South Korea Vegan Food Market Size, Share, Trends and Forecast by Product, Source, Distribution Channel, and Region, 2025-2033

South Korea Vegan Food Market Overview:

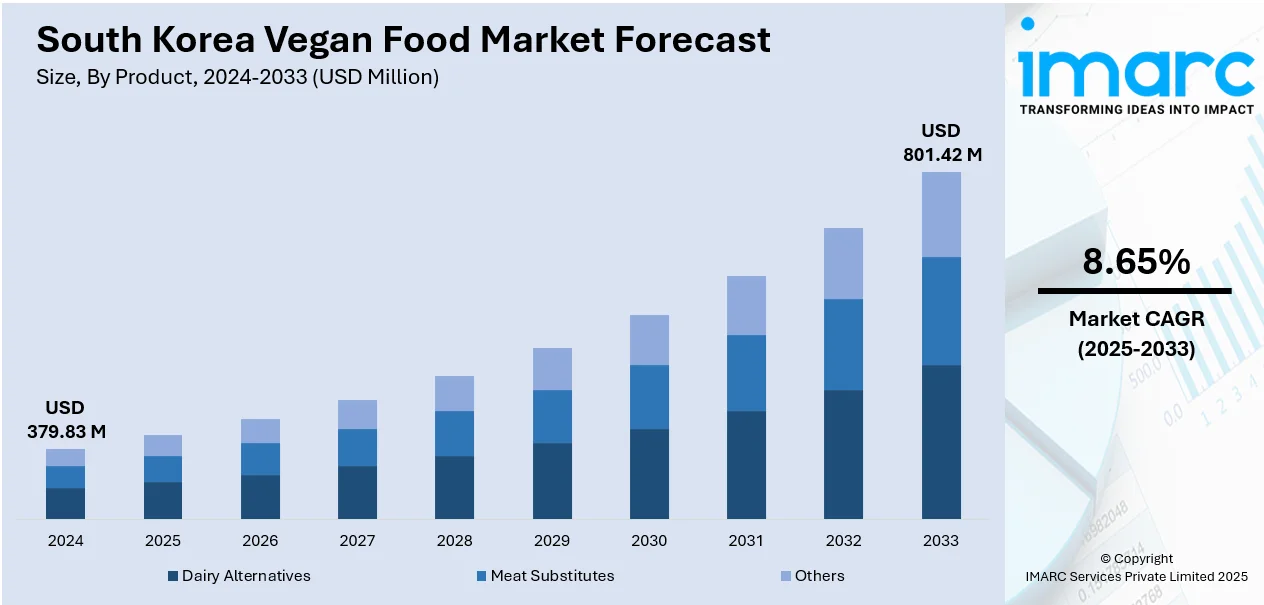

The South Korea vegan food market size reached USD 379.83 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 801.42 Million by 2033, exhibiting a growth rate (CAGR) of 8.65% during 2025-2033. Innovation in plant-based products and strategic partnerships are driving the vegan food market in South Korea. Companies are expanding offerings of realistic plant-based products, while investments in food technology enhance flavor and convenience. Collaborations with major brands are improving distribution and market accessibility, further contributing to the expansion of the South Korea vegan food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 379.83 Million |

| Market Forecast in 2033 | USD 801.42 Million |

| Market Growth Rate 2025-2033 | 8.65% |

South Korea Vegan Food Market Trends:

Innovation in Vegan Product Offerings

With increasing consumer demand for plant-based alternatives, food companies are expanding their offerings to provide a variety of options that mimic traditional animal-based foods. Ranging from plant-derived meats that mimic the flavor and feel of beef, chicken, and pork, to alternatives for dairy and a variety of vegan-friendly snacks, innovations are simplifying the process for people to adopt a vegan lifestyle while maintaining taste and convenience. Progress in food technology is further refining these innovations, producing vegan options that appeal to diverse tastes and preferences. This change is reshaping the South Korean food industry, offering consumers traditional tastes along with innovative dining experiences. A notable instance of this advancement is the 2025 introduction of a vegan burger pop-up by Hwaeomsa Temple in Seoul. The event drew more than 5,000 attendees and showcased plant-based dishes, such as the "Paradise Burger," aimed at promoting Korean Buddhist principles via vegan fast food. This project emphasizes how plant-based cuisine can effortlessly blend into regional cooking practices, providing both ethical and tasty options. With such innovations, more people in South Korea are discovering plant-based eating as a viable, enjoyable, and sustainable option, further strengthening the position of vegan cuisine in the nation’s developing food culture.

To get more information on this market, Request Sample

Strategic Partnerships and Investment in Plant-Based Technology

Strategic partnerships and investments in plant-based food technology are playing a crucial role in supporting the South Korea vegan food market growth. Businesses are progressively partnering with prominent food and beverage (F&B) industry leaders to accelerate the creation and delivery of plant-based offerings. These collaborations allow innovative food startups to expand their operations and obtain access to broader distribution networks, improving product availability nationwide. Investing in cutting-edge technologies, such as high-moisture plant-based meat, allows for the creation of more realistic and appealing alternatives to traditional animal products, catering to consumers seeking familiar tastes and textures in their vegan meals. This influx of financial backing and technological knowledge not only encourages product development but also aids plant-based companies in accessing wider markets, including retail outlets and foodservice venues. Plant-based companies can more effectively enter the mainstream food market by collaborating with well-known brands that have extensive distribution channels, thereby making vegan options more accessible and convenient for a wider audience. For example, in August 2024, South Korea’s SUJIS LINK secured a ₩3 billion ($2.5M) investment from Samyang Foods to scale its high-moisture plant-based meat technology. The partnership aimed to launch new vegan K-food products using Samyang’s distribution network. Such partnerships are essential for addressing the growing demand for plant-based foods while guaranteeing that production and supply chains can expand to meet the increasing consumer interest in sustainable, ethical, and health-focused diets.

South Korea Vegan Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, source, and distribution channel.

Product Insights:

- Dairy Alternatives

- Cheese

- Dessert

- Snacks

- Others

- Meat Substitutes

- Tofu

- TVP

- Seiten

- Quorn

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dairy alternatives (cheese, dessert, snacks, and others), meat substitutes (tofu, TVP, seiten, Quorn, and others), and others.

Source Insights:

- Almond

- Soy

- Oats

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes almond, soy, oats, wheat, and others.

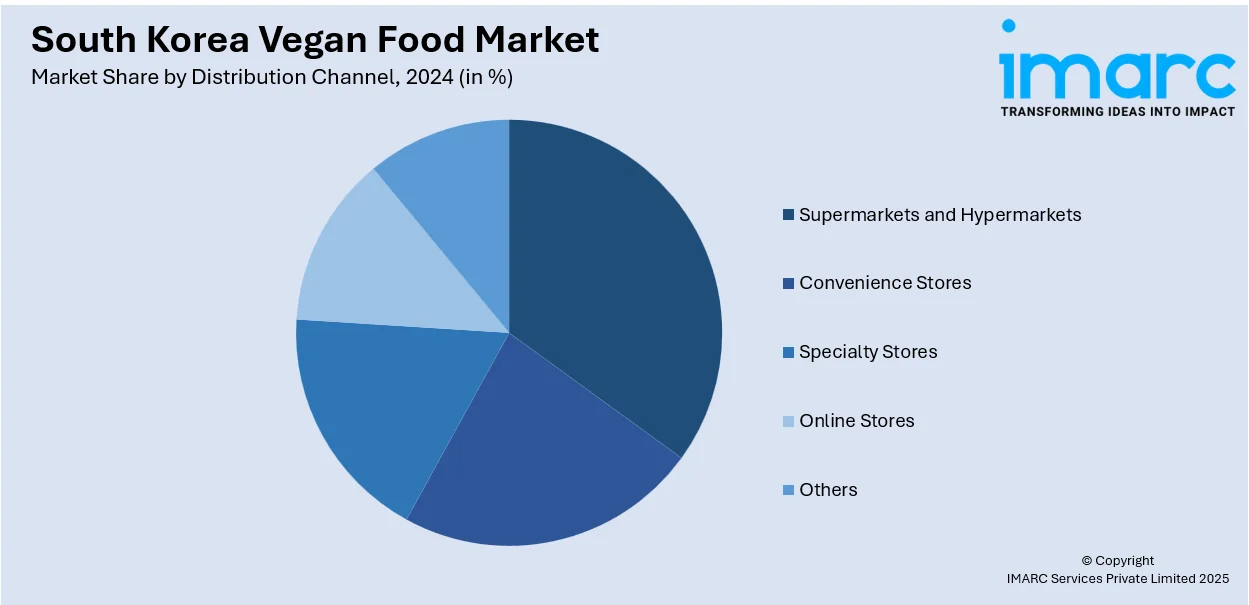

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Vegan Food Market News:

- In July 2025, the Korea Vegan Fair 2025 will take place from July 18–20, 2025 at COEX in Seoul. It is a major plant-based industry event showcasing vegan food, fashion, beauty, and sustainability products, along with seminars and workshops.

- In March 2024, South Korea announced a nine-day vegan food tour running from September 20–28, 2024, led by Green Earth Travel. The tour visited cities like Seoul, Busan, and Jeju, offering plant-based Korean cuisine experiences. It highlighted South Korea’s rising vegan movement and culinary innovation.

South Korea Vegan Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report` |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Almond, Soy, Oats, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea vegan food market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea vegan food market on the basis of product?

- What is the breakup of the South Korea vegan food market on the basis of source?

- What is the breakup of the South Korea vegan food market on the basis of distribution channel?

- What is the breakup of the South Korea vegan food market on the basis of region?

- What are the various stages in the value chain of the South Korea vegan food market?

- What are the key driving factors and challenges in the South Korea vegan food market?

- What is the structure of the South Korea vegan food market and who are the key players?

- What is the degree of competition in the South Korea vegan food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea vegan food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea vegan food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea vegan food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)