Spain Automotive Wiring Harness Market Size, Share, Trends and Forecast by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, and Region, 2026-2034

Spain Automotive Wiring Harness Market Summary:

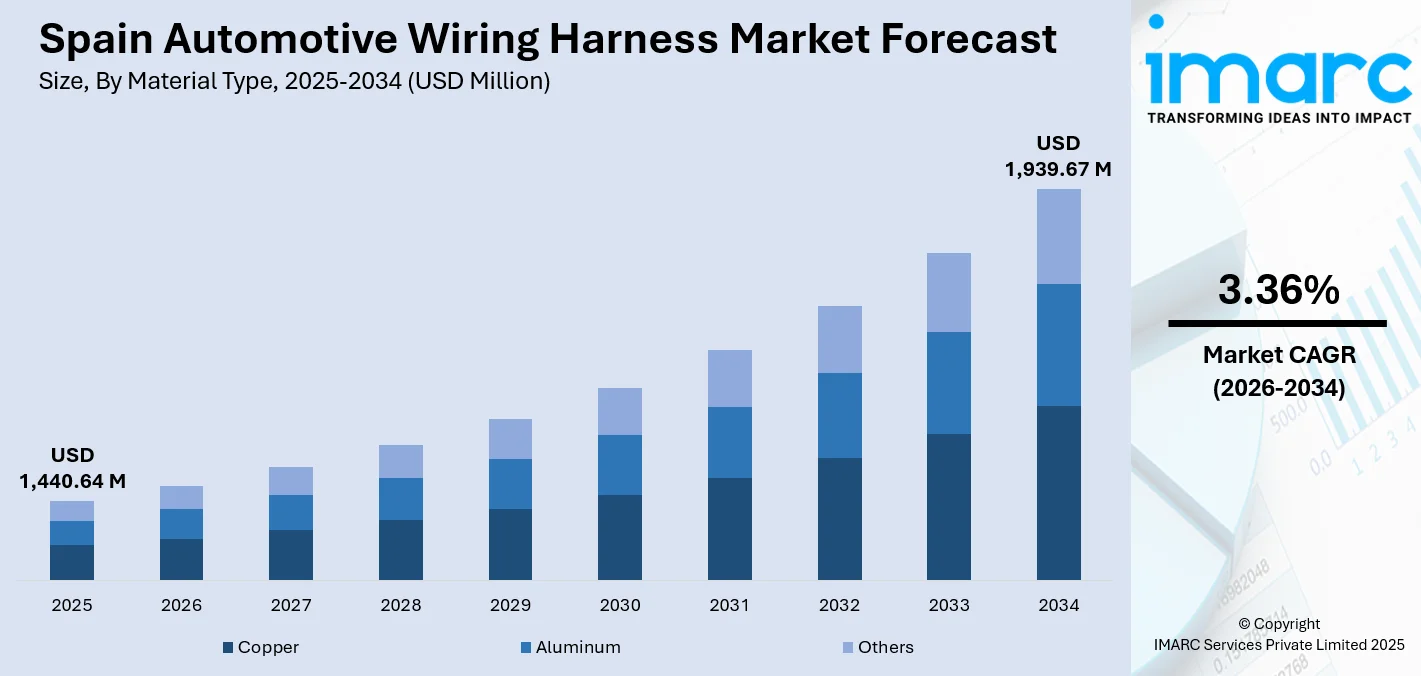

The Spain automotive wiring harness market size was valued at USD 1,440.64 Million in 2025 and is projected to reach USD 1,939.67 Million by 2034, growing at a compound annual growth rate of 3.36% from 2026-2034.

Spain's automotive wiring harness market is expanding due to the country's position as Europe's second-largest vehicle manufacturing hub. The growing adoption of advanced driver-assistance systems and the accelerating transition toward electric vehicles are driving the demand for sophisticated wiring architectures. Additionally, the increasing integration of infotainment systems and enhanced safety features in modern vehicles is driving the need for complex electrical distribution networks, further expanding the Spain automotive wiring harness market share.

Key Takeaways and Insights:

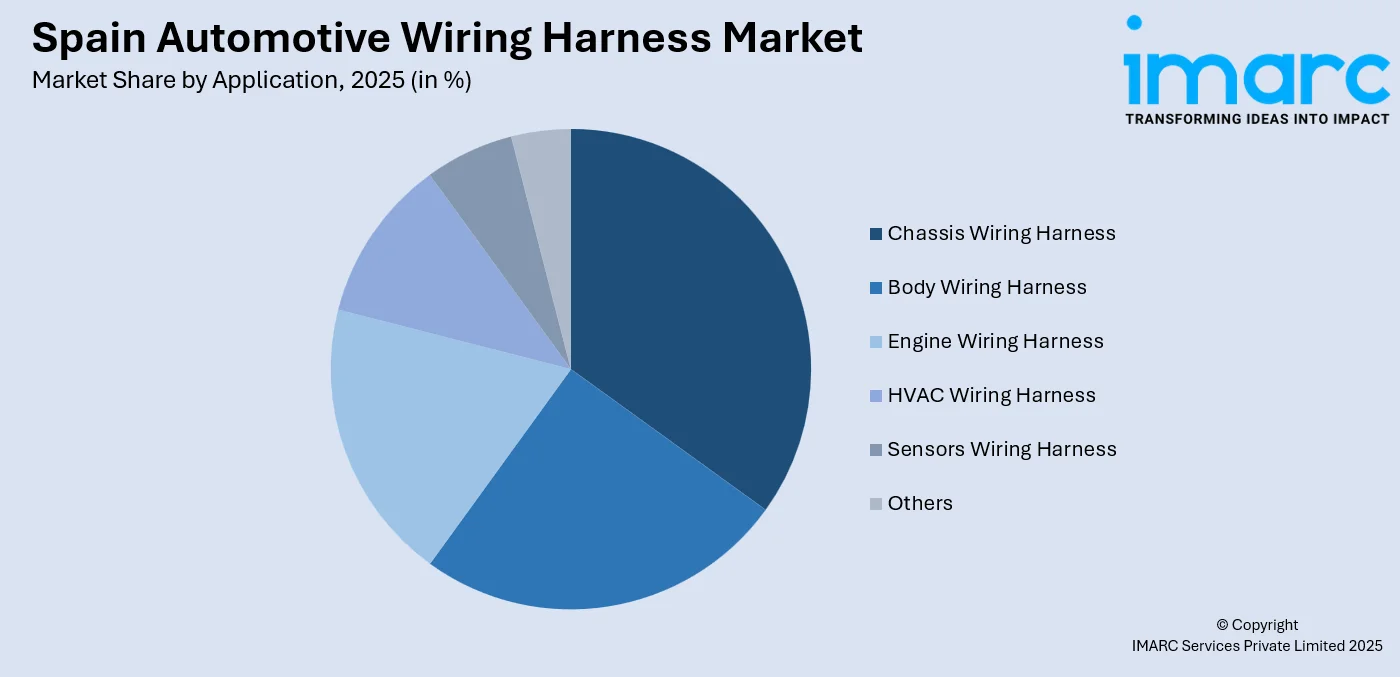

- By Application: Chassis wiring harness dominates the market with a share of 34.94% in 2025, driven by the increasing integration of advanced braking systems, electronic stability control, and suspension management technologies in modern vehicles.

- By Material Type: Copper leads the market with a share of 86.28% in 2025, attributed to its superior electrical conductivity, durability, and heat resistance properties essential for reliable power transmission across vehicle systems.

- By Transmission Type: Electrical wiring represents the largest segment with a market share of 81.56% in 2025, owing to its fundamental role in power distribution across vehicle electrical systems and electronic components.

- By Vehicle Type: Passenger cars lead the market with a share of 52.29% in 2025, driven by rising consumer demand for advanced connectivity features and safety technologies integrated into personal vehicles.

- By Category: General wires represent the largest segment with a market share of 40.08% in 2025, owing to their widespread application across standard vehicle electrical systems operating within normal temperature and electromagnetic environments.

- By Component: Wires lead the market with a 42.22% share in 2025, driven by their fundamental role as the primary medium for electrical power and signal transmission throughout vehicle harness assemblies.

- By Region: Central Spain represents the largest segment with a market share of 33% in 2025, supported by the concentration of major automotive manufacturing facilities and supplier networks in the Madrid metropolitan area.

- Key Players: The Spain automotive wiring harness market exhibits a moderately consolidated competitive landscape, with global manufacturers maintaining significant presence through established relationships with domestic vehicle producers and strategic investments in local production capabilities.

To get more information on this market Request Sample

The Spain automotive wiring harness market is experiencing transformational growth driven by the country's strategic importance in European vehicle manufacturing. Spain produced approximately 2.38 million motor vehicles in 2024, reinforcing its position as Europe's second-largest automotive producer after Germany. The market is benefiting from substantial investments in electric vehicle manufacturing infrastructure, with the Volkswagen Group committing EUR 10 billion to establish Spain as a European EV hub, including battery cell production at the PowerCo gigafactory in Sagunto and assembly capabilities at the Martorell and Pamplona plants. The government's extension of the MOVES III incentive program with EUR 400 million allocation for 2025 is accelerating electric vehicle adoption, with BEV registrations increasing year-over-year during 2025. This electrification surge is subsequently driving demand for specialized high-voltage wiring harnesses capable of managing complex power distribution in electrified vehicles, while the integration of advanced connectivity and autonomous driving features continues expanding wiring content per vehicle across all powertrain configurations.

Spain Automotive Wiring Harness Market Trends:

Electric Vehicle (EV) Electrification Driving High-Voltage Wiring Demand

The rapid acceleration of EV adoption in Spain is fundamentally transforming wiring harness requirements. The transition to battery electric vehicles necessitates specialized high-voltage wiring systems capable of managing power distribution from battery packs to electric motors. The shift toward higher voltage architectures, including emerging 800-volt systems, is driving innovation in cable insulation materials and electromagnetic shielding technologies. Seat's Martorell facility commenced pre-series production of battery assembly systems in 2025, designed to produce up to 300,000 battery packs annually, demonstrating the expanding infrastructure supporting EV-specific wiring harness demand in Spain.

Advanced Driver-Assistance Systems (ADAS) Integration Intensifying Wiring Complexity

The increasing integration of advanced driver-assistance systems is significantly elevating wiring harness complexity in vehicles manufactured in Spain. Modern ADAS-equipped vehicles require sophisticated sensor connectivity networks supporting cameras, radar, LiDAR, and ultrasonic sensors throughout the vehicle. In 2025, Applus+ IDIADA, a prominent global ally for automotive producers, is excited to reveal a major enhancement of its ADAS/CAV testing facilities at its proving ground in Spain. This strategic investment highlights IDIADA's dedication to fostering the development and validation of cutting-edge mobility technologies, reinforcing its status as a premier Euro NCAP accredited testing center.

Lightweight Material Adoption Reshaping Harness Architecture

The automotive industry's focus on weight reduction is driving the adoption of lightweight materials and innovative wiring harness architectures. Manufacturers are increasingly exploring aluminum conductors as alternatives to traditional copper in specific applications where weight savings outweigh conductivity requirements. Zonal electrical architectures are gaining traction, enabling shorter cable runs and reduced overall harness weight. On December 3, Spanish Prime Minister Pedro Sanchez revealed that the Spain Auto 2030 plan incorporates the Auto+ Plan, which will allocate EUR 400 million in 2026 to assist electric vehicle (EV) purchases, a Moves Corridors initiative with EUR 300 million to increase charging stations, and an additional EUR 580 million for PERTE VEC programme.

Market Outlook 2026-2034:

The Spain automotive wiring harness market outlook remains robustly positive, supported by continued investments in electric vehicle manufacturing and the country's strategic positioning as a European automotive production hub. The market generated a revenue of USD 1,440.64 Million in 2025 and is projected to reach a revenue of USD 1,939.67 Million by 2034, growing at a compound annual growth rate of 3.36% from 2026-2034. The convergence of electrification trends, autonomous driving technologies, and connected vehicle features is creating sustained demand for increasingly sophisticated wiring solutions capable of supporting high-voltage power distribution, high-speed data transmission, and enhanced electromagnetic compatibility requirements. The ongoing transition toward zonal electrical architectures is reshaping harness design approaches, with manufacturers investing in modular solutions that reduce complexity while improving serviceability and manufacturing efficiency.

Spain Automotive Wiring Harness Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

Chassis Wiring Harness |

34.94% |

|

Material Type |

Copper |

86.28% |

|

Transmission Type |

Electrical Wiring |

81.56% |

|

Vehicle Type |

Passenger Cars |

52.29% |

|

Category |

General Wires |

40.08% |

|

Component |

Wires |

42.22% |

|

Region |

Central Spain |

33% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

Chassis wiring harness dominates with a market share of 34.94% of the total Spain automotive wiring harness market in 2025.

The chassis wiring harness segment maintains its leadership position due to its critical role in connecting essential vehicle safety and control systems. These harnesses facilitate power distribution and signal transmission across brake systems, suspension components, steering mechanisms, and fuel delivery systems. The increasing integration of electronic stability control, anti-lock braking systems, and adaptive suspension technologies in Spanish-manufactured vehicles is amplifying demand for sophisticated chassis wiring solutions capable of reliable performance under demanding operational conditions.

The segment is further strengthened by regulatory requirements mandating advanced safety systems in new vehicles. Spanish vehicle manufacturers are incorporating increasingly complex chassis electronics to meet European safety standards, driving the need for harnesses with enhanced electromagnetic compatibility and environmental protection. Apart from this, the development of integrated chassis systems combining multiple control functions is creating opportunities for modular wiring harness designs that simplify installation while improving system reliability and serviceability.

Material Type Insights:

- Copper

- Aluminum

- Others

Copper leads with a share of 86.28% of the total Spain automotive wiring harness market in 2025.

Copper maintains its dominant position in the Spanish automotive wiring harness market due to its exceptional electrical conductivity, thermal properties, and mechanical durability. These characteristics make copper the preferred conductor material for critical vehicle applications requiring reliable power transmission and signal integrity. The material's ability to withstand repeated thermal cycling and maintain connection stability under vibration makes it particularly suitable for automotive environments where performance consistency is essential for safety-critical systems.

The segment continues to benefit from copper's established supply chains and well-understood manufacturing processes within the Spanish automotive sector. While lightweight alternatives are gaining attention for specific applications, copper remains the material of choice for high-current applications, precision signal transmission, and systems requiring maximum reliability. The transition to electric vehicles is reinforcing copper demand, as EV powertrains require high-quality copper conductors for battery connections and motor windings where conductivity directly impacts vehicle efficiency and range.

Transmission Type Insights:

- Data Transmission

- Electrical Wiring

Electrical wiring exhibits a clear dominance with a 81.56% share of the total Spain automotive wiring harness market in 2025.

The electrical wiring segment maintains its commanding market position as the foundational infrastructure for vehicle power distribution systems. These harnesses carry electrical current to power essential vehicle functions including lighting, motors, climate control, and electronic control units. The ubiquitous nature of electrical wiring across all vehicle types and the continuing electrification of previously mechanical systems ensures sustained demand for comprehensive electrical distribution networks throughout vehicles manufactured in Spain.

The segment is experiencing evolution driven by the transition to electric and hybrid powertrains, which require substantially more electrical wiring than conventional vehicles. High-voltage electrical wiring for battery systems and electric motors represents a growing portion of total harness content, requiring specialized insulation materials and enhanced safety features. The integration of regenerative braking systems and power electronics in modern vehicles further expands the electrical wiring requirements, supporting continued segment growth throughout the forecast period.

Vehicle Type Insights:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Passenger cars lead with a share of 52.29% of the total Spain automotive wiring harness market in 2025.

The passenger car segment in the Spain automotive wiring harness market is the largest and continues to expand due to increasing consumer demand for more advanced and feature-rich vehicles. Modern passenger cars rely heavily on complex electrical systems to support features such as advanced driver-assistance systems (ADAS), infotainment, powertrains, and connectivity. As a result, wiring harnesses play a crucial role in ensuring the seamless operation of these electrical systems. The rise of electric vehicles (EVs) also fuels the need for high-quality, durable wiring harnesses, as EVs often require specialized systems to manage energy distribution and battery management effectively.

The growing shift toward automation and electrification in the automotive sector further drives the demand for sophisticated wiring harnesses in passenger cars. With innovations in autonomous driving, hybrid powertrains, and connected technologies, wiring harnesses must meet stringent performance and safety standards. As automakers shift toward producing environmentally friendly and technologically advanced cars, the complexity of wiring harnesses increases. This evolution requires manufacturers to develop more efficient and compact wiring solutions, ensuring that they can handle the increasing number of sensors, cameras, and electronic control units (ECUs) in modern vehicles.

Category Insights:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

General wires exhibit a clear dominance with a 40.08% share of the total Spain automotive wiring harness market in 2025.

The general wires segment is the largest category in the automotive wiring harness market, driven by its broad application in various vehicle components. These wires are used in fundamental electrical circuits within passenger cars, two-wheelers, and commercial vehicles. General wires are designed to handle basic electrical tasks such as power supply to lighting systems, dashboard controls, and other essential functions. Their versatility, affordability, and reliability make them a preferred choice for many automotive manufacturers, ensuring that vehicles maintain efficient electrical connectivity. The demand for general wires is set to continue growing as vehicles become increasingly dependent on electrical systems.

As automotive technology evolves, the need for general wires remains essential due to their ability to adapt to a wide range of vehicle designs and functionalities. With the rise of electric vehicles and the integration of more electronic components in traditional internal combustion engine (ICE) vehicles, general wires are used in various critical applications. They provide the backbone for vehicle electrical systems, supporting various low-voltage functions, from lighting and sensors to climate control systems. Their low cost and proven reliability make them a key component in ensuring the safe and effective operation of modern vehicles.

Component Insights:

- Connectors

- Wires

- Terminals

- Others

Wires lead with a share of 42.22% of the total Spain automotive wiring harness market in 2025.

The wires segment is the largest component in the automotive wiring harness market, playing a critical role in connecting various electrical systems within vehicles. Wires are essential for transmitting power, signals, and data between components such as sensors, infotainment systems, powertrains, and lighting. Their versatility and functionality make them indispensable in all vehicle types, including passenger cars, two-wheelers, and commercial vehicles. With the rise of electrification, the demand for high-quality wiring solutions has surged, as they are vital for ensuring the efficient operation of complex electrical networks and supporting the growing number of electronic systems in modern vehicles.

As vehicles increasingly adopt advanced technologies such as electric drivetrains, autonomous systems, and connectivity, the need for robust and efficient wires continues to grow. Wires are integral to a vehicle’s overall performance, with applications ranging from basic functions like lighting and safety systems to more sophisticated features such as electric powertrains and autonomous driving technologies. The rising shift toward electric vehicles (EVs) further amplifies the importance of wires, as these vehicles require advanced wiring to handle the high power demands of electric motors, battery systems, and charging infrastructure, cementing their position as the largest component in the market.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Central Spain exhibits a clear dominance with a 33% share of the total Spain automotive wiring harness market in 2025.

Central Spain holds the largest share in the automotive wiring harness market due to its strategic location and industrial prominence. It serves as the hub for automotive manufacturing and assembly, housing key players in the automotive supply chain. Major cities in the region, such as Madrid, have seen significant investments in the automotive sector, creating a strong demand for wiring harnesses. The central location allows for efficient distribution of components to other parts of Spain, ensuring that the automotive industry in the region remains a focal point of development. This central position also enhances access to suppliers and service providers.

The automotive industry in Central Spain is bolstered by the presence of established automotive manufacturers and a thriving network of suppliers. The region benefits from a well-developed infrastructure and logistics network, facilitating the efficient movement of raw materials and finished products. With continuous investments in electric and hybrid vehicles, Central Spain is seeing an increase in the demand for advanced wiring solutions to support high-tech automotive features. The region is expected to continue to dominate the automotive wiring harness market as more manufacturers focus on technological advancements and electrification, driving the need for reliable and efficient wiring systems.

Market Dynamics:

Growth Drivers:

Why is the Spain Automotive Wiring Harness Market Growing?

Electric Vehicle Manufacturing Expansion Accelerating Harness Demand

The substantial investment in EV manufacturing infrastructure across Spain is creating significant growth opportunities for the automotive wiring harness market. EVs require considerably more complex wiring systems than conventional vehicles, incorporating high-voltage circuits for battery management and power distribution alongside traditional low-voltage networks. In 2025, Iberdrola Spain and Airbus are advancing the electrification of transport beyond urban areas and roadways into the core of heavy industry, installing almost 500 electric vehicle charging stations at Airbus production sites in Spain. The accord prioritizes workplace mobility and fleet electrification in the aerospace industry's decarbonization initiatives, an area historically characterized by energy-intensive manufacturing rather than transportation changes.

Strategic Position as European Automotive Production Hub

Spain's established position as Europe's second-largest vehicle producer provides a stable foundation for automotive wiring harness demand. The country produced approximately 2.38 million motor vehicles in 2024, maintaining significant manufacturing scale despite transitional challenges. Nine multinational automotive brands operate production facilities across Spain, including Stellantis, Volkswagen Group, Renault, Ford, and Mercedes-Benz, generating consistent demand for wiring harness components. Stellantis maintained its leadership position with nearly 981120 vehicles manufactured across its Madrid, Vigo, and Zaragoza plants. This diversified manufacturing base ensures broad-based demand for wiring harnesses across multiple vehicle platforms, segments, and powertrain configurations throughout the Spanish automotive industry.

Government Policy Support Automotive Industry Transformation

Government initiatives supporting automotive sector transformation are creating favorable conditions for wiring harness market growth. The Spain Auto 2030 plan aims to mobilize EUR 30 billion over five years to reshape the electric vehicle market through incentives, infrastructure investment, and expanded PERTE VEC programs. The extension of the MOVES III incentive program with EUR 400 million allocation for 2025 is accelerating consumer adoption of EVs. The government's commitment to reaching 2.7 million fully electrified annual sales and maintaining 1.9 million automotive sector jobs demonstrates policy alignment supporting continued industry growth. These supportive measures are encouraging both domestic production expansion and foreign investment in Spanish automotive manufacturing, sustaining demand for wiring harness components across the value chain.

Market Restraints:

What Challenges the Spain Automotive Wiring Harness Market is Facing?

Supply Chain Vulnerabilities and Raw Material Constraints

The automotive wiring harness industry faces ongoing challenges related to supply chain complexity and raw material availability. Semiconductor shortages and logistics disruptions continue affecting vehicle production schedules, creating uncertainty for component suppliers. Copper price volatility impacts manufacturing costs, while specialized materials for high-voltage applications face supply constraints as global EV production scales rapidly.

High Production Costs and Labor-Intensive Manufacturing Processes

Wiring harness production remains predominantly manual and labor-intensive, creating cost pressures in European manufacturing environments. Apart from this, the complexity of modern harnesses limits automation opportunities, while quality requirements demand skilled workforce capabilities. These factors drive production cost structures that challenge competitiveness against lower-cost manufacturing regions serving the Spanish automotive market.

Transitional Uncertainties in Powertrain Mix Evolution

The uncertain pace of transition from internal combustion engines to electric powertrains creates planning challenges for wiring harness manufacturers. Fluctuating consumer demand between powertrain types complicates production planning and capacity investment decisions. The declining conventional vehicle production affects traditional wiring harness demand while EV-specific requirements necessitate significant manufacturing capability adjustments.

Competitive Landscape:

The Spain automotive wiring harness market features a competitive landscape characterized by the presence of global industry leaders alongside regional specialists serving domestic vehicle manufacturers. Major international players maintain significant market positions through established relationships with vehicle producers operating in Spain. These companies leverage global scale, technological capabilities, and integrated supply chain networks to serve complex customer requirements across multiple vehicle platforms and powertrain configurations. Competition is intensifying around electric vehicle wiring capabilities, with manufacturers investing substantially in high-voltage system expertise, lightweight material development, and advanced manufacturing automation to address evolving market requirements. Regional manufacturing presence remains important, with suppliers maintaining production facilities in proximity to major vehicle assembly plants to ensure supply chain responsiveness and just-in-time delivery capabilities. The market is also witnessing increased collaboration between wiring harness manufacturers and vehicle OEMs on next-generation electrical architecture development, particularly for upcoming electric vehicle platforms requiring specialized high-voltage and high-speed data transmission solutions.

Spain Automotive Wiring Harness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, Others |

| Material Types Covered | Copper, Aluminum, Others |

| Transmission Types Covered | Data Transmission, Electrical Wiring |

| Vehicle Types Covered | Two Wheelers, Passenger Cars, Commercial Vehicles |

| Categories Covered | General Wires, Heat Resistant Wires, Shielded Wires, Tubed Wires |

| Components Covered | Connectors, Wires, Terminals, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain automotive wiring harness market size was valued at USD 1,440.64 Million in 2025.

The Spain automotive wiring harness market is expected to grow at a compound annual growth rate of 3.36% from 2026-2034 to reach USD 1,939.67 Million by 2034.

Chassis wiring harness dominated the market with a 34.94% share in 2025, driven by the increasing integration of advanced braking systems, electronic stability control, and sophisticated suspension technologies in modern vehicles.

Key factors driving the Spain automotive wiring harness market include the expansion of electric vehicle manufacturing infrastructure, the country's strategic position as Europe's second-largest vehicle producer, and supportive government policies including the MOVES III incentive program and Spain Auto 2030 initiative.

Major challenges include supply chain vulnerabilities and raw material constraints, high production costs associated with labor-intensive manufacturing processes, and uncertainties surrounding the pace of transition between internal combustion and electric powertrain technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)