South Korea Tuna Market Size, Share, Trends and Forecast by Species, Type, and Region, 2025-2033

South Korea Tuna Market Overview:

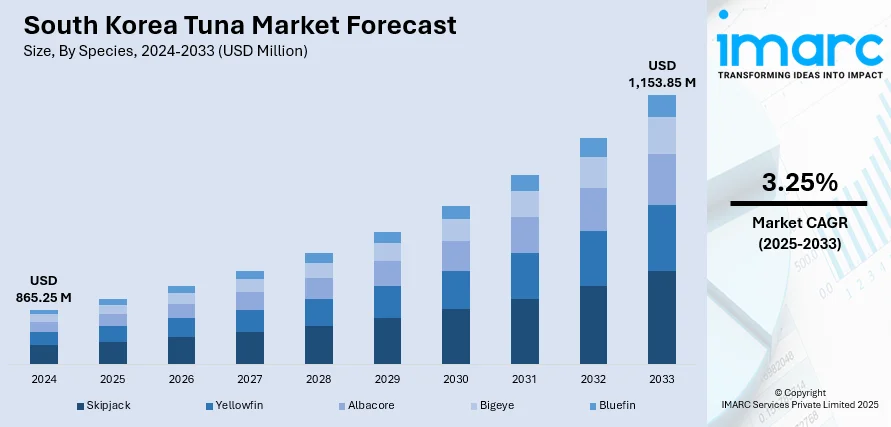

The South Korea tuna market size reached USD 865.25 Million in 2024. Looking forward, the market is expected to reach USD 1,153.85 Million by 2033, exhibiting a growth rate (CAGR) of 3.25% during 2025-2033. The market is driven by strong domestic consumption, growing demand for ready-to-eat seafood, and increasing health awareness among consumers. Imports and local processing support market expansion, while sustainability and traceability concerns shape purchasing preferences. Convenience-driven retail formats further boost sales, collectively influencing the South Korea tuna market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 865.25 Million |

| Market Forecast in 2033 | USD 1,153.85 Million |

| Market Growth Rate 2025-2033 | 3.25% |

South Korea Tuna Market Trends:

Rising Health Consciousness and Protein Demand

South Korean consumers are becoming increasingly health-conscious, leading to higher demand for nutritious, low-fat, high-protein foods like tuna. Tuna is a healthy food among others because it is abundant in omega-3 fatty acids, low in protein, and rich in important nutrients. Due to the increase in the number of individuals focusing on healthy diets and physical activities, the consumption of tuna has increased tremendously in both fresh and canned tuna. The health tendencies, such as weight control and cardiac healthy products, also emphasize the popularity of tuna as a staple protein. In addition, the campaigns of the government and the food industry on healthy eating also contribute to the increased market reach. The increased health consciousness is one of the factors behind the stable demand, and tuna is becoming a common diet in the domestic kitchen and convenience food products in South Korea.

To get more information on this market, Request Sample

Expanding Domestic Processing and Import Capabilities

South Korea has a well-established tuna processing industry, supported by advanced cold-chain infrastructure and strategic port locations. The country imports large volumes of raw tuna from key suppliers, including the Philippines and Indonesia, which are processed domestically for local consumption and export. The robust processing sector ensures a consistent supply and enables product innovation tailored to Korean tastes. Additionally, South Korea’s leading seafood companies continue to invest in sustainable sourcing and international partnerships to secure long-term tuna supply. The combination of advanced processing facilities, a reliable import network, and strong supply chain logistics reinforces the country’s ability to meet growing consumer demand. This industrial strength plays a crucial role in driving the overall South Korea tuna market growth.

Growth in Convenience and Ready-to-Eat Food Segment

The rising pace of urban life in South Korea has increased demand for convenient and ready-to-eat meals. Tuna, especially in canned, pouched, or pre-seasoned forms, fits perfectly into this lifestyle. Busy consumers, including working professionals and students, favor tuna for its portability, long shelf life, and ease of preparation. Many brands are innovating with flavored tuna, meal kits, and single-serve options that cater to on-the-go consumption. Additionally, the popularity of lunchboxes (dosirak) and home meal replacements (HMR) has further embedded tuna into everyday meals. The alignment of tuna with convenience-driven consumer habits significantly supports its continued market growth and popularity in both retail and foodservice channels across South Korea.

South Korea Tuna Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on species and type.

Species Insights:

- Skipjack

- Yellowfin

- Albacore

- Bigeye

- Bluefin

The report has provided a detailed breakup and analysis of the market based on the species. This includes skipjack, yellowfin, albacore, bigeye, and bluefin.

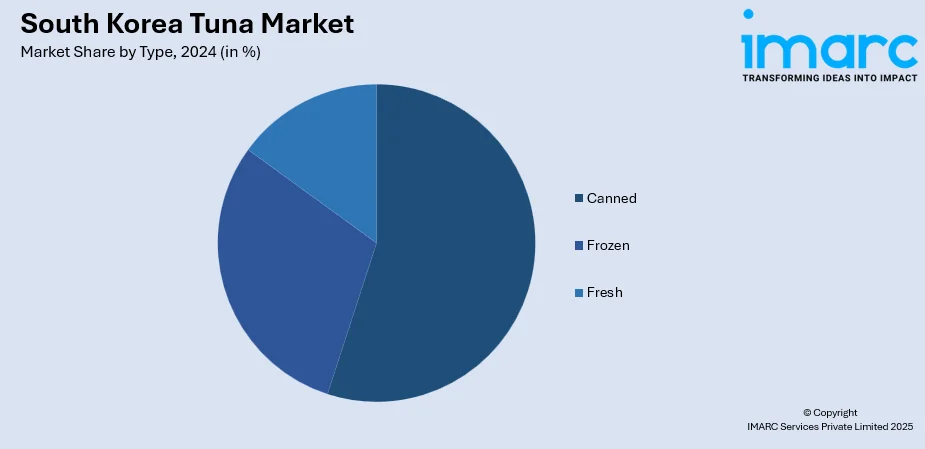

Type Insights:

- Canned

- Frozen

- Fresh

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes canned, frozen, and fresh.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Tuna Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Skipjack, Yellowfin, Albacore, Bigeye, Bluefin |

| Types Covered | Canned, Frozen, Fresh |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea tuna market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea tuna market on the basis of species?

- What is the breakup of the South Korea tuna market on the basis of type?

- What is the breakup of the South Korea tuna market on the basis of region?

- What are the various stages in the value chain of the South Korea tuna market?

- What are the key driving factors and challenges in the South Korea tuna market?

- What is the structure of the South Korea tuna market and who are the key players?

- What is the degree of competition in the South Korea tuna market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea tuna market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea tuna market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea tuna industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)