South Korea Sports Nutrition Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, and Region, 2026-2034

South Korea Sports Nutrition Market Overview:

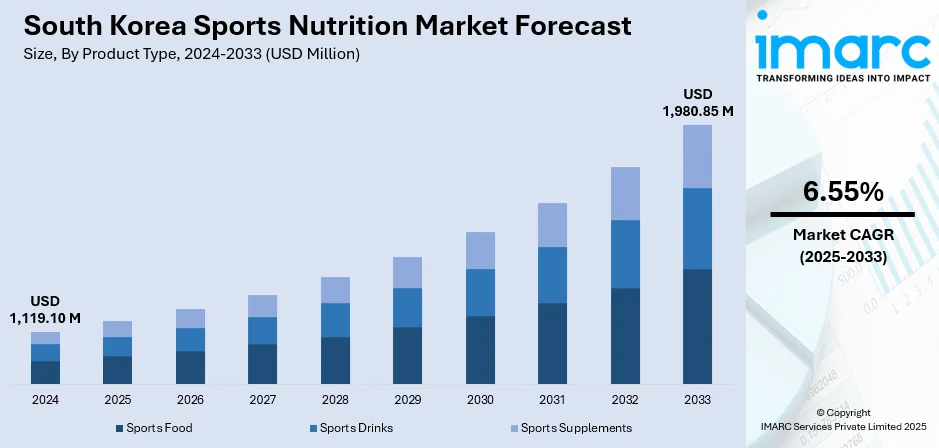

The South Korea sports nutrition market size reached USD 1,119.10 Million in 2025. Looking forward, the market is projected to reach USD 1,980.85 Million by 2034, exhibiting a growth rate (CAGR) of 6.55% during 2026-2034. The market is driven by stringent regulatory frameworks that mandate safety, labelling, and ingredient compliance, reinforcing product credibility and consumer trust. Rising participation in fitness activities, gym culture, and health-conscious lifestyles, particularly among urban youth, increases demand for performance-focused supplements and clean-label formulations. Expanded distribution with innovative delivery formats are resulting in enhanced accessibility, further augmenting the South Korea sports nutrition market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,119.10 Million |

| Market Forecast in 2034 | USD 1,980.85 Million |

| Market Growth Rate 2026-2034 | 6.55% |

South Korea Sports Nutrition Market Trends:

Cultural Fitness Trends and Consumer Wellness Awareness

South Korean consumers increasingly embrace fitness-oriented lifestyles influenced by social media, celebrity endorsements and celebrity culture. The prevalence of gym culture and participation in endurance events such as marathons and cycling contribute to rising use of protein supplements, pre‑workout formulations, and energy bars. Younger demographics seek physique enhancement, recovery support and energy maintenance through nutrition solutions tailored to active routines. South Korea's food industry experienced significant growth, with the Ministry of Food and Drug Safety (MFDS) reporting a 5.8% increase in total production to KRW 114 Trillion (USD 84.36 Billion) and a 10% rise in food exports, reaching USD 7.26 Billion. Notably, the sugar-free (Sugar Zero) sector grew by 20.1% to KRW 572.6 Billion (USD 423.7 Million), with a notable expansion in non-beverage categories, reflecting shifting consumer preferences towards healthier, indulgent options. Additionally, high-protein product production surged by 24% to KRW 568.8 Billion (USD 420.9 Million), driven by rising fitness trends. Urban centers such as Seoul, Busan, Gyeonggi and Daegu lead in consumption given robust gym infrastructure and availability of specialty retail. Rising interest in plant‑based, clean‑label and allergen‑free products reflects evolving dietary preferences among health-conscious consumers. Government and private health campaigns further drive awareness of preventive health, muscle maintenance and overall wellbeing. These cultural norms translate into strong consumer traction for ready‑to‑drink beverages, protein powders, collagen blends, and fortified snacks that support both athletic and lifestyle wellness. This demand stimulus supports continuous product innovation and brand differentiation efforts, which is a catalyst of the South Korea sports nutrition market growth.

To get more information on this market, Request Sample

Distribution Expansion and Diversified Product Formats

Market accessibility in South Korea is expanding rapidly through omnichannel distribution models including e‑commerce platforms, pharmacies, specialty health stores and convenience retail chains. Consumers increasingly purchase sports nutrition from mobile apps and internet platforms offering fast delivery, subscription options and wide product selection. Product innovation across formats such as bars, gels, buffered tablets, RTD shakes and powder sachets caters to on‑the‑go consumption preferences. Brands are introducing diverse formulations with whey, casein, plant‑based proteins, sugar‑free options and collagen additives to serve demographic segments such as aging users and performance driven youth. On February 26, 2025, South Korea's Pulmuone Green Juice reported strong sales of its Dangslim X2, a low-sugar, functional beverage designed to manage blood sugar and support intestinal health, with over 350,000 bottles sold within four months of launch. The product combines probiotics and a blood sugar management supplement in a dual-format, catering to the growing consumer demand for functional and convenient health foods. In response to the expanding low-sugar trend, Pulmuone plans to introduce more low-sugar beverages, positioning itself in the rapidly growing segment of health-focused nutrition. Marketing collaborations with fitness influencers, gyms and digital communities elevate brand visibility and trial. Meanwhile, demand for analytical testing and certification services is rising among manufacturers seeking to validate product claims and comply with regulatory standards. This convergence of channel expansion and format innovation enhances consumer engagement and enables premium positioning, driving consistent market penetration and revenue growth.

South Korea Sports Nutrition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, raw material, and distribution channel.

Product Type Insights:

- Sports Food

- Sports Drinks

- Sports Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sports food, sports drinks, and sports supplements.

Raw Material Insights:

- Animal Derived

- Plant-Based

- Mixed

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes animal derived, plant-based, and mixed.

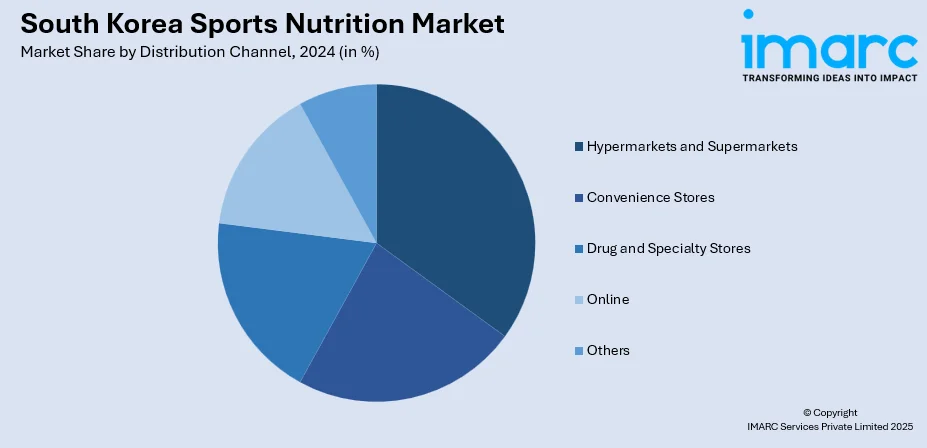

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Drug and Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, convenience stores, drug and specialty stores, online, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Sports Nutrition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sports Food, Sports Drinks, Sports Supplements |

| Raw Materials Covered | Animal Derived, Plant-Based, Mixed |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Drug and Specialty Stores, Online, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea sports nutrition market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea sports nutrition market on the basis of product type?

- What is the breakup of the South Korea sports nutrition market on the basis of raw material?

- What is the breakup of the South Korea sports nutrition market on the basis of distribution channel?

- What is the breakup of the South Korea sports nutrition market on the basis of region?

- What are the various stages in the value chain of the South Korea sports nutrition market?

- What are the key driving factors and challenges in the South Korea sports nutrition market?

- What is the structure of the South Korea sports nutrition market and who are the key players?

- What is the degree of competition in the South Korea sports nutrition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea sports nutrition market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea sports nutrition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea sports nutrition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)