South Korea Smart Lighting Market Size, Share, Trends and Forecast by Offering, Communication Technology, Installation Type, Light Source, Application, and Region, 2026-2034

South Korea Smart Lighting Market Summary:

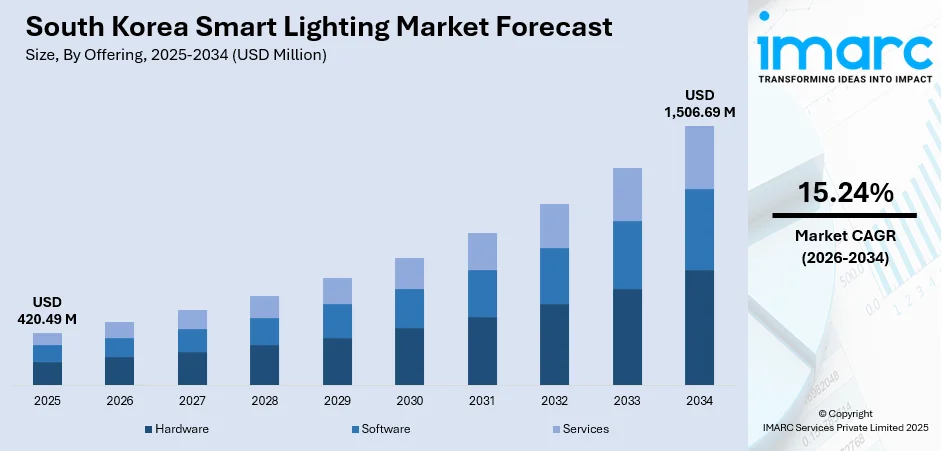

The South Korea smart lighting market size was valued at USD 420.49 Million in 2025 and is projected to reach USD 1,506.69 Million by 2034, expanding at a compound annual growth rate of 15.24% from 2026-2034.

The market expansion is propelled by the nation's commitment to sustainable urban development and energy conservation objectives. South Korea's advanced technological infrastructure, combined with robust government support for smart city initiatives, creates a conducive environment for smart lighting adoption. The integration of Internet of Things (IoT)-enabled systems with artificial intelligence (AI) capabilities is transforming conventional illumination into intelligent solutions that optimize energy consumption while enhancing user experience.

Key Takeaways and Insights:

- By Offering: Hardware dominates the market with a share of 70% in 2025, driven by the widespread demand for light-emitting diode (LED) luminaires, lighting controls, sensors, and smart switches that form the foundation of intelligent lighting systems across commercial and residential applications.

- By Communication Technology: Wireless technology leads the market with a share of 60% in 2025, owing to the ease of installation, scalability, and seamless compatibility with IoT platforms that enable remote control through wireless fidelity (Wi-Fi), Bluetooth, ZigBee, and other protocols.

- By Installation Type: Retrofit installation represents the largest segment with a market share of 55% in 2025, reflecting the growing emphasis on upgrading existing infrastructure with energy-efficient LED solutions to reduce operational costs and carbon footprints.

- By Light Source: LED lamps prevail the market with a share of 72% in 2025, attributed to their superior energy efficiency delivering maximum savings compared to traditional lighting, extended lifespan, and mercury-free composition.

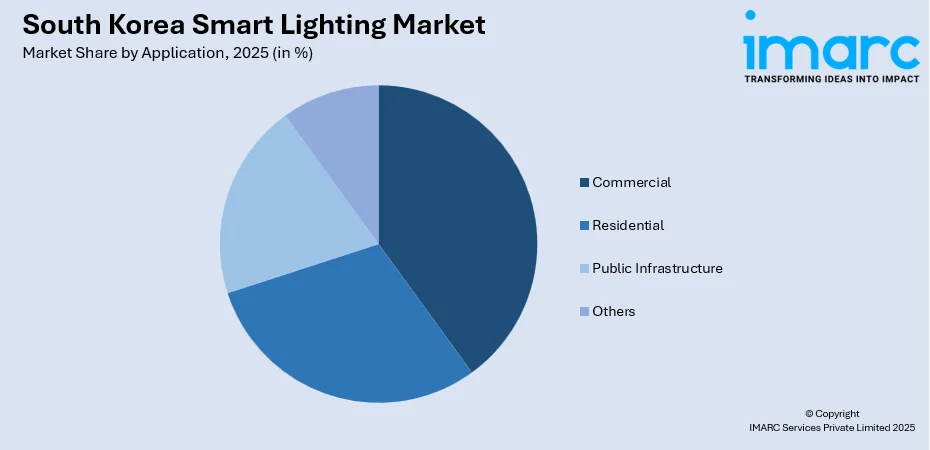

- By Application: Commercial comprises the largest market share of 42% in 2025, driven by widespread adoption of energy-efficient lighting solutions in offices, retail establishments, hospitality venues, and healthcare facilities.

- Key Players: The South Korea smart lighting market exhibits robust competitive intensity, with established domestic manufacturers competing alongside multinational lighting corporations across product categories and price segments.

To get more information on this market Request Sample

The South Korean smart lighting industry benefits from strong domestic manufacturing capabilities and a technology-forward consumer base that readily adopts smart home solutions. As per IMARC Group, the South Korea smart home devices market size reached USD 3,869.41 Million in 2024. Seoul Metropolitan Government has been implementing smart pole installations integrating streetlights with public Wi-Fi and IoT sensors across multiple districts. Rising urbanization rates, with projections indicating that major population is set to reside in urban areas, are driving the demand for efficient and sustainable lighting systems across commercial, residential, and public infrastructure applications, bolstering the market share.

South Korea Smart Lighting Market Trends:

Integration of AI and Machine Learning (ML) Technologies

The incorporation of AI and ML capabilities into smart lighting systems is reshaping the industry landscape. These advanced technologies enable predictive failure detection, automated energy management, and personalized lighting experiences based on occupancy patterns and user preferences. This trend is accelerating the adoption, as consumers and businesses are seeking intelligent solutions that enhance convenience while optimizing energy consumption. An OECD survey indicated that as of September 2025, the AI adoption rate in South Korean firms was at 28%, the highest rate among member nations.

Smart City Infrastructure and Connected Pole Deployment

Smart city infrastructure and connected pole deployment are accelerating the market growth in South Korea by integrating lighting with sensors, cameras, and communication networks. Smart poles support traffic monitoring, public safety, environmental sensing, and Wi-Fi services, making lighting systems multi-functional urban assets. Cities adopt connected lighting to improve energy efficiency and enable centralized control and maintenance. Data-driven lighting optimization reduces costs and improves visibility in public spaces. As municipalities are modernizing streets and public areas, smart poles are becoming standard infrastructure, driving continuous demand for intelligent street lighting solutions across urban developments. The Public Design Festival 2024 was set to begin in October 2024, taking place in Seoul and Daejeon, with an emphasis on how the design quality of South Korea's public spaces could develop to better meet the needs of its citizens.

Human-Centric and Natural Light Technology Adoption

The growing awareness about light's impact on health and well-being is driving the demand for human-centric lighting solutions that replicate natural sunlight spectrums. These systems adjust color temperature and intensity throughout the day to support circadian rhythms and enhance occupant productivity. In August 2025, Seoul Semiconductor created a groundbreaking LED light source- ‘SunLike’ that mirrored a spectrum that was very similar to natural sunlight. The technology attracted interest for its beneficial impact on eye health, such as decreasing eye strain and possibly easing myopia. This trend reflects broader societal emphasis on wellness-oriented building design and sustainable lighting practices across commercial and residential applications.

Market Outlook 2026-2034:

The market growth will be catalyzed by accelerating smart city deployments, mandatory zero-energy building certifications for public structures, and the proliferation of connected home ecosystems. The market generated a revenue of USD 420.49 Million in 2025 and is projected to reach a revenue of USD 1,506.69 Million by 2034, growing at a compound annual growth rate of 15.24% from 2026-2034. The commercial sector will continue to lead adoption, as businesses prioritize energy cost reduction and building automation integration. Residential demand will surge as falling LED prices, enhanced interoperability through protocols, and expanding voice assistant compatibility lower adoption barriers. Government investments in urban infrastructure modernization and carbon neutrality initiatives will further stimulate market expansion throughout the forecast period.

South Korea Smart Lighting Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Offering | Hardware | 70% |

| Communication Technology | Wireless Technology | 60% |

| Installation Type | Retrofit Installation | 55% |

| Light Source | LED Lamps | 72% |

| Application | Commercial | 42% |

Offering Insights:

- Hardware

- Lights and Luminaires

- Lighting Controls

- Software

- Services

- Design and Engineering

- Installation

- Post-Installation

Hardware (lights and luminaires) dominates with a market share of 70% of the total South Korea smart lighting market in 2025.

Hardware leads the market because physical components like LED luminaires form the foundation of intelligent lighting systems. Without advanced hardware, software and connectivity features cannot function, making hardware the primary area of investment.

Cities and commercial developers prioritize hardware upgrades when shifting from conventional lighting to smart systems, creating strong demand for luminaires and control devices. Sensors for motion, daylight, and environmental monitoring increase system value and drive hardware purchases. Smart poles integrating cameras, speakers, and communication devices further strengthen sales. Hardware also has higher replacement and installation costs, generating larger revenue per project. Unlike software, which is updated digitally, hardware requires physical deployment and maintenance, ensuring continuous demand. As infrastructure projects are expanding and older lighting systems are modernized, hardware remains the most visible and capital-intensive segment dominating the market. According to IMARC Group, the South Korea infrastructure market is set to reach USD 82.90 Billion by 2033, exhibiting a growth rate (CAGR) of 3.55% during 2025-2033.

Communication Technology Insights:

- Wired Technology

- Wireless Technology

Wireless technology leads with a share of 60% of the total South Korea smart lighting market in 2025.

Wireless technology holds prominence as it allows flexible installation, quick deployment, and easy system expansion. Unlike wired systems, wireless networks reduce construction complexity and cost. They enable smooth communication between lights, sensors, and central platforms across large urban areas.

Wireless solutions support real-time monitoring, remote control, and automated lighting adjustments based on traffic, weather, or occupancy. Cities benefit from lower maintenance costs since faults can be detected instantly without physical inspections. Wireless systems also integrate easily with broader smart city platforms such as surveillance and environmental monitoring. As urban infrastructure continuously evolves, wireless networks allow lighting systems to adapt without extensive rewiring. Scalability is another major advantage, enabling municipalities to add new lights or zones with minimal disruption. Because of these operational and financial benefits, wireless technology has become the preferred communication method in South Korea’s smart lighting deployments.

Installation Type Insights:

- New Installation

- Retrofit Installation

Retrofit installation exhibits a clear dominance with a 55% share of the total South Korea smart lighting market in 2025.

Retrofit installation leads the market because it allows cities and businesses to upgrade existing lighting systems without complete infrastructure replacement. This approach reduces project costs, installation time, and operational disruption while still delivering major energy savings and smart functionality.

Many buildings and public areas already have installed lighting networks, making retrofit the fastest way to introduce smart features. Controllers, sensors, and connected lighting modules can be added to existing fixtures to improve efficiency and enable remote control. This method is popular among municipalities and commercial property owners aiming to reduce electricity consumption without heavy capital investment. Retrofit projects also support sustainability goals by extending asset life and minimizing waste. Compared to new installations, retrofits deliver quicker returns on investment (ROI), encouraging widespread adoption and making retrofit installation the dominant approach in South Korea’s smart lighting market.

Light Source Insights:

- LED Lamps

- Fluorescent Lamps

- Compact Fluorescent Lamps

- High Intensity Discharge Lamps

- Others

LED lamps represent the leading segment with a 72% share of the total South Korea smart lighting market in 2025.

LED lamps offer high energy efficiency, long lifespan, and compatibility with intelligent control systems. Compared to traditional lighting, LEDs reduce power consumption and maintenance needs, making them the preferred choice for smart lighting projects.

LEDs integrate easily with sensors, wireless networks, and automated controls, enabling dimming, scheduling, and motion-based lighting. Their durability makes them ideal for large-scale public and commercial installations where maintenance must be minimized. Cities and businesses prioritize LEDs because they support sustainability goals and lower electricity bills. LED technology also delivers better brightness control and uniform illumination, improving safety and visibility in streets and buildings. Unlike conventional bulbs, LEDs work efficiently under frequent switching, which is essential for smart systems. As modernization continues, LED adoption remains central to South Korea’s transition towards intelligent and energy-efficient lighting infrastructure.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Commercial

- Residential

- Public Infrastructure

- Others

Commercial holds the largest segment with a 42% share of the total South Korea smart lighting market in 2025.

The commercial segment leads the South Korea smart lighting market because offices, malls, hotels, and retail spaces demand energy-efficient, automated lighting to reduce operating costs. Businesses adopt smart lighting to improve ambience, customer experience, and brand image while meeting sustainability and efficiency targets.

Commercial buildings operate for long hours, making energy savings from smart lighting highly valuable. Automated controls, motion sensors, and daylight adjustment systems significantly cut electricity usage. Facility managers also benefit from centralized monitoring that detects faults and reduces maintenance effort. Smart lighting enhances workspace comfort and boosts employee productivity through better illumination control. Retailers and hospitality businesses use lighting customization to attract customers and create immersive environments. Compared to residential users, commercial properties invest more heavily in building technologies, generating larger project values. As urban commercial development is expanding, this segment continues to dominate the market. In June 2025, Hyundai Department Store revealed intentions to create a modern complex mall, the Hyundai Busan, in Eco Delta City, Daejo-dong, Gangseo-gu, South Korea. Construction was planned to start as soon as October 2025, aiming for an official opening in the first half of 2027.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area holds prominence due to dense urban development and large commercial infrastructure. Government-led smart city projects, high public transport usage, and technology-driven offices accelerate demand for connected lighting solutions across streets, buildings, and residential complexes.

Yeongnam (Southeastern Region) benefits from industrial expansion and port city development, increasing the need for smart outdoor lighting. Factories, logistics hubs, and commercial centers adopt intelligent lighting for efficiency, safety, and energy control applications.

In Honam (Southwestern Region), the market is driven by public infrastructure upgrades and city modernization programs. Smart street lighting is implemented to improve safety, energy efficiency, and tourism appeal across both urban and semi-urban areas.

Hoseo (Central Region) is growing through industrial parks and tech institutions. Smart lighting is adopted in campuses, research facilities, and newly developed commercial zones to support energy management and intelligent building operations.

Market Dynamics:

Growth Drivers:

Why is the South Korea Smart Lighting Market Growing?

Government Smart City Initiatives and Policy Support

The South Korean government has demonstrated sustained commitment to smart city development through substantial policy frameworks and financial allocations. As per IMARC Group, South Korea smart cities market size reached USD 27,125.7 Million in 2024. Public authorities are investing in intelligent street lighting as part of broader city modernization programs aimed at reducing power consumption and improving traffic management. Smart lighting systems are integrated with surveillance, environmental sensors, and emergency response networks, making them essential urban tools. Policy incentives encourage municipalities to replace outdated lighting with LED-based connected systems. Government-backed pilot projects increase awareness and demonstrate cost savings, encouraging wider implementation. As more cities are adopting smart infrastructure frameworks, lighting systems are becoming a key starting point for digital transformation, creating strong market momentum across public and private sectors.

Increasing Commercial Development

Rising commercial construction across South Korea is a major driver of demand for smart lighting solutions. In September 2025, Mandarin Oriental revealed plans to enter the South Korean market by developing a new high-end hotel in the capital, Seoul. Scheduled to open in 2030, the 128-room hotel will be situated in the Central Business District, north of the Han River, and will be surrounded by Seoul's cultural sites and commercial hub. Office complexes, shopping malls, hotels, and business hubs require advanced lighting systems to improve energy efficiency and enhance customer environments. Smart lighting allows businesses to control brightness, color, and operating schedules, creating tailored experiences for employees and customers. Commercial spaces operate for long hours, making automation and energy savings financially valuable. Developers prioritize integrated building management systems, in which smart lighting plays a central role. Property owners also use intelligent lighting to attract tenants by promoting sustainability and lower operating costs.

Energy Efficiency Mandates and Carbon Neutrality Goals

Energy efficiency mandates and carbon neutrality goals are strongly driving the South Korea smart lighting market by encouraging the replacement of traditional lighting with intelligent LED systems. Government policies are encouraging cities, industries, and commercial buildings to reduce electricity consumption and carbon emissions, making smart lighting a practical solution. Automated dimming, motion sensing, and daylight adjustment reduce wasted energy and improve sustainability performance. Organizations adopt connected lighting to monitor power usage and meet environmental reporting requirements. Smart lighting also supports green building certifications, increasing property value and regulatory compliance. Municipal projects focus on upgrading street and public lighting to cut long-term operational costs while lowering emissions. As environmental accountability becomes a business priority, companies are investing in efficient lighting as a quick and impactful improvement. These mandates are transforming smart lighting from an option into a necessity, accelerating nationwide adoption and investment.

Market Restraints:

What Challenges the South Korea Smart Lighting Market is Facing?

High Initial Investment Costs

The transition to smart lighting systems involves substantial upfront capital expenditure. Many municipalities and property owners face budget constraints that make it challenging to allocate funds for advanced lighting technologies, particularly when competing against other infrastructure priorities. While long-term operational savings and energy cost reductions are well-documented, the immediate financial barrier can hinder adoption, especially among small and medium enterprises (SMEs) and cost-sensitive residential consumers.

Limited Consumer Awareness

Despite the benefits of LED and smart lighting, consumer awareness remains relatively low. This lack of understanding can impede residential market growth, as homeowners may resist changes to traditional lighting systems or underestimate potential benefits. Educational campaigns and community engagement efforts are essential to increase awareness and acceptance of smart lighting technologies, particularly among older demographics less accustomed to IoT-enabled home solutions.

Technical Complexity and Interoperability Challenges

The complexity of smart lighting technologies, particularly systems requiring integration with broader home automation ecosystems, poses adoption challenges for consumers lacking technical expertise. Proprietary platforms from major manufacturers, including Samsung SmartThings and LG ThinQ, can limit cross-brand functionality and increase switching costs. While emerging standards like Matter promise improved interoperability, the installed base evolves slowly, keeping many consumers locked into siloed ecosystems that discourage large-scale retrofits and limit immediate addressable market expansion.

Competitive Landscape:

The South Korea smart lighting market exhibits a dynamic competitive structure, characterized by the presence of established domestic conglomerates, specialized LED manufacturers, and multinational lighting corporations. Domestic players leverage strong brand equity, advanced R&D capabilities, and government relationships to maintain market leadership. Samsung Electronics and LG Electronics anchor vertically integrated ecosystems spanning consumer electronics and smart home platforms. International participants, including Signify Holdings, Osram, and Acuity Brands, compete through premium product offerings and advanced connected lighting systems. The competitive landscape increasingly emphasizes AI integration, IoT connectivity, and energy management capabilities as differentiators. Strategic partnerships between technology companies, telecommunications operators, and construction firms are accelerating market penetration, while ongoing consolidation through acquisitions strengthens market positions among leading players.

Recent Developments:

- In January 2025, Seoul Semiconductor and Seoul Viosys participated in CES 2025 in Las Vegas under the slogan ‘Paradigm Shift in Light by World First Technology,’ unveiling their No-wire MicroLED Car Demo with 6000nit brightness grille displays and showcasing SunLike natural light technology for commercial and automotive applications.

South Korea Smart Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Communication Technologys Covered | Wired Technology, Wireless Technology |

| Installation Types Covered | New Installation, Retrofit Installation |

| Light Sources Covered | LED Lamps, Fluorescent Lamps, Compact Fluorescent Lamps, High Intensity Discharge Lamps, Others |

| Applications Covered | Commercial, Residential, Public Infrastructure, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea smart lighting market size was valued at USD 420.49 Million in 2025.

The South Korea smart lighting market is expected to grow at a compound annual growth rate of 15.24% from 2026-2034 to reach USD 1,506.69 Million by 2034.

Hardware dominated the market with approximately 70% revenue share in 2025, driven by demand for LED luminaires, lighting controls, sensors, and smart switches that form the foundation of intelligent lighting systems.

Key factors driving the South Korea smart lighting market include government smart city initiatives and policy support, rapid urbanization with commercial construction expansion, energy efficiency mandates supporting carbon neutrality goals, technological advancements in IoT and AI integration, and increasing consumer adoption of connected home ecosystems.

Major challenges include high initial investment costs for smart lighting systems, limited consumer awareness about technology benefits, technical complexity in system integration, interoperability issues between proprietary platforms, and the need for robust infrastructure upgrades to support advanced connectivity requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)