South Korea Student Information System Market Size, Share, Trends and Forecast by Component, Deployment Type, End User, and Region, 2025-2033

South Korea Student Information System Market Overview:

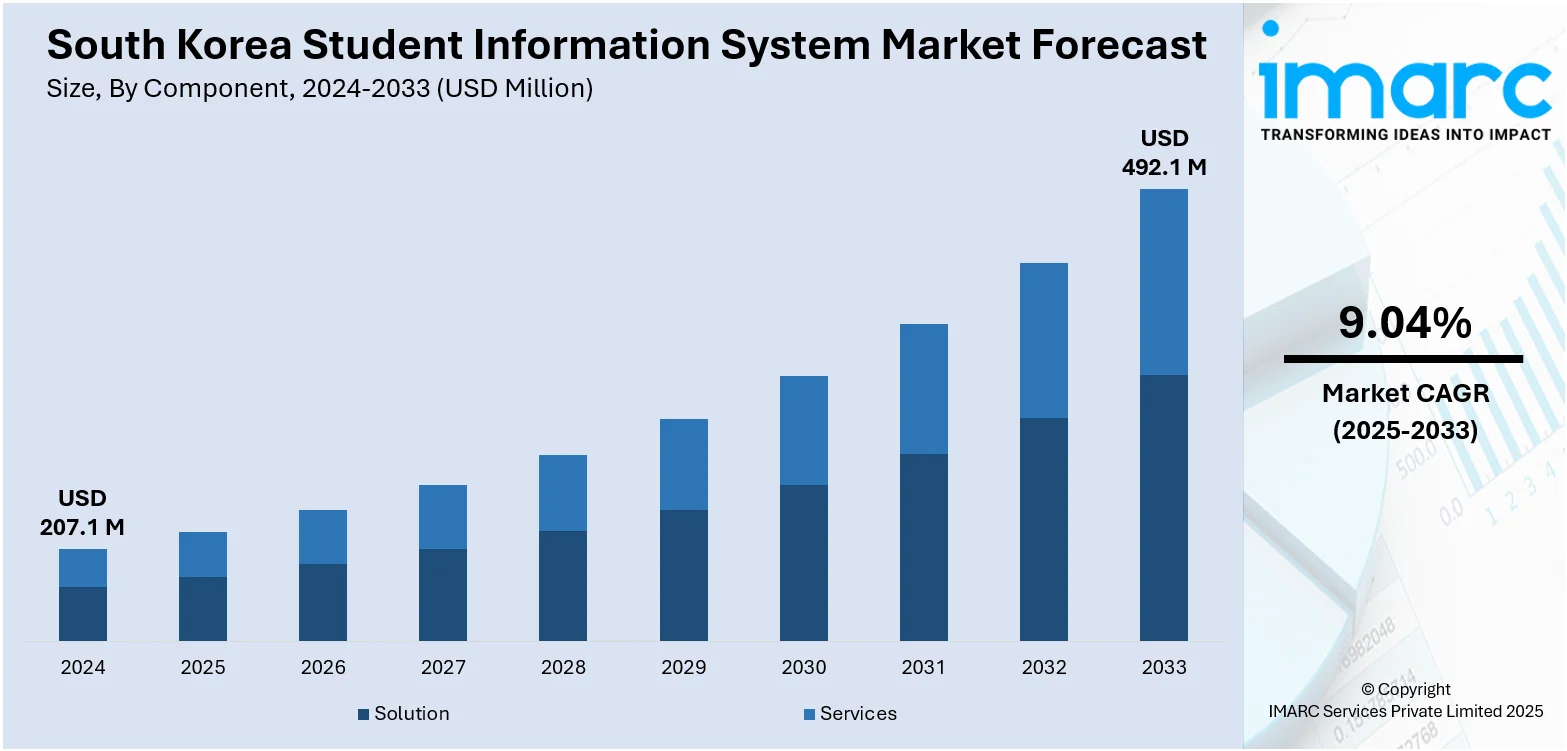

The South Korea student information system market size reached USD 207.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 492.1 Million by 2033, exhibiting a growth rate (CAGR) of 9.04% during 2025-2033. The market is driven by the efforts of the government to digitalize education by integrating advanced technologies and robust frameworks. Additionally, the high prevalence of smartphone usage is driving the demand for mobile-optimized student information system. The shift toward personalized, student-centered curricula, which necessitates flexible and adaptive platforms, is contributing to the expansion of the South Korea student information systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 207.1 Million |

| Market Forecast in 2033 | USD 492.1 Million |

| Market Growth Rate 2025-2033 | 9.04% |

South Korea Student Information System Market Trends:

Government-Led Digital Education Initiatives

South Korea’s government is making the digital transformation of education a national priority, embedding it within its broader smart nation strategy. This commitment is leading to the widespread integration of advanced technologies across schools, with student information systems (SIS) emerging as foundational tools for managing student records, attendance, academic performance, and communication efficiently. In 2025, South Korea established a robust education technology framework that incorporates AI, digital textbooks, personalized learning tools, and strict cybersecurity measures, all supported by comprehensive teacher training programs. The 2019–2023 Master Plan VI, followed by subsequent policies, emphasized digital inclusion, STEAM education, and the development of resilient online learning infrastructure. These structured efforts, backed by both funding and legislation, are creating a favorable environment for SIS adoption across both public and private sectors. The growing focus on standardizing systems across regions ensures uniformity and drives continuous investment, reinforcing SIS as a critical component of South Korea’s paperless, tech-integrated education system.

To get more information on this market, Request Sample

Rising Demand for Mobile-Optimized Systems

The widespread ownership of smartphones and tablets in South Korea is significantly driving the demand for mobile-friendly SIS. According to the 2024 Internet Usage Survey by the Ministry of Science and ICT, 97.3% of the population owns a smartphone, with 68.2% using 5G-enabled devices, and tablet ownership reaching 28%. This digital environment is raising expectations among students, parents, and educators for anytime, anywhere access to student data, attendance, grades, and communication tools through mobile apps or responsive portals. Such mobility enhances engagement by enabling parents to monitor the progress of their children in real time and allowing teachers to update records and communicate on the go. Schools are increasingly adopting SIS platforms with strong mobile integration to match this lifestyle, boosting convenience and transparency. This shift also supports remote and hybrid learning models, making mobile accessibility a key factor in student information systems market growth and vendor competition.

Shift Toward Student-Centered Curriculum Models

The transition towards a more flexible, credit-based high school curriculum in South Korea is driving the demand for advanced SIS. These systems are essential for managing individualized schedules, tracking course selections, monitoring academic progress, and supporting student counseling services. As schools adopt personalized learning pathways, SIS platforms enable efficient handling of diverse academic records and real-time data sharing across departments. In 2025, South Korea officially launched a high school credit system allowing students to choose classes like university, promoting personalized learning and career alignment. Pilot schools report increased student engagement and interdisciplinary opportunities. The Seoul education office is expanding counseling and support to ensure smooth implementation ahead of wider reforms in 2026. This shift not only increases administrative complexity but also strengthens the need for centralized, adaptive systems capable of supporting a dynamic and student-centered educational environment.

South Korea Student Information System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment type, and end user.

Component Insights:

- Solution

- Enrollment

- Academics

- Financial Aid

- Billing

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (enrollment, academics, financial aid, and billing) and services (professional services and managed services).

Deployment Type Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud-based.

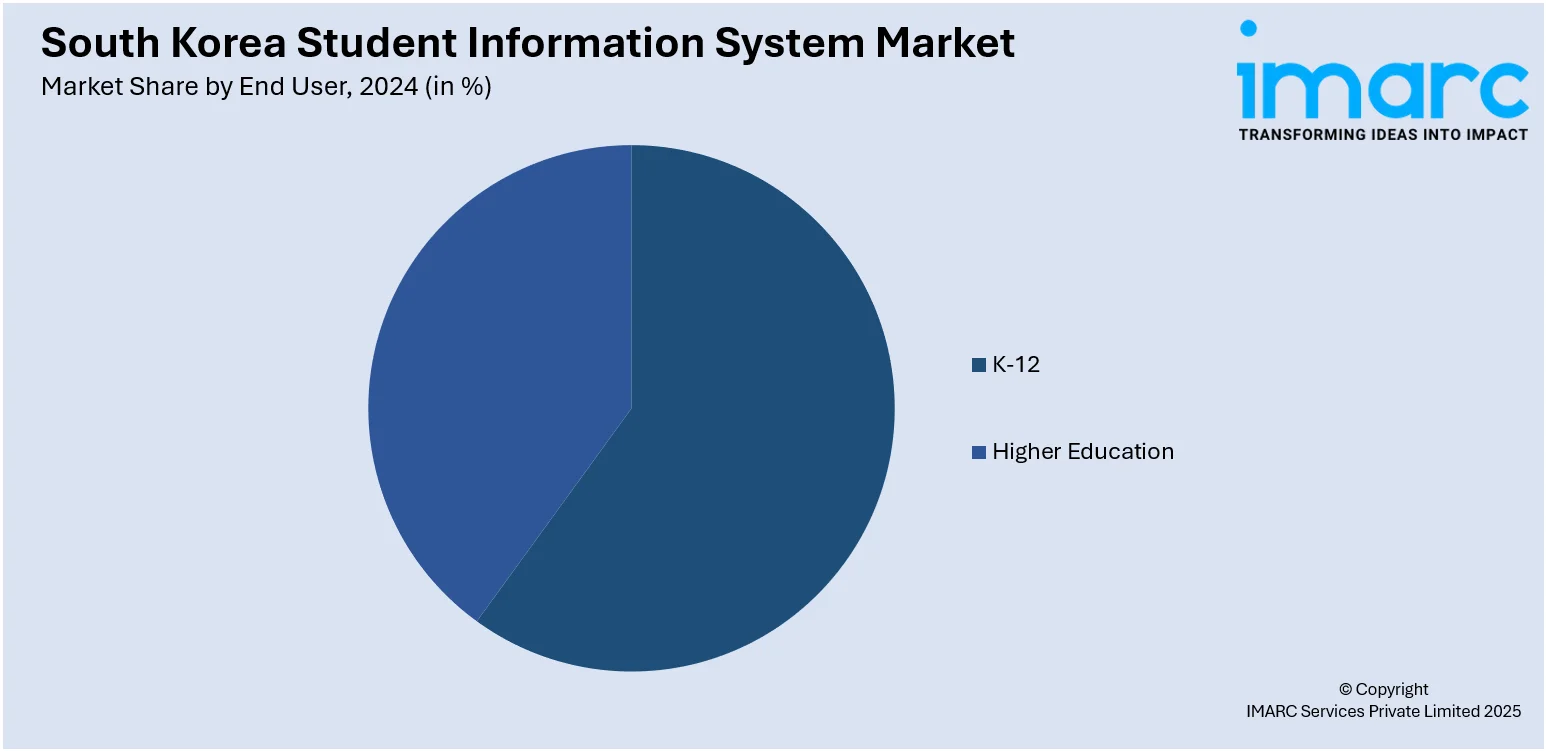

End User Insights:

- K-12

- Higher Education

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes K-12 and higher education.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Student Information System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On-premises, Cloud-based |

| End Users Covered | K-12, Higher Education |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea student information system market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea student information system market on the basis of component?

- What is the breakup of the South Korea student information system market on the basis of deployment type?

- What is the breakup of the South Korea student information system market on the basis of end user?

- What is the breakup of the South Korea student information system market on the basis of region?

- What are the various stages in the value chain of the South Korea student information system market?

- What are the key driving factors and challenges in the South Korea student information system market?

- What is the structure of the South Korea student information system market and who are the key players?

- What is the degree of competition in the South Korea student information system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea student information system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea student information system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea student information system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)