South Korea Water Treatment Chemicals Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

South Korea Water Treatment Chemicals Market Overview:

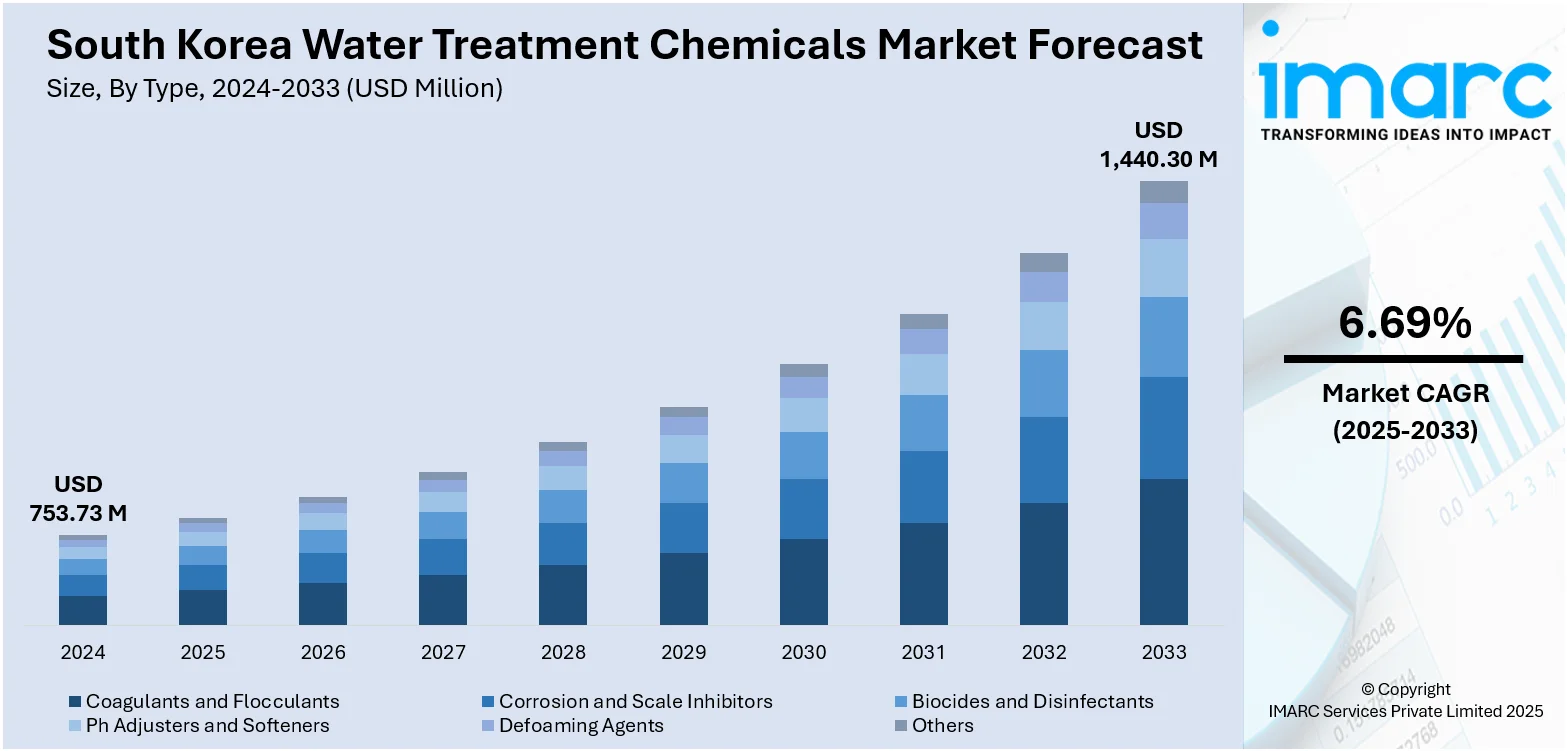

The South Korea water treatment chemicals market size reached USD 753.73 Million in 2024. Looking forward, the market is expected to reach USD 1,440.30 Million by 2033, exhibiting a growth rate (CAGR) of 6.69% during 2025-2033. The market benefits from strict environmental regulations and a strong industrial base, which drive demand for specialized chemicals in municipal, industrial, and power sectors. Advanced industrialization, rising emphasis on water reuse and zero discharge initiatives, and increasing focus on sustainability and clean water standards underpin market expansion. These trends significantly bolster the South Korea water treatment chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 753.73 Million |

| Market Forecast in 2033 | USD 1,440.30 Million |

| Market Growth Rate 2025-2033 | 6.69% |

South Korea Water Treatment Chemicals Market Trends:

Strict Environmental Regulations and Government Initiatives

South Korea’s stringent environmental policies are a major force behind the growing demand for water treatment chemicals. The government enforces tight wastewater discharge regulations through frameworks like the Water Management Act, ensuring industrial and municipal compliance with quality standards. Penalties for non-compliance and mandatory reporting have compelled businesses to invest in effective chemical treatments. Additionally, government-backed programs promote the reuse of wastewater and the adoption of advanced purification systems. Financial incentives, R&D support, and public-private partnerships further encourage the use of specialty chemicals for pollution control and clean water delivery. These regulatory pressures, combined with proactive governance, have created a robust and stable demand for water treatment chemicals across sectors, including manufacturing, utilities, and municipal water systems.

To get more information on this market, Request Sample

Rapid Industrialization and Rising Demand for Process Water

South Korea’s continued growth in manufacturing, electronics, power generation, and petrochemical industries has significantly increased the demand for high-quality process water and efficient wastewater treatment. These sectors require a range of specialized chemicals, such as scale inhibitors, coagulants, biocides, and corrosion inhibitors—to maintain equipment, ensure regulatory compliance, and improve operational efficiency. As environmental expectations grow, industries are upgrading existing systems with more advanced chemical-based treatments to minimize water usage and enhance waste discharge quality. The expansion of industrial zones and smart factories further fuels the need for customized chemical formulations tailored to specific industry needs. This industrial momentum is a key contributor to the consistent expansion of the South Korea water treatment chemicals market growth.

Water Scarcity, Reuse Technologies, and Innovation

Facing growing concerns over freshwater scarcity and pollution, South Korea is investing heavily in water reuse and advanced treatment technologies. As the country promotes sustainable water management, there is a rising adoption of zero-liquid discharge systems, membrane filtration, and AI-powered treatment monitoring. These innovations rely heavily on compatible and high-performance chemicals for optimal function, including anti-scalants, pH stabilizers, and membrane cleaners. The demand for precision and efficiency in water treatment has led to the development of smart chemical dosing systems and real-time water quality control. This drive toward eco-friendly practices and high-tech solutions not only enhances water security but also boosts the long-term demand for advanced water treatment chemicals across the country’s public and private sectors.

South Korea Water Treatment Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Coagulants and Flocculants

- Corrosion Inhibitors

- Scale Inhibitors

- Biocides and Disinfectants

- Chelating Agents

- Anti-Foaming Agents

- Ph Adjusters and Softeners

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes coagulants and flocculants, corrosion inhibitors, scale inhibitors, biocides and disinfectants, chelating agents, anti-foaming agents, ph adjusters and softeners, and others.

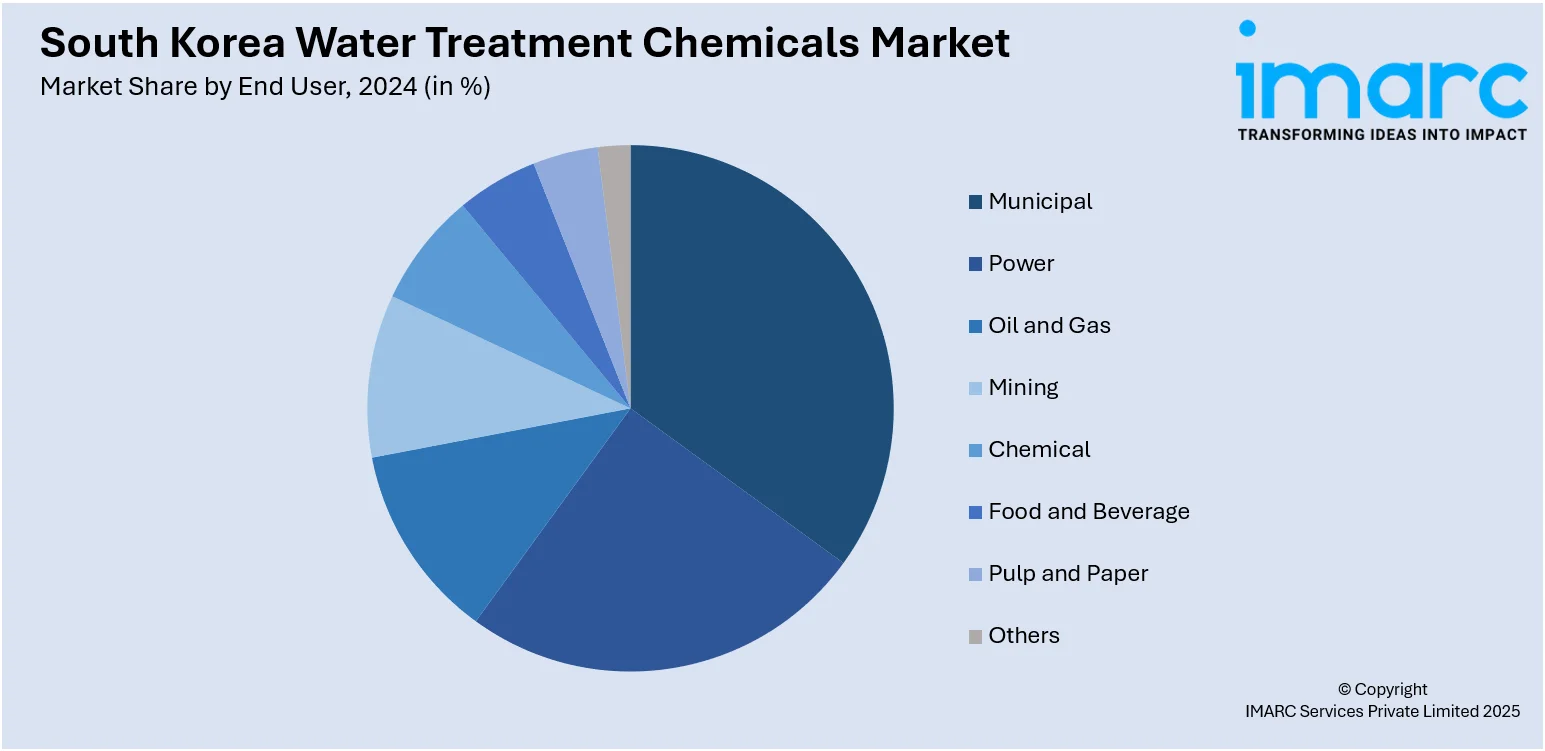

End User Insights:

- Municipal

- Power

- Oil and Gas

- Mining

- Chemical

- Food and Beverage

- Pulp and Paper

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes municipal, power, oil and gas, mining, chemical, food and beverage, pulp and paper, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Water Treatment Chemicals Market News:

- In June 2025, Lotte Chemical Corp., South Korea’s second-largest petrochemical firm, is divesting its water treatment division to a Synopex Inc. subsidiary as it shifts focus back to its core operations. The decision comes as the company faces increasing financial losses due to an extended slump in the petrochemical industry.

- In December 2023, Samyang Corporation, recognized as Korea’s pioneer in ion exchange resin development and a key player in industrial water treatment materials, introduced two new products and formed a specialized division. This move aims to position the company as a global leader in comprehensive water solutions and drive its international market expansion.

South Korea Water Treatment Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion Inhibitors, Scale Inhibitors, Biocides and Disinfectants, Chelating Agents, Anti-Foaming Agents, Ph Adjusters and Softeners, Others |

| End Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea water treatment chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea water treatment chemicals market on the basis of type?

- What is the breakup of the South Korea water treatment chemicals market on the basis of end user?

- What is the breakup of the South Korea water treatment chemicals market on the basis of region?

- What are the various stages in the value chain of the South Korea water treatment chemicals market?

- What are the key driving factors and challenges in the South Korea water treatment chemicals market?

- What is the structure of the South Korea water treatment chemicals market and who are the key players?

- What is the degree of competition in the South Korea water treatment chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea water treatment chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea water treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)