refrigerated sea transport, refrigerated rail transport, and refrigerated air transport.

Technology Insights:

- Vapor Compression Systems

- Air-Blown Evaporators

- Eutectic Devices

- Cryogenic Systems

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes vapor compression systems, air-blown evaporators, eutectic devices, and cryogenic systems.

Temperature Insights:

- Single-Temperature

- Multi-Temperature

The report has provided a detailed breakup and analysis of the market based on the temperature. This includes single-temperature and multi-temperature.

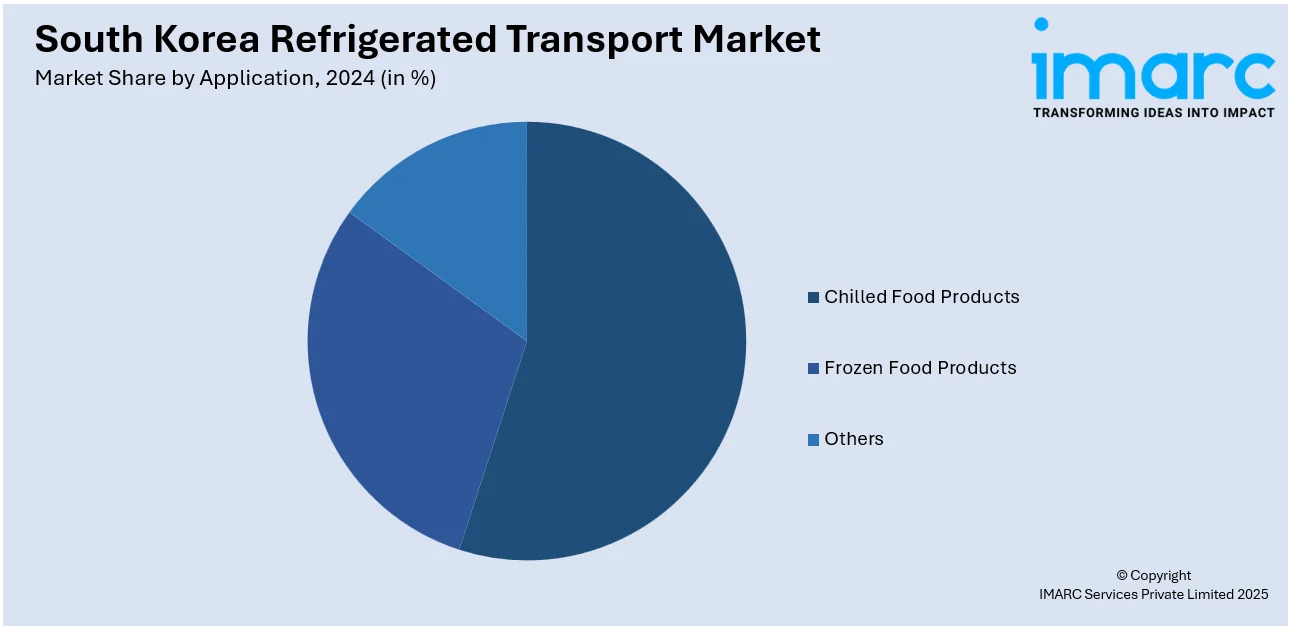

Application Insights:

- Chilled Food Products

- Dairy Products

- Bakery and Confectionery Products

- Fresh Fruits and Vegetables

- Others

- Frozen Food Products

- Frozen Dairy Products

- Processed Meat Products

- Fish and Seafood Products

- Others

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chilled food products (dairy products, bakery and confectionery products, fresh fruits and vegetables, and others), frozen food products (frozen dairy products, processed meat products, fish and seafood products, and others), and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Refrigerated Transport Market News:

- In July 2024, HMM signed a Memorandum of Understanding with KORAIL to enhance eco-friendly intermodal transportation. The collaboration aims to optimize domestic rail infrastructure for refrigerated cargo and establish an integrated transportation system, reducing carbon emissions and improving efficiency for reefer container distribution.

South Korea Refrigerated Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes of Transportation Covered | Refrigerated Road Transport, Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport |

| Technologies Covered | Vapor Compression Systems, Air-Blown Evaporators, Eutectic Devices, Cryogenic Systems |

| Temperatures Covered | Single-Temperature, Multi-Temperature |

| Applications Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea refrigerated transport market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea refrigerated transport market on the basis of mode of transportation?

- What is the breakup of the South Korea refrigerated transport market on the basis of technology?

- What is the breakup of the South Korea refrigerated transport market on the basis of temperature?

- What is the breakup of the South Korea refrigerated transport market on the basis of application?

- What is the breakup of the South Korea refrigerated transport market on the basis of region?

- What are the various stages in the value chain of the South Korea refrigerated transport market?

- What are the key driving factors and challenges in the South Korea refrigerated transport market?

- What is the structure of the South Korea refrigerated transport market and who are the key players?

- What is the degree of competition in the South Korea refrigerated transport market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea refrigerated transport market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea refrigerated transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea refrigerated transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)