South Korea Tire Market Size, Share, Trends and Forecast by Design, End Use, Vehicle Type, Distribution Channel, Season, and Region, 2025-2033

South Korea Tire Market Size and Share:

The South Korea tire market size was valued at USD 3,296.70 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,027.26 Million by 2033, exhibiting a CAGR of 4.80% from 2025-2033. The market is witnessing significant growth driven by strong automotive manufacturing, rising electric vehicle adoption, and growing demand for high-performance and eco-friendly tires. Advancements in smart tire technologies and expansion of online distribution channels also support market expansion. Regional diversity and innovation-focused strategies enhance competitiveness across segments, further influencing the overall dynamics of the South Korea tire market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,296.70 Million |

| Market Forecast in 2033 | USD 5,027.26 Million |

| Market Growth Rate (2025-2033) | 4.80% |

The South Korea tire market is primarily driven by the country’s robust automotive manufacturing sector, which includes both passenger and commercial vehicles. According to the data published by CEIC, South Korea's motor vehicle production increased to 4,243,597 units in December 2023, up from 3,757,049 units in December 2022. Strong domestic demand and growing exports of automobiles have spurred consistent tire production. Additionally, South Korea's reputation for technological innovation has led to increased adoption of high-performance and eco-friendly tires. The presence of leading global and domestic tire manufacturers in the country also supports continuous product development, meeting both domestic and international market standards.

.webp)

Another key driver is the rising demand for replacement tires, fueled by an aging vehicle fleet and increasing vehicle ownership. The expansion of e-commerce platforms and digital retailing has made tire purchases more accessible to consumers, enhancing aftermarket sales. For instance, in March 2025, Bridgestone Korea launched its first direct online shopping mall, "Tire Select," enhancing customer access to premium tires and services. The platform features easy tire purchases and the 'Tire Call' service for on-site replacements. Discounts and promotions are available for new members and product reviewers. Moreover, government initiatives promoting electric vehicles (EVs) have stimulated innovation in tire design, focusing on durability and energy efficiency. These factors combined are expected to sustain long-term growth in the South Korean tire market.

South Korea Tire Market Trends:

Growth of Smart Tire Technology

The South Korea tire market is experiencing notable growth in smart tire technology, driven by increasing demand for enhanced vehicle safety and performance. Smart tires are integrated with sensors that continuously monitor critical parameters such as tire pressure, temperature, and tread wear. This real-time data helps optimize driving conditions, reduce the risk of accidents, and extend tire lifespan. The advancement of connected and autonomous vehicles is further accelerating the adoption of these intelligent systems. Tire manufacturers are investing in digital innovation to meet evolving consumer expectations, positioning smart tires as a key component in the future of mobility.

Rising Demand for EV-Compatible Tires

The growing adoption of electric vehicles (EVs) is significantly shaping the South Korea tire market outlook. EVs require specially designed tires that can withstand higher torque, heavier battery loads, and ensure quiet operation. As a result, domestic tire manufacturers are increasingly focusing on producing low-rolling-resistance and durable tires to meet EV performance standards. For instance, in April 2025, Hankook Tire secured a $10.5 million deal to supply tires for Aptera Motors’ solar electric vehicles, starting in 2026. The two-seater Aptera EV, designed to travel up to 643 Kilometers on a single charge, aims for full production by 2028 following significant preorders and collaborations with key partners. This trend is expected to accelerate, supported by government incentives for EV adoption and consumer demand for sustainable, high-efficiency mobility solutions in the coming years.

Rising Focus on Sustainable Materials

The South Korea tire market forecast highlights a strong shift toward sustainability, with manufacturers adopting eco-friendly and recyclable materials in tire production. This trend is driven by increasing environmental awareness, regulatory pressures, and global sustainability commitments. Companies are investing in green technologies, such as bio-based polymers, silica compounds, and renewable rubber alternatives, to reduce their environmental footprint. For instance, in March 2024, South Korea's Hyosung Advanced Materials, SK Chemicals, and Hankook Tire launched the "ion," the first electric vehicle tire made from recycled polyethylene terephthalate (PET). Developed over two years, it contains 45% sustainable materials and features tire cords designed for durability, marked with the ISCC Plus certification. Moreover, there is a growing emphasis on minimizing waste through circular practices like tire recycling and re-manufacturing. As sustainability becomes a core focus, these innovations are expected to contribute positively to the South Korea tire market growth.

South Korea Tire Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea tire market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on design, end use, vehicle type, distribution channel, and season.

Analysis by Design:

- Radial Market

- Bias Market

The radial tire segment dominates the South Korea tire market due to its superior performance, durability, and fuel efficiency compared to bias tires. Radial tires offer better grip, improved ride comfort, and longer tread life, making them preferred for passenger cars and commercial vehicles. Technological advancements and increasing demand for high-performance and eco-friendly tires are fueling growth in this segment. Additionally, the shift toward electric vehicles further boosts the radial tire market, as these tires better handle EV-specific requirements like weight and torque.

The bias tire segment maintains a niche presence in South Korea, primarily used in certain commercial and off-road applications where durability and cost-effectiveness are prioritized. Bias tires have a simpler construction and lower manufacturing cost but typically offer less ride comfort and shorter lifespan compared to radial tires. Despite gradual market share erosion due to the rise of radial tires, bias tires remain relevant in heavy-duty and agricultural vehicles due to their robustness and ability to withstand harsh operating conditions.

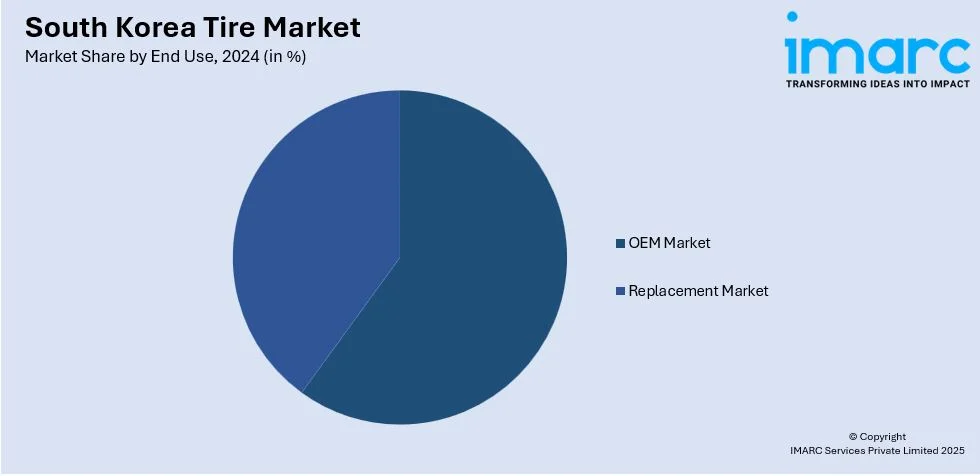

Analysis by End Use:

- OEM Market

- Replacement Market

The OEM market in South Korea’s tire industry is driven by strong automotive manufacturing, including passenger vehicles, commercial trucks, and electric vehicles. Tire manufacturers work closely with automobile producers to supply tires that meet strict quality and performance standards. Innovation in tire technology, such as low rolling resistance and enhanced durability, is a key focus to match evolving vehicle specifications. The OEM segment benefits from steady demand linked to new vehicle production and government policies promoting cleaner and safer transportation solutions.

The replacement market in South Korea is fueled by the growing vehicle population and increasing average vehicle age. As vehicles age, demand for replacement tires rises, supported by expanding aftermarket networks and e-commerce platforms offering convenience. Consumers increasingly seek high-quality, durable tires that improve safety and fuel efficiency. The replacement segment also reflects growing interest in premium and specialty tires, such as those for electric and performance vehicles, making it a crucial revenue source for manufacturers.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

The passenger car segment holds a significant share in the South Korea tire market, driven by high vehicle ownership and urban mobility demand. Consumers prioritize tire performance, comfort, and fuel efficiency. The rise in electric and hybrid vehicles further influences tire specifications, prompting manufacturers to offer advanced, quiet, and durable options tailored for this growing segment.

Light commercial vehicles in South Korea require tires that offer a balance of durability, fuel efficiency, and load-handling capacity. Growth in e-commerce and last-mile delivery services has boosted demand in this segment. Tire manufacturers are focusing on producing long-lasting, cost-effective solutions that meet the needs of logistics and small-scale distribution businesses operating in urban and semi-urban areas.

This segment relies on tires built for durability and performance under heavy loads and long-distance travel. With a strong logistics and industrial sector, demand for robust tires in South Korea remains steady. Fleet operators prefer tires that reduce operational costs through extended tread life, better fuel economy, and minimal maintenance, encouraging advancements in radial and retread tire technologies.

Two-wheeler tire demand in South Korea is moderate, influenced by urban commuting trends and youth mobility. Consumers seek tires that provide safety, grip, and reliability on city roads. While the segment is smaller than others, growth in eco-friendly two-wheelers and scooters is gradually boosting demand for high-quality tires suited for electric and compact mobility vehicles.

The three-wheeler segment holds a minimal share in South Korea’s tire market due to limited use. These vehicles are primarily seen in specific industrial and utility applications. Tire demand in this segment focuses on affordability, strength, and the ability to operate under variable load conditions. Although small, the segment shows niche potential in certain localized and specialized industries.

OTR tires are essential for industries such as construction, mining, and agriculture in South Korea. These tires are designed for rough terrains and extreme conditions, emphasizing durability and resistance to wear and punctures. Growth in infrastructure projects and resource-based sectors supports the steady demand for OTR tires, encouraging manufacturers to develop advanced, high-strength designs with longer service life.

Analysis by Distribution Channel:

- Offline

- Online

The offline distribution channel continues to dominate the South Korea tire market, with consumers preferring physical outlets for trusted brands, professional installation, and after-sales support. Tire shops, auto dealerships, and service centers form the backbone of offline sales. Personal consultations and immediate product availability drive buyer confidence, particularly for replacement tires. Despite the growth of online platforms, the offline segment remains strong due to customer habits, the technical nature of tire purchases, and the importance of in-person inspection and fitment services.

The online distribution channel is growing steadily in South Korea’s tire market, fueled by digital adoption and convenience. Consumers are increasingly using e-commerce platforms to compare prices, read reviews, and access a wider range of products. Online retailers offer home delivery and partnerships with service centers for installation, enhancing the buying experience. The rise in tech-savvy and price-conscious customers, along with expanding internet penetration, is expected to further boost online tire sales, especially in urban areas.

Analysis by Season:

- All Season Tires

- Winter Tires

- Summer Tires

All season tires hold a strong presence in the South Korea tire market due to their versatility and convenience. These tires perform adequately in both dry and mildly snowy conditions, making them suitable for most urban driving environments. Their year-round usability reduces the need for seasonal tire changes, appealing to cost-conscious consumers seeking reliable performance in varying weather.

Winter tires are essential in South Korea’s colder regions where heavy snowfall and icy roads are common. These tires offer superior traction, braking, and handling in low temperatures. As safety awareness increases and regulations evolve, more drivers are opting for winter tires during peak cold months, especially in northern and mountainous areas where weather conditions demand specialized tire performance.

Summer tires are preferred for their excellent grip and handling in warm, dry, and wet road conditions. In South Korea, these tires are commonly used in high-performance and luxury vehicles. Their optimized tread design enhances cornering and braking efficiency. As demand for performance driving increases during warmer months, summer tires remain a relevant choice among auto enthusiasts and city drivers prioritizing speed and responsiveness.

Regional Analysis:

- Seoul Capital Area

- Yeongam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area leads the South Korea tire market due to its dense population, high vehicle ownership, and advanced infrastructure. Demand is strong across all vehicle categories, particularly for passenger and electric cars. Consumers in this region prioritize high-performance and premium tires, supported by well-established distribution networks and a growing focus on smart and eco-friendly mobility solutions.

The Yeongam region is a key automotive manufacturing hub, driving consistent demand for original equipment tires. The presence of major production facilities supports strong OEM partnerships and tire testing operations. With a significant logistics and industrial base, the region also sees steady growth in commercial vehicle tire demand, emphasizing durability, load handling, and cost-efficient solutions for regional transport fleets.

Honam’s tire market is influenced by its strong agricultural and rural presence, leading to notable demand for off-the-road and commercial vehicle tires. Replacement tire sales remain steady due to aging vehicles and limited public transportation in remote areas. The market here favors affordable and long-lasting tire options, while infrastructure development projects are gradually expanding demand for more specialized tire types.

Hoseo serves as a balanced market for both urban and rural tire demands. With growing residential zones and developing industrial activity, this region reflects moderate but consistent demand for passenger and light commercial vehicle tires. Consumer preferences here include reliable, all-season tires suited for mixed road conditions, while agricultural and logistic operations support niche demand for commercial and specialty tire types.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Bridgestone Tire Sales Korea Ltd. (Bridgestone Corporation)

- Hankook Tire & Technology

- Kumho Tire Co. Inc.

- Nexen Tire Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- April 2025: LD Carbon opened a tire pyrolysis plant in Dangjin, capable of processing 50,000 tons of tire chips annually. The facility aims to produce 20,000 tons of recovered carbon black and 24,000 tons of pyrolysis oil, supporting sustainable tire manufacturing and securing major supply deals, including a 10-year contract with SK Incheon Petrochem.

- January 2025: Seongnam-si-based tire company Hankook Tire began exclusively supplying rally tires for WRC1, WRC2, and WRC3 from the 2025 FIA World Rally Championship season. Its Ventus, Dynapro, and Winter tire lines supported performance across diverse terrains.

- October 2024: Hankook Tire began mass-producing tires using ISCC PLUS-certified carbon black derived from recycled end-of-life tires. Developed through a consortium with 12 Korean partners, including HD Hyundai Oilbank and HD Hyundai OCI, this initiative marks a significant step toward a circular economy in tire manufacturing. The project aims to achieve 100% sustainable materials by 2050, reducing reliance on petrochemicals and lowering carbon emissions.

South Korea Tire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Designs Covered | Radial Market, Bias Market |

| End Uses Covered | OEM Market, Replacement Market |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Seasons Covered | All Season Tires, Winter Tires, Summer Tires |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Companies Covered | Bridgestone Tire Sales Korea Ltd. (Bridgestone Corporation), Hankook Tire & Technology, Kumho Tire Co. Inc., Nexen Tire Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea tire market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea tire industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tire market in the South Korea was valued at USD 3,296.70 Million in 2024.

The South Korea tire market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 5,027.26 Million by 2033.

Key factors driving the South Korea tire market include strong automotive production, rising demand for electric and hybrid vehicles, growth in replacement tire sales, advancements in tire technologies, and increasing consumer preference for fuel-efficient and durable tires. Government support for green mobility also contributes to market expansion.

Some of the major players in the South Korea tire market include Bridgestone Tire Sales Korea Ltd. (Bridgestone Corporation), Hankook Tire & Technology, Kumho Tire Co. Inc., Nexen Tire Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)