South Korea Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034

South Korea Whiskey Market Summary:

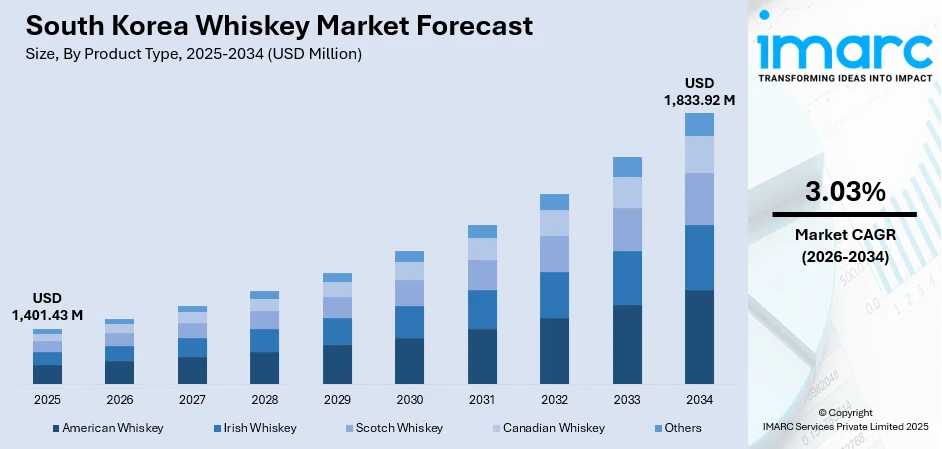

The South Korea whiskey market size was valued at USD 1,401.43 Million in 2025 and is projected to reach USD 1,833.92 Million by 2034, growing at a compound annual growth rate of 3.03% from 2026-2034.

The market is witnessing significant growth as consumer preferences shift toward premium, aged, and craft whiskey varieties. Rising interest in Western drinking culture, expanding cocktail consumption, and the popularity of home drinking trends continue to support demand. Imported whiskey brands are gaining stronger visibility, while local distributors focus on diverse flavor profiles and limited-edition releases. Growing e-commerce alcohol sales and experiential retail formats further strengthen the market’s long-term outlook.

Key Takeaways and Insights:

- By Product Type: Scotch whiskey dominates the market with a share of 62% in 2025, driven by strong brand recognition, heritage appeal, and alignment with Korean preferences for smooth, aged spirits suitable for highball cocktails and premium gifting occasions.

- By Quality: Premium leads the market with a share of 50% in 2025, reflecting the balance between accessibility and quality-consciousness among Korean consumers who increasingly prioritize drinking experiences over volume consumption.

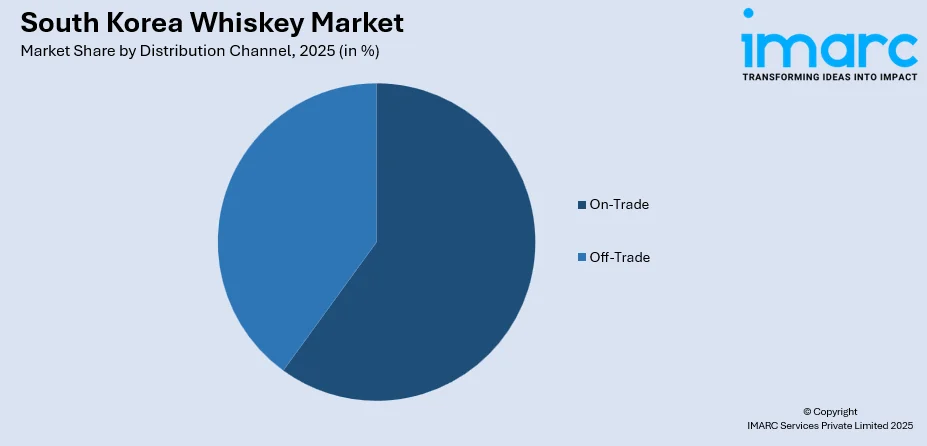

- By Distribution Channel: On-trade represents the largest segment with a market share of 60% in 2025, fueled by the vibrant nightlife culture, proliferation of whiskey bars, and the popularity of highball cocktails in restaurants, pubs, and lounges across urban centers.

- Key Players: The South Korea whiskey market exhibits a moderately competitive landscape with multinational spirits corporations competing alongside regional distributors and emerging domestic producers. Major international players leverage premium brand portfolios and marketing investments to capture market share among discerning Korean consumers.

To get more information on this market Request Sample

The whiskey market in South Korea is experiencing steady growth, fueled by changing consumer habits, increasing disposable incomes, and a rising interest in premium alcoholic drinks. Younger consumers are increasingly exploring diverse whiskey profiles, fueling demand for single malts, blended varieties, and craft labels. The influence of Western drinking culture, combined with the rise of cocktail-focused bars and home drinking trends, continues to widen the consumer base. Imported whiskey brands maintain strong momentum, supported by active promotions, digital engagement, and duty-free retail channels. At the same time, local distributors and retailers are expanding product portfolios with limited-edition releases and age-statement variants to attract enthusiasts and collectors. In November 2025, Korean distillery Ki One partnered with Hypebeans Coffee to release a unique Coffee Cask Whisky, aged for three years. Available exclusively in South Korean bars and restaurants, it promises a smooth finish and rich aroma. Together, these factors position the South Korea whiskey market for steady long-term growth.

South Korea Whiskey Market Trends:

Premiumization and Demand for Aged Varieties

South Korea’s whiskey market is seeing strong premiumization as consumers increasingly seek aged, single-malt, and high-quality blends. This shift reflects a desire for refined drinking experiences, greater product authenticity, and deeper flavor complexity. Enthusiasts are willing to pay more for craftsmanship, heritage, and exclusivity, boosting demand for premium and ultra-premium whiskey categories across retail and on-trade channels. In December 2025, Diageo Korea launched 'Diageo Special Releases 2025,' a collection of eight limited-edition whiskies themed 'Horizons Unbound.' Featuring unique flavor combinations, including mezcal-finished and pineapple cut whiskies, the collection aims to redefine whisky experiences and will be available mid-month.

Growing Cocktail and Mixology Culture

The expansion of cocktail bars, speakeasies, and mixology-focused venues is elevating whiskey’s role in modern drink culture. Bartenders are experimenting with diverse whiskey profiles to create innovative cocktails, increasing demand for smooth, versatile, and flavor-forward variants. In July 2025, Kavalan and Golden Blue launch 'Team Kavalan 2.0' to celebrate South Korea's bars through cocktail collaborations. Eight top bartenders will craft contrasting cocktails featuring Kavalan whisky, with campaigns unfolding throughout 2025, highlighting the brand's growth in the region. This trend also influences consumers at home, where interest in DIY cocktails and premium mixers is rising, further fueling whiskey consumption.

Rise of E-commerce and Digital Discovery

E-commerce is becoming a key channel for whiskey purchases as consumers prioritize convenience, wider product access, and transparent pricing. South Korea e-commerce market size reached USD 510 Billion in 2024. The market is projected to reach USD 3,810 Billion by 2033, further accelerating online alcohol buying. Digital platforms offer mainstream to rare labels, supported by reviews, tasting notes, and curated recommendations that influence purchase decisions and encourage exploration of premium whiskey varieties.

Market Outlook 2026-2034:

The South Korea whiskey market outlook remains positive, supported by rising premiumization, expanding mixology culture, and increasing consumer interest in diverse flavor profiles. Younger drinkers are driving experimentation with single malts, craft varieties, and limited-edition releases, while home drinking and gifting trends continue to strengthen demand. E-commerce platforms are widening product accessibility and boosting category visibility. With evolving lifestyles and growing appreciation for quality spirits, the market is expected to maintain steady, long-term growth. The market generated a revenue of USD 1,401.43 Million in 2025 and is projected to reach a revenue of USD 1,833.92 Million by 2034, growing at a compound annual growth rate of 3.03% from 2026-2034.

South Korea Whiskey Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Scotch Whiskey | 62% |

| Quality | Premium | 50% |

| Distribution Channel | On-Trade | 60% |

Product Type Insights:

- American Whiskey

- Irish Whiskey

- Scotch Whiskey

- Canadian Whiskey

- Others

Scotch whiskey dominates with a market share of 62% of the total South Korea whiskey market in 2025.

Scotch whiskey dominates the South Korea whiskey market, driven by its strong heritage, perceived prestige, and wide availability of aged and premium expressions. Consumers associate Scotch with authenticity and craftsmanship, making it a preferred choice across both casual drinkers and connoisseurs. Its diverse flavor profiles, ranging from smoky varieties to smoother blends, cater to evolving taste preferences.

Demand for Scotch whiskey is further supported by rising premiumization and increased interest in single malts. In October 2025, Lotte Chilsung Beverage launched a limited edition single malt whiskey, "Glengoine Korea Edition," in collaboration with Kansong Art Museum. Only 285 bottles will be available. Aged for 17 years in Oloroso Sherry Oak, it offers complex flavors and aromas, making it an ideal gift for special occasions. Marketing efforts, tasting events, and brand-led promotional experiences enhance product visibility and consumer education. As South Korea’s whiskey culture matures, Scotch maintains a strong foothold through consistent quality, broad brand portfolios, and strong on-trade presence in bars, lounges, and upscale dining venues.

Quality Insights:

- Premium

- High-End Premium

- Super Premium

The premium leads with a share of 50% of the total South Korea whiskey market in 2025.

Premium whiskey leads the market as consumers seek higher-quality spirits without the price barriers associated with high-end premium or super-premium segments. This category offers a balanced value proposition, providing refined taste, better aging, and notable brand credibility. In September 2025, Diageo officially launched its premium single malt whisky "Mortlach" in Korea, known for its bold flavor. The lineup features "Mortlach 16 Years" aged in Sherry Cask and a limited "Mortlach Neverbound" maturing in French oak. This move aims to cater to the growing demand for unique whisky flavors in the market. Growing lifestyle upgrades and the desire for elevated drinking experiences continue to strengthen this segment.

The popularity of premium whiskey is also fueled by broader availability across retail channels and increasing product innovations. Attractive packaging, limited editions, and diversified flavor profiles encourage trade-ups from standard varieties. Social drinking culture, gifting traditions, and rising interest in curated bar menus further support the expansion of the premium segment.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

The on-trade exhibits a clear dominance with a 60% share of the total South Korea whiskey market in 2025.

The on-trade segment dominates due to South Korea’s vibrant nightlife, bar culture, and growing emphasis on experiential drinking. Restaurants, hotels, and premium lounges play a key role in whiskey promotion through curated menus, mixology-driven offerings, and guided tasting sessions. These venues allow consumers to explore new varieties, supporting demand for both premium and innovative whiskey types.

On-trade growth is also propelled by tourism expansion and rising hospitality investments. Whiskey brands benefit from strong placement opportunities, premium positioning, and enhanced consumer engagement in social settings. As experiential dining and cocktail culture continue to thrive, the on-trade channel remains essential for driving brand visibility and influencing purchasing behavior.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area drives whiskey demand due to its dense population, strong nightlife culture, and concentration of premium bars, hotels, and restaurants. High consumer spending and rapid adoption of global drinking trends make it the most influential regional market.

The Yeongnam region shows steady whiskey consumption supported by its major urban centers and strong hospitality sector. Growing interest in premium drinking experiences, combined with expanding dining and entertainment venues, continues to boost market activity in this economically active southeastern region.

The Honam region reflects gradual growth in whiskey demand, driven by expanding retail access and increasing consumer willingness to explore premium spirits. Local bars and restaurants are enhancing their beverage offerings, contributing to rising adoption among younger and urban populations.

The Hoseo region exhibits moderate but consistent whiskey consumption, supported by growing urban development and improving nightlife infrastructure. Rising disposable incomes and expanding on-trade establishments encourage consumers to try diverse whiskey varieties across both premium and accessible segments.

Market Dynamics:

Growth Drivers:

Why is the South Korea Whiskey Market Growing?

Rising Disposable Incomes

Rising disposable incomes in South Korea are encouraging consumers to spend more on premium alcoholic beverages, including high-quality whiskey variants. According to the industry reports, in December 2024, South Korea's Gross National Disposable Income rose to 680,063.1 KRW Billion, up from 651,865.6 KRW Billion in September 2024. As lifestyles evolve, many consumers are shifting from mainstream spirits to refined drinking experiences that emphasize craftsmanship, aging, and flavor depth. This trend is particularly strong among young professionals and urban consumers who associate premium whiskey with social status, personal reward, and experiential value, supporting steady demand growth across retail and on-premise channels.

Innovative Product Launches

Innovative product launches are reshaping the South Korea whiskey market as brands introduce flavored, cask-finished, and small-batch variants tailored to evolving consumer preferences. In August 2025, HiteJinro launched Four Roses, its premium bourbon whiskey line, in Korea. The collection includes Four Roses Bourbon, Single Barrel, Small Batch, and Small Batch Select, each with distinct flavors and alcohol content ranging from 40% to 52%. The whiskies will be available through select bars and lifestyle platform Daily Shot. These offerings appeal to both new drinkers seeking approachable flavor profiles and seasoned enthusiasts looking for unique, premium experiences. Limited editions and experimental finishes generate excitement, drive brand loyalty, and support higher price points. This diversification also helps brands stand out in a competitive landscape while tapping into growing interest in craftsmanship and artisanal production methods.

Tourism and Hospitality Growth

South Korea’s expanding tourism and hospitality industry significantly boosts whiskey demand, supported by rising visitor inflows and growing premium consumption. The South Korea tourism market size reached USD 13,066.0 Million in 2024. The market is projected to reach USD 19,805.3 Million by 2033, reinforcing opportunities for on-trade whiskey sales. Hotels, luxury lounges, and upscale restaurants increasingly showcase curated whiskey menus to attract both domestic and international guests. The growth of experiential dining, mixology-focused bars, and themed venues enhances whiskey visibility, strengthens brand positioning, and drives tasting-led discovery across major urban hubs.

Market Restraints:

What Challenges the South Korea Whiskey Market is Facing?

High Price Sensitivity

Many consumers in South Korea remain cautious about spending on higher-priced spirits, especially imported and premium whiskey labels. Elevated retail prices reduce purchase frequency and make whiskey less accessible to a wider audience. This sensitivity often pushes consumers toward more affordable alcoholic beverages, slowing overall market expansion and limiting premium whiskey penetration in mainstream segments.

Strict Alcohol Regulations

South Korea’s stringent regulations on alcohol advertising, promotional activities, and retail visibility create significant barriers for whiskey brands. Limited marketing opportunities restrict consumer awareness and inhibit brand differentiation. Additionally, tight rules on sales and consumption environments reduce the scope for experiential promotions, ultimately slowing market momentum and constraining long-term outreach strategies.

Competition from Alternative Beverages

Whiskey faces strong competition from rapidly growing categories such as craft beer, premium soju, wine, and ready-to-drink cocktails. These alternatives appeal particularly to younger drinkers who prefer lighter, trend-driven, and lower-alcohol options. This shift in preference reduces whiskey’s share of occasions, challenging its relevance among evolving consumer lifestyles.

Competitive Landscape:

The competitive landscape of the South Korea whiskey market is shaped by a mix of established global brands and emerging regional players, all vying for visibility in a rapidly evolving consumer environment. Companies focus on premium product lines, limited-edition releases, and strong storytelling to differentiate their offerings. Marketing efforts increasingly target younger consumers through experiential events, collaborations with bars, and digital engagement strategies. Competition is further intensified by the growing interest in cocktail culture, prompting brands to highlight versatility and mixability. Continuous innovation, portfolio expansion, and retail presence remain central to gaining market share.

Recent Developments:

- In September 2025, Campari Korea announced its plans to launch a premium whiskey gift set for Chuseok, featuring brands like Wild Turkey, Russell Reserve, and The Glengrant. The sets include exclusive glasses and various capacities, available at major retailers like Homeplus and GS25, highlighting a selection of age-specific Scotch and bourbon offerings.

- In April 2025, Diageo Korea announced the launch of "Johnny Walker Black Ruby" at convenience stores, targeting the MZ generation. This accessible product, introduced by the brand's first female master blender, features a fruit-forward profile aimed at beginners and women.

South Korea Whiskey Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | American Whiskey, Irish Whiskey, Scotch Whiskey, Canadian Whiskey, Others |

| Qualities Covered | Premium, High-End Premium, Super Premium |

| Distribution Channels Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea whiskey market size was valued at USD 1,401.43 Million in 2025.

The South Korea whiskey market is expected to grow at a compound annual growth rate of 3.03% from 2026-2034 to reach USD 1,833.92 Million by 2034.

Scotch whiskey dominated the market with 62% share, driven by strong brand heritage, consumer preference for smooth aged spirits, and versatility across traditional neat consumption and contemporary highball serves favored by Korean consumers.

Key factors driving the South Korea whiskey market include rising premiumization, expanding cocktail culture, increasing disposable incomes, and strong influence from global drinking trends. Growing online availability and enhanced brand engagement also support higher consumption across diverse consumer groups.

Major challenges include high price sensitivity among mainstream consumers, strict alcohol regulations limiting marketing flexibility, and growing competition from alternative beverages such as premium soju, craft beer, wine, and ready-to-drink cocktails, which reduce whiskey’s share in younger segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)