Spain Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2026-2034

Spain Bancassurance Market Summary:

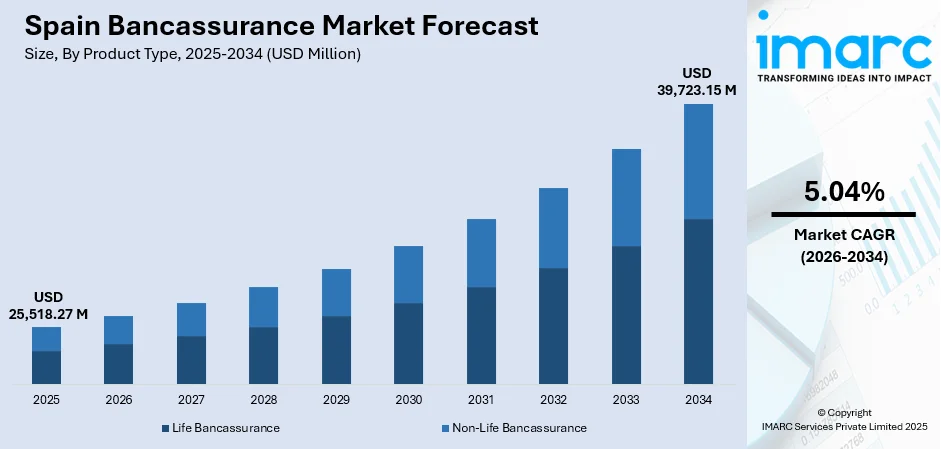

The Spain bancassurance market size was valued at USD 25,518.27 Million in 2025 and is projected to reach USD 39,723.15 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034.

The Spain bancassurance market is experiencing sustained growth driven by the increasing demand for integrated financial solutions and the expanding distribution networks of domestic banking institutions. Key factors propelling this expansion include growing consumer preference for convenient one-stop financial services and rising awareness of financial protection products. Additionally, the strategic collaboration between leading banks and insurance providers is enhancing product accessibility and customization, further augmenting the Spain bancassurance market share.

Key Takeaways and Insights:

- By Product Type: Life bancassurance dominates the market with a share of 75.14% in 2025, driven by strong demand for retirement planning products, wealth accumulation solutions, and the rising requirement for financial security among an aging population.

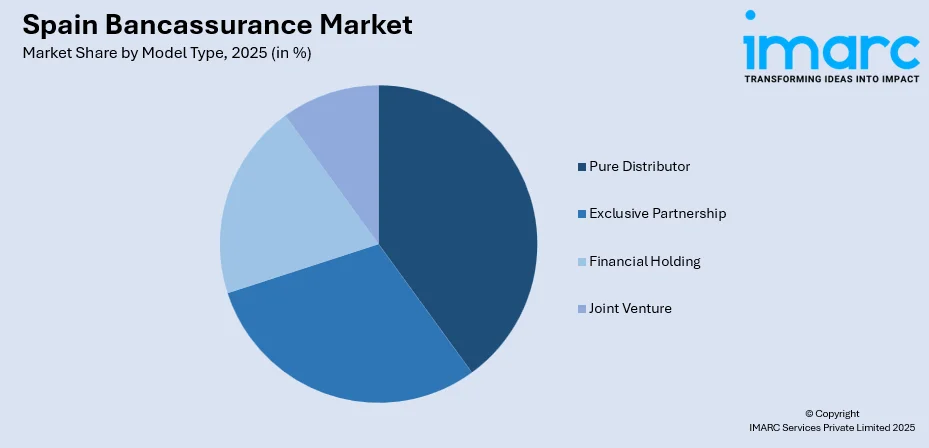

- By Model Type: Pure distributor leads the market with a share of 38.93% in 2025, owing to its operational simplicity, cost efficiency, and the ability of banks to focus on distribution excellence while minimizing insurance underwriting risks.

- Key Players: The Spain bancassurance market exhibits a moderately consolidated competitive structure, with major banking groups maintaining substantial market presence through established insurance subsidiaries and strategic partnerships with domestic and international insurers.

To get more information on this market Request Sample

The Spain bancassurance market represents a vital component of the nation's financial services ecosystem, with bank-affiliated insurers commanding approximately half of the country's insurance business. The integration of banking and insurance services through bancassurance channels contributes significantly to domestic bank profitability, representing a substantial portion of their earnings. Spanish banks leverage their extensive branch networks, established customer relationships, and digital platforms to distribute insurance products efficiently. The market benefits from Spain's mature financial infrastructure and the growing sophistication of consumer financial planning. For instance, the CaixaBank Group, serving over 20.4 million customers through more than 4,100 branches across Spain and Portugal, reported a net attributable profit of €1.47 billion in the first quarter, up from €1.01 billion in the same period the previous year, reflecting a 46.2% increase and a 6.9% rise on a like-for-like basis. The ongoing digital transformation of distribution channels and the development of personalized product offerings continue to enhance market growth prospects.

Spain Bancassurance Market Trends:

Digital Transformation of Bancassurance Distribution

Spanish financial institutions are ramping up their commitments to digital platforms and mobile solutions, prioritizing smoother customer interactions and streamlined internal processes. Banks and insurers are increasingly directing resources toward advanced online systems, improved app functionality, and automated service capabilities to boost convenience, strengthen engagement, and optimize overall operational performance. Banks are implementing artificial intelligence-powered tools for personalized product recommendations, streamlined underwriting processes, and instant policy issuance capabilities. Digital platforms enable convenient access to insurance products, simplified policy comparisons, and efficient claims processing. This technological evolution particularly resonates with younger consumers who prefer online interactions. For instance, Admiral Seguros and ING Spain launched the fully digital bancassurance product ING Orange Auto Insurance in June 2023, combining insurance capabilities with digital banking services to deliver flexible, integrated solutions for customers.

Expansion of Life Insurance Products for Aging Demographics

The demographic shift toward an aging population is driving strong demand for life insurance, annuities, and retirement planning products through bancassurance channels. Banks are creating comprehensive product suites that combine pension plans, senior protection coverage, and wealth transfer solutions to meet the financial security needs of older customers. This emphasis on retirement products aligns with ongoing pension system reforms, encouraging supplementary private savings and providing significant opportunities for bancassurance providers to expand their life insurance offerings. In Spain, the population of individuals aged over 65 has grown by 1.4 million over the past decade, rising from 8.25 million in 2013 to 9.69 million in 2023, marking an increase of 17.38%.

Strategic Deepening of Bank-Insurer Partnerships

Spanish banks and insurance companies are deepening their collaborative ties through expanded partnership agreements, joint ventures, and strategic equity arrangements. These alliances allow banks to enhance their product portfolios and generate additional fee-based income, while insurers gain access to broad customer bases and established distribution channels. Collaborations increasingly focus on joint technology initiatives, shared data analytics, and coordinated marketing campaigns, reinforcing long-term bancassurance partnerships and demonstrating continued commitment to the Spanish financial and insurance markets.

Market Outlook 2026-2034:

The Spain bancassurance market is positioned for continued expansion over the forecast period, supported by favorable demographic trends, digital innovation, and evolving consumer preferences for integrated financial services. Key growth catalysts include the ongoing digitalization of distribution channels, increasing penetration of life insurance products among aging populations, and the strengthening of strategic partnerships between banking and insurance sectors. The development of personalized product offerings leveraging data analytics and artificial intelligence capabilities will further enhance customer engagement and policy uptake across all market segments. The market generated a revenue of USD 25,518.27 Million in 2025 and is projected to reach a revenue of USD 39,723.15 Million by 2034, growing at a compound annual growth rate of 5.04% from 2026-2034.

Spain Bancassurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Life Bancassurance | 75.14% |

| Model Type | Pure Distributor | 38.93% |

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

Life Bancassurance dominates the market with a share of 75.14% of the total Spain bancassurance market in 2025.

The life bancassurance segment maintains its dominant position, driven by the strong alignment between banking products and long-term financial planning needs of customers. Life insurance products, including savings-linked policies, unit-linked investments, and traditional protection plans, are seamlessly integrated into banking customer journeys. The segment benefits from favorable tax treatment for retirement savings products and the trust consumers place in their banking relationships for wealth management decisions. Spanish banks leverage their deposit customer bases to cross-sell life insurance products, particularly annuities and pension plans that complement existing savings accounts and investment portfolios.

The growing awareness of retirement planning needs among Spanish households and the ongoing pension system reforms are accelerating demand for private savings solutions distributed through bancassurance channels. Premium income for individual life annuities has increased substantially in recent years, driven by higher interest rates making guaranteed return products more attractive compared to traditional bank deposits. Banks are investing in advisor training and digital tools to enhance their capability to offer comprehensive life insurance consultations, addressing customer needs for financial security across different life stages.

Model Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Pure distributor leads the market with a share of 38.93% of the total Spain bancassurance market in 2025.

The pure distributor model dominates the Spain bancassurance market due to its operational simplicity and clear separation of risks between banking and insurance functions. Under this arrangement, banks focus exclusively on distribution and customer relationship management, earning commission income without assuming insurance underwriting risks. This model appeals to banks seeking to diversify revenue streams while maintaining their core banking focus and capital allocation strategies. The approach enables banks to partner with multiple insurers and offer diversified product portfolios tailored to different customer segments.

The pure distributor model provides flexibility for banks to respond to changing market conditions and customer preferences by adjusting their insurance product offerings without significant capital commitments. Banks benefit from lower regulatory complexity compared to integrated models while still generating substantial fee income from insurance distribution activities. The growing emphasis on digital distribution capabilities is further enhancing the efficiency of pure distributor arrangements, enabling banks to scale their insurance sales through online and mobile channels while maintaining lean operational structures.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain benefits from high urbanization and strong economic activity in regions like Basque Country and Galicia. Rising financial literacy and growing awareness of insurance products drive demand for life, health, and property coverage through banks. Established branch networks and expanding digital banking platforms allow banks to efficiently distribute insurance. Consumers increasingly prefer integrated financial solutions, while supportive regulations and trust in banks reinforce the adoption of bancassurance products.

Eastern Spain, including Catalonia and Valencia, sees bancassurance growth due to robust industrial and service-sector activity. Banks leverage strong customer relationships and digital channels to cross-sell insurance products, especially life, health, and investment-linked solutions. Increasing financial awareness among households and businesses, coupled with rising demand for comprehensive financial protection, strengthens bancassurance adoption. Regional economic dynamism and supportive regulatory frameworks further encourage banks to expand their insurance offerings.

Southern Spain’s bancassurance market is driven by a mix of tourism, agriculture, and urban economic growth. Banks utilize branch networks and digital platforms to reach diverse customer segments with life, health, and property insurance. Growing awareness of financial security, combined with rising household income and regulatory encouragement, supports product uptake. Consumers increasingly seek convenience and trust in banking channels, making bancassurance an attractive distribution model in the region.

Central Spain, anchored by Madrid, is a key driver of bancassurance due to its concentration of financial institutions, corporate clients, and affluent households. Banks capitalize on extensive branch networks, digital channels, and high financial literacy to offer comprehensive insurance solutions. Demand is fueled by consumer preference for integrated financial services, regulatory support for transparent practices, and the adoption of life, health, and property insurance through trusted banking partners.

Market Dynamics:

Growth Drivers:

Why is the Spain Bancassurance Market Growing?

Increasing Demand for Integrated Financial Solutions

Spanish consumers are increasingly seeking comprehensive financial services that address their banking and insurance needs through unified provider relationships. The preference for one-stop financial solutions reflects changing consumer expectations for convenience, simplified account management, and coordinated financial planning. Banks are well-positioned to meet this demand by offering seamless access to insurance products alongside deposit accounts, mortgages, and investment services. The integration of insurance into banking customer journeys reduces friction in the purchasing process and enables more effective cross-selling opportunities. Major Spanish banks have invested substantially in developing unified customer platforms that present banking and insurance products cohesively. CaixaBank, for example, serves over 20.4 million customers through an integrated approach, with its bancassurance operations contributing significantly to overall group profitability and customer retention.

Aging Population Driving Life Insurance Demand

Spain's demographic transition toward an older population structure is creating substantial demand for life insurance, retirement planning, and wealth transfer products. The aging demographic profile increases the priority consumers place on financial security, healthcare coverage, and legacy planning, all of which are effectively addressed through bancassurance product offerings. Banks are developing specialized product suites targeting the senior population segment, including annuity products, long-term care coverage, and estate planning solutions. The pension system reforms encouraging private retirement savings are further accelerating demand for supplementary savings products distributed through bancassurance channels.

Extensive Bank Branch Distribution Networks

The well-established branch networks of Spanish banks provide effective distribution infrastructure for insurance products, enabling access to customers across diverse geographic areas. Bank branches serve as trusted points of contact where customers can receive personalized advice on insurance products alongside their regular banking transactions. The physical presence of bank branches complements digital distribution channels, offering omnichannel access that addresses varying customer preferences for insurance purchasing. Bank relationship managers leverage their understanding of customer financial profiles to recommend appropriate insurance products, enhancing conversion rates and customer satisfaction. The extensive branch networks also enable banks to serve customers in smaller municipalities and rural areas where standalone insurance distribution may be limited, contributing to broader insurance penetration across the Spanish market.

Market Restraints:

What Challenges the Spain Bancassurance Market is Facing?

Regulatory Compliance Burden

The bancassurance sector operates within a complex regulatory environment encompassing banking supervision, insurance regulation, and consumer protection requirements. Compliance with evolving frameworks, including the Insurance Distribution Directive, Solvency II capital requirements, IFRS 17 accounting standards, and data protection regulations, creates operational challenges and cost pressures. Banks and insurers must invest continuously in compliance infrastructure, staff training, and reporting capabilities to meet regulatory expectations.

Competition from Digital-Only Insurers

The emergence of insurtech companies and digital-only insurance platforms is introducing new competitive dynamics in the Spanish insurance market. These digital competitors often offer streamlined purchasing experiences, competitive pricing, and innovative product features that appeal to digitally-savvy consumers. Traditional bancassurance providers face pressure to accelerate their digital transformation initiatives to maintain relevance and competitiveness against agile digital entrants.

Evolving Customer Expectations for Digital Services

Consumer expectations for digital convenience and instant service delivery are continually rising, creating pressure on bancassurance providers to enhance their digital capabilities. Customers increasingly expect seamless online purchasing, instant policy issuance, and digital claims processing that matches their experiences with other financial services. Meeting these expectations requires substantial investment in technology infrastructure, digital product development, and process automation.

Competitive Landscape:

The Spain bancassurance market exhibits a moderately consolidated structure characterized by the dominant presence of major banking groups operating through captive insurance subsidiaries and strategic partnerships. Leading players leverage their extensive customer bases, established brand recognition, and comprehensive branch networks to maintain competitive advantages. The market features diverse partnership arrangements ranging from exclusive distribution agreements to joint ventures and financial holding structures. Competition increasingly centers on digital capabilities, product innovation, and customer experience enhancement. Banks are investing in technology platforms, data analytics tools, and advisor training to differentiate their bancassurance offerings and improve sales effectiveness across distribution channels.

Recent Developments:

-

October 2025: Zurich Insurance increased its stake in Banco Sabadell to 3%, becoming the fourth-largest shareholder in the Spanish bank. This investment reinforces Zurich's longstanding bancassurance joint venture with Sabadell, through which the bank distributes Zurich's insurance products across its branch network under an exclusive distribution agreement.

Spain Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain bancassurance market size was valued at USD 25,518.27 Million in 2025.

The Spain bancassurance market is expected to grow at a compound annual growth rate of 5.04% from 2026-2034 to reach USD 39,723.15 Million by 2034.

Life bancassurance held the largest market share at 75.14% in 2025, driven by strong demand for retirement planning products, wealth accumulation solutions, and financial security needs among the aging population.

Key factors driving the Spain bancassurance market include increasing demand for integrated financial solutions, aging population demographics driving life insurance uptake, extensive bank branch distribution networks, and ongoing digital transformation of distribution channels.

Major challenges include complex regulatory compliance requirements encompassing banking and insurance regulations, competition from digital-only insurers and insurtech companies, evolving customer expectations for seamless digital experiences, and the need for substantial technology investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)