Spain Biochip Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2026-2034

Spain Biochip Market Summary:

The Spain biochip market size was valued at USD 403.13 Million in 2025 and is projected to reach USD 936.72 Million by 2034, growing at a compound annual growth rate of 9.82% from 2026-2034.

The Spain biochip market is experiencing robust growth, driven by substantial government investments in biotechnology research and development (R&D), a highly skilled workforce specializing in biotech innovations, and growing demand for personalized medicine and diagnostics. The expanding network of biotechnology firms and research institutions, particularly concentrated in Catalonia and Madrid, is fostering technological advancements and accelerating the commercialization of biochip technologies.

Key Takeaways and Insights:

-

By Type: Lab-on-chip dominates the market with a share of 32% in 2025, owing to its exceptional miniaturization capabilities, integration of multiple laboratory functions onto a single chip, and growing adoption in point-of-care (POC) diagnostics. Rising demand for rapid testing solutions is fueling the market expansion.

-

By End-Use: Biotechnology and pharmaceutical companies lead the market with a share of 35% in 2025. This dominance is driven by extensive R&D investments, increasing adoption of biochips for drug discovery, and growing applications in personalized medicine development across Spanish pharmaceutical enterprises.

-

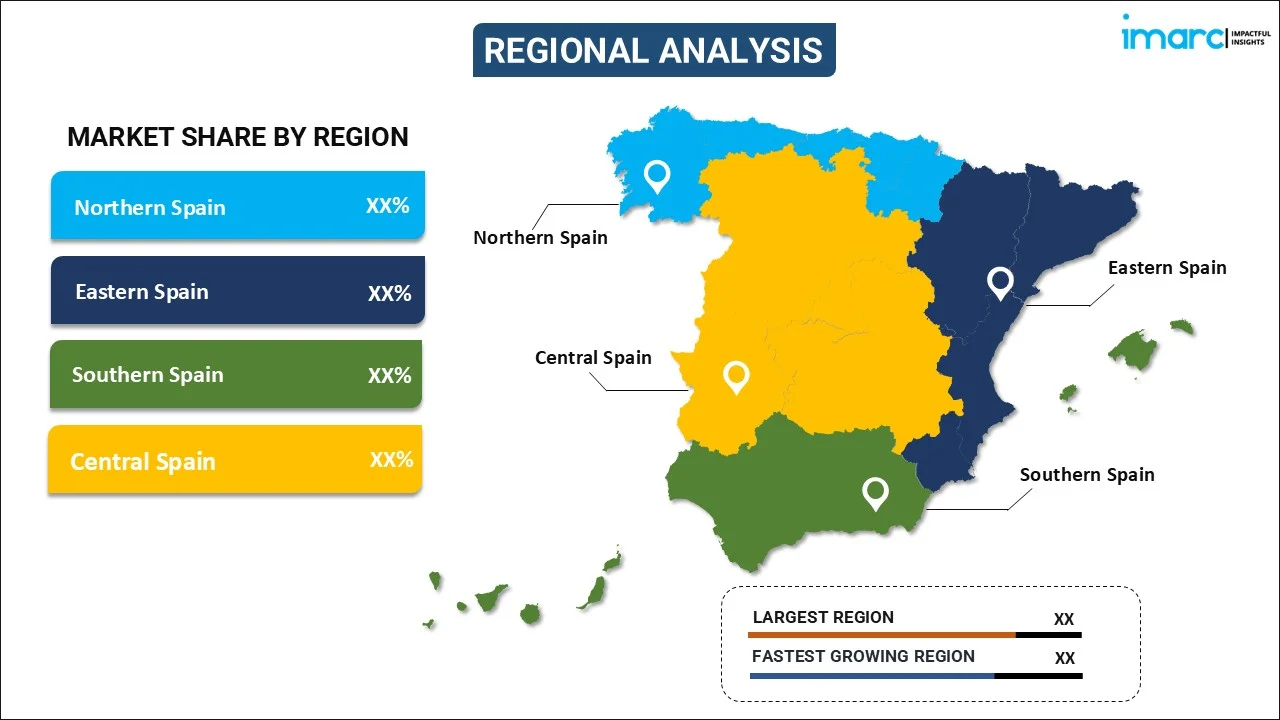

By Region: Central Spain represents the largest region with 34% share in 2025, driven by the concentration of major pharmaceutical companies and research institutions in Madrid metropolitan area, higher healthcare spending enabling advanced diagnostic adoption, and robust government support for biotechnology innovation.

-

Key Players: Key players drive the Spain biochip market by expanding product portfolios, advancing microfluidic and lab-on-chip technologies, and strengthening partnerships with research institutions. Their investments in precision diagnostics, personalized medicine platforms, and collaborations with healthcare providers boost innovation and accelerate market adoption.

The Spain biochip market demonstrates dynamic growth fueled by the country's strategic positioning as a biotechnology hub within Europe. In 2024, Spain was home to 4,411 companies involved in biotech activities, with more than 1,000 identified as biotech firms, serving as research, development, and production centers for biochips. The government has significantly financed biotech ventures, with most projects targeted towards diagnostics and personalized medicine due to the focus on cutting-edge healthcare solutions. The robust investment ecosystem, combined with Spain's highly qualified human capital and extensive network of public and private hospitals, creates a favorable environment for biochip technology development and commercialization, positioning Spain as a prime player in the international biotechnology industry. Additionally, the rise in medical tourism is boosting demand for quality medical care, prompting healthcare professionals to invest in cutting-edge diagnostic equipment that satisfies global standards and patient demands.

Spain Biochip Market Trends:

Increasing Adoption of POC Diagnostics

The Spain biochip market is witnessing significant adoption of POC diagnostic technologies, driven by the need for rapid and accurate testing at patient bedside or remote locations. Lab-on-chip devices are revolutionizing diagnostic approaches by enabling decentralized testing that reduces turnaround times and improves patient outcomes. Healthcare facilities across Spain are increasingly investing in portable biochip platforms that can perform multiple biochemical analyses simultaneously, minimizing sample requirements while maximizing diagnostic efficiency for chronic disease monitoring and infectious disease screening.

Integration of Artificial Intelligence (AI) in Biochip Analysis

The integration of AI and machine learning (ML) technologies into biochip platforms is emerging as a transformative trend in the Spain biochip market. AI-powered analysis systems are enhancing the interpretation of complex biological signals from microarrays and lab-on-chip devices, improving diagnostic accuracy while reducing analysis time. Spanish research institutions are increasingly leveraging AI to develop intelligent neuromodulation systems and advanced diagnostic platforms, with healthcare startups in Catalonia alone receiving EUR 347 Million in investment during 2024, demonstrating strong momentum in technology-driven healthcare innovation.

Expansion of Personalized Medicine Applications

Personalized medicine is gaining significant traction in Spain, driving the demand for advanced biochip technologies that enable tailored therapeutic approaches. Deoxyribonucleic acid (DNA) microarrays and protein chips are increasingly utilized for genetic profiling, biomarker identification, and pharmacogenomics applications that help clinicians select optimal treatments based on individual patient characteristics. This trend is further supported by rising investments in precision healthcare initiatives and increasing awareness about the benefits of individualized treatment strategies. As per IMARC Group, the Spain precision medicine market is set to attain USD 4.18 Billion by 2033, exhibiting a growth rate (CAGR) of 11.87% during 2025-2033

Market Outlook 2026-2034:

The Spain biochip market outlook remains highly positive, underpinned by continued government investments in biotechnology research, expanding applications in clinical diagnostics, and growing pharmaceutical industry demand for advanced analytical platforms. The market generated a revenue of USD 403.13 Million in 2025 and is projected to reach a revenue of USD 936.72 Million by 2034, growing at a compound annual growth rate of 9.82% from 2026-2034. The market is expected to benefit from increasing adoption of lab-on-chip technologies for POC testing, rising investments in genomics research, and growing integration of biochips in drug discovery processes. Spain's position as a leading clinical trial destination in Europe further strengthens the demand for sophisticated biochip-based diagnostic and research platforms.

Spain Biochip Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Lab-on-Chip | 32% |

| End-Use | Biotechnology and Pharmaceutical Companies | 35% |

| Region | Central Spain | 34% |

Type Insights:

.webp)

To get detailed segment analysis of this market, Request Sample

- DNA Chips

- Cancer Diagnosis and Treatment

- Gene Expression

- SNP Genotyping

- Genomics

- Drug Discovery

- Agricultural Biotechnology

- Others

- Protein Chips

- Proteomics

- Expression Profiling

- Diagnostics

- HTS

- Drug Discovery

- Others

- Lab-on-chip

- Genomics

- IVD and POC

- Proteomics

- Drug Discovery

- Others

- Tissue Arrays

- Cell Arrays

Lab-on-chip dominates with a market share of 32% of the total Spain biochip market in 2025.

Lab-on-chip technology has emerged as the leading segment in the Spain biochip market, driven by its transformative capabilities in miniaturizing complex laboratory procedures onto single integrated platforms. These devices offer exceptional advantages in terms of reduced sample volumes, faster analysis times, and decreased reagent consumption, making them increasingly attractive for clinical and research applications. The technology enables simultaneous processing of multiple samples with high precision, addressing the growing need for efficient diagnostic solutions that can deliver rapid results at the point of care.

The dominance of lab-on-chip technology is further reinforced by increasing adoption in genomics, in-vitro diagnostics, and proteomics applications across Spanish healthcare facilities. Spanish research institutions are actively developing microfluidic biochip technology for analyzing isolated samples and advancing POC testing capabilities. The integration of lab-on-chip devices with AI and Internet of Things (IoT) technologies is enhancing real-time data processing and remote monitoring capabilities, positioning Spain as a key adopter of next-generation diagnostic platforms that support decentralized healthcare delivery models.

End-Use Insights:

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostics Centers

- Academic and Research Institutes

- Others

Biotechnology and pharmaceutical companies lead with a share of 35% of the total Spain biochip market in 2025.

Biotechnology and pharmaceutical companies represent the largest end use segment in the Spain biochip market, driven by extensive R&D investments and the critical role of biochips in drug discovery and development processes. These organizations extensively utilize DNA chips, protein chips, and lab-on-chip platforms for high-throughput screening of chemical compounds, biomarker research, and toxicity testing during lead identification stages. Spain hosts numerous biotechnology companies, with many leading the healthcare industry through innovative diagnostics and therapeutic products.

The pharmaceutical industry's leadership in biochip adoption is further evidenced by Spain's position as one of the top participants in clinical trials within Europe. Pharmaceutical companies account for nearly 80% of all clinical trials conducted in Catalonia, with oncology representing 32% of these trials in 2024. The growing emphasis on pharmacogenomics to study individual variability in drug response and design personalized therapies is accelerating biochip integration across Spanish pharmaceutical enterprises, supporting more efficient drug development pipelines and improved therapeutic outcomes.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Central Spain exhibits a clear dominance with a 34% share of the total Spain biochip market in 2025.

Central Spain, anchored by the Madrid metropolitan area, leads the biochip market owing to its concentration of major pharmaceutical companies, research institutions, and government healthcare facilities. The region benefits from substantial biotechnology infrastructure, including the Madrid Science Park that encompasses diverse disciplines including nanotechnology and life sciences research. Central Spain's strategic position as the nation's capital attracts significant foreign direct investment (FDI) in healthcare and biotechnology sectors, facilitating advanced diagnostic technology adoption across public and private healthcare networks.

The dominance of Central Spain is reinforced by the presence of leading international pharmaceutical companies establishing R&D centers in the region. Madrid hosts numerous biotech startups focused on personalized medicine and diagnostic innovation, supported by government funding programs and favorable regulatory policies. The region's extensive network of hospitals and research institutions provides robust demand for biochip technologies, while its highly qualified workforce and cutting-edge technological infrastructure create an enabling environment for biochip market expansion.

Market Dynamics:

Growth Drivers:

Why is the Spain Biochip Market Growing?

Rising Prevalence of Chronic and Genetic Diseases

The growing incidence of chronic and genetic disorders in Spain is significantly driving the biochip market. Conditions, such as cardiovascular diseases, cancer, diabetes, and rare genetic syndromes, require precise diagnostic and monitoring tools to improve patient outcomes. As per REDECAN, in Spain, the estimated total number of cancer cases for 2024 was 286,664, with 161,678 in men and 124,986 in women. Biochips offer high-throughput, sensitive, and specific detection of disease-associated genes, proteins, and biomarkers, facilitating early diagnosis and personalized treatment planning. The increasing disease burden has prompted healthcare providers and laboratories to adopt biochip-based assays for screening, prognosis, and therapy monitoring. Additionally, public health initiatives emphasize preventive care and early detection, boosting demand for rapid, cost-effective, and scalable diagnostic technologies. Pharmaceutical companies also leverage biochips to identify therapeutic targets and stratify patient populations in clinical trials, enhancing drug development efficiency. The combination of rising disease prevalence and growing clinical demand ensures that biochips remain integral to Spain’s healthcare infrastructure.

Technological Advancements in Biochip Platforms

The growth of the biochip market in Spain is largely driven by technological innovations. The sensitivity, precision, and multiplexing capabilities of biochips have been enhanced by developments in microfabrication, nanotechnology, and lab-on-a-chip systems, enabling the simultaneous investigation of thousands of genetic and protein targets. In clinical diagnostics and research, integration with digital health tools, automated platforms, and AI improves data interpretation and speeds up decision-making. POC testing is made possible by tiny, portable biochips, which improve patient accessibility and turnaround times in hospitals and distant areas. Better manufacturing methods also lower production costs, increasing the financial viability of biochips for extensive clinical use. By fostering partnerships between biotech firms, academic institutions, and healthcare providers, ongoing innovations broaden the scope of applications in proteomics, genomics, and drug discovery. High-performance, adaptable, and user-friendly biochip systems are becoming more necessary in Spanish labs and hospitals, and continuous technical improvements continue to be a key factor driving the market expansion and competitive differentiation.

Supportive Government Policies and Funding Initiatives

The biochips market in Spain is largely fueled by funding projects and favorable government policies. Research institutions, hospitals, and industry players developing biochip technology are supported in terms of funding, tax exemptions, and infrastructure assistance through national and regional initiatives focused on supporting biotechnology, genomic studies, and genomic medicine. Spain's participation in European Union initiatives makes it relatively easy to secure substantial funding for research and collaborations for global cooperation. The market is encouraged by initiatives to use highly advanced diagnostic devices in healthcare and medical laboratories. Moreover, the commercialization of biochips is made better by government policies supporting the rapid approval of new diagnostic platforms. Additionally, general acceptance of biochips in Spain is ensured through public and government-backed biobanks, genetic databases, and collaborations involving public and private institutions aimed at rapidly advancing biochip technology. All these factors combined make investment in biochips relatively risk-free in Spain.

Market Restraints:

What Challenges the Spain Biochip Market is Facing?

High Initial Investment and Operational Costs

Widespread market acceptance is severely hampered by the high costs of developing, producing, and using biochip technology. Many smaller healthcare facilities and research institutes find it difficult to meet the upfront capital needs due to the difficulty of designing and manufacturing biochips, which calls for specialized equipment and knowledge.

Complex Regulatory Framework and Approval Processes

Market participants face uncertainty due to the absence of established regulatory requirements for biochip-based diagnostic testing services. Healthcare providers may be reluctant to adopt biochip technology widely due to regulatory uncertainties surrounding genetic data privacy and clinical validation requirements, which can also hinder product approvals and increase compliance burdens.

Data Interpretation and Bioinformatics Infrastructure Challenges

Analyzing large genomic and proteomic datasets generated by biochips requires specialized bioinformatics expertise and robust information technology infrastructure that may be lacking in many Spanish healthcare settings. The complexity of interpreting this data accurately for clinical application can slow diagnostic turnaround times and increase adoption barriers, inhibiting the growth of the market.

Competitive Landscape:

The Spain biochip market features a competitive landscape, comprising global diagnostics leaders, specialized biotechnology firms, and emerging local innovators. Major international players maintain significant market presence through established distribution networks, comprehensive product portfolios spanning DNA chips, protein arrays, and lab-on-chip platforms, and strategic partnerships with Spanish healthcare institutions. These companies emphasize continuous innovations, regulatory compliance, and integration of advanced technologies, including AI, to enhance diagnostic capabilities. Local biotechnology startups and research spin-offs contribute to market dynamism through specialized applications and novel microfluidic technologies. Competitive strategies focus on expanding clinical validation, strengthening collaborations with research institutions, and developing cost-effective solutions that address specific regional healthcare requirements.

Spain Biochip Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End-Uses Covered | Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostics Centers, Academic & Research Institutes, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain biochip market size was valued at USD 403.13 Million in 2025.

The Spain biochip market is expected to grow at a compound annual growth rate of 9.82% from 2026-2034 to reach USD 936.72 Million by 2034.

Lab-on-chip dominated the market with a share of 32%, driven by its miniaturization capabilities, integration of multiple laboratory functions, and growing adoption in POC diagnostic applications in Spain.

Key factors driving the Spain biochip market include substantial government investments in biotechnology research, growing demand for personalized medicine, expanding biotechnology infrastructure, and increasing adoption of POC diagnostics.

Major challenges include high initial investment and operational costs, complex regulatory frameworks and approval processes, data interpretation complexities requiring specialized bioinformatics expertise, and infrastructure requirements for advanced genomic analysis platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)