South Korea Toothpaste Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

South Korea Toothpaste Market Overview:

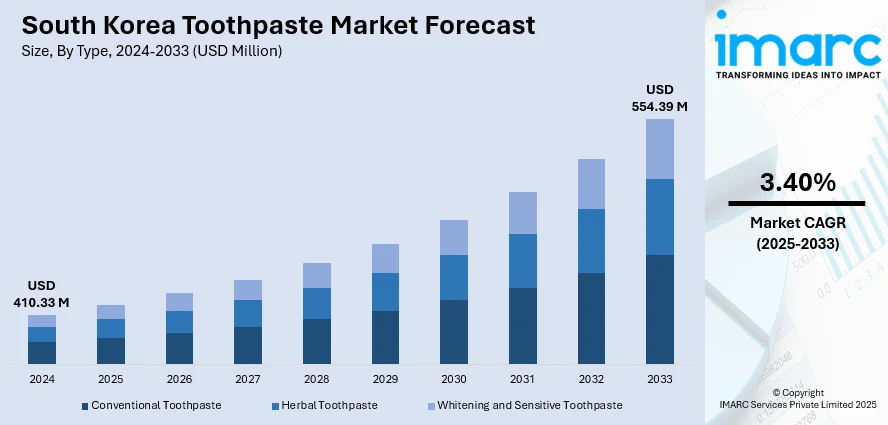

The South Korea toothpaste market size reached USD 410.33 Million in 2024. Looking forward, the market is expected to reach USD 554.39 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market is led by consumers' increasing interest in oral beauty, preventive dentistry, and convenience. Increased health awareness and aging population trends are boosting interest in gum protection and sensitivity relief products. Eco-friendly shoppers are also driving brands to create biodegradable toothpaste tablets and returnable packaging, echoing nationwide initiatives to eliminate plastic waste. Digital innovation such as connectivity with beauty apps and online platforms such as Coupang and Naver Shopping increases discovery and personalization, which collectively influences competitive forces and South Korea toothpaste market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 410.33 Million |

| Market Forecast in 2033 | USD 554.39 Million |

| Market Growth Rate 2025-2033 | 3.40% |

South Korea Toothpaste Market Trends:

Innovative Natural and Hybrid Formulations

South Korea's toothpaste industry is driven by consumer demand for transparency and health. Consumers such as Pleasia tap into domestic botanicals—e.g., Jeju green tea extract and bamboo salt—specific to Korean tastes. These products highlight clean-label promises, positioning themselves as paraben-free, sulfate-free, and artificial-free additives. Aside from natural positioning, innovation has extended to hybrid textures: foam-based toothpastes that create micro-bubbles for efficient cleansing without abrasion, and tablet forms aimed at environmentally aware consumers. These innovations bring about convenience and are in line with South Korea's wider K‑beauty philosophy, where beauty meets functionality. Packaging design also contributes to differentiation, with wide-cap tubes, travel sizes, and esthetically pleasing containers appealing to Korean consumers. With the dominance of domestic giants like Perioe and 2080 in the market, such new product forms and geographic ingredient branding have also become critical for domestic challengers as well as foreign premium brands to establish distinctive positions and appeal to Korean oral care consumers.

To get more information on this market, Request Sample

Premium and Specialty Positioning through Localized Innovation

Premium and specialty positioning in the South Korean toothpaste market has become salient, with consumers demanding more than mere oral cleansing. Products promoted to address whitening, sensitivity, gum care, and breath benefits use science-based messaging and regional ingredient storytelling. For example, brands highlight whitening benefits attuned to Korea's culture of beauty, where a white smile completes skincare goals. Localization also emerges in clinical-grade formulations tailored to MFDS standards and consumer needs—certain international brands out-license their formulations to Korean producers for speedy market entry and local compliance assurance. Additionally, specialist ingredients such as tranexamic acid, which is used regularly for gum health and stain prevention, are becoming popular in aesthetic oral care-focused toothpaste versions. Coupled with sophisticated packaging innovations—such as vertical travel tubes or women's designs—these trends indicate a market in which performance, beauty, and localized innovation converge. Bigger distribution channels through e‑commerce websites, pharmacies, and convenience stores allow for these differentiated products to penetrate a health-aware, beauty-focused consumer base underpinned by the wellness culture in the region, which further contributes to the South Korea toothpaste market growth.

Eco-Conscious Consumption and Sustainability

South Korea's growing emphasis on environmentally friendly living has driven the developing trend toward sustainable oral care, specifically toothpaste forms. Toothpaste tablets and zero-packaging forms are in line with the nation's growing green consciousness and the appeal of minimalist, reusable products in K‑beauty. Tablet forms avoid plastic tubes, have mass appeal among travelers and younger consumers, and are becoming increasingly accessible through top e-commerce platforms like Coupang and G‑market. Brands are also trying refill packaging and bioplastics to capture demand for sustainable personal care. This trend for sustainability crosses with aesthetic expectations: consumers prefer high-end, sleek-looking packaging but also look for products to show ecological responsibility. Oral care players in South Korea are now more and more promoting these formats through digital marketing and influencer partnerships appealing to ecologically conscious urban shoppers. With plastic reduction now a national priority, sustainable packaging formats are both commercial imperative and cultural significance in South Korea's contemporary beauty and wellness economy.

South Korea Toothpaste Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Type Insights:

- Conventional Toothpaste

- Herbal Toothpaste

- Whitening and Sensitive Toothpaste

The report has provided a detailed breakup and analysis of the market based on the type. This includes conventional toothpaste, herbal toothpaste, and whitening and sensitive toothpaste.

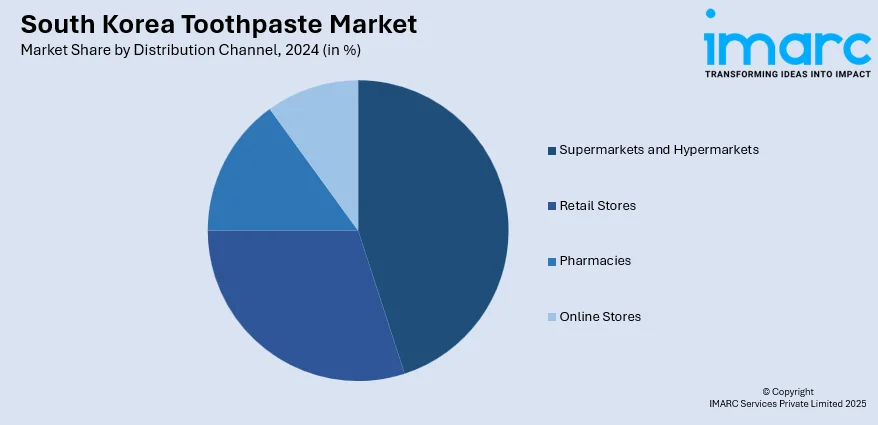

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Retail Stores

- Pharmacies

- Online Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, retail stores, pharmacies, and online stores.

End User Insights:

- Adults

- Kids

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes adults and kids.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Toothpaste Market News:

- In December 2024, the Italian luxury toothpaste brand Mavis revealed that it has sold more than 4 million units in South Korea since its debut in 2018, taking advantage of a rising trend of small luxury purchases among the youth. At a cost of 19,900 won (USD 13.9) per tube, Mavis sets itself apart by incorporating natural components, like mint, and steering clear of artificial surfactants. In contrast to mass-market brands such as Perioe and Median that lead Korea's toothpaste sector, Mavis appeals to a specific audience by emphasizing high quality and distributing through specialized beauty retailers like CJ Olive Young.

South Korea Toothpaste Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Conventional Toothpaste, Herbal Toothpaste, Whitening and Sensitive Toothpaste |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Retail Stores, Pharmacies, Online Stores |

| End Users Covered | Adults, Kids |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea toothpaste market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea toothpaste market on the basis of type?

- What is the breakup of the South Korea toothpaste market on the basis of distribution channel?

- What is the breakup of the South Korea toothpaste market on the basis of end user?

- What is the breakup of the South Korea toothpaste market on the basis of region?

- What are the various stages in the value chain of the South Korea toothpaste market?

- What are the key driving factors and challenges in the South Korea toothpaste market?

- What is the structure of the South Korea toothpaste market and who are the key players?

- What is the degree of competition in the South Korea toothpaste market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea toothpaste market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea toothpaste market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea toothpaste industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)