Spain Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2026-2034

Spain Bottled Water Market Summary:

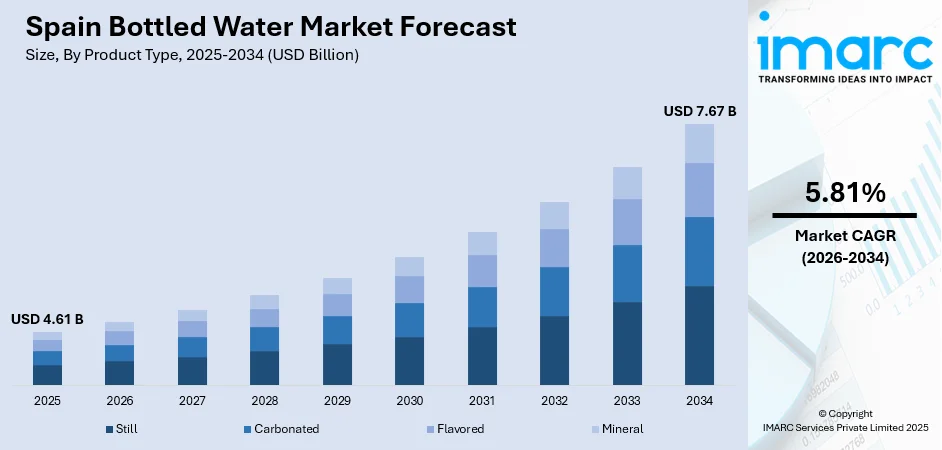

The Spain bottled water market size was valued at USD 4.61 Billion in 2025 and is projected to reach USD 7.67 Billion by 2034, growing at a compound annual growth rate of 5.81% from 2026-2034.

The market is experiencing robust expansion driven by heightened health consciousness among the masses, the country's thriving tourism sector, and increasing preference for natural mineral water over sugary beverages. Spain's warm Mediterranean climate and regional variations in tap water quality continue to fuel consistent demand, particularly during extended summer seasons when both domestic consumption and tourist activity peak. Additionally, the growing emphasis on sustainable packaging solutions and premium product offerings are reshaping consumer purchasing decisions across supermarkets, convenience stores, and on-trade channels, further expanding the Spain bottled water market share.

Key Takeaways and Insights:

-

By Product Type: Still dominates the market with a share of 38% in 2025, valued for natural purity, versatility, and universal appeal across consumer demographics.

-

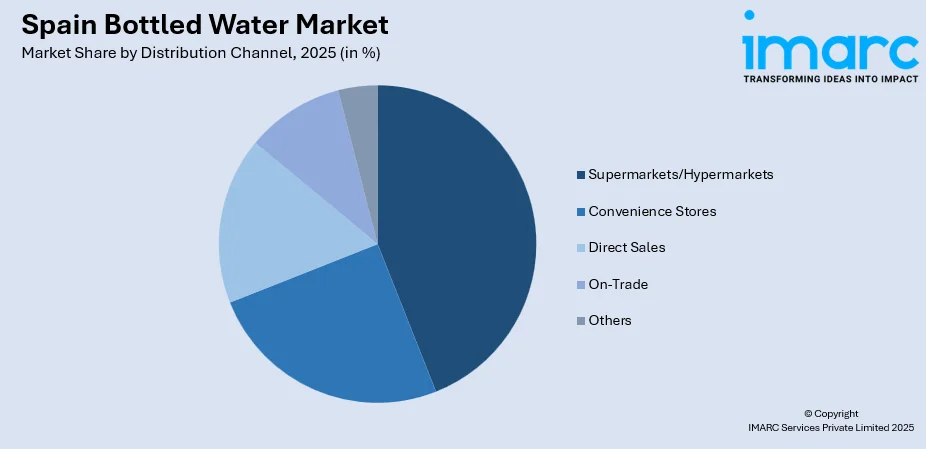

By Distribution Channel: Supermarkets/hypermarkets lead the market with a share of 44% in 2025, offering competitive pricing, wide selection, and convenient one-stop shopping experiences for families.

-

By Packaging Type: PET bottles represent the largest segment with a market share of 67% in 2025, preferred for lightweight portability, recyclability, transparency, and multi-size format versatility options.

-

By Region: Central Spain leads the market with a share of 35% in 2025, driven by Madrid's dense population, strong economy, and year-round consumption patterns.

-

Key Players: Leading companies in Spain’s bottled water market are strengthening growth by innovating product ranges, investing in sustainable packaging, improving distribution networks, and enhancing brand positioning to align with health trends, environmental awareness, and changing consumer preferences.

To get more information on this market Request Sample

The market for bottled water in Spain is influenced by consumer preferences that focus on health and green aspects. Moreover, Spanish consumers are now drawn to natural spring water and mineral-enriched variants due to their perceived better functionality and compatibility for meeting health aims and needs. The tourism industry is crucial and makes significant contributions to this market as Spain hosted 85.6 million foreign visitors in 2025. This is often responsible for creating a massive demand for convenient drinking solutions in areas where tourists visit large numbers, such as coastal areas and metropolitan cities. For example, Aquadeus showed tremendous performance in 2024 as it raised its overall sales by 15% to reach €75.5 million and produced 600 million liters of bottled water.

Spain Bottled Water Market Trends:

Rising Demand for Premium and Functional Water

The premium and functional bottled water market is witnessing rapid growth, as consumers in Spain demand advanced hydration experiences, moving beyond refreshing drinking water. Electrolyte, mineral, and alkaline-enhanced, and naturally flavored functional waters find acceptance with health-aware groups such as athletes, health practitioners, and city professionals. The functional water market has much appeal to younger consumers, interested in taste innovations and health attributes, which give brands leverage to quote premium pricing through their value-enhancing and sophisticated marketing communications highlighting purity, origins, and wellness attributes. In the year 2024, Beloka Water presented its premium water, of which the sources lie deep within the Snowy Mountains of Australia, in the Fine Waters Water Tasting Competition, which took place on April 26th, 2024, in San Sebastián, Spain.

Sustainability and Eco-Friendly Packaging Initiatives

Environmental awareness is currently driving a change in the way the bottled water industry in Spain packages its products, with consumers, especially millennials and Generation Z, highly valuing the sustainability of the products they buy. Manufacturers have therefore started adopting measures that include the use of recyclable PET packaging, the use of recycled materials, lightweight packaging designs with reduced plastic use, and the search for biodegradable substitutes. The Spanish Parliament, on March 31, 2022, passed the ‘Law on Waste and Contaminated Soil for a Circular Economy,’ which specifically bans the use of phthalates and bisphenol A (BPA, CAS 80-05-7) in packaging, and actively favors the use of reusable packaging in the food sector, while setting clear targets with the intention of generally diminishing the amount of waste and single-use plastic specifically. These measures are following the necessary harmonized approaches set by the EU, which currently requires strict compliance with packaging standards.

Growth of Flavored and Sparkling Water Categories

Flavored and sparkling bottled water markets are also growing fast, as consumers increasingly look for alternatives to traditional non-stilled and sweet drinks. Natural fruit flavors, herbal notes, and exotic mixes entice consumers with their taste preferences without compromising on the low calorie count, making them fit the bill for health and wellness. As per the Global Atlas of Obesity, the prevalence of obesity for the year 2035 is expected to remain high or very high for both adults and children in Spain. This is also making them more conscious about their own consumption behavior and preferences. The perceived premium aspect and health benefits associated with sparkling water analyzes the benefits it holds for the on-trade customer, as it is considered a premium option to soft drinks as such. Spanish manufacturers are working on innovation and unique packaging solutions for tapping into the share for these premium markets, with global brands such as Nestlé's San Pellegrino launching new flavor lines for maintaining their positioned growth and premiumism across the European markets.

Market Outlook 2026-2034:

The Spain bottled water market is poised for sustained growth, driven by continued health awareness campaigns, tourism recovery and expansion, urbanization patterns, and evolving retail distribution networks. The market generated a revenue of USD 4.61 Billion in 2025 and is projected to reach a revenue of USD 7.67 Billion by 2034, growing at a compound annual growth rate of 5.81% from 2026-2034. The market will continue to benefit from innovations in sustainable packaging, premium product development, and digital commerce channels that enhance accessibility and consumer engagement across demographic segments.

Spain Bottled Water Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Still | 38% |

| Distribution Channel | Supermarkets/Hypermarkets | 44% |

| Packaging Type | PET Bottles | 67% |

| Region | Central Spain | 35% |

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

Still dominates with a market share of 38% of the total Spain bottled water market in 2025.

Still bottled water dominates the Spain market with commanding presence across all consumer segments due to its fundamental alignment with everyday hydration requirements and universal appeal as the purest water form. Spanish consumers consistently prefer still water for its natural taste profile, perceived health benefits, and versatility across multiple consumption occasions including home, workplace, sports activities, and dining experiences. The segment's market leadership stems from comprehensive distribution coverage, competitive price positioning relative to carbonated and flavored alternatives, and strong brand loyalty cultivated through decades of consumer trust in established mineral water sources.

Still water variants particularly resonate with health-conscious demographics who value transparent mineral content disclosure and geographic provenance that connects products to specific Spanish springs and aquifers. Regional producers leverage local spring heritage to develop authentic brand narratives emphasizing terroir, traditional extraction methods, and mineral composition uniqueness. The segment benefits from year-round stable demand patterns, lower production costs compared to carbonated varieties, and broad demographic appeal spanning all age groups and income levels.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

Supermarkets/hypermarkets lead with a share of 44% of the total Spain bottled water market in 2025.

Supermarkets and hypermarkets maintain dominant market positioning through extensive geographic penetration across urban and suburban Spanish communities, offering consumers convenient access to comprehensive bottled water assortments within familiar shopping environments that facilitate regular purchasing patterns. These large-format retailers leverage substantial buying power to negotiate favorable supplier terms, enabling competitive pricing strategies and frequent promotional activities that attract value-conscious households seeking economical family-sized formats and multi-pack configurations. The channel provides manufacturers with critical shelf visibility, strategic end-cap placements, and integrated marketing opportunities that build brand awareness and drive impulse purchases during routine grocery shopping trips.

Modern supermarket chains increasingly emphasize private label water offerings that deliver quality assurance at lower price points, creating competitive pressure that benefits consumers while challenging branded manufacturers to differentiate through premium positioning, functional innovations, or sustainability credentials. Additionally, supermarkets serve as educational touchpoints where product labeling, in-store demonstrations, and promotional campaigns communicate health benefits, mineral content, and source provenance information that influence purchasing decisions and build category knowledge among Spanish consumers.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

PET bottles exhibit a clear dominance with a 67% share of the total Spain bottled water market in 2025.

PET bottle packaging commands dominant market share through optimal integration of consumer convenience attributes and practical distribution advantages that satisfy both retail efficiency requirements and end-user lifestyle needs. The format's lightweight construction significantly reduces transportation costs and carbon emissions while enabling easy handling for consumers across age demographics, from elderly individuals requiring manageable weight to active professionals seeking portable hydration solutions. Transparency inherent to PET material allows visual product inspection, building consumer confidence in purity and quality while facilitating brand differentiation through colored tints and innovative bottle designs that enhance shelf appeal.

The packaging format's shatter-resistant properties ensure safety during transport, storage, and consumption, eliminating glass-related hazards particularly important for outdoor activities, sports venues, and family settings. Recent industry innovations focus on increasing recycled PET content ratios, reducing wall thickness through advanced molding technologies, and developing plant-based PET alternatives that address environmental concerns while maintaining structural integrity. Size versatility represents another competitive advantage, with PET enabling economical production across formats from single-serve portions to multi-liter household containers that accommodate diverse consumption occasions and purchasing preferences throughout Spanish market segments.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Central Spain leads with a share of 35% of the total Spain bottled water market in 2025.

Central Spain, anchored by Madrid metropolitan area and surrounding provinces, represents the largest regional market through concentrated population density exceeding six million residents, robust economic activity generating high disposable incomes, and sophisticated consumer behaviors that favor premium and functional water categories. The region's mature retail infrastructure encompasses extensive supermarket networks, modern convenience store chains, and thriving hospitality sectors that ensure comprehensive product availability and competitive market dynamics. Madrid's position as Spain's political and business capital attracts substantial corporate presence, creating significant workplace consumption through office delivery channels and commercial foodservice establishments that serve professional demographics.

Year-round stable demand patterns distinguish Central Spain from coastal regions experiencing pronounced seasonal fluctuations, enabling manufacturers to optimize production planning and distribution logistics. The capital's international tourism appeal, drawing millions of business travelers and cultural visitors annually, supplements domestic consumption and drives premium product uptake in hotels, restaurants, and tourist venues. Urban consumers demonstrate heightened health consciousness, environmental awareness, and willingness to experiment with functional and flavored variants, making Central Spain a strategic test market for product innovations and premium positioning strategies.

Market Dynamics:

Growth Drivers:

Why is the Spain Bottled Water Market Growing?

Increasing Health Consciousness and Wellness Trends

The Spanish population is experiencing a fundamental shift toward health-conscious lifestyles, with consumers actively seeking hydration solutions that support wellness objectives and nutritional goals beyond basic thirst quenching. This transformation is evidenced by declining consumption of sugary beverages and growing preference for natural, mineral-rich bottled water that provides perceived health benefits without added calories, artificial sweeteners, or chemical additives. Medical and nutritional guidance increasingly emphasizes proper hydration's role in metabolic health, cognitive function, and physical performance, creating favorable market conditions for bottled water as the preferred healthy beverage category. Spanish consumers across age demographics, particularly millennials and health-focused professionals, are willing to pay premium prices for products that deliver functional benefits, natural mineral content, and provenance transparency, driving market value growth alongside volume expansion. The wellness trend extends beyond individual health to encompass environmental consciousness, prompting brands to develop sustainable packaging solutions that resonate with consumers' holistic lifestyle values and ethical purchasing criteria. The Spain health and wellness market is projected to attain USD 91.18 Billion by 2033, as per the predictions of IMARC Group.

Robust Tourism Industry Driving Seasonal Demand

Spain's tourism sector stands as a cornerstone growth driver, with the country maintaining its position as the world's second-most visited destination, attracting international visitors annually who generate substantial bottled water consumption throughout their stays. Spain saw a historic 94 million foreign visitors in 2024, marking its most successful tourism year ever. This 10 percent rise from 2023 produced earnings of 126 billion euros. Tourist activity creates pronounced seasonal demand peaks during summer months and holiday periods when visitors seek convenient, portable hydration solutions while exploring cities, beaches, cultural sites, and recreational attractions. The hospitality industry, including hotels, restaurants, airports, and tourist venues, depends heavily on bottled water to meet quality expectations of international guests accustomed to consistent taste and purity standards.

Growing Preference for Natural Mineral and Spring Water

Spanish consumers are demonstrating increasing affinity for natural mineral water and spring water variants that emphasize provenance, mineral composition, and authentic source credentials over generic purified alternatives. This preference reflects broader consumer trends valuing naturalness, terroir, and traditional production methods that connect products to specific geographic origins and heritage narratives. Mineral-rich waters are perceived as offering superior health benefits through essential mineral content including calcium, magnesium, and potassium that support bodily functions and nutritional requirements. Spanish brands leverage regional spring sources to develop compelling brand stories that resonate with national pride and local authenticity, creating emotional connections with consumers who value supporting domestic producers and regional economies. The shift toward natural mineral water also aligns with premiumization dynamics as consumers are willing to pay higher prices for products that deliver demonstrable quality, purity, and wellness attributes beyond basic hydration. In 2024, Fertiberia persists created a water treatment grade ammonia, mainly designed for applications in processes that clean water for human consumption. Fertiberia is the top ammonia producer in Spain and is undergoing a transformation to spearhead the advancement of low carbon ammonia within the European Union.

Market Restraints:

What Challenges the Spain Bottled Water Market is Facing?

Environmental Concerns Over Plastic Waste

The bottled water industry faces mounting pressure from environmental advocacy groups, regulatory bodies, and increasingly conscious consumers regarding plastic waste generation and its ecological impact on marine ecosystems, landfills, and carbon emissions from production and transportation processes. Public awareness campaigns highlighting ocean plastic pollution and microplastic contamination have intensified scrutiny on single-use packaging, creating potential reputational risks for brands that fail to demonstrate meaningful sustainability commitments. While PET recycling infrastructure exists in Spain, collection rates and circular economy implementation remain below optimal levels, leading to criticism from environmental organizations that advocate for tap water consumption and reusable bottle alternatives as more sustainable hydration solutions.

Competition for Filtered Tap Water and Water Purification Systems

The growing availability and sophistication of home water filtration systems, including reverse osmosis units, activated carbon filters, and advanced purification technologies, presents a competitive alternative to bottled water by enabling consumers to produce high-quality drinking water at significantly lower per-liter costs. Spanish tap water quality meets rigorous EU standards in most urban municipalities, creating a viable foundation for filtered consumption that avoids packaging waste and transportation costs. Environmental consciousness among younger demographics is driving adoption of reusable bottles paired with filtration systems or filtered tap water from public refill stations, particularly in major cities where sustainability initiatives promote reducing single-use plastic consumption through infrastructure investments and awareness campaigns.

Price Sensitivity and Economic Fluctuations

Economic uncertainties, inflation pressures, and fluctuating consumer purchasing power can impact bottled water consumption patterns, particularly in price-sensitive demographic segments that may shift toward lower-cost alternatives including private label brands, larger economy formats, or tap water during periods of financial constraint. The commodity nature of basic still water creates intense price competition among manufacturers and retailers, compressing margins and limiting profitability for brands unable to differentiate through premium positioning or functional benefits. Fluctuations in PET resin prices, energy costs, and transportation expenses create input cost volatility that manufacturers must carefully manage through operational efficiency, supply chain optimization, and strategic pricing decisions that balance profitability with competitive positioning in a market where consumers demonstrate clear value consciousness.

Competitive Landscape:

Key players in Spain’s bottled water market are tightening how they operate and how they present products to stay competitive. Packaging is a major focus. Companies are shifting toward lighter bottles, simpler labels, and higher use of recycled materials to cut plastic use and align with stricter environmental rules. Refillable and glass options are gaining more attention in urban areas and hospitality channels, helping position water as a more responsible everyday choice. Supply chains are also being adjusted. Producers are investing in better collection and recycling systems, working closely with distributors and retailers to improve bottle recovery and reduce waste across the value chain. At the plant level, upgrades in energy use, water efficiency, and logistics planning help lower costs while addressing environmental pressure around water extraction. On the consumer side, portfolios are being refined. Smaller pack sizes, premium formats, and subtle flavor variations are used to maintain interest without moving away from the core product. Health positioning remains central, with messaging around purity, origin, and suitability for daily consumption.

Spain Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain bottled water market size was valued at USD 4.61 Billion in 2025.

The Spain bottled water market is expected to grow at a compound annual growth rate of 5.81% from 2026-2034 to reach USD 7.67 Billion by 2034.

Still dominates with 38% market share, followed by carbonated, flavored, and mineral water variants. The still water segment benefits from universal appeal, competitive pricing, and year-round consumption across all demographic groups and usage occasions.

The market is primarily driven by increasing health consciousness among consumers, Spain's robust tourism industry generating significant seasonal demand, growing preference for natural mineral and spring water over sugary beverages, and expanding retail distribution networks that enhance product accessibility across geographic regions.

The market faces environmental concerns over plastic waste generation, competition from filtered tap water and home purification systems, and price sensitivity during economic fluctuations. Companies are addressing these challenges through sustainable packaging innovations, premium product differentiation, and operational efficiency improvements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)