South Korea Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

South Korea Running Gear Market Overview:

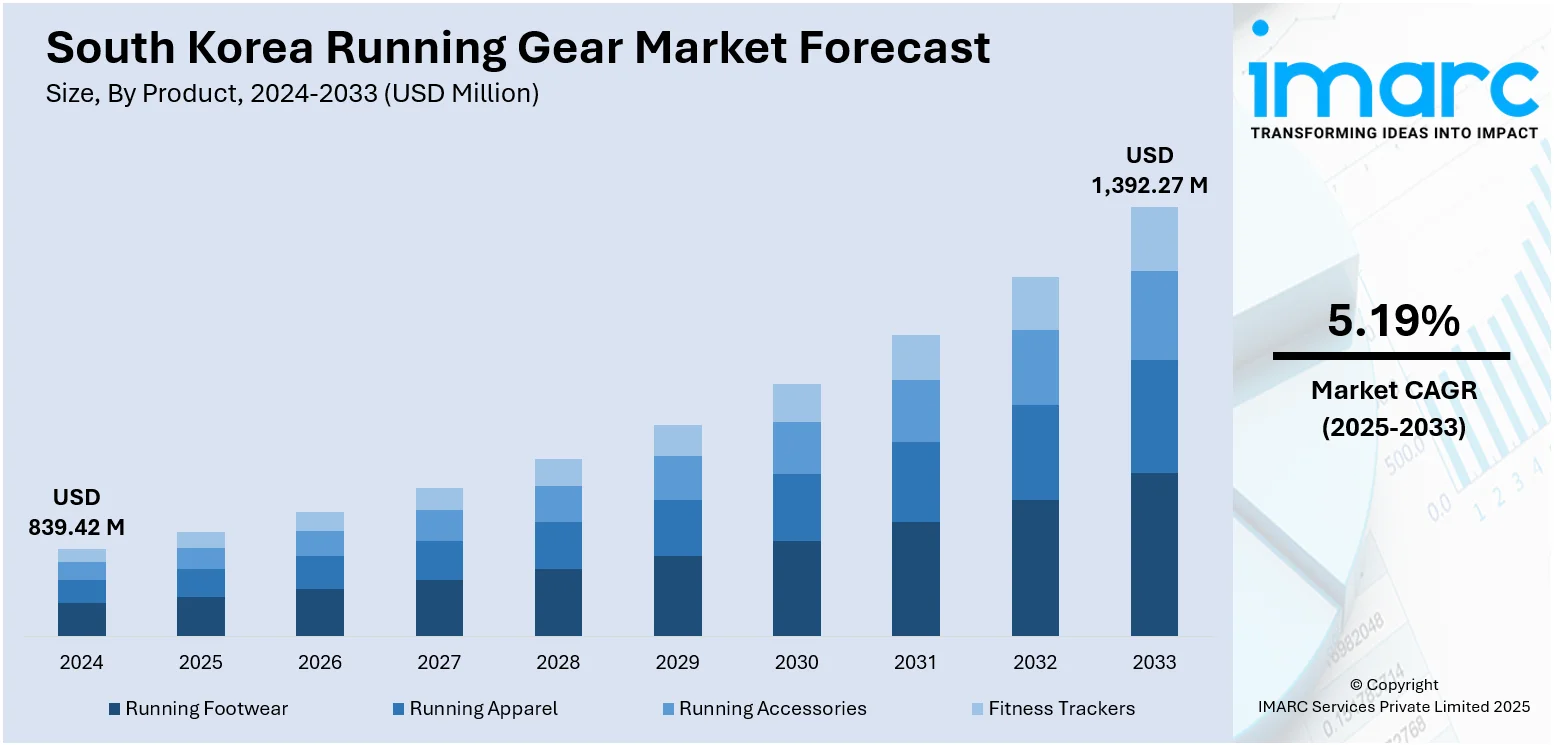

The South Korea running gear market size reached USD 839.42 Million in 2024. Looking forward, the market is projected to reach USD 1,392.27 Million by 2033, exhibiting a growth rate (CAGR) of 5.19% during 2025-2033. The market is driven by advanced digital and omnichannel retailing offering convenience, personalization, and seamless access. Strong participation in fitness events and community running culture fuels sustained demand for season-adapted, high-performance gear. Concurrent innovation in materials, technical design, and branding, combined with eco-conscious consumer alignment, further augment the South Korea running gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 839.42 Million |

| Market Forecast in 2033 | USD 1,392.27 Million |

| Market Growth Rate 2025-2033 | 5.19% |

South Korea Running Gear Market Trends:

Digital and Omnichannel Retail Evolution

South Korea’s running gear market has evolved significantly due to high smartphone penetration, advanced logistics networks, and growing consumer trust in digital commerce. Consumers frequently browse and purchase running shoes, apparel, and accessories from both global and local e‑commerce platforms featuring 3D foot scanners, live chat support, and same‑day delivery. Physical stores complement this by offering interactive fitting rooms, gait analysis services, and curated product displays tailored to local preferences. This shift toward tech-enabled retail experiences is further reflected in brand expansions catering to evolving consumer expectations. For instance, in January 2025, U.S.-based footwear brand Kizik announced its entry into the South Korean market through a distribution partnership with Platform Inc., a company with over 20 years of experience introducing global brands. Kizik’s footwear range, including running footwear, will be featured in Platform Place, a leading multi-brand concept store, targeting Korean consumers seeking functional and stylish convenience. Influencer campaigns, livestream commerce events, and brand loyalty programs engage younger fitness consumers. Limited‑edition releases and customizable gear options further stimulate interest. Subscription models and restocking services increase repeat purchasing behavior. These retail innovations enhance access to performance products nationwide, blending convenience with experiential touchpoints. These integrated channels and customer-centric features are significantly driving South Korea running gear market growth.

To get more information on this market, Request Sample

Fitness Culture and Community Engagement

South Korea boasts a vibrant running culture, driven by widespread participation in urban marathons, trail runs, corporate wellness events, and virtual fitness challenges. F45 Korea reported a 90% monthly renewal rate and an average membership period of 18 to 19 months, supported by a core demographic of professionals aged 25–35 (62.7%). Monthly membership fees reaching 348,000 won (USD 260) highlight consumer willingness to invest in premium, community-based fitness experiences. Residents increasingly adopt running not only for health and endurance training but also as a social activity. This trend fuels demand for technical footwear offering cushioning, stability, and weather-specific performance, as well as breathable apparel engineered for Korea’s four distinct seasons. Wellness influencers, local running clubs, and online communities promote regular gear upgrades. Korea's booming running culture drove an over 58% year-on-year surge in running shoe sales from July to September, with September alone seeing an 80% increase. Consumers seek gear optimized for hot, humid summers as well as insulation for dry, cold winters. Youth and middle-aged professionals prioritize health, appearance, and stress relief, supporting steady demand for premium-quality gear. Sustainability awareness also influences choices toward eco-friendly materials and transparent sourcing. The community-based culture around running sustains consistent engagement with brands offering performance-enhancing and socially aligned running solutions.

South Korea Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on gender. This includes male, female, and unisex.

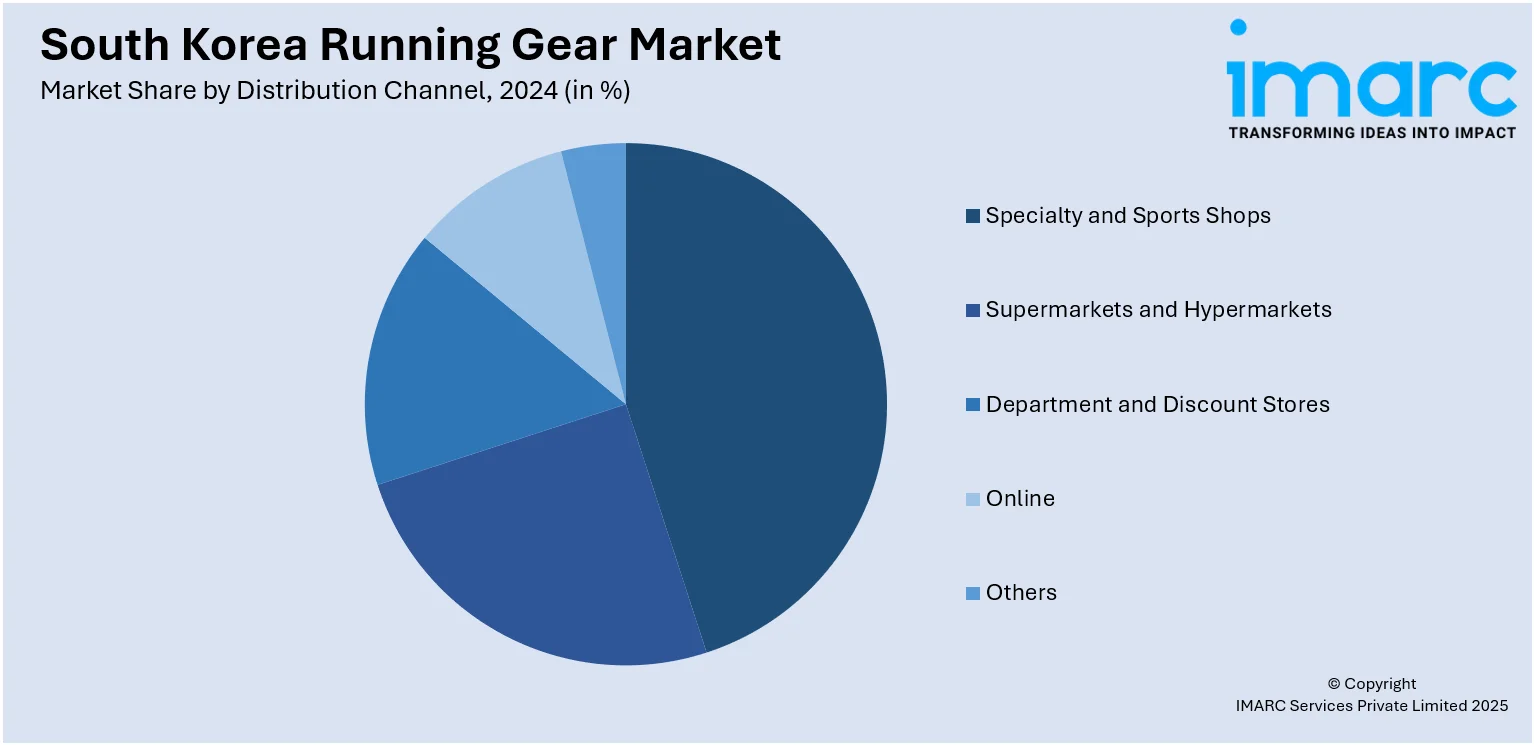

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Running Gear Market News:

- On February 17, 2025, New Balance announced the extension of its partnership with Eland World through 2030 and revealed plans to launch a dedicated Korean subsidiary by January 2027. The brand recorded over KRW 1 Trillion (USD 700 Million) in sales in South Korea in 2024, its highest ever in the country, underscoring Korea’s role as a key global market.

South Korea Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea running gear market on the basis of product?

- What is the breakup of the South Korea running gear market on the basis of gender?

- What is the breakup of the South Korea running gear market on the basis of distribution channel?

- What is the breakup of the South Korea running gear market on the basis of region?

- What are the various stages in the value chain of the South Korea running gear market?

- What are the key driving factors and challenges in the South Korea running gear market?

- What is the structure of the South Korea running gear market and who are the key players?

- What is the degree of competition in the South Korea running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)