South Korea Synthetic Rubber Market Size, Share, Trends and Forecast by Type, Form, Application, and Region, 2025-2033

South Korea Synthetic Rubber Market Overview:

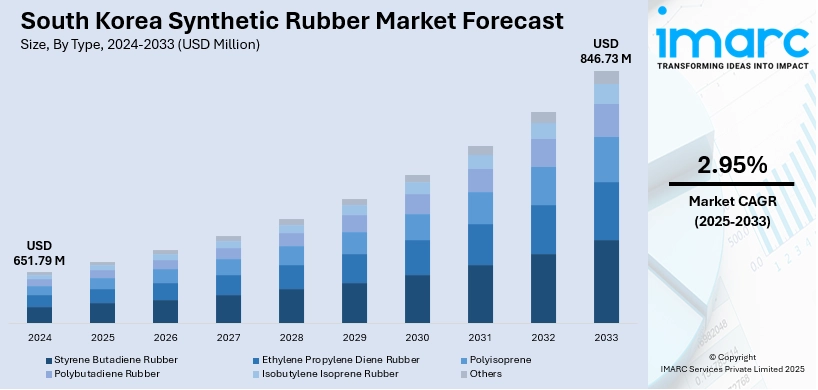

The South Korea synthetic rubber market size reached USD 651.79 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 846.73 Million by 2033, exhibiting a growth rate (CAGR) of 2.95% during 2025-2033. At present, the increased demand for electric vehicles (EVs) and hybrid versions is impelling the growth of the market. Moreover, innovations in the South Korea's construction and manufacturing industry are catalyzing the demand for high quality rubber. Additionally, heightened usage of rubber for manufacturing footwear soles, domestic products, sports equipment, and personal care products is expanding the South Korea synthetic rubber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 651.79 Million |

| Market Forecast in 2033 | USD 846.73 Million |

| Market Growth Rate 2025-2033 | 2.95% |

South Korea Synthetic Rubber Market Trends:

Innovations in Automobile and Tire Business

The South Korean synthetic rubber industry is positively influenced by the nation's strong automotive and tire production industries. As a prominent automobile manufacturer of Asia, South Korea is home to international giants such as Hyundai, Kia, and Hankook Tires, which rely heavily on synthetic rubber for tires, hoses, belts, seals, and other parts of the automobile. The increased demand for electric vehicles (EVs) and hybrid versions further accelerates the demand for advanced synthetic rubber compounds with better performance and energy efficiency. Additionally, synthetic rubber's better properties like elasticity, durability, and abrasion resistance make it highly suitable for tire applications. With auto production levels expected to continue to rise gradually over 2025, particularly for export markets, the use of synthetic rubber is witnessing commensurate growth. Government programs to support South Korea's green mobility and EV sectors are also driving the demand for high-end rubber products. IMARC Group predicts that the South Korea electric car market is projected to attain USD 39,773.4 Million by 2033.

To get more information on this market, Request Sample

Growth in Industrial Manufacturing and Construction

The heightened innovations in the South Korea's construction and manufacturing industry are catalyzing the demand for synthetic rubber. In building, synthetic rubber finds applications in adhesives, sealants, flooring, roof membranes, and vibration dampers. With ongoing development of infrastructure, especially smart cities, business complexes, and transport terminals, there is an increase in the need for high-performance rubber products with thermal stability, water resistance, and flexibility. In manufacturing industries, synthetic rubber is a part of machinery belts, seals, and gaskets, particularly in industries such as electronics, chemicals, and shipbuilding. These require materials that endure heat, corrosion, and repetitive mechanical stress, qualities delivered by synthetic rubber on a consistent basis. As South Korea becomes a high-tech manufacturing center and invests in industrial automation, the demand for sophisticated synthetic rubber materials increases. Additionally, the increasing emphasis on local sourcing and material development is stimulating the domestic manufacture of synthetic rubber grades for targeted industrial uses. In 2025, Kumho Polychem allocated 300 billion won in Yeosu, Jeollanam-do, to enhance its production capabilities for functional synthetic rubber (EPDM). Kumho Polychem is a fully owned division of Kumho Petrochemical. Kumho Petrochemical declared on the 13th that Kumho Polychem conducted a ceremony to mark the completion of the EPDM 5 line expansion at the Yeosu 2 plant on that day. Through the addition of 70,000 tons of five-line capacity, Kumho Polychem will create an annual production capability of 310,000 tons of EPDM. EPDM is a specialized synthetic rubber with exceptional functionality. Owing to its outstanding heat resistance, the user base of tire tubes is growing.

Increased Demand for Consumer Products and Medical Uses

Rising applications for synthetic rubber in consumer goods as well as healthcare products are supporting the South Korea synthetic rubber market growth. Synthetic rubber is widely applied in the production of items such as footwear soles, domestic products, sports equipment, and personal care products owing to its elasticity, comfort, and durability. In the medical industry, products like nitrile rubber play a crucial role in manufacturing gloves, tubing, stoppers, and other disposable products. Additionally, as people lean toward higher quality, longer-lasting consumer products, manufacturers are turning to performance-enhancing rubber formulations. With South Korea’s strong domestic market and export-oriented production capacity, synthetic rubber continues to be a critical material for both consumer and healthcare industries. Improvements in rubber compounding technologies and bio-based synthetic rubbers is also driving the market.

South Korea Synthetic Rubber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, form, and application.

Type Insights:

- Styrene Butadiene Rubber

- Ethylene Propylene Diene Rubber

- Polyisoprene

- Polybutadiene Rubber

- Isobutylene Isoprene Rubber

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes styrene butadiene rubber, ethylene propylene diene rubber, polyisoprene, polybutadiene rubber, isobutylene isoprene rubber, and others.

Form Insights:

- Liquid Synthetic Rubber

- Solid Synthetic Rubber

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid synthetic rubber and solid synthetic rubber.

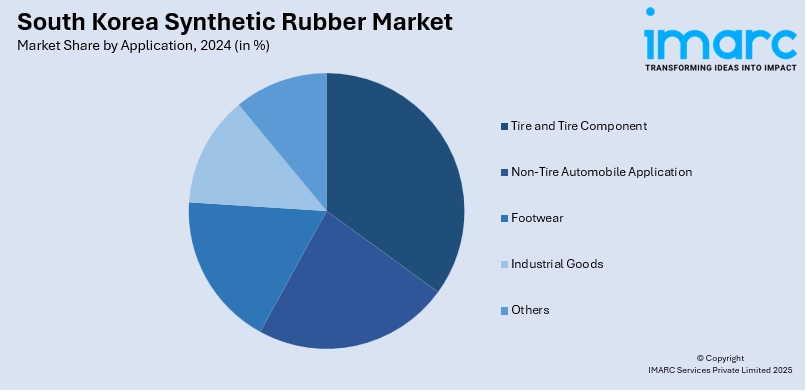

Application Insights:

- Tire and Tire Component

- Non-Tire Automobile Application

- Footwear

- Industrial Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes tire and tire component, non-tire automobile application, footwear, industrial goods, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Synthetic Rubber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Styrene Butadiene Rubber, Ethylene Propylene Diene Rubber, Polyisoprene, Polybutadiene Rubber, Isobutylene Isoprene Rubber, Others |

| Forms Covered | Liquid Synthetic Rubber, Solid Synthetic Rubber |

| Applications Covered | Tire and Tire Component, Non-Tire Automobile Application, Footwear, Industrial Goods, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea synthetic rubber market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea synthetic rubber market on the basis of type?

- What is the breakup of the South Korea synthetic rubber market on the basis of form?

- What is the breakup of the South Korea synthetic rubber market on the basis of application?

- What is the breakup of the South Korea synthetic rubber market on the basis of region?

- What are the various stages in the value chain of the South Korea synthetic rubber market?

- What are the key driving factors and challenges in the South Korea synthetic rubber market?

- What is the structure of the South Korea synthetic rubber market and who are the key players?

- What is the degree of competition in the South Korea synthetic rubber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea synthetic rubber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea synthetic rubber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea synthetic rubber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)