Spain Architectural Coatings Market Size, Share, Trends and Forecast by Resin, Technology, End User, and Region, 2026-2034

Spain Architectural Coatings Market Summary:

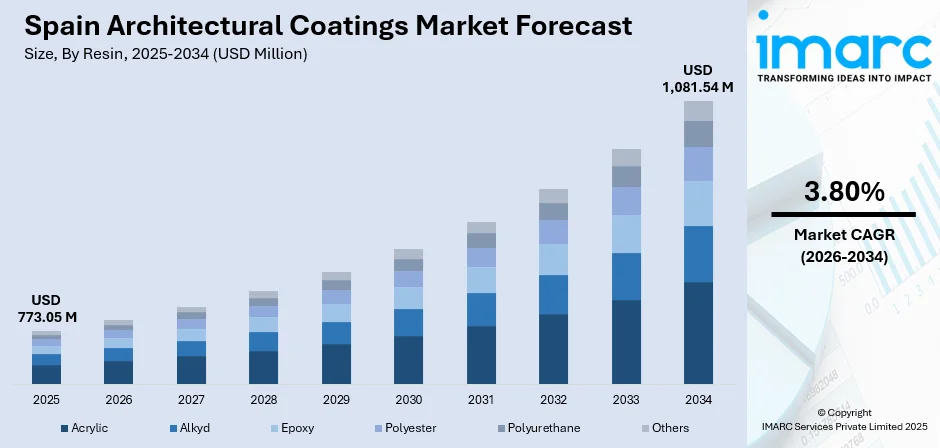

The Spain architectural coatings market size was valued at USD 773.05 Million in 2025 and is projected to reach USD 1,081.54 Million by 2034, growing at a compound annual growth rate of 3.80% from 2026-2034.

The Spain architectural coatings market is experiencing steady growth driven by robust construction and renovation activities across residential and commercial sectors. Stringent environmental regulations under the European Union's VOC Directive are accelerating the adoption of sustainable coating solutions, particularly waterborne and low-emission formulations. Government incentives supporting energy-efficient building renovations, coupled with rising urbanization in major metropolitan areas, continue to strengthen demand. Technological advancements in coating durability, weather resistance, and aesthetic finishes are reshaping consumer preferences and expanding the Spain architectural coatings market share.

Key Takeaways and Insights:

- By Resin: Acrylic dominates the market with a share of 48% in 2025, driven by superior durability, excellent weather resistance, and compliance with low-VOC environmental standards across residential and commercial applications.

- By Technology: Waterborne leads the market with a share of 72% in 2025, reflecting stringent EU environmental regulations limiting volatile organic compound emissions and growing consumer preference for eco-friendly, health-conscious coating solutions.

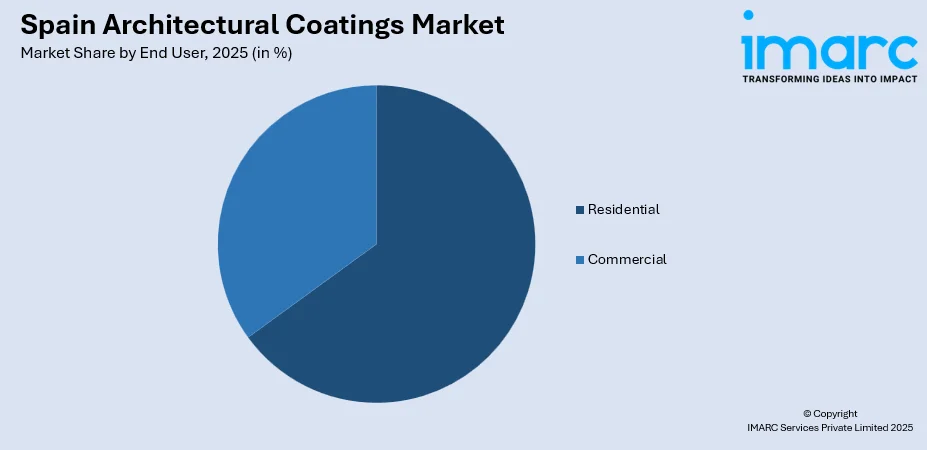

- By End User: The residential segment holds the largest share at 65% in 2025, supported by robust housing renovation initiatives, energy efficiency upgrade programs, and sustained demand for decorative and protective interior and exterior coatings.

- Key Players: The Spain architectural coatings market features moderate competitive intensity, with multinational coating manufacturers competing alongside established regional producers through product innovation, sustainability initiatives, and strategic distribution partnerships.

To get more information on this market Request Sample

The Spain architectural coatings market is advancing as manufacturers and consumers prioritize sustainable building practices aligned with European environmental frameworks. The market benefits from Spain's position as one of Europe's largest construction markets, with significant investments flowing into residential renovations and commercial infrastructure development. The National Recovery and Resilience Plan allocates substantial funding toward building energy efficiency upgrades, creating sustained demand for protective and decorative coatings. In July 2024, Arkema achieved ISCC+ certification for its powder coating resins facility in Sant Celoni, Spain, introducing bio-attributed polyester resins with up to 25% reduced carbon footprint. This reflects the industry's commitment to decarbonization and meeting green building certification requirements such as BREEAM and LEED standards increasingly adopted across Spanish construction projects.

Spain Architectural Coatings Market Trends:

Rising Demand for Sustainable and Low-VOC Coatings

The Spain architectural coatings market is witnessing accelerated adoption of sustainable and environmentally friendly formulations as regulatory pressures intensify across Europe. The EU Directive 2004/42/EC establishes strict limits on volatile organic compound content in decorative paints, compelling manufacturers to reformulate products toward waterborne and low-emission alternatives. Consumer awareness regarding indoor air quality and health impacts is driving preference for eco-certified coatings. In November 2023, AkzoNobel announced a EUR 32 Million investment in a new bisphenol-free coatings plant in Spain, designed with advanced automation and eco-efficiency standards to produce sustainable packaging coatings. This trend supports Spain architectural coatings market growth as sustainability becomes a core purchasing criterion.

Technological Innovations in Coating Formulations

Technological advancements are transforming the Spain architectural coatings market as manufacturers develop high-performance formulations with enhanced durability, UV resistance, and self-cleaning properties. Nanotechnology integration enables coatings to withstand environmental stresses including moisture, pollution, and temperature fluctuations while extending repainting intervals. Smart coatings with antimicrobial and thermal insulation properties are gaining traction in healthcare, educational, and commercial building applications. In September 2025, AkzoNobel, Arkema, and BASF announced a value chain partnership that achieved up to 40% lower carbon footprint in superdurable architectural powder coatings through bio-attributed raw materials and supplier-specific product carbon footprint data. These innovations strengthen competitive positioning and address evolving customer performance expectations.

Renovation and Urbanization Driving Coating Demand

The ongoing renovation boom and sustained urbanization across Spain are creating significant opportunities for architectural coatings suppliers. Spain possesses one of the oldest housing stocks in Europe, with a substantial portion of buildings requiring energy efficiency upgrades according to the Ministry of Housing. The National Recovery and Resilience Plan allocates considerable funding toward ambitious renovation and urban renewal initiatives targeting residential energy efficiency improvements. The Spanish government has committed substantial investment toward building renovations, with generous grants covering a significant portion of eligible retrofit costs for qualifying properties. These programs are accelerating demand for thermal insulation coatings, moisture-resistant finishes, and protective exterior solutions across both residential and commercial building segments, positioning the renovation sector as a key growth driver.

Market Outlook 2026-2034:

The Spain architectural coatings market is positioned for sustained expansion as construction activity strengthens and renovation investments accelerate under European recovery programs. Growing emphasis on green building certifications and energy-efficient construction practices will continue driving demand for low-VOC and sustainable coating solutions. The market generated a revenue of USD 773.05 Million in 2025 and is projected to reach a revenue of USD 1,081.54 Million by 2034, growing at a compound annual growth rate of 3.80% from 2026-2034. Technological innovations in coating performance, durability, and environmental compliance will further support market growth trajectories.

Spain Architectural Coatings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Resin | Acrylic | 48% |

| Technology | Waterborne | 72% |

| End User | Residential | 65% |

Resin Insights:

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Others

Acrylic lead the market with a share of 48% of the total Spain architectural coatings market in 2025.

Acrylic maintain market dominance due to their exceptional versatility and performance characteristics across interior and exterior applications. It offers superior adhesion, color retention, and resistance to weathering and UV degradation, making them ideal for Spain's varied climate conditions. The low-VOC content of acrylic formulations aligns with European environmental regulations, enabling manufacturers to meet stringent emissions standards while delivering high-quality aesthetic finishes. Consumer preference for durable, long-lasting coatings that reduce repainting frequency further strengthens acrylic adoption across residential and commercial segments. The segment benefits from continuous research and development investments aimed at enhancing performance properties including scrub resistance, flexibility, and application ease. Major coating manufacturers are introducing advanced acrylic formulations with improved hiding power and faster drying times to address contractor efficiency requirements.

Technology Insights:

- Solventborne

- Waterborne

Waterborne dominates the market with a share of 72% of the total Spain architectural coatings market in 2025.

Waterborne has established clear market leadership driven by stringent European environmental regulations and growing sustainability consciousness among consumers and building professionals. The EU Directive 2004/42/EC sets strict VOC limits for decorative paints, , compelling the industry transition toward water-based formulations. These coatings offer significant health and safety advantages including reduced odor, lower toxicity, and easier cleanup, making them preferred for residential applications and enclosed commercial spaces where indoor air quality is paramount. Technological advancements have significantly improved waterborne coating performance, achieving durability and finish quality comparable to traditional solventborne alternatives. Green building certification programs prioritize low-emission materials, further incentivizing waterborne adoption across new construction and renovation projects.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

Residential holds the largest share at 65% of the total Spain architectural coatings market in 2025.

Residential commands market leadership supported by robust housing renovation activity and sustained demand for decorative and protective coating solutions. Spain's housing stock represents one of the oldest in Europe. Government renovation incentives provide grants and tax deductions for energy efficiency improvements, stimulating homeowner investment in building upgrades that include protective coating applications. The segment benefits from growing consumer awareness regarding aesthetic enhancement and property value preservation through quality interior and exterior finishes. Rising disposable incomes in urban areas enable investment in premium coating products offering superior durability and design flexibility.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain benefits from established industrial manufacturing activity and robust construction markets in regions including the Basque Country and Cantabria. The area's humid climate drives demand for moisture-resistant and weatherproof coating solutions for both residential and commercial building applications.

Eastern Spain, anchored by Barcelona and Valencia metropolitan areas, represents a significant market driven by tourism infrastructure development, commercial construction, and residential building activity. The Mediterranean climate necessitates coatings offering superior UV resistance and durability against coastal environmental conditions.

Southern Spain, particularly Andalusia, is experiencing growth through renewable energy infrastructure development and tourism-related construction projects. The region's warm climate and intense sunlight create demand for heat-reflective coatings and exterior solutions offering enhanced weather protection and longevity.

Central Spain, centered on Madrid, commands substantial market presence through its role as the national capital with significant residential, commercial, and government building activity. Urban redevelopment projects and modernization initiatives support sustained coating demand across diverse application segments.

Market Dynamics:

Growth Drivers:

Why is the Spain Architectural Coatings Market Growing?

Expanding Construction and Renovation Activities

Spain's construction sector is experiencing sustained growth supported by public and private investment across residential, commercial, and infrastructure segments. The Spanish construction market reached significant valuations with projections for continued expansion through the forecast period, driven by urban development initiatives and modernization of existing building stock. Major metropolitan areas including Madrid and Barcelona are witnessing substantial residential construction activity to address housing demand from population growth and urbanization trends. Large-scale projects including stadium renovations, data center construction, and renewable energy infrastructure development are creating additional demand for protective and decorative coatings across diverse application requirements.

Stringent Environmental Regulations Supporting Sustainable Coatings

European Union environmental regulations are driving fundamental transformation in coating formulations and manufacturing processes across Spain. The EU Directive 2004/42/EC establishes strict VOC content limits for decorative paints and varnishes, requiring manufacturers to reformulate products toward waterborne and low-emission alternatives. The EU Green Deal and REACH regulations impose additional requirements on chemical usage and emissions reduction, compelling industry adoption of sustainable practices throughout the value chain. These regulatory frameworks create market opportunities for compliant coating solutions while driving out non-conforming products, accelerating the transition toward environmentally responsible coating technologies that meet both regulatory requirements and consumer sustainability expectations.

Government Initiatives for Energy-Efficient Buildings

Spanish government initiatives supporting building energy efficiency are creating sustained demand for architectural coatings with thermal and protective properties. Spain aims to reduce residential energy consumption by 2030, significantly exceeding EU minimum thresholds, through comprehensive building modernization initiatives. The government plans investment of nearly €40 Billion in building renovations by 2030. In September 2024, the Spanish government updated its National Energy and Climate Plan targeting 32% greenhouse gas emissions reduction by 2030 and 43% energy efficiency improvement. These programs are driving demand for coatings offering thermal insulation, moisture resistance, and weather protection that contribute to building energy performance improvements.

Market Restraints:

What Challenges the Spain Architectural Coatings Market is Facing?

Raw Material Price Volatility

The Spain architectural coatings market faces challenges from fluctuating raw material costs that impact manufacturer profitability and product pricing. Key inputs including titanium dioxide, petroleum-based solvents, and specialty resins experience significant price volatility driven by global supply chain dynamics and energy costs. Construction material price indices recorded substantial increases in recent years, with cement, copper, and iron materials experiencing double-digit percentage gains that compress industry margins and affect project economics.

High Regulatory Compliance Costs

Meeting stringent European environmental regulations requires substantial investment in product reformulation, manufacturing process modifications, and testing certification. Smaller regional manufacturers face disproportionate compliance burdens that limit their ability to compete effectively against multinational coating producers with greater resources for regulatory adaptation. The ongoing revision of EU Ecolabel criteria and evolving REACH requirements create uncertainty regarding future compliance standards and associated investment needs.

Skilled Labor Shortages in Construction Sector

Labor shortages across Spain's construction industry pose challenges for coating demand realization and project completion timelines. The industry faces difficulties attracting and retaining skilled workers for painting and coating application, potentially constraining the pace of renovation activity despite available funding and market demand. These workforce limitations can delay building projects and impact overall coating consumption volumes across residential and commercial segments.

Competitive Landscape:

The Spain architectural coatings market exhibits moderate competitive intensity with multinational coating corporations competing alongside established regional manufacturers. Major international players leverage extensive distribution networks, brand recognition, and research capabilities to maintain market positions, while regional producers compete through localized service, product customization, and price competitiveness. Companies are increasingly differentiating through sustainability credentials, with investments in low-carbon manufacturing processes, bio-based formulations, and environmental certifications becoming competitive advantages. Strategic partnerships across the value chain are accelerating innovation in sustainable coating technologies. The market is witnessing consolidation activity as larger players acquire regional brands to strengthen distribution and market coverage.

Spain Architectural Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resins Covered | Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, Others |

| Technologies Covered | Solventborne, Waterborne |

| End Users Covered | Commercial, Residential |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain architectural coatings market size was valued at USD 773.05 Million in 2025.

The Spain architectural coatings market is expected to grow at a compound annual growth rate of 3.80% from 2026-2034 to reach USD 1,081.54 Million by 2034.

Acrylic dominates the market with a share of 48%, driven by superior durability, weather resistance, low-VOC compliance, and widespread application across residential and commercial building segments requiring protective and decorative coating solutions.

Key factors driving the Spain architectural coatings market include expanding construction and renovation activities, stringent EU environmental regulations promoting sustainable coatings, government energy efficiency initiatives, rising urbanization, and increasing demand for low-VOC and waterborne coating solutions.

Major challenges include raw material price volatility affecting manufacturer margins, high regulatory compliance costs for meeting evolving EU environmental standards, skilled labor shortages in the construction sector, and competitive pressures requiring continuous investment in product innovation and sustainability initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)