South Korea Surgical Robots Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

South Korea Surgical Robots Market Overview:

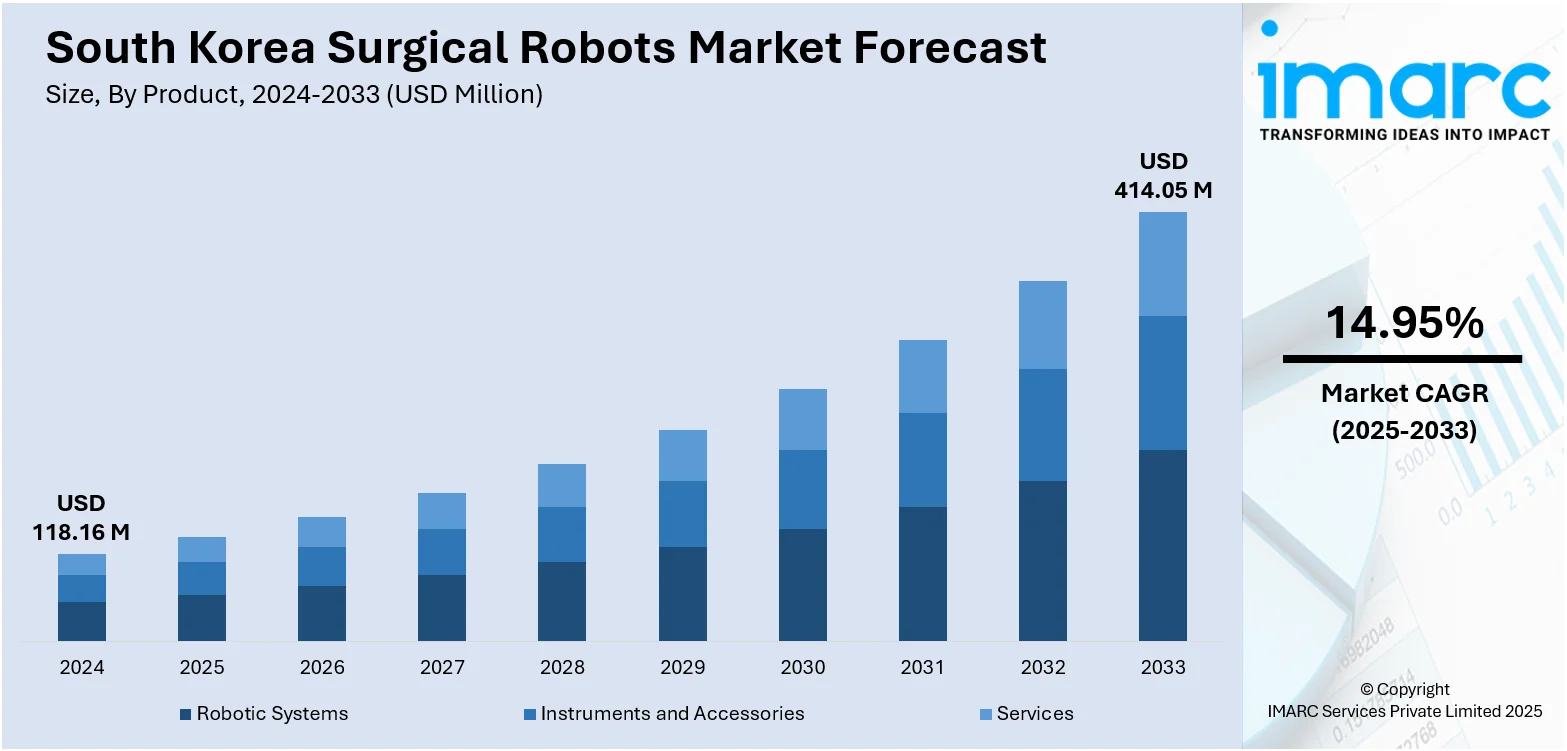

The South Korea surgical robots market size reached USD 118.16 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 414.05 Million by 2034, exhibiting a growth rate (CAGR) of 14.95% during 2026-2034. The speedy development of surgical robotic systems is a key factor strengthening the market growth in South Korea. Moreover, the increasing need for minimally invasive surgery (MIS) is impelling the market growth. Apart from this, the implementation of government policies and initiatives to improve the healthcare system is expanding the South Korea surgical robots market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 118.16 Million |

| Market Forecast in 2034 | USD 414.05 Million |

| Market Growth Rate 2026-2034 | 14.95% |

South Korea Surgical Robots Market Trends:

Government Initiatives and Support for Healthcare Innovation

Government policies and initiatives to improve the healthcare system are fueling the market growth. The South Korean government has been actively promoting medical technology and innovation, financing research and development of robot surgery. Programs like tax concessions to hospitals for investments in sophisticated medical technologies and government subsidies for the acquisition of robotic systems have promoted mass adoption. Furthermore, the emphasis of the government on strengthening healthcare infrastructure and public-private partnerships in the health sector has provided a friendly ecosystem for the adoption of new-age technologies. This aid not only makes robotic surgery more available to numerous hospitals but also speeds the innovation, development, and commercialization of emerging robotic surgical systems, making South Korea a global leader in the medical robotics field. In 2025, Intuitive Surgical, a US-based developer of robotic surgical systems, established agreements in South Korea and India to assist in enhancing the skills of healthcare professionals. According to its memorandum of understanding (MoU) with the Seoul government, it plans to invest 15 billion won ($10.7 million) in foreign direct investment (FDI) over the next five years to enhance its robotic surgery training center and explore new business initiatives.

To get more information on this market, Request Sample

Technological Innovation and Progress in Robotic Surgery

The speedy development of surgical robotic systems is a key factor strengthening the market growth in South Korea. With ongoing progress in artificial intelligence (AI), machine learning (ML), and robotics, surgical robots are becoming smarter. The systems are now designed with improved precision, dexterity, and flexibility, making them provide substantial enhancement in minimally invasive surgery (MIS). The incorporation of AI enables enhanced diagnostics and customized treatment plans, while ML optimizes surgical procedures with the passage of time, improving efficiency and patient outcomes. In South Korea, a well-established healthcare infrastructure combined with excellent government and private sector funding in medical technology is expediting the introduction of such high-tech systems. This is especially true in high-demanding surgical fields like orthopedics, urology, and gynecology, where robotic surgery has the potential to provide significant gains in precision, quicker recovery, and lower complications. In 2025, the Korea Health Industry Development Institute (KHIDI) and the Ministry of Health and Welfare (MOHW) in South Korea revealed three new initiatives under the Korean Advanced Research Projects Agency for Health (ARPA-H). One type of this is a robot assistant powered by AI, meant to carry out repetitive tasks that aid doctors during surgical procedures. The goal of its development is to tackle the lack of surgical personnel.

Increased Need for MIS

The increasing need for MIS is impelling the South Korea surgical robotics market growth. MIS, typically leading to less invasive cuts, reduced blood loss, and shorter recovery times, is increasingly the choice for patients as well as surgeons. Robotic systems improve the efficacy of MIS by allowing for improved control, increased accuracy, and the ability to carry out complex surgeries with high accuracy. This has been followed by higher patient satisfaction and reduced healthcare expenditures, both of which are essential in the South Korean market, where patients expect high-quality and affordable healthcare. The aging population in South Korea is also responsible for this trend, as older patients generally look for less invasive options compared to conventional surgeries. Hence, hospitals and clinics are embracing robotic surgery to meet this rising demand, further supporting the market growth. IMARC Group predicts that the South Korea minimally invasive surgery devices market is expected to reach USD 1,450 Million by 2033.

South Korea Surgical Robots Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Robotic Systems

- Instruments and Accessories

- Services

The report has provided a detailed breakup and analysis of the market based on the product. This includes robotic systems, instruments and accessories, and services.

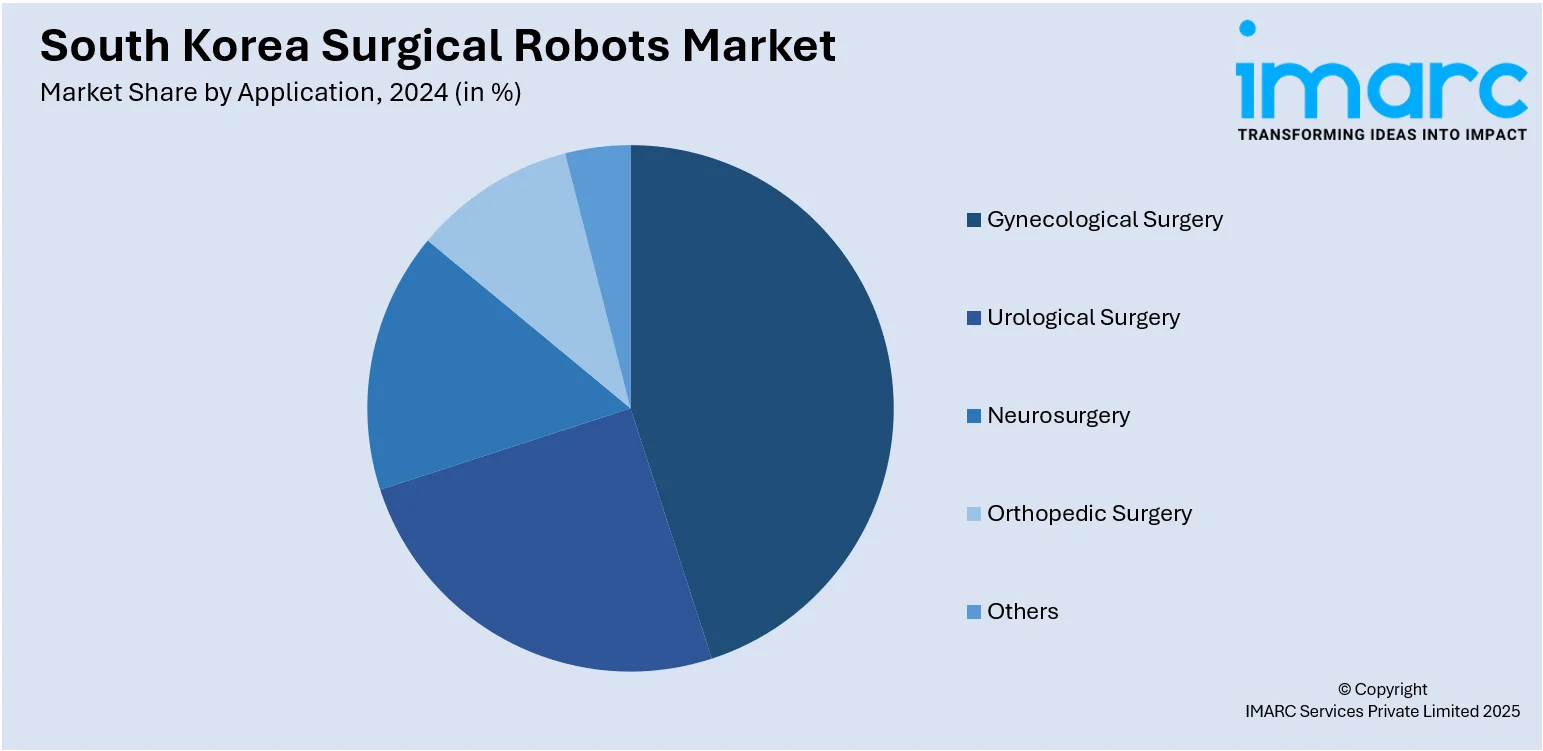

Application Insights:

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gynecological surgery, urological surgery, neurosurgery, orthopedic surgery, and others.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgical centers, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Surgical Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Robotic Systems, Instruments and Accessories, Services |

| Applications Covered | Gynecological Surgery, Urological Surgery, Neurosurgery, Orthopedic Surgery, Others. |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea surgical robots market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea surgical robots market on the basis of product?

- What is the breakup of the South Korea surgical robots market on the basis of application?

- What is the breakup of the South Korea surgical robots market on the basis of end user?

- What is the breakup of the South Korea surgical robots market on the basis of region?

- What are the various stages in the value chain of the South Korea surgical robots market?

- What are the key driving factors and challenges in the South Korea surgical robots market?

- What is the structure of the South Korea surgical robots market and who are the key players?

- What is the degree of competition in the South Korea surgical robots market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea surgical robots market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea surgical robots market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea surgical robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)