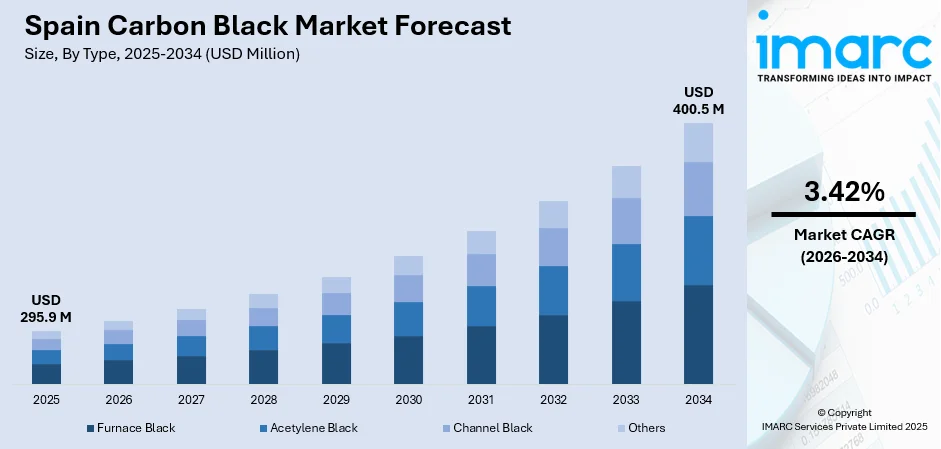

Spain Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2026-2034

Spain Carbon Black Market Overview:

The Spain carbon black market size reached USD 295.9 Million in 2025. Looking forward, the market is projected to reach USD 400.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.42% during 2026-2034. The market is fueled by demand from Spain’s automotive, construction, and printing sectors, where carbon black serves as both a reinforcing filler and specialty pigment. The country’s packaging and ink industries are increasing demand for low-PAH, food-safe, and high-dispersion grades. Emerging applications in conductive polymers and battery systems are deepening the specialty-grade segment, further augmenting the Spain carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 295.9 Million |

| Market Forecast in 2034 | USD 400.5 Million |

| Market Growth Rate 2026-2034 | 3.42% |

Spain Carbon Black Market Trends:

Automotive Recovery and Tire Retreading Industry

Spain remains one of Europe’s key automotive manufacturing hubs, with production concentrated in Catalonia, Castile and León, and Navarre. This industrial base supports steady carbon black consumption, particularly for OEM tires and under-the-hood rubber components. A notable feature of the Spanish market is its strong tire retreading and aftermarket servicing ecosystem, which maintains consistent demand for reinforcing-grade carbon black. The Spanish automotive sector accounts for 10% of the country’s GDP and 18% of all exports, including both vehicles and auto parts. In 2024, the external trade surplus for vehicles stood at €16 Billion. Fleet operators and logistics companies often opt for retreaded tires to manage costs and comply with environmental targets, especially in light commercial and freight segments. This drives demand for high-quality black reinforcing agents used in treads and sidewalls, as performance and wear characteristics must match or exceed first-life specifications. Moreover, Spain's proximity to export routes across Europe and North Africa has encouraged the growth of local rubber goods manufacturers who rely on durable compounds for hoses, belts, and seals. Government subsidies to improve energy efficiency in transportation and rising vehicle safety norms are prompting increased tire replacements, especially in aging passenger car fleets. The balanced ecosystem of automotive manufacturing and tire servicing significantly anchors carbon black demand and underpins long-term Spain carbon black market growth.

To get more information on this market Request Sample

Construction Plastics, Pipes, and Cable Sheathing

Spain’s construction sector, driven by residential rehabilitation, green building programs, and infrastructure upgrades, contributes to rising carbon black usage in polymer-based materials. The material is widely used in the production of black HDPE and PVC pipes for potable water systems, underground cabling, and sewage networks, where UV stability and environmental stress resistance are key. Additionally, carbon black enhances the durability of exterior construction panels, roof membranes, window profiles, and sealants. Local manufacturers are also producing carbon-black-infused plastic sheaths for power cables, both for residential wiring and industrial applications. Spain’s push toward energy-efficient buildings under EU mandates further supports the uptake of carbon-black-reinforced foams, coatings, and insulating components. In addition to this, Barcelona hosts Europe’s flagship event for the recovered carbon black (rCB) industry. The 2025 Recovered Carbon Black Europe conference, organized by Smithers, is scheduled for November 4–6, 2025. The conference is a central platform for discussing market trends, technological innovations, sustainability strategies, and real-world success stories from major companies operating in Spain and across Europe. Moreover, infrastructure programs related to high-speed rail and smart city projects require resilient polymer systems that incorporate carbon black for longevity and aesthetic uniformity. The widespread use of plastic composites in Spanish construction, especially in coastal and sun-exposed environments, necessitates high-performance UV protectants and black colorants. As building codes tighten and material durability becomes more critical to lifecycle assessments, demand for technically precise carbon black grades in the construction sector continues to rise, further embedding the material into Spain’s urban modernization efforts.

Spain Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

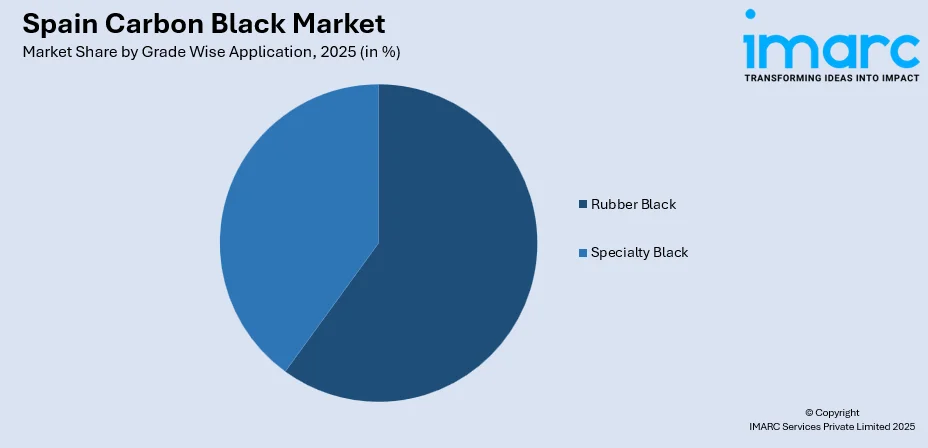

Grade Wise Application Insights:

Access the comprehensive market breakdown Request Sample

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Carbon Black Market News:

- In July 2024, Birla Carbon, a global leader in carbon-based solutions, announced that its manufacturing plant in Santander, Spain, secured ISCC PLUS Certification. This certification is a key achievement, reflecting Birla Carbon’s commitment to environmental stewardship and traceable, circular production practices. Birla Carbon’s Spanish plant in Cantabria continues to serve as a strategic European manufacturing base for both traditional and advanced carbon black grades.

Spain Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain carbon black market on the basis of type?

- What is the breakup of the Spain carbon black market on the basis of grade wise application?

- What is the breakup of the Spain carbon black market on the basis of region?

- What are the various stages in the value chain of the Spain carbon black market?

- What are the key driving factors and challenges in the Spain carbon black market?

- What is the structure of the Spain carbon black market and who are the key players?

- What is the degree of competition in the Spain carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain carbon black market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)