South Korea RegTech Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033

South Korea RegTech Market Overview:

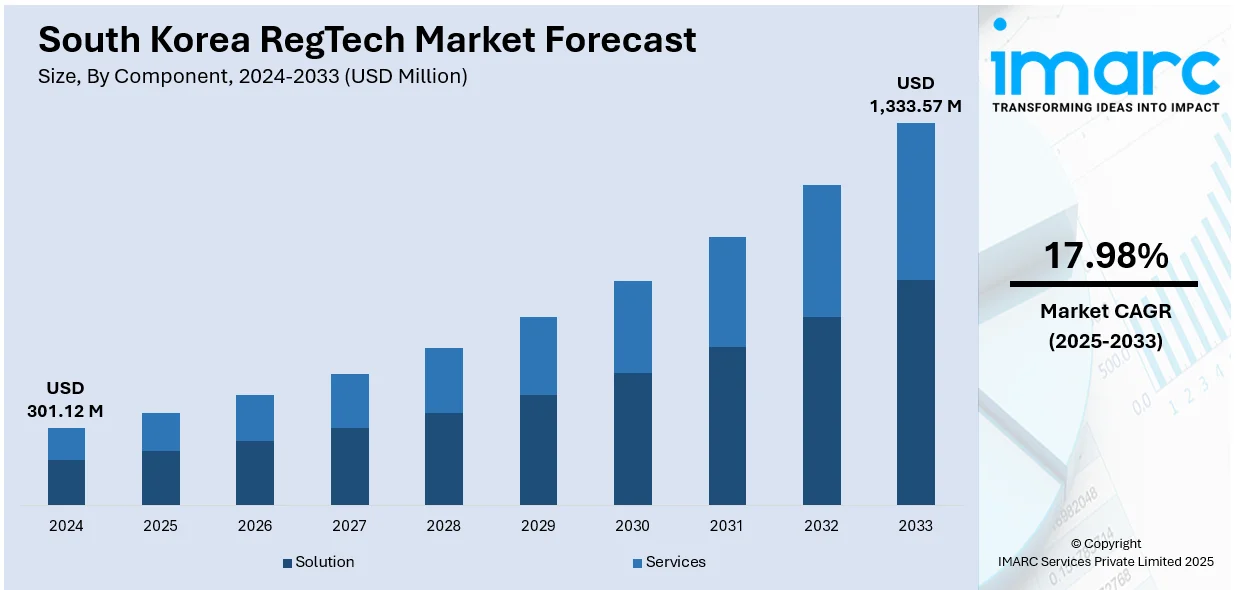

The South Korea RegTech market size reached USD 301.12 Million in 2024. Looking forward, the market is expected to reach USD 1,333.57 Million by 2033, exhibiting a growth rate (CAGR) of 17.98% during 2025-2033. The market is spurred by robust government backing, fast-paced digitalization, and increasing regulatory sophistication across industries. Rising cyber-attacks and need for real-time compliance platforms are compelling banking and fintech institutions to make investments in cloud-based and AI-powered RegTech solutions. Increase in digital finance, mobile banking and robust data privacy regulations further speeds up this trend, contributing to the consistent growth of the South Korea RegTech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 301.12 Million |

| Market Forecast in 2033 | USD 1,333.57 Million |

| Market Growth Rate 2025-2033 | 17.98% |

South Korea RegTech Market Trends:

Development of Government-supported Regulatory Sandboxes and Institutional Cooperation

The RegTech market of South Korea is being fueled by government-driven programs like regulatory sandboxes and collaborative structures involving regulators and tech companies. The Financial Supervisory Service (FSS) has been at the forefront, launching a RegTech Development Forum and working closely with a group of startup businesses to evaluate compliance technology in test environments. These systems allow for fintech and compliance solution providers to pilot AI‑based transaction monitoring, machine‑readable regulation systems, and regulatory intelligence tools with reduced regulatory overhang, facilitating financial services innovation at speed. Additionally, the FSS's proactive collaboration with private companies reflects a public‑private approach for integrating new compliance paradigms into current regulatory frameworks. This hands-on assistance from regulators in Seoul demonstrates national digital policy objectives and makes South Korea a regional pioneer in RegTech regulation and innovation, building trust and reducing development barriers.

To get more information on this market, Request Sample

Use of AI, Machine Learning, and Cybersecurity‑oriented Tools

The rapid integration of cybersecurity, machine learning, and artificial intelligence (AI) into compliance systems is a significant regional trend in the South Korean RegTech sector. Korea plans to invest KRW 710.2 Billion (USD 527 Million) across 69 sectors this year to support artificial intelligence (AI)-driven innovation, according to a recent announcement from the Ministry of Science and ICT. This project seeks to incorporate AI into individuals' everyday activities, sectors, and governmental administrative services. A government-sponsored analysis forecasts that effectively integrating AI into different industries might produce a yearly economic effect of KRW 310 Trillion by 2026. This initiative and the research began with the AI Strategy High-Level Consultative Council, a governing body focused on steering the country's extensive AI innovation strategies. Domestic companies increasingly utilize AI‑enabled algorithms for transaction anomalous behavior detection, anti‑money laundering filtering, and voice‑phishing prevention—each being specially designed to the sophistication of the South Korean banking and digital payment landscape. These technologies can monitor real‑time large numbers of transactions and customer information, improving speed and accuracy in regulatory reporting. Concurrently, cybersecurity has become a central tenet due to the nation's data-intensive financial system; South Korea's RegTech technologies prioritize encryption, secure verification of identity, and breach protection. The fact that South Korea is one of the most technologically advanced economies in the world serves as further motivation for this priority, with government plans such as the Digital Government Master Plan making calls for strong data protection and tech‑led resilience across all industries, which also contributes to the South Korea RegTech market growth.

Going Beyond Finance: Multi‑sector Integration and National Innovation Strategy

While RegTech adoption initially focused on financial institutions, South Korea is increasingly applying regulatory technology advancements across more sectors, consistent with national digital transformation efforts. Outside of banks and fintech companies, RegTech solutions are being tested in healthcare, transportation, and environmental administration to aid regulation, reporting, and risk assessment through algorithmic systems that can interpret machine‑readable regulations and translate policy to compliance processes. This diversification is part of a wider effort by Seoul to bring AI and machine automation together through measures such as the AI Framework Act and the Intelligent Informatization Act that position RegTech at the nexus of governance and innovation. The grouping of RegTech and AI startups in innovation clusters like Pangyo Techno Valley, referred to often as Korea's Silicon Valley, also facilitates cross‑pollination across industries, underpinned by government infrastructure and regional pilot schemes. Consequently, South Korea's RegTech market is transforming into a multi-segment compliance smart network due to digital ecosystem synergies and public-sector innovation initiatives.

South Korea RegTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, application, and end user.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Mode Insights:

- Cloud-Based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size has also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

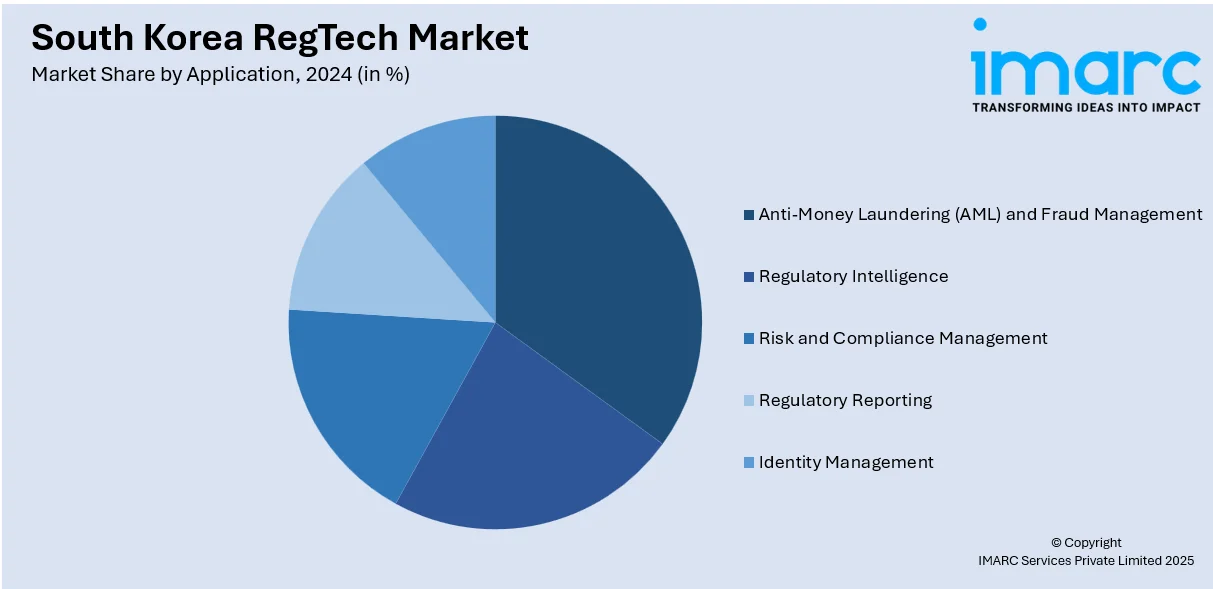

Application Insights:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

The report has provided a detailed breakup and analysis of the market based on the application. This includes anti-money laundering (AML) and fraud management, regulatory intelligence, risk and compliance management, regulatory reporting, and identity management.

End User Insights:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, insurance companies, fintech firms, IT and telecom, public sector, energy and utilities, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea RegTech Market News:

- In 2023, To strengthen the financial industry's regulatory framework, the Financial Supervisory Service (FSS) of South Korea started working with a number of RegTech businesses. This collaboration aims to reduce the risks associated with regulatory infractions and improve compliance processes through the use of technology. One noteworthy partnership was the establishment of a regulatory sandbox by the FSS in association with a number of RegTech companies. This sandbox fosters an innovation ecosystem while upholding regulatory oversight by allowing companies to test their innovative compliance solutions in a controlled environment. By means of these partnerships, the FSS is positioning South Korea as a leader in the RegTech space and encouraging the adoption of cutting-edge technologies across the financial sector.

South Korea RegTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Anti-Money Laundering (AML) and Fraud Management, Regulatory Intelligence, Risk and Compliance Management, Regulatory Reporting, Identity Management |

| End Users Covered | Banks, Insurance Companies, FinTech Firms, IT and Telecom, Public Sector, Energy and Utilities, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea RegTech market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea RegTech market on the basis of component?

- What is the breakup of the South Korea RegTech market on the basis of deployment mode?

- What is the breakup of the South Korea RegTech market on the basis of enterprise size?

- What is the breakup of the South Korea RegTech market on the basis of application?

- What is the breakup of the South Korea RegTech market on the basis of end user?

- What is the breakup of the South Korea RegTech market on the basis of region?

- What are the various stages in the value chain of the South Korea RegTech market?

- What are the key driving factors and challenges in the South Korea RegTech market?

- What is the structure of the South Korea RegTech market and who are the key players?

- What is the degree of competition in the South Korea RegTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea RegTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea RegTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea RegTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)