South Korea Sugar Substitutes Market Size, Share, Trends and Forecast by Product Type, Application, Origin, and Region, 2026-2034

South Korea Sugar Substitutes Market Summary:

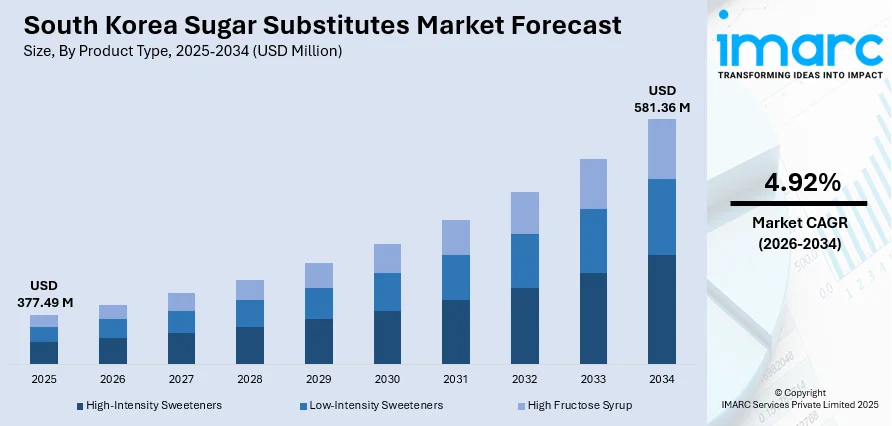

The South Korea sugar substitutes market size was valued at USD 377.49 Million in 2025 and is projected to reach USD 581.36 Million by 2034, growing at a compound annual growth rate of 4.92% from 2026-2034.

The market is driven by rising health consciousness among consumers, growing prevalence of lifestyle diseases such as diabetes and obesity, and a marked shift toward low-calorie dietary choices. Consumer preference for natural and artificial sweeteners as replacements for traditional sugar in beverages, snacks, and processed foods continues to expand. The regulatory environment supporting food labeling transparency and the emergence of functional sweetener blends further contribute to evolving consumption patterns in the South Korea sugar substitutes market share.

Key Takeaways and Insights:

-

By Product Type: High-intensity sweeteners dominate the market with 70.04% revenue share in 2025, driven by superior sweetness potency compared to conventional sugar enabling lower usage volumes, cost-effectiveness in large-scale food and beverage manufacturing, and widespread adoption across carbonated beverages, confectionery, and pharmaceutical applications.

-

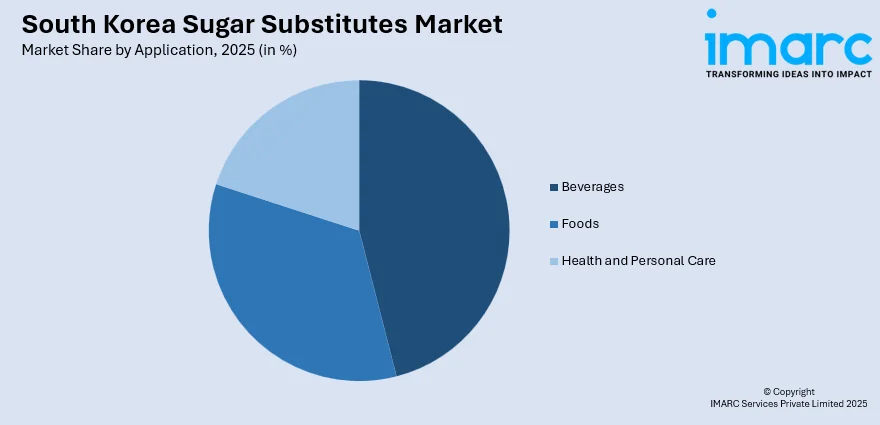

By Application: Beverages lead the market with 45.62% share in 2025. This dominance is driven by proliferation of zero-sugar carbonated drinks, functional beverages, and ready-to-drink products that align with health-conscious consumer preferences and regulatory emphasis on sugar reduction in liquid refreshments.

-

By Origin: Artificial holds the market share of 48% in 2025, owing to established manufacturing processes, competitive pricing structures, regulatory approvals across multiple product categories, and proven functionality in maintaining taste profiles while reducing caloric content.

-

Key Players: The South Korea sugar substitutes market exhibits moderate competitive intensity, with multinational food ingredient corporations competing alongside domestic manufacturers across various sweetener categories and price segments.

To get more information on this market Request Sample

The South Korea sugar substitutes market is characterized by robust demand across multiple application sectors as health awareness continues to reshape dietary preferences. Increasing adoption of low-calorie alternatives is evident in the food and beverage industry, where manufacturers are reformulating products to meet consumer expectations for reduced sugar content. Major domestic producers have invested significantly in expanding production capacity for next-generation sweeteners like allulose. In September 2024, Samyang Corporation completed construction of Korea's largest allulose production facility in Ulsan with annual capacity of 13,000 Tons, reinforcing the country's position as a leading manufacturer of alternative sweeteners. The convergence of government health initiatives, technological innovation in sweetener development, and shifting consumer behavior toward wellness-oriented products continues to strengthen market fundamentals.

South Korea Sugar Substitutes Market Trends:

Rising Consumer Preference for Natural Sweeteners

South Korean consumers are demonstrating growing preference for plant-derived sweeteners such as stevia, monk fruit extract, and erythritol. This shift reflects broader wellness trends emphasizing clean-label products with recognizable ingredients and minimal processing. The natural sweetener category appeals particularly to health-conscious consumers seeking alternatives with lower glycemic indices and perceived safety advantages over synthetic options. Food manufacturers are responding by incorporating these ingredients into functional beverages, dairy products, and health supplements to capture expanding market demand.

Allulose Emerges as Next-Generation Alternative Sweetener

Allulose has gained significant traction as a rare sugar offering sweetness comparable to fructose with virtually zero calories. Major Korean manufacturers have accelerated investments in allulose production infrastructure, positioning the country as a global leader in this sweetener category. The ingredient's caramelization properties enable flavor profiles similar to traditional sugar, making it particularly suitable for beverages, baked goods, and confectionery applications. Regulatory recognition from authorities including the United States Food and Drug Administration has strengthened commercial viability and export potential.

Clean Label Movement Driving Product Reformulation

The clean label trend is significantly influencing sweetener selection across the food and beverage industry, as consumers increasingly demand products with transparent ingredient lists. Surveys indicate that Korean consumers actively scrutinize product labels and express willingness to pay premium prices for items perceived as natural and minimally processed. This consumer behavior has prompted manufacturers to reformulate existing products and develop new offerings featuring sweeteners that align with clean label expectations while maintaining desired taste and functionality.

Market Outlook 2026-2034:

The South Korea sugar substitutes market is anticipated to register substantial revenue growth. Expansion will be supported by accelerating demand for zero-sugar beverages, rising diabetic population requiring dietary modifications, and sustained investments in advanced sweetener manufacturing capabilities. Innovation in functional sweetener blends combining sweetness with additional health benefits such as prebiotic properties will create new opportunities across multiple product categories. The market generated a revenue of USD 377.49 Million in 2025 and is projected to reach a revenue of USD 581.36 Million by 2034, growing at a compound annual growth rate of 4.92% from 2026-2034.

South Korea Sugar Substitutes Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

High-Intensity Sweeteners |

70.04% |

|

Application |

Beverages |

45.62% |

|

Origin |

Artificial |

48% |

Product Type Insights:

- High-Intensity Sweeteners

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharin

- Others

- Low-Intensity Sweeteners

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

- High Fructose Syrup

High-intensity sweeteners lead the South Korea sugar substitutes market with 70.04% share in 2025.

The high-intensity sweeteners segment dominates the market due to exceptional sweetening efficiency that requires minimal quantities to achieve desired taste profiles. These sweeteners deliver sweetness levels ranging from two hundred to several hundred times greater than conventional sugar, enabling manufacturers to achieve significant calorie reduction while maintaining consumer-preferred flavor characteristics. These sweeteners offer significant advantages in beverage manufacturing, where maintaining optimal taste while reducing caloric content remains paramount for brand competitiveness. The explosive growth of zero-sugar carbonated drinks, sports beverages, and functional drinks has substantially increased demand for high-intensity sweetening solutions.

The segment encompasses established synthetic sweeteners such as aspartame, sucralose, and saccharin alongside plant-derived options including stevia and steviol glycosides. Regulatory clarity regarding permissible usage levels and growing consumer familiarity with these ingredients supports sustained market leadership. Korean food safety authorities maintain acceptable daily intake standards aligned with international guidelines, providing formulation certainty for manufacturers. Ongoing research into taste optimization and aftertaste reduction continues to enhance product formulations across the segment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Foods

- Beverages

- Health and Personal Care

Beverages hold 45.62% share of the South Korea sugar substitutes market in 2025.

The beverage application accounts for the largest share of sugar substitute consumption, driven by explosive growth in zero-sugar carbonated soft drinks, functional beverages, and ready-to-drink products. Major beverage manufacturers have aggressively expanded their sugar-free product portfolios in response to health-conscious consumer demand and the popular healthy pleasure lifestyle trend. The zero-sugar carbonated beverage market has experienced remarkable expansion in recent years, with leading brands launching zero-calorie versions of signature products across multiple beverage categories including carbonated sodas, sports and electrolyte drinks, and milk-based refreshments. Consumer preference for guilt-free indulgence has prompted continuous product innovation, with manufacturers reformulating existing offerings while developing entirely new sugar-free beverage lines to capture evolving taste preferences. This segment benefits from strong retail distribution through convenience stores, supermarkets, and expanding e-commerce platforms, enabling widespread consumer access to reduced-calorie beverage options across urban and suburban markets throughout the country.

Origin Insights:

- Artificial

- Natural

Artificial dominates with 48% share of the South Korea sugar substitutes market in 2025.

Artificial sweeteners maintain market leadership through established manufacturing infrastructure, competitive production costs, and proven performance across diverse food and beverage applications. Decades of industrial production have enabled manufacturers to achieve economies of scale that translate into favorable pricing for food and beverage processors seeking cost-effective sugar reduction solutions. The segment benefits from decades of regulatory assessment confirming safety at established intake levels and extensive formulation expertise enabling precise sweetness profiles. Korean regulatory authorities have maintained acceptable daily intake standards aligned with international guidelines, providing continued market stability and formulation certainty for manufacturers developing reduced-calorie products. The extensive technical knowledge accumulated through years of commercial application allows formulators to address challenges such as heat stability, pH compatibility, and interaction with other ingredients across various product categories. While consumer interest in natural alternatives is growing, artificial sweeteners retain advantages in price accessibility, supply chain reliability, and functional versatility that support continued dominance across mass-market food and beverage categories where ingredient economics significantly influence product positioning and consumer affordability.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area dominates the South Korea sugar substitutes market, driven by its concentrated population of over half the nation's residents, elevated disposable income levels, and dense concentration of food and beverage manufacturers. The metropolitan region's health-conscious urban consumers demonstrate strong preference for zero-sugar beverages and reduced-calorie food products. Advanced retail infrastructure through convenience stores, supermarkets, and e-commerce platforms ensures widespread product accessibility.

Yeongnam (Southeastern Region) represents a significant market for sugar substitutes, anchored by major industrial cities including Busan, Daegu, and Ulsan. The region has emerged as a critical production hub for alternative sweeteners, with leading manufacturers establishing large-scale allulose production facilities in Ulsan. Strong manufacturing base, established distribution networks, and growing health awareness among consumers support sustained market expansion across beverage and food processing applications.

Honam (Southwestern Region) contributes to sugar substitutes demand through its established food processing industry and agricultural heritage. The region's traditional food manufacturers are increasingly incorporating low-calorie sweeteners into regional specialty products to align with evolving consumer health preferences. Growing urbanization in metropolitan centers such as Gwangju has accelerated adoption of zero-sugar beverages and diet-conscious food products among younger demographics seeking healthier lifestyle choices.

Hoseo (Central Region) demonstrates steady growth in sugar substitutes consumption, supported by its strategic location connecting Seoul with southern provinces and expanding industrial development. The region's food and beverage processing facilities increasingly utilize artificial and natural sweeteners for product reformulation initiatives. Rising health consciousness among residents, coupled with government-backed wellness initiatives and improving retail distribution infrastructure, continues driving demand for low-calorie sweetener alternatives across multiple application categories.

Market Dynamics:

Growth Drivers:

Why is the South Korea Sugar Substitutes Market Growing?

Rising Prevalence of Diabetes and Metabolic Disorders

The increasing burden of diabetes mellitus and related metabolic conditions represents a primary driver for sugar substitute adoption in South Korea. Diabetes prevalence among Korean adults aged thirty years and above has reached significant levels, creating substantial demand for dietary modifications that reduce sugar intake without sacrificing taste satisfaction. The condition disproportionately affects older populations, with prevalence rates considerably higher among individuals aged seventy and above. Healthcare authorities have emphasized preventive dietary interventions including sugar reduction as essential components of disease management strategies. The diabetic population's requirement for blood glucose management has created a dedicated consumer segment actively seeking sugar substitute products across food, beverage, and pharmaceutical categories.

Expansion of Zero-Sugar Beverage Industry

The explosive growth of zero-sugar beverages has emerged as a transformative driver for the sugar substitutes market. Leading beverage manufacturers have substantially expanded their sugar-free product portfolios, with zero-calorie versions of popular carbonated drinks, sports beverages, and flavored waters gaining significant market traction. Consumer preference for healthier beverage options has prompted major brands to launch ten new sugar-free drink varieties annually in recent years. This expansion reflects broader industry recognition that zero-sugar formulations represent not merely a niche category but an increasingly mainstream consumer expectation. The beverage industry's substantial sweetener demand volumes create economies of scale benefiting the broader sugar substitutes market.

Health-Conscious Consumer Behavior and Wellness Trends

Evolving consumer attitudes toward health and wellness have fundamentally reshaped dietary preferences, creating sustained demand for sugar reduction solutions. The healthy pleasure concept, wherein consumers seek enjoyable food and beverage experiences without compromising health objectives, has gained significant cultural resonance in South Korea. Younger demographics demonstrate particularly strong preference for products aligning with fitness and weight management goals. Social media influence and increasing nutritional literacy have heightened awareness regarding sugar's health implications, motivating active ingredient label scrutiny. This behavioral shift extends beyond beverages to confectionery, bakery products, and ready meals, broadening the addressable market for sugar substitute ingredients.

Market Restraints:

What Challenges the South Korea Sugar Substitutes Market is Facing?

Safety Perception Concerns Regarding Artificial Sweeteners

Consumer uncertainty regarding long-term health effects of artificial sweeteners poses ongoing market challenges. Periodic scientific assessments and regulatory classifications create temporary demand fluctuations as consumers evaluate ingredient safety. Some manufacturers have proactively explored reformulation options to address consumer anxiety, even when regulatory authorities confirm established safety standards remain appropriate.

Taste Profile Replication Challenges

Achieving taste parity with traditional sugar remains technically challenging for many sugar substitute applications. Certain sweeteners exhibit aftertaste characteristics or flavor profiles that differ from consumer expectations based on conventional sugar experience. These sensory limitations restrict adoption in specific product categories where taste authenticity is paramount, requiring continued research and development investment.

Premium Pricing for Natural Sweetener Alternatives

Higher production costs for natural sweeteners compared to synthetic alternatives create pricing barriers limiting widespread adoption across price-sensitive consumer segments. The cost differential particularly affects mass-market food and beverage categories where ingredient economics significantly influence final product pricing and competitive positioning.

Competitive Landscape:

The South Korea sugar substitutes market features competitive dynamics shaped by both multinational ingredient corporations and established domestic manufacturers. Market participants compete across product innovation, production capacity expansion, and pricing strategies to capture share across diverse application segments. Leading companies have invested substantially in next-generation sweetener technologies, particularly allulose production capabilities, to establish competitive differentiation. Domestic manufacturers benefit from proximity to major food and beverage customers and established distribution relationships. The competitive environment emphasizes technical expertise in sweetener formulation, regulatory compliance capabilities, and supply chain reliability to meet quality and consistency requirements of food processing customers.

South Korea Sugar Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Foods, Beverages, Health and Personal Care |

| Origins Covered | Artificial, Natural |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea sugar substitutes market size was valued at USD 377.49 Million in 2025.

The South Korea sugar substitutes market is expected to grow at a compound annual growth rate of 4.92% from 2034 to reach USD 581.36 Million by 2034.

Major challenges include safety perception concerns regarding artificial sweeteners, taste profile replication difficulties, premium pricing barriers for natural alternatives, regulatory uncertainties affecting consumer confidence, and competitive pressure from traditional sugar in price-sensitive market segments.

Key factors driving the Italy e-invoicing market include the implementation of mandatory regulations from the Italian Revenue Agency, aiming to improve tax compliance and reduce VAT fraud. In 2024, the mandate expanded to include micro-businesses, requiring the use of the Sistema di Interscambio (SdI) platform, further boosting adoption.

Major challenges include integration complexity with legacy enterprise systems requiring significant customization, initial implementation costs constraining micro-enterprise adoption, data security concerns regarding sensitive commercial information transmission, and technical adaptation challenges for cross-border invoice format compliance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)