South Korea Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

South Korea Steel Tubes Market Overview:

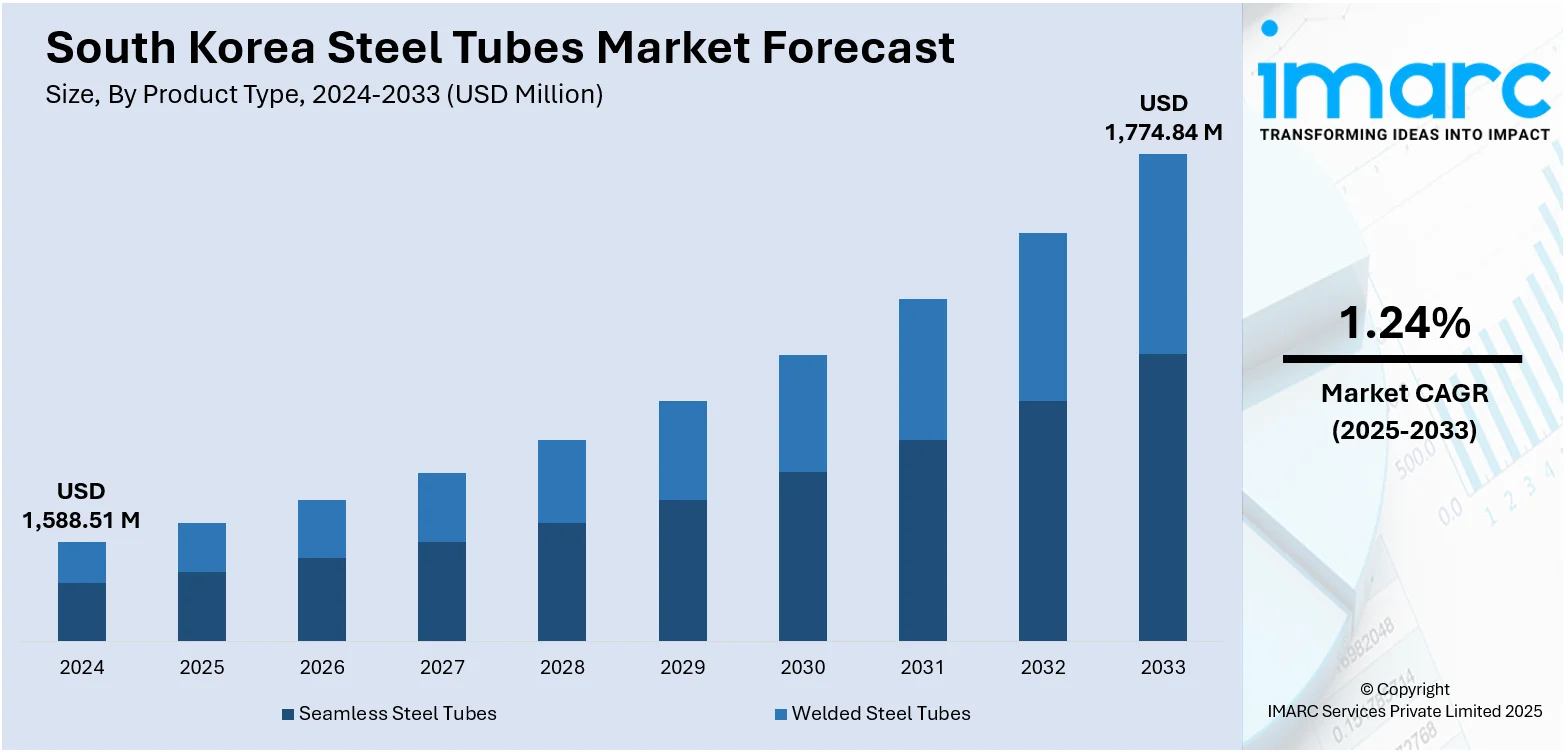

The South Korea steel tubes market size reached USD 1,588.51 Million in 2024. The market is projected to reach USD 1,774.84 Million by 2033, exhibiting a growth rate (CAGR) of 1.24% during 2025-2033. The market is spurred by the country’s expanding infrastructure, automotive, shipbuilding, and energy sectors. Manufacturers are adopting innovative materials and precision engineering to meet rising demand for high-performance, corrosion-resistant tubing. Government support for industrial innovation and supply chain localization further strengthens market foundations. Although global competition and fluctuating raw material costs present challenges, sustained investment in R&D and manufacturing efficiency continues to drive progress, enhancing the competitiveness and depth of the South Korea steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,588.51 Million |

| Market Forecast in 2033 | USD 1,774.84 Million |

| Market Growth Rate 2025-2033 | 1.24% |

South Korea Steel Tubes Market Trends:

Infrastructure Development Drives Steel Tube Demand

In September 2024, the South Korean government announced progress on the Hydrogen City project in Ulsan, which includes roughly 9.7 kilometers of new hydrogen pipeline infrastructure. This initiative is helping to sustain steady demand for steel tubes specially designed to withstand high pressure and corrosive environments. Beyond this energy transition effort, ongoing investments in urban transit systems and industrial zones continue to support the need for durable steel tubing used in elevated rail tracks and underground conduits. The project integrates advanced coating and welding technologies, prompting suppliers to quickly adapt to these evolving technical requirements. While certain market segments may experience fluctuations, infrastructure development remains a consistent and reliable driver for steel tube consumption nationwide. Additionally, this infrastructure activity strengthens local supply chains, helping manufacturers maintain steady production levels despite shifting demand in other sectors. Overall, these multi-sector infrastructure projects provide a solid foundation for material procurement and are crucial in sustaining momentum. In this context, South Korea steel tubes market growth is closely linked to infrastructure investments, ensuring ongoing demand even during market uncertainties.

To get more information on this market, Request Sample

Urban Infrastructure Renewal Supports Steady Tubing Demand

In May 2025, ongoing upgrades to wastewater and sewage networks in major South Korean cities are driving steady demand for steel tubes. These projects are part of broader smart city initiatives focused on improving resource efficiency and environmental standards, particularly in Seoul and surrounding urban areas. While some pipelines are shifting to high-density polymers, steel tubes continue to play a vital role in key applications such as pumping stations, main lines, and critical load-bearing conduits. Local authorities emphasize that steel remains preferred where strength, durability, and integration with monitoring technologies are required. This mix of materials ensures balanced demand across sectors, stabilizing consumption even as newer alternatives emerge. Furthermore, regional maintenance schedules and infrastructure renewal plans provide predictable, recurring business for tube manufacturers and suppliers. These factors combine to maintain a steady supply chain and support long-term material planning. In summary, South Korea steel tubes market trends reflect a market grounded in urban renewal efforts, where steel tubing remains essential despite evolving infrastructure materials.

Steady Consumption Highlights Market Resilience

In 2024, South Korea’s per capita consumption of iron and steel tube fittings was approximately 2.7 kilograms, one of the highest in the Asia-Pacific region. This statistic underscores the country’s ongoing reliance on steel-based components across various sectors, including construction, utilities, and industrial manufacturing. Despite the growing adoption of composite and polymer materials, steel tubes remain indispensable where structural strength and durability are critical, such as in fire suppression systems, drainage reinforcement, and load-bearing connections. The existing infrastructure, including older buildings and legacy utility networks, continues to depend heavily on steel tubing. Additionally, emerging industries like robotics and automation contribute to consistent demand for precision-grade tubes, ensuring the market maintains a robust base. This blend of traditional and advanced applications illustrates the steel tube sector’s ability to adapt while retaining core demand for drivers. Overall, South Korea steel tubes market is supported by these steady consumption patterns, driven by both established infrastructure needs and technological advancement, helping the market remain resilient despite material diversification.

South Korea Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033 Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

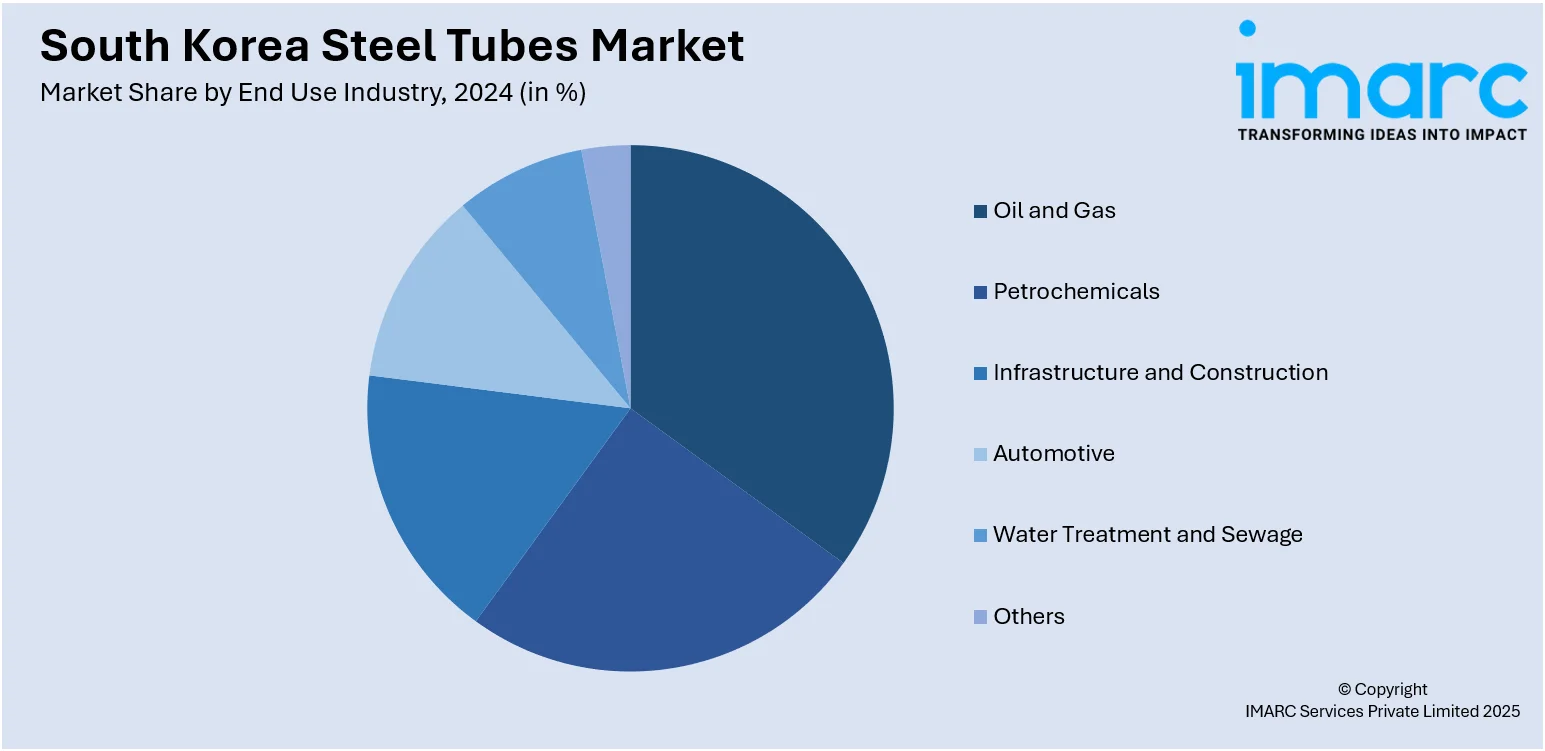

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea steel tubes market on the basis of product type?

- What is the breakup of the South Korea steel tubes market on the basis of material type?

- What is the breakup of the South Korea steel tubes market on the basis of end use industry?

- What is the breakup of the South Korea steel tubes market on the basis of region?

- What are the various stages in the value chain of the South Korea steel tubes market?

- What are the key driving factors and challenges in the South Korea steel tubes market?

- What is the structure of the South Korea steel tubes market and who are the key players?

- What is the degree of competition in the South Korea steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)