South Korea Risk Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033

South Korea Risk Management Market Overview:

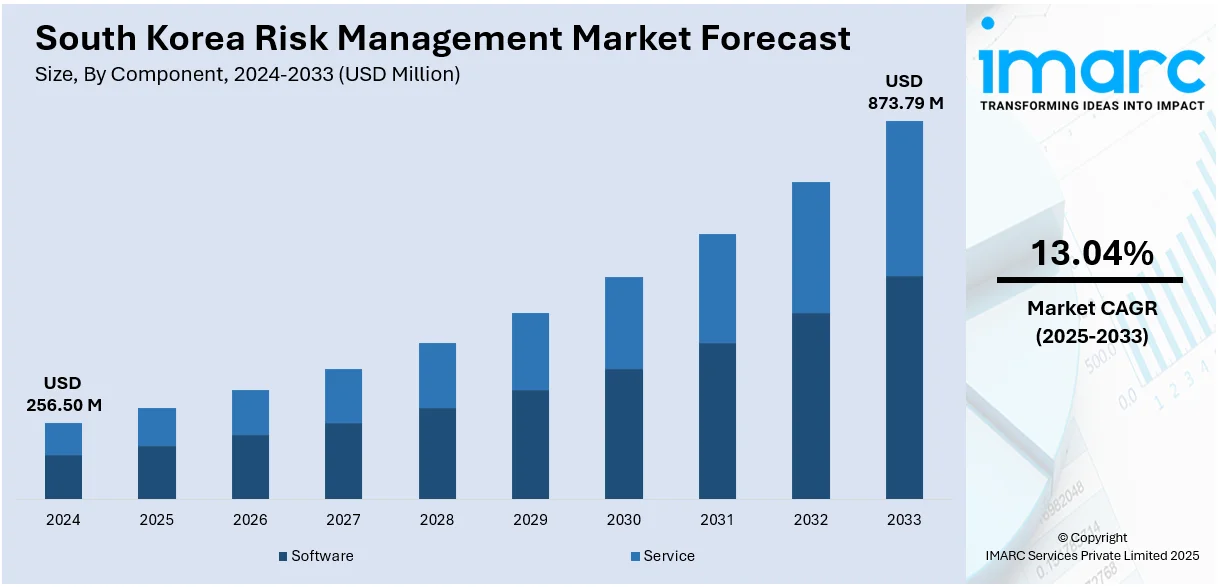

The South Korea risk management market size reached USD 256.50 Million in 2024. Looking forward, the market is projected to reach USD 873.79 Million by 2033, exhibiting a growth rate (CAGR) of 13.04% during 2025-2033. The market is driven by institutional adoption of integrated GRC frameworks to align corporate governance with regulatory compliance. Growing cyber threats and data privacy mandates are elevating the importance of digital risk oversight. Intensified focus on operational resilience and structured business continuity planning is further augmenting the South Korea risk management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 256.50 Million |

| Market Forecast in 2033 | USD 873.79 Million |

| Market Growth Rate 2025-2033 | 13.04% |

South Korea Risk Management Market Trends:

Integrated Governance, Risk and Compliance (GRC) Implementation

South Korea’s corporate and financial sectors are rapidly embedding governance, risk, and compliance frameworks to manage regulatory obligations, reputational risks, and operational continuity. Multinational and domestic firms implement enterprise-wide systems covering risk profiling, incident tracking, and audit assurance, particularly in industries such as banking, manufacturing, and energy. These systems incorporate scenario analysis, control testing, and stress simulations linked to board and regulatory reporting. As complexity grows with digital transformation, spanning cyber threats, supply chain variability, and ESG exposures, organizations adopt centralized, policy-driven architectures to align risk appetite with strategic objectives. This formalization of monitoring, mitigation, and remediation processes is reinforced by automated workflows, escalation protocols, and real-time dashboards. South Korea risk management market growth is increasingly anchored in the robust deployment of integrated GRC platforms tailored to evolving corporate governance standards.

To get more information on this market, Request Sample

Cyber Risk and Data Privacy Management

The increasing frequency of cyberattacks and tightening data protection regulations are driving demand for advanced risk monitoring and mitigation frameworks. Organizations deploy continuous threat assessment tools, vendor risk ratings, and incident response protocols at both IT and executive levels. Within financial services, healthcare, retail, and public sectors, there is a focus on encryption, secure access, and proactive intrusion detection. Third-party risk management is emerging as a critical discipline, ensuring digital ecosystems, from cloud suppliers to outsourced process partners, adhere to strict privacy guidelines. Internal audit and compliance teams leverage analytics and dashboarding to identify anomalies and monitor controls in real time. This cyber-aware risk posture supports resilience and compliance, while reducing the impact of breaches. As security becomes integral to both market trust and regulatory alignment, structured risk practices around cyber resilience are expanding rapidly.

Operational Resilience and Business Continuity Planning

Weather disruptions, geopolitical uncertainties, and logistics interruptions have intensified attention on operational resilience and business continuity management (BCM) across South Korea’s manufacturing, logistics, and utilities sectors. Organizations maintain risk registers addressing supplier dependencies, disaster scenarios, and process failures, supported by regularly tested continuity plans. Digital twins and scenario modeling tools enable simulation of crisis conditions and assessment of recovery strategies. Site-level preparedness is augmented by redundancies in production and supply, while regional coordination is standard for large enterprises. BCM frameworks also extend to pandemic response, remote working readiness, and cyber-attack contingencies. Cross-functional governance committees oversee risk metrics, KPIs, and internal coordination, ensuring strategic alignment and regulatory compliance. The emphasis on resilience is further validated by stakeholder expectations, credit ratings, and insurance criteria, creating sustained demand for structured risk-assessment and continuity architectures.

South Korea Risk Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, and industry vertical.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-Premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

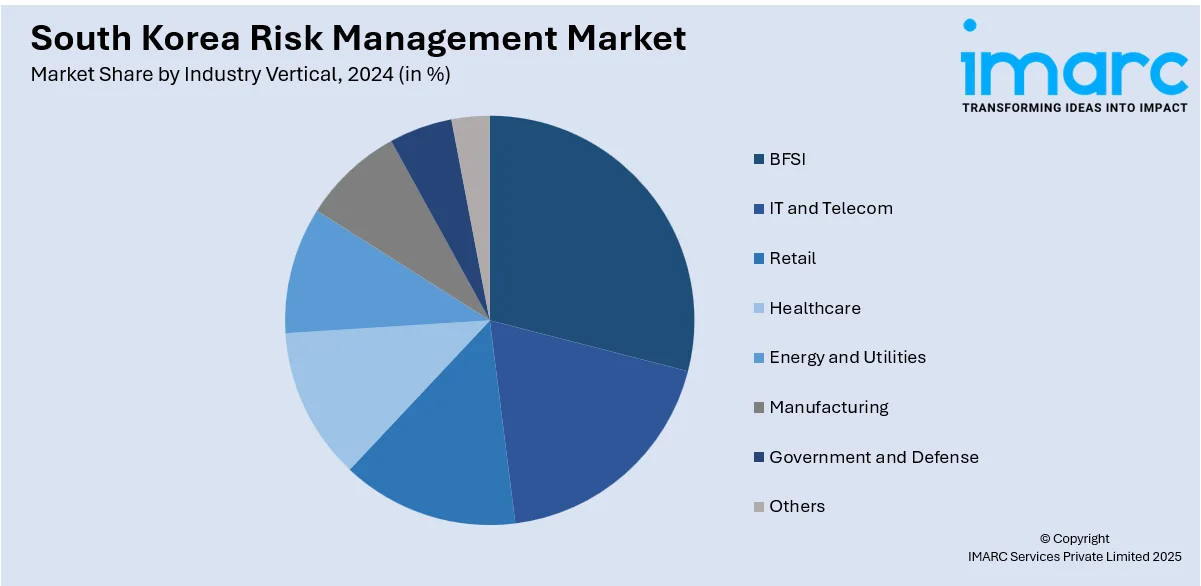

Industry Vertical Insights:

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Government and Defense

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, IT and telecom, retail, healthcare, energy and utilities, manufacturing, government and defense, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Risk Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea risk management market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea risk management market on the basis of component?

- What is the breakup of the South Korea risk management market on the basis of deployment mode?

- What is the breakup of the South Korea risk management market on the basis of enterprise size?

- What is the breakup of the South Korea risk management market on the basis of industry vertical?

- What is the breakup of the South Korea risk management market on the basis of region?

- What are the various stages in the value chain of the South Korea risk management market?

- What are the key driving factors and challenges in the South Korea risk management market?

- What is the structure of the South Korea risk management market and who are the key players?

- What is the degree of competition in the South Korea risk management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea risk management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea risk management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea risk management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)