Spain Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End User, and Region 2026-2034

Spain Car Rental Market Summary:

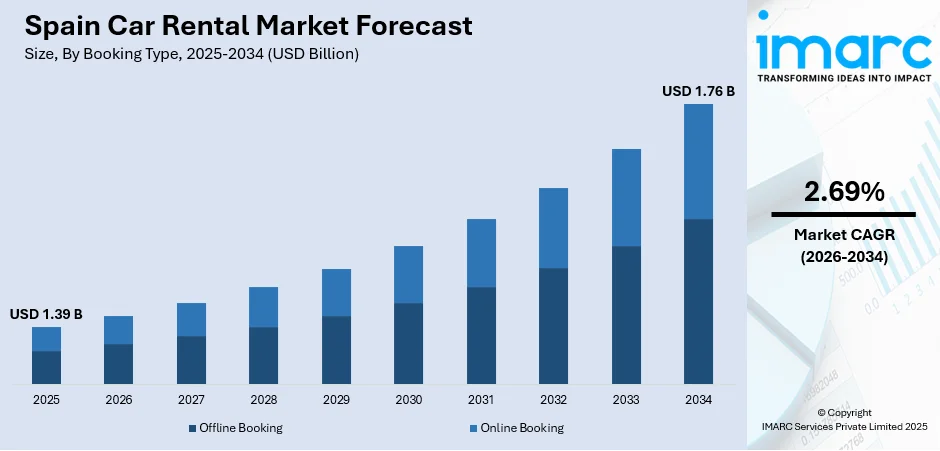

The Spain car rental market size was valued at USD 1.39 Billion in 2025 and is projected to reach USD 1.76 Billion by 2034, growing at a compound annual growth rate of 2.69% from 2026-2034.

The growth of the Spain car rental market is driven by the strong performance of the tourism sector, as the country continues to attract a significant number of international visitors in need of flexible mobility solutions. The ongoing digital transformation of booking platforms, the expansion of electric vehicle (EV) fleets, and the increased accessibility facilitated by platform-based rental integration are collectively reshaping the competitive landscape. These developments are creating considerable opportunities for market participants, enhancing the overall dynamics of the market.

Key Takeaways and Insights:

- By Booking Type: Online booking dominates the market with a share of 70% in 2025, driven by the widespread adoption of mobile applications, transparent pricing mechanisms, and seamless booking experiences that enable travelers to compare options across multiple rental providers.

- By Rental Length: Short term leads the market with a share of 85% in 2025, owing to the tourism-centric nature of the market, with leisure travelers preferring flexible rental periods ranging from daily to weekly durations.

- By Vehicle Type: Economy represent the largest segment with a market share of 45% in 2025, driven by their cost-effectiveness, fuel efficiency, and suitability for navigating narrow streets in historic city centers and coastal towns.

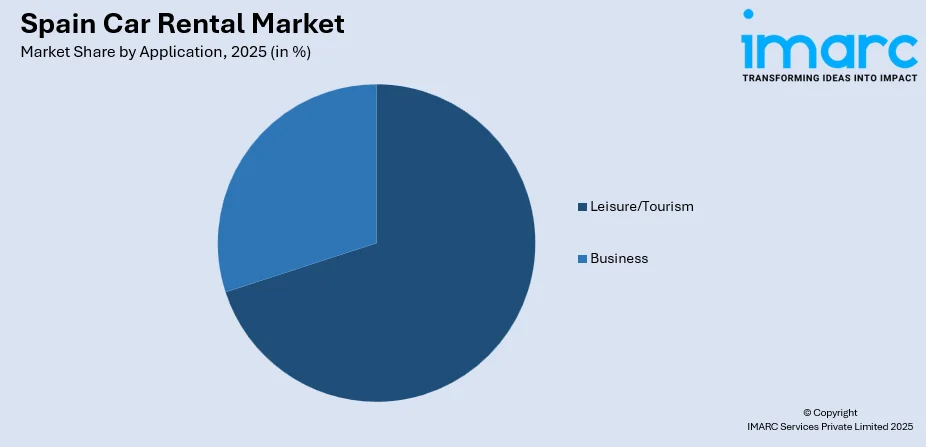

- By Application: Leisure/Tourism dominates the market with a share of 70% in 2025, highlighting the increasing influx of international visitors seeking convenient transportation to explore the country's diverse destinations, coupled with the growing trend of personalized, flexible travel experiences.

- By End User: Self-driven hold a market share of 90% in 2025, reflecting user preferences for independence and flexibility when exploring Spain's extensive road network and diverse destinations.

- Key Players: The Spain car rental market exhibits moderate competitive intensity, with multinational car rental corporations competing alongside regional operators across diverse geographic markets and price segments.

To get more information on this market, Request Sample

The Spain car rental market is experiencing growth due to several key drivers, including the thriving tourism sector, which attracts millions of international visitors annually. Spain's extensive and well-maintained road network provides an attractive environment for tourists seeking convenience and flexibility in transportation. Additionally, the rising popularity of experiential travel, where individuals look to explore beyond typical tourist destinations, further supports the need for rental cars. This growing trend of experiential travel and exploring non-traditional destinations is supported by the industry's focus on future innovation, as highlighted at the Tourism Innovation Summit (TIS2025) in Seville in 2025, which focused on Agentic AI and Regenerative Tourism. Besides this, the advent of digital platforms is simplifying the booking process, increasing accessibility and broadening the user base. Furthermore, rental companies are offering flexible terms, accommodating both short-term and long-term requirements, catering to a diverse clientele.

Spain Car Rental Market Trends:

Expansion of Rental Fleet and Service Offerings

As rental companies invest in new vehicles equipped with advanced technologies, they enhance client experience by offering convenient services like EV charging, parking, and car washes. These improvements increase the appeal of car rental options, attracting a broader range of individuals and boosting the overall market competitiveness. In line with this trend, in 2024, Sicily by Car launched operations in Spain with a new rental office at Ibiza's San José International Airport. The fleet included 600 new vehicles equipped with advanced technologies, offering a range of services, such as parking, car wash, and EV charging.

Growing Demand for Sustainable Transportation Solutions

As environmental concerns continue to rise, travelers are seeking alternatives to traditional gasoline-powered vehicles. The growing availability of electric and hydrogen-powered rental cars meets this demand, offering individuals a greener way to explore Spain while reducing their carbon footprint. For example, in 2024, Hyundai and IR Maxoinversiones launched Spain's first hydrogen-powered rent-a-car service at the Repsol Morro Jable H2GO station in Fuerteventura. The fleet included six Hyundai NEXO hydrogen fuel cell vehicles and six IONIQ 5 electric cars. The station, the first in Spain with 700 bar hydrogen pressure, supported green hydrogen and electric refueling.

Robust Tourism Industry

As one of the world's most popular tourist destinations, Spain sees a high influx of international travelers, many of whom seek car rentals for greater convenience and flexibility in exploring the country. According to Spain's National Statistics Institute (INE), more than 87 million international tourists visited the country in 2024, surpassing the previous record of 83.7 million in 2019. The growing number of inbound tourists, coupled with longer travel durations and increasing interest in regional tourism, is leading to higher demand for rental vehicles. This trend is expected to continue as Spain maintains its appeal as a prime European vacation spot, thereby contributing to the growth of the market.

Market Outlook 2026-2034:

The Spain car rental market demonstrates robust growth potential throughout the forecast period, underpinned by sustained tourism growth and evolving mobility preferences. The market generated a revenue of USD 1.39 Billion in 2025 and is projected to reach USD 1.76 Billion by 2034, growing at a compound annual growth rate of 2.69% from 2026-2034. The expansion of digital platforms, the rise of EV adoption, and the growing demand for short-term rentals further contribute to the market's upward trajectory, presenting significant opportunities for key industry players.

Spain Car Rental Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Booking Type | Online Booking | 70% |

| Rental Length | Short Term | 40% |

| Vehicle Type | Economy | 45% |

| Application | Leisure/Tourism | 70% |

| End User | Self-Driven | 90% |

Booking Type Insights:

- Offline Booking

- Online Booking

Online booking dominates with a market share of 70% of the total Spain car rental market in 2025.

Online booking leads the market due to its convenience and accessibility. People can easily compare prices, availability, and vehicle options from the comfort of their homes, leading to more informed decisions. This seamless process is highly favored by both leisure and business travelers.

Additionally, the rise of mobile applications and user-friendly platforms is making booking more efficient. With instant confirmation, flexible payment options, and the ability to manage reservations on the go, online booking provides an unmatched level of convenience, driving its dominance in the Spain car rental market. The enhanced convenience offered by mobile applications and flexible payment options is further solidified by technological advancements in the region, such as BBVA's launch of BBVA Pay in Spain in 2025, which allows Visa cardholders to make contactless payments directly within the bank's mobile app using NFC technology.

Rental Length Insights:

- Short Term

- Long Term

Short term leads with a share of 85% of the total Spain car rental market in 2025.

Short-term rentals dominate the market owing to the growing demand from tourists and business travelers who require flexible transportation for brief stays. Whether for a weekend trip or a few days of business meetings, short-term rentals provide the convenience and flexibility these customers seek.

Moreover, short-term rentals align with the preferences of travelers who value cost-effective, temporary mobility solutions. The ability to rent a vehicle for a few days or a week, without long-term commitment, makes it a practical choice for those visiting Spain for leisure or work, further strengthening the market growth.

Vehicle Type Insights:

- Luxury

- Executive

- Economy

- SUVs

- Others

Economy exhibits a clear dominance with a 45% share of the total Spain car rental market in 2025.

Economy dominates the market owing to its affordability and fuel efficiency, making it the preferred choice for budget-conscious travelers. With increasing demand for cost-effective transportation, especially from tourists and business travelers, economy car offers the best value for short-term rentals.

Additionally, economy vehicle provides practical benefits for urban travel, where compact size is ideal for navigating crowded streets and tight parking spaces. Its lower rental prices make it accessible to a broader user base, further contributing to its dominance in the car rental market across Spain.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Leisure/Tourism

- Business

Leisure/tourism represent the largest segment with a 70% share of the total Spain car rental market in 2025.

Leisure and tourism dominate the market supported by the significant influx of international visitors to Spain, who require convenient and flexible transportation. As tourists seek to explore the country's diverse destinations, car rentals offer the freedom to travel at their own pace.

Additionally, Spain's popularity as a vacation destination drives consistent demand for rental cars, particularly in regions like coastal areas and major cities. Spain ranks as the second most popular destination globally, after France, on the U.N. World Tourism Barometer. Spain saw a 10% increase in international tourist arrivals in 2024, according to Industry and Tourism Minister Jordi Hereu, further catalyzing the demand for rental services.

End User Insights:

- Self-Driven

- Chauffeur-Driven

Self-driven leads the market with a 90% share of the total Spain car rental market in 2025.

Self-driven rentals dominate the market due to the increasing preference for independence and flexibility among travelers. Clients value the ability to plan their own routes, make impromptu stops, and explore destinations at their own pace, which is especially appealing for tourists and business travelers.

Additionally, self-driven rentals offer greater control over travel expenses and comfort. With no need to rely on a driver, individuals can optimize their itineraries, avoid additional costs, and enjoy privacy, making self-driven vehicles the preferred choice for a large segment of Spain’s car rental market.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain car rental market is driven by its popular tourist destinations like the Basque Country, Galicia, and Asturias. The region’s scenic coastal routes, mountainous landscapes, and cultural landmarks attract travelers seeking flexibility and independence in exploring these diverse areas.

Eastern Spain, including regions like Valencia and Catalonia, sees high demand for car rentals, especially during the summer months. Tourists flock to its Mediterranean coast for beach vacations, and the vibrant cities require efficient transportation to access historical sites and modern attractions.

Southern Spain market thrives due to the region's rich cultural heritage, with cities like Seville, Granada, and Málaga drawing tourists year-round. The ability to explore Andalusia's picturesque landscapes, coastal resorts, and historical landmarks makes car rental essential for visitors.

Central Spain, home to Madrid and surrounding regions, remains a key hub for car rentals. Visitors often rent cars to explore both the capital's cultural offerings and nearby historical cities like Toledo and Ávila, making car rental essential for regional exploration.

Market Dynamics:

Growth Drivers:

Why is the Spain Car Rental Market Growing?

Growth in Digital Payment Systems

The increasing adoption of mobile payment platforms, online wallets, and contactless transactions is providing clients with greater ease and security when booking and paying for rentals. According to CaixaBank’s 2025 report, mobile payment transactions rose by 34.4%. With 38% of card purchases made via mobile devices, highlighting the growing trend in digital payments that supports rental companies’ operational efficiency. This shift toward digital payments streamlines the rental process, improving the overall user experience and encouraging higher booking rates. The convenience of seamless online and in-person payment options appeals to both local and international users, contributing to the market growth.

Strengthening Infrastructure and Transport Networks

The ongoing improvements in Spain's transportation infrastructure, including roads, highways, and airports, are enhancing the accessibility and convenience of car rentals. Well-developed transport networks make it easier for both locals and tourists to access rental services and travel across the country efficiently. With enhanced infrastructure supporting smoother travel, people are more inclined to rent vehicles, knowing they can easily navigate Spain's extensive and well-maintained road systems. This continuous improvement of Spain's transportation infrastructure, which enhances accessibility and travel convenience, is underscored by Assured Guaranty's guarantee of a EUR 96 million (USD 108 million) loan in 2025 for the A-127 regional road upgrade in Aragón, a project aimed at widening and rebuilding key sections of the highway.

Rise of Online Booking Trends

The increasing availability of internet access in Spain is bolstering the growth of the market by enabling easier online bookings, expanding client reach, and enhancing overall accessibility to rental services. As per the data provided by the INE in 2025, 97.4% of households in Spain have access to the internet, with the majority using fixed broadband connections. This widespread internet penetration enables users to seamlessly engage in online car rental bookings, compare options, and manage reservations through digital platforms. As more people rely on mobile and fixed broadband for daily tasks, car rental companies are optimizing their services for online convenience, further contributing to the market growth by enhancing accessibility and client engagement.

Market Restraints:

What Challenges the Spain Car Rental Market is Facing?

Seasonal Demand Fluctuations Creating Operational Challenges

Car rental companies in Spain face significant operational challenges due to seasonal fluctuations in tourist demand. These variations require companies to implement dynamic fleet management strategies, ensuring an optimal balance of vehicle availability. During peak summer months, demand rises, requiring expanded capacity, while during off-peak periods, fleets may be underutilized. Managing this balance effectively is crucial to maximizing profitability and minimizing operational inefficiencies across the year.

Rising Vehicle Acquisition and Maintenance Costs

The Spain car rental industry is facing increasing costs related to vehicle acquisition and maintenance, putting pressure on profit margins. As vehicle prices rise, rental companies must adjust their pricing strategies, often leading to higher rental rates for individuals. These cost increases may negatively affect price-sensitive clients, potentially reducing demand among certain segments. Companies must carefully navigate these rising expenses while ensuring competitiveness in a market where cost-conscious users are prevalent.

Infrastructure Limitations in Rural and Remote Destinations

In rural and remote areas, the lack of sufficient infrastructure and limited service coverage create challenges for car rental companies. Travelers seeking to explore off-the-beaten-path destinations often find it difficult to access rental services, limiting the market potential in these regions. As a result, the industry growth remains concentrated in established urban and coastal areas, with limited expansion into less-traveled rural locations.

Competitive Landscape:

The Spain car rental market exhibits moderate competitive intensity characterized by the presence of multinational rental corporations alongside established regional operators competing across diverse geographic markets and price segments. Market dynamics reflect strategic positioning, ranging from premium innovation-driven offerings emphasizing advanced digital services and sustainable fleet composition to value-oriented products targeting cost-conscious leisure travelers. The competitive landscape is increasingly shaped by digital platform integration, EV fleet expansion, and client experience enhancement initiatives. Competition centers on airport location accessibility, online booking platform functionality, and service differentiation through loyalty programs and personalized offerings.

Recent Developments:

- In September 2025, Final Rentals expanded into Spain and Italy, opening new locations in Málaga, Mallorca, and Sicily. This move enhances their mission to provide seamless car rentals for global travelers exploring top European destinations. The service is now available for booking through their website and mobile app.

- In December 2024, Amazon partnered with Drivalia to offer car subscriptions in Spain through its marketplace. The service, called CarCloud, provided flexible, annual vehicle rentals with options to swap cars and cancel without penalty after the first month.

Spain Car Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain car rental market size was valued at USD 1.39 Billion in 2025.

The market is expected to grow at a compound annual growth rate of 2.69% from 2026-2034 to reach USD 1.76 Billion by 2034.

Online Booking dominated the Spain car rental market with 70% share in 2025, driven by widespread digital platform adoption, transparent pricing, and seamless mobile booking experiences.

Key factors driving the Spain car rental market include the status of Spain's as a leading tourist destination driving the demand for car rentals, with over 87 million international tourists visiting in 2024, surpassing the 2019 record. This increase in tourist arrivals, combined with longer stays and regional tourism interest, is bolstering the market growth.

Major challenges include seasonal demand fluctuations requiring dynamic fleet management to balance vehicle availability, especially during peak seasons. Additionally, rising vehicle acquisition and maintenance costs pressure profit margins, while infrastructure limitations in rural areas hinder market expansion beyond urban centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)