South Korea Spectrometry Market Size, Share, Trends and Forecast by Type, Product, Application, End User, and Region, 2026-2034

South Korea Spectrometry Market Overview:

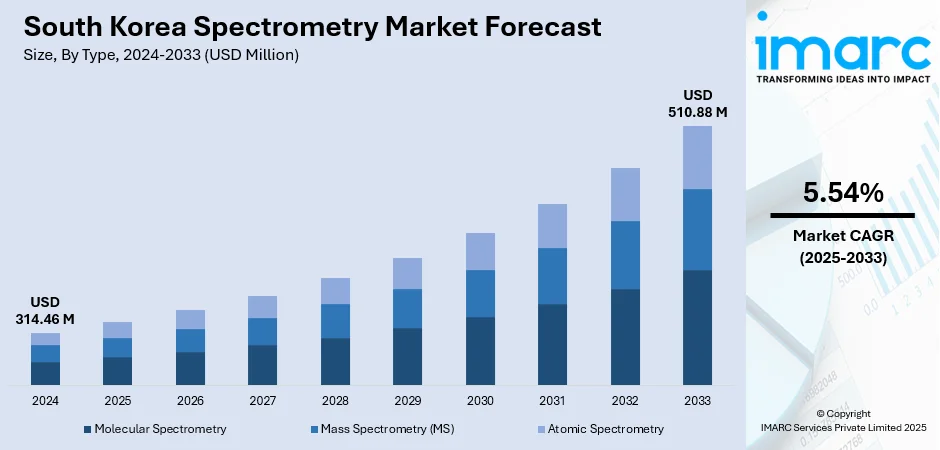

The South Korea spectrometry market size reached USD 314.46 Million in 2025. The market is projected to reach USD 510.88 Million by 2034, exhibiting a growth rate (CAGR) of 5.54% during 2026-2034. The market is advancing through adoption of diverse technologies including molecular, mass, and atomic spectrometry to support pharmaceuticals, environmental testing, and academic research. Ongoing innovation in next-generation and LC-MS platforms reflects the nation’s commitment to precision science and industrial competitiveness. These developments are shaping a strong future trajectory for South Korea spectrometry market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 314.46 Million |

| Market Forecast in 2034 | USD 510.88 Million |

| Market Growth Rate 2026-2034 | 5.54% |

South Korea Spectrometry Market Trends:

Expansion of Laboratory Gas Infrastructure

In July 2024, a new facility was opened in Daejeon by a global laboratory gas solutions provider, expanding its footprint in South Korea to support rising demand for scientific instrumentation. This second location enhances national capacity to support spectrometry workflows by improving service responsiveness and localized customer engagement. The facility launch was accompanied by active recruitment across service, sales, and support teams signaling deeper investment in South Korea’s growing life sciences and analytical chemistry sectors. The location in Daejeon, a major research and industrial hub, strategically places technical teams closer to clients using gas generators for mass spectrometry and other analytical platforms. This expansion also supports the national emphasis on building out research infrastructure, aligning with broader goals to foster scientific innovation and autonomy. As demand for real-time, precision analytical systems increase, support ecosystems like these will be essential in reducing downtime, increasing throughput, and expanding operational capacity. This momentum reflects an encouraging shift in infrastructure maturity, reinforcing South Korea’s readiness to support sustained growth in its spectrometry market.

To get more information on this market, Request Sample

Population‑Scale Proteomics in Action

In June 2025, Korea University launched a landmark study using a next‑generation proteomics workflow capable of processing 20,000 plasma samples via mass spectrometry, an achievement that marks a new level of scale in South Korea’s analytical capabilities. This initiative supports large-cohort exploration of early-onset cancer in young adults, leveraging automated SP200 instruments and AI-driven analysis. It demonstrates how high-throughput spectrometry platforms can be integrated into population-level research, particularly when supported by national health initiatives. The project is funded under the Ministry of Health and Welfare’s K‑Health MIRAE program, illustrating a coordinated effort to couple technological infrastructure with strategic health objectives. High-frequency workflow processing over a thousand samples weekly enables deep proteome insight that will inform diagnostic pipelines and biomarker discovery. As this proteomic initiative scales, it validates the role of mass spectrometry as a core tool for translational research and precision medicine. The success of this study signals growing capacity and maturity in large-scale analytical applications and reinforces South Korea spectrometry market trends.

Expansion of Electron Paramagnetic Resonance (EPR) Capability

In April 2025, CIQTEK appointed BK Instruments Inc. as the exclusive distributor of Electron Paramagnetic Resonance (EPR) spectrometers in South Korea, opening the door for expanded domestic access to high-end EPR instrumentation. This move enables Korean research institutions and industrial labs to access EPR systems with localized support, including installation, maintenance, and training all essential for scaling usage in precision environments. EPR is a powerful technique used to study unpaired electrons in complex materials and has become vital in disciplines like materials science, clean energy research, and biophysics. With this distribution agreement, more Korean laboratories will be able to incorporate EPR into both academic and applied research workflows. Faster response times and stronger technical service are expected to drive increased adoption across sectors that demand highly sensitive spectrometry. This shift supports South Korea’s broader strategy of strengthening its analytical instrumentation base while keeping pace with international standards. As new technologies are introduced with strong local infrastructure, the scientific ecosystem becomes more agile, better equipped, and more capable of supporting advanced exploration and diagnostic research.

South Korea Spectrometry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, product, application, and end user.

Type Insights:

- Molecular Spectrometry

- Visible and Ultraviolet Spectroscopy

- Infrared Spectroscopy

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Others

- Mass Spectrometry (MS)

- MALDI-TOF

- Triple Quadrupole

- Quadrupole-Trap

- Hybrid Linear Ion Trap Orbitrap

- Quadrupole-Orbitrap

- Atomic Spectrometry

- Atomic Absorption Spectroscopy (AAS)

- Atomic Emission Spectroscopy (AES)

- Atomic Fluorescence Spectroscopy (AFS)

- X-ray Fluorescence (XRF)

- Inorganic Mass Spectroscopy

The report has provided a detailed breakup and analysis of the market based on the type. This includes molecular spectrometry (visible and ultraviolet spectroscopy, infrared spectroscopy, nuclear magnetic resonance (NMR) spectroscopy, and others), mass spectrometry (MS) (MALDI-TOF, triple quadrupole, quadrupole-trap, hybrid linear ion trap orbitrap, and quadrupole-orbitrap), and atomic spectrometry (atomic absorption spectroscopy (AAS), atomic emission spectroscopy (AES), atomic fluorescence spectroscopy (AFS), x-ray fluorescence (XRF), and inorganic mass spectroscopy).

Product Insights:

- Instruments

- Consumables

- Services

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes instruments, consumables, and services.

Application Insights:

- Proteomics

- Metabolomics

- Pharmaceutical Analysis

- Forensic Analysis

- Others

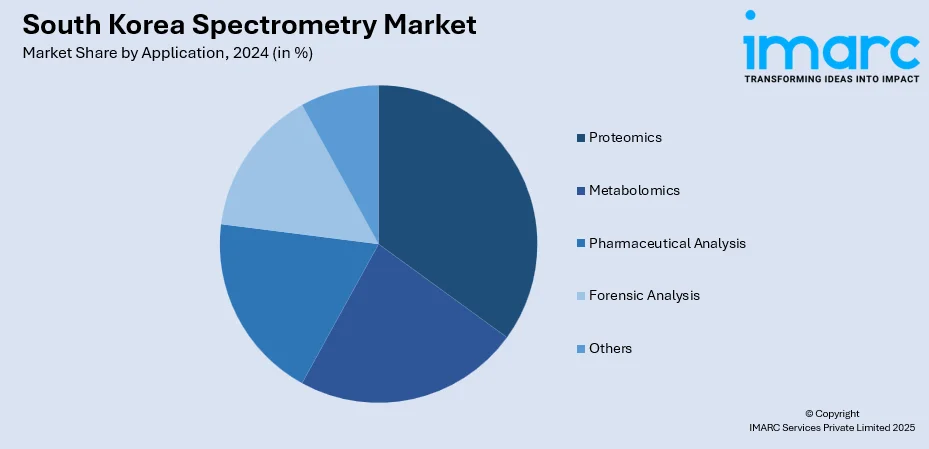

The report has provided a detailed breakup and analysis of the market based on the application. This includes proteomics, metabolomics, pharmaceutical analysis, forensic analysis, and others.

End User Insights:

- Government and Academic Institutions

- Pharmaceutical and Biotechnology Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government and academic institutions, pharmaceutical and biotechnology companies, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Spectrometry Market News:

- March 2025: Terumo Blood and Cell Technologies has partnered with South Korea’s Osong Medical Innovation Foundation to develop specialized workforce training for cell and gene therapy manufacturing. The collaboration will focus on training for mesenchymal stem cell and CAR T-cell therapies using Terumo’s advanced cell expansion and fill-finish systems. KBIOHealth plans to establish a training center offering hands-on and virtual reality programs to support GMP-based manufacturing and quality control. This initiative aims to strengthen South Korea’s capabilities in biopharma workforce development and CGT manufacturing.

- July 2025: Chungnam National University (CNU) in South Korea has entered a Memorandum of Understanding with SCIEX, a world leader in mass spectrometry, to enhance their partnership. The strategic partnership as part of CNU's "Industry on Campus" will bring SCIEX's cutting-edge analytical technologies into universities and research institutions. Collaborative activities will involve joint research projects, technical workshops, seminars, and incorporation of up-to-date mass spectrometry into curriculum. The collaboration is designed to develop a vibrant industry–academia system, catalyzing innovation and nurturing next-generation scientific leaders.

South Korea Spectrometry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products Covered | Instruments, Consumables, Services |

| Applications Covered | Proteomics, Metabolomics, Pharmaceutical Analysis, Forensic Analysis, Others |

| End Users Covered | Government and Academic Institutions, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea spectrometry market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea spectrometry market on the basis of type?

- What is the breakup of the South Korea spectrometry market on the basis of product?

- What is the breakup of the South Korea spectrometry market on the basis of application?

- What is the breakup of the South Korea spectrometry market on the basis of end user?

- What is the breakup of the South Korea spectrometry market on the basis of region?

- What are the various stages in the value chain of the South Korea spectrometry market?

- What are the key driving factors and challenges in the South Korea spectrometry market?

- What is the structure of the South Korea spectrometry market and who are the key players?

- What is the degree of competition in the South Korea spectrometry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea spectrometry market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea spectrometry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea spectrometry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)