South Korea Spices and Seasonings Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

South Korea Spices and Seasonings Market Overview:

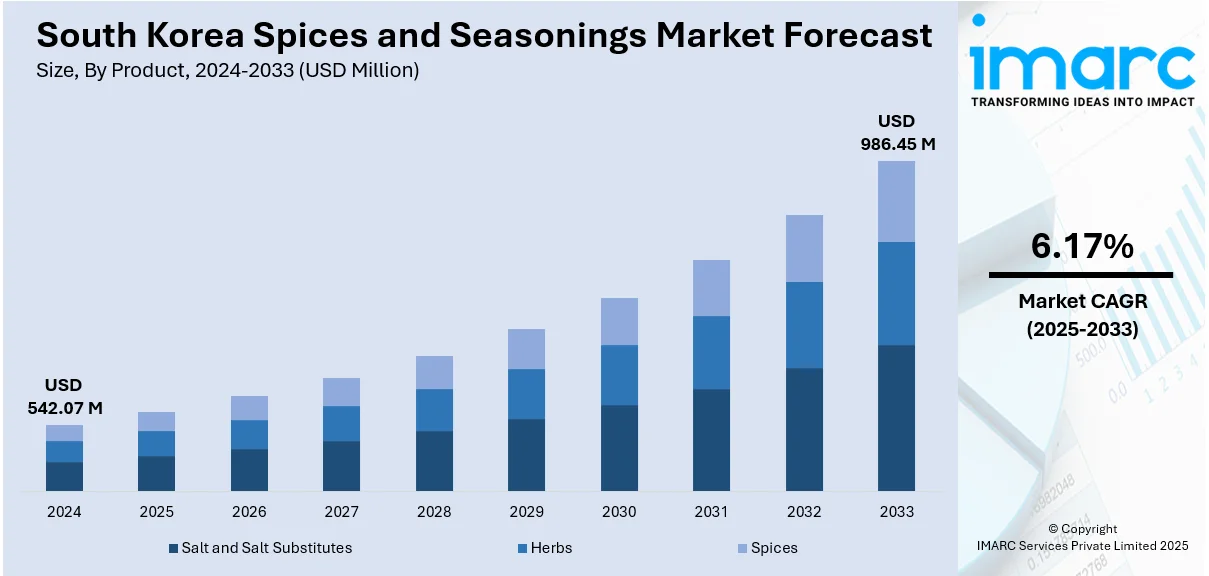

The South Korea spices and seasonings market size reached USD 542.07 Million in 2025. Looking forward, the market is projected to reach USD 986.45 Million by 2034, exhibiting a growth rate (CAGR) of 6.17% during 2026-2034. The market is driven by rapid expansion of e commerce and digital delivery channels offering variety and speed to consumers. Heightened health awareness and an emphasis on clean label, organic seasoning choices reinforce demand for transparent, locally sourced products. Meanwhile, exposure to global culinary traditions encourages experimentation with international spice blends and exotic seasoning formats, further augmenting the South Korea spices and seasonings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 542.07 Million |

| Market Forecast in 2034 | USD 986.45 Million |

| Market Growth Rate 2026-2034 | 6.17% |

South Korea Spices and Seasonings Market Trends:

E‑Commerce Expansion and Consumer Convenience Channels

South Korea’s advanced digital infrastructure has fundamentally shifted how spices and seasonings reach consumers. Major platforms such as Coupang, Gmarket and Naver Shopping provide same-day and next-day delivery to a majority of urban households. These platforms offer extensive assortments of local and imported spices, seasoning mixes and herbal blends at competitive prices. Mobile commerce continues to capture higher market share as consumers seek convenience and variety. Influencer-led campaigns and personalized recommendations on live‑commerce streams further drive trial and adoption. In 2024, Samyang Foods recorded a 45% sales increase, reaching USD 1.26 Billion, with exports surpassing 1 Trillion Won (approx. USD 730 Million), reflecting the growing influence of spicy Korean flavors and seasonings in global markets, particularly in the U.S. and China. Pre-packaged seasoning kits tailored for home cooking and meal kits appeal to time‑pressed consumers. Subscription models and bundle offerings promote repeat purchase behavior. After more than eighty words into this discussion it becomes clear that these modern channels and digital engagement serve as a key contributor to South Korea spices and seasonings market growth.

To get more information on this market, Request Sample

Culinary Globalization and Flavor Diversification

A growing appetite for international cuisines and fusion cooking has fueled demand for exotic spices and seasoning blends. South Korea’s cooking styles are embracing trends from South Asian, Middle Eastern, and Latin flavor profiles, and the market is positively influenced by exports into these countries. In Q1 2025, South Korea’s total agrifood exports reached USD 2.48 Billion, marking a 9.6% year-on-year increase. Exports to the Gulf Cooperation Council (GCC) region rose by 37.9% year-on-year, totaling USD 81 Million, with spicy products like ramen and sauces identified as key drivers. Consumers experiment with spice varieties such as za’atar, smoked paprika and chili-garlic blends. Food service channels including gourmet restaurants, delivery kitchens and food festivals continue to showcase global seasoning trends. This culinary diplomacy encourages both imports and domestic innovation in spice offerings. Manufacturers and retailers introduce novel spice blends tailored for Korean palates while preserving ethnic authenticity. Specialty and premium products receive shelf space in upscale supermarkets and online stores. Market players also collaborate with chefs and influencers to launch limited‑edition spice lines and seasonal collections. These cross‑cultural influences stimulate innovation, diversify portfolios and attract adventurous consumers to new flavor experiences.

South Korea Spices and Seasonings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Salt and Salt Substitutes

- Herbs

- Thyme

- Basil

- Oregano

- Parsley

- Others

- Spices

- Pepper

- Cardamom

- Cinnamon

- Clove

- Nutmeg

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes salt and salt substitutes, herbs (thyme, basil, oregano, parsley, and others), and spices (pepper, cardamom, cinnamon, clove, nutmeg, and others).

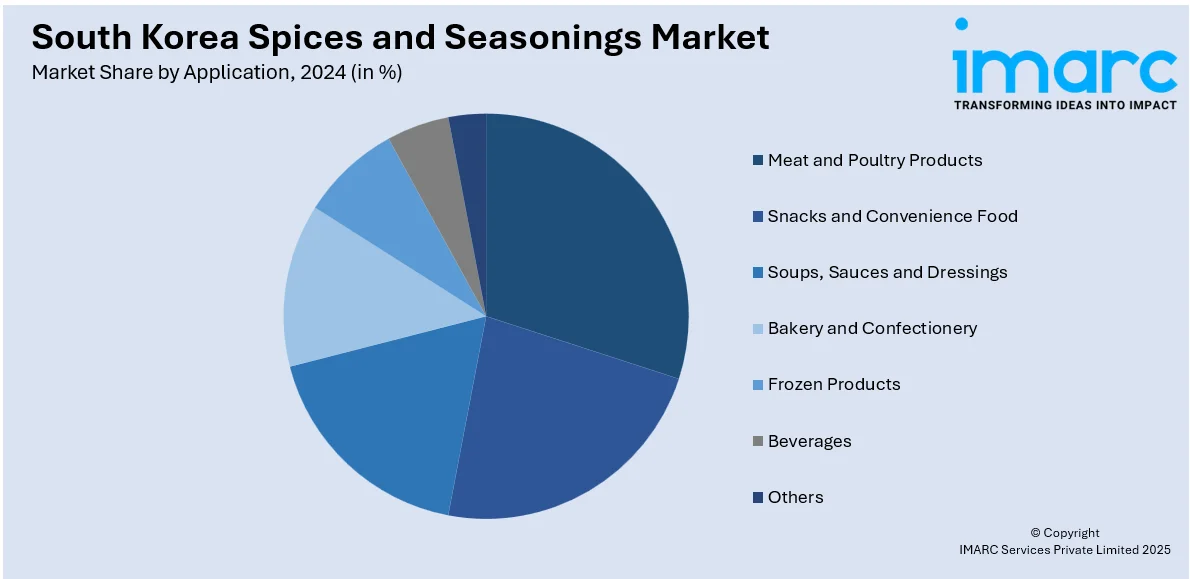

Application Insights:

- Meat and Poultry Products

- Snacks and Convenience Food

- Soups, Sauces and Dressings

- Bakery and Confectionery

- Frozen Products

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes meat and poultry products, snacks and convenience food, soups, sauces and dressings, bakery and confectionery, frozen products, beverages, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Spices and Seasonings Market News:

- On October 31, 2024, Foodrella (Hanmi F3 Co., Ltd.) introduced a new line of sauces and a pre-seasoned crispy batter mix tailored for Korean-style chicken, marking its strategic expansion into the North American spices and seasonings market. The sweet-and-spicy fried chicken sauce and versatile batter mix enable chefs and home cooks to reproduce authentic Korean flavors across a range of dishes, from barbecues and stir-fries to tacos, thereby broadening South Korea’s seasoning export portfolio.

- On June 11, 2025, Samyang Foods completed the expansion of its manufacturing facility in Milyang, South Korea, adding an annual production capacity of 830 Million units to meet rising international demand for its Buldak spicy ramyeon products. This expansion brings the company’s total Buldak output across four domestic plants to 2.9 Billion units annually and positions the new Milyang site as a global hub equipped with smart factory systems.

South Korea Spices and Seasonings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Meat and Poultry Products, Snacks and Convenience Food, Soups, Sauces and Dressings, Bakery and Confectionery, Frozen Products, Beverages, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea spices and seasonings market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea spices and seasonings market on the basis of product?

- What is the breakup of the South Korea spices and seasonings market on the basis of application?

- What is the breakup of the South Korea spices and seasonings market on the basis of region?

- What are the various stages in the value chain of the South Korea spices and seasonings market?

- What are the key driving factors and challenges in the South Korea spices and seasonings market?

- What is the structure of the South Korea spices and seasonings market and who are the key players?

- What is the degree of competition in the South Korea spices and seasonings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea spices and seasonings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea spices and seasonings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea spices and seasonings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)