South Korea Traction Control System Market Size, Share, Trends and Forecast by Type, Component, Vehicle Type, Distribution Channel, and Region, 2026-2034

South Korea Traction Control System Market Overview:

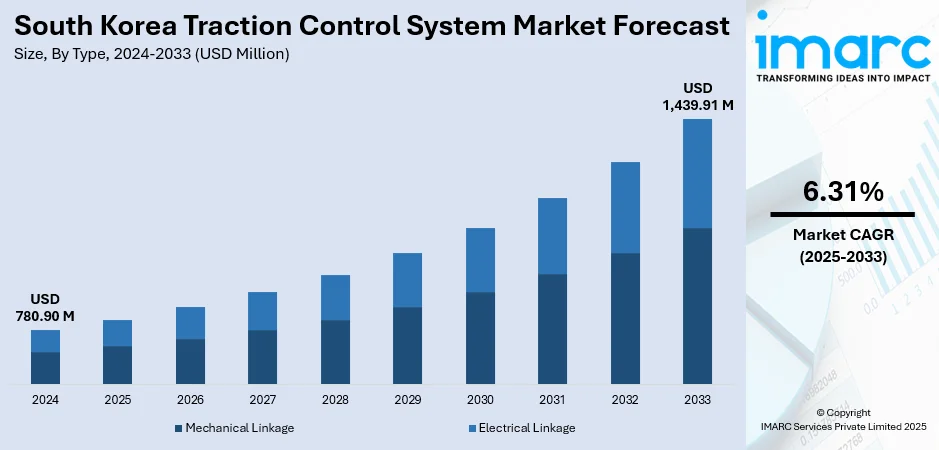

The South Korea traction control system market size reached USD 780.90 Million in 2025. The market is projected to reach USD 1,439.91 Million by 2034, exhibiting a growth rate (CAGR) of 6.31% during 2026-2034. The market is primarily driven by stringent government safety regulations that require the implementation of advanced technologies such as traction control systems (TCS) in vehicles to improve road safety. The rapid growth of electric and hybrid vehicles further fuels demand, as these vehicles require precise torque control for stability. Additionally, rising consumer expectations for safer and more comfortable driving experiences are pushing automakers to include TCS across various vehicle segments thus aiding the South Korea traction control system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 780.90 Million |

| Market Forecast in 2034 | USD 1,439.91 Million |

| Market Growth Rate 2026-2034 | 6.31% |

South Korea Traction Control System Market Trends:

Government Regulations and Safety Standards

One of the key trends in the South Korea traction control system market is the enforcement of rigorous vehicle safety standards that closely align with international regulations. Regulatory bodies emphasize the integration of advanced driver assistance systems (ADAS) such as traction control systems to reduce road accidents and enhance public safety. Automakers operating within the country are required to comply with these standards not only for domestic sales but also for exports. TCS is frequently integrated with other safety technologies like electronic stability control (ESC), anti-lock braking systems (ABS), and hill-start assist, making it a key component in meeting compliance. As these regulations tighten over time, manufacturers are proactively embedding TCS even in entry-level models to ensure long-term compliance and competitiveness. This regulatory push serves as a foundational driver for the traction control system market, ensuring continuous integration across vehicle platforms and increasing its penetration in South Korea’s evolving automotive industry.

To get more information on this market, Request Sample

Expansion of Electric and Hybrid Vehicles

South Korea is at the forefront of the global transition to electric and hybrid vehicles, driven by major automakers like Hyundai and Kia. Hybrid vehicle registrations in the country surged from 104,000 in 2019 to about 372,000 in 2023 and are projected to reach 458,000 in 2024—a 23% annual increase. This rapid growth in eco-friendly vehicles amplifies the need for traction control systems (TCS), as EVs deliver instant torque that can cause wheel slippage, especially during sudden acceleration or on slippery surfaces. TCS mitigates such risks by detecting wheel spin and adjusting power delivery or applying brake force to maintain control. As electric and hybrid models become more mainstream, including in mid-range segments, TCS is increasingly included as a standard safety feature. The rising adoption of EVs and hybrids thus plays a crucial role in accelerating South Korea traction control system market growth.

Rising Demand for Driving Comfort and Safety

South Korean consumers are increasingly prioritizing safety and driving comfort when choosing vehicles. With changing road conditions, traffic congestion, and a greater focus on well-being, drivers expect features that enhance control and stability—especially during acceleration or on slippery roads. Over 60% of car owners now consider eco-friendly options like hybrids and EVs for their next purchase, but concerns over convenience and safety remain. This makes traction control systems (TCS) especially valuable, as they help prevent wheel slippage and maintain direction even in normal conditions. TCS contributes to a smoother, safer driving experience, aligning with the preferences of Korea’s technology-oriented and safety-aware consumers. In response, automakers are expanding TCS integration beyond luxury models, including it in mid-range and compact vehicles to meet rising expectations. As consumer demand for stability and control grows, TCS adoption is accelerating across all segments of South Korea’s automotive market.

South Korea Traction Control System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, component, vehicle type, and distribution channel.

Type Insights:

- Mechanical Linkage

- Electrical Linkage

The report has provided a detailed breakup and analysis of the market based on the type. This includes mechanical linkage, and electrical linkage.

Component Insights:

- Hydraulic Modulators

- ECU

- Sensors

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hydraulic modulators, ECU, sensors, and others.

Vehicle Type Insights:

- ICE Vehicles

- Electric Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes ICE vehicles, and electric vehicles.

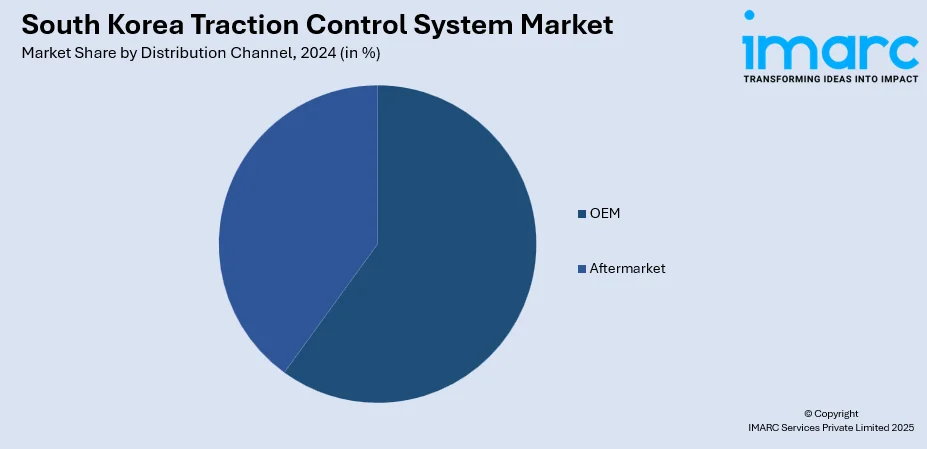

Distribution Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM, and aftermarket.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Traction Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical Linkage, Electrical Linkage |

| Components Covered | Hydraulic Modulators, ECU, Sensors, Others |

| Vehicle Types Covered | ICE Vehicles, Electric Vehicles |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea traction control system market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea traction control system market on the basis of type?

- What is the breakup of the South Korea traction control system market on the basis of component?

- What is the breakup of the South Korea traction control system market on the basis of vehicle type?

- What is the breakup of the South Korea traction control system market on the basis of distribution channel?

- What is the breakup of the South Korea traction control system market on the basis of region?

- What are the various stages in the value chain of the South Korea traction control system market?

- What are the key driving factors and challenges in the South Korea traction control system market?

- What is the structure of the South Korea traction control system market and who are the key players?

- What is the degree of competition in the South Korea traction control system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea traction control system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea traction control system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea traction control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)