Spain Bread and Bakery Market Report by Type (Bread, Cake and Pastries, Cookies and Biscuits, and Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, E-Commerce, and Others), and Region 2026-2034

Spain Bread and Bakery Market Overview:

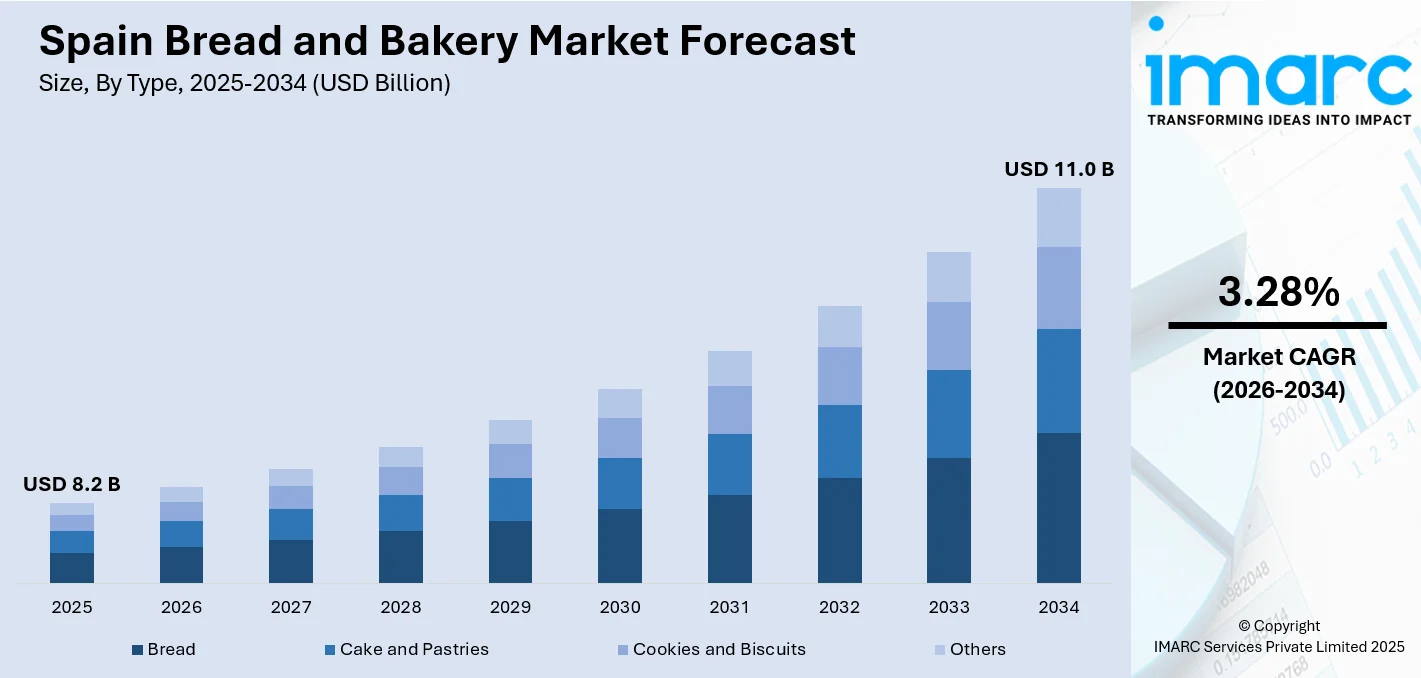

The Spain bread and bakery market size reached USD 8.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2034, exhibiting a growth rate (CAGR) of 3.28% during 2026-2034. The increasing consumer preference for artisanal and healthy products, the rising popularity of on-the-go snacks, growing innovation in product offerings, the growth of the tourism sector, and the increasing demand for traditional and premium bakery products are some of the major factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.2 Billion |

|

Market Forecast in 2034

|

USD 11.0 Billion |

| Market Growth Rate 2026-2034 | 3.28% |

Spain Bread and Bakery Market Trends:

Rising Demand for Artisanal and Healthy Products

Consumers are increasingly seeking high-quality, artisanal, and health-focused bakery items which is driving the market demand. For instance, in January 2024, Mexico’s Grupo Bimbo acquired Spain-based gluten-free bakery company, Amaritta. Financial details of the deal were not disclosed. With the acquisition of Amaritta, the Grupo Bimbo mentioned that it intends to incorporate a very relevant company in the gluten-free bread segment, which enables the addition of this product into the Amaritta’s portfolio. Grupo Bimbo further described Amaritta as having a “leadership” position in the gluten-free bakery category in Spain. This is further expected to fuel the growth of the market.

To get more information on this market Request Sample

Increasing Innovation and Variety

Continuous innovation in flavors, ingredients, and product types attracts a diverse customer base. For instance, in April 2024, Mondelēz International, Inc. announced that applications are now open for the second year of its CoLab Tech program. This accelerator program, led by Mondelēz’s global R&D team, seeks early-stage companies that have developed innovative technologies in nutrition, ingredients, packaging, and sustainability. CoLab Tech plays an important role in Mondelēz’s growth strategy to accelerate innovation in its core categories of chocolate, biscuits, and baked snacks The selected cohort will provide the R&D team with early access to new capabilities that can help in the development of breakthrough products and platforms. Similarly, in June 2024, Mondelēz International and Lotus Bakeries announced a strategic partnership to expand and grow the Lotus Biscoff® cookie brand in India, and to develop exciting new chocolate products combining the unique, caramelized, crunchy Biscoff® taste and texture with Mondelēz’s iconic Cadbury, Milka and other key chocolate brands in Europe, with the option to expand globally. This partnership provides new opportunities for both companies to accelerate their growth ambitions in the attractive cookie and chocolate categories, with potential options to expand into additional markets and/or adjacent segments.

Spain Bread and Bakery Market News:

- In May 2024, Mondelēz International, Inc. announced the inauguration of its Regional Biscuit and Baked Snacks Lab and Innovation Kitchen in Singapore, reaffirming its commitment to innovation and product development across Southeast Asia and Australia, New Zealand, and Japan. This new facility was officially opened by Mr Chan Ih-Ming, Executive Vice President, the Singapore Economic Development Board.

- In March 2024, Monbake Group, a frozen baked-goods business in Spain, was acquired by Luxembourg-based private-equity firm CVC Capital Partners. CVC Capital has purchased Monbake from France-based investment company Ardian and co-investors Alantra, Artá and Landon.

Spain Bread and Bakery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Bread

- Cake and Pastries

- Cookies and Biscuits

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bread, cake and pastries, cookies and biscuits, and others.

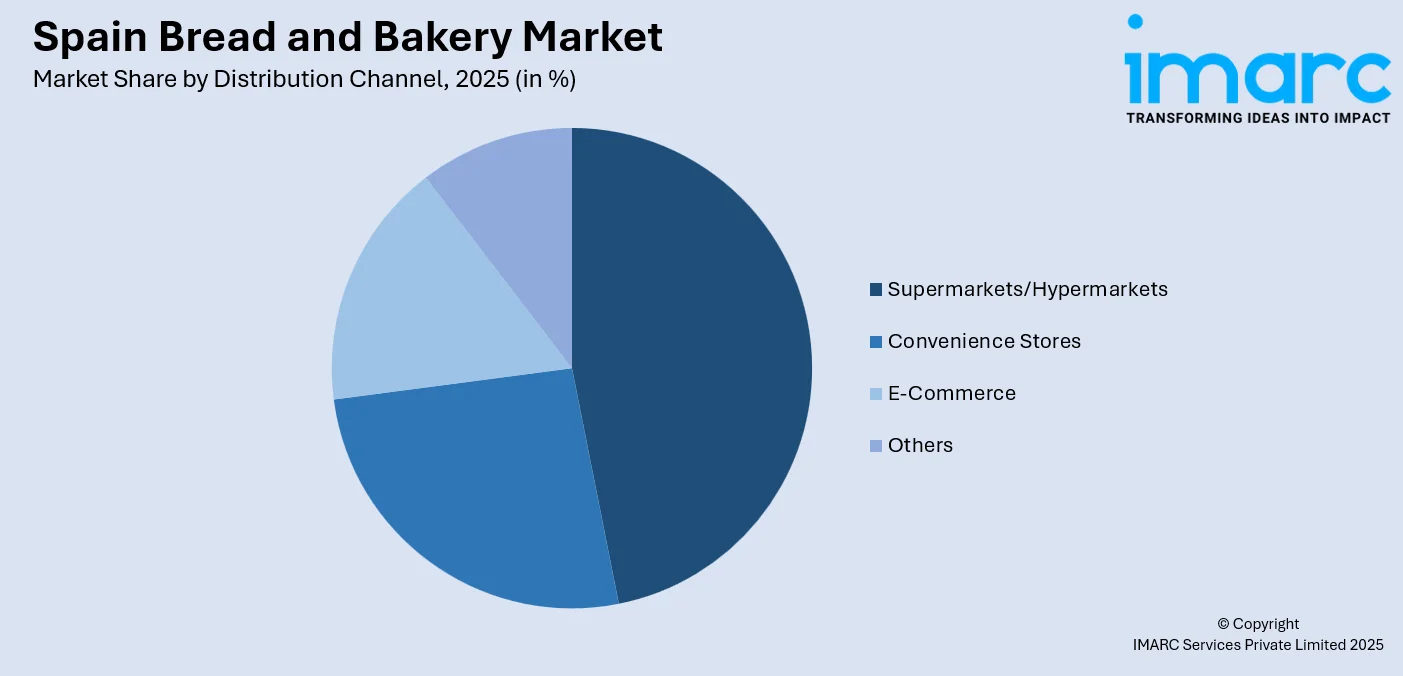

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- E-Commerce

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, e-commerce, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, Central Spain, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Bread and Bakery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bread, Cake and Pastries, Cookies and Biscuits, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, E-Commerce, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain bread and bakery market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Spain bread and bakery market?

- What is the breakup of the Spain bread and bakery market on the basis of type?

- What is the breakup of the Spain bread and bakery market on the basis of distribution channel?

- What are the key driving factors and challenges in the Spain bread and bakery?

- What is the structure of the Spain bread and bakery market and who are the key players?

- What is the degree of competition in the Spain bread and bakery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain bread and bakery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain bread and bakery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain bread and bakery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)