Spain Cardiovascular Devices Market Size, Share, Trends and Forecast by Device Type, Application, End User, and Region, 2026-2034

Spain Cardiovascular Devices Market Overview:

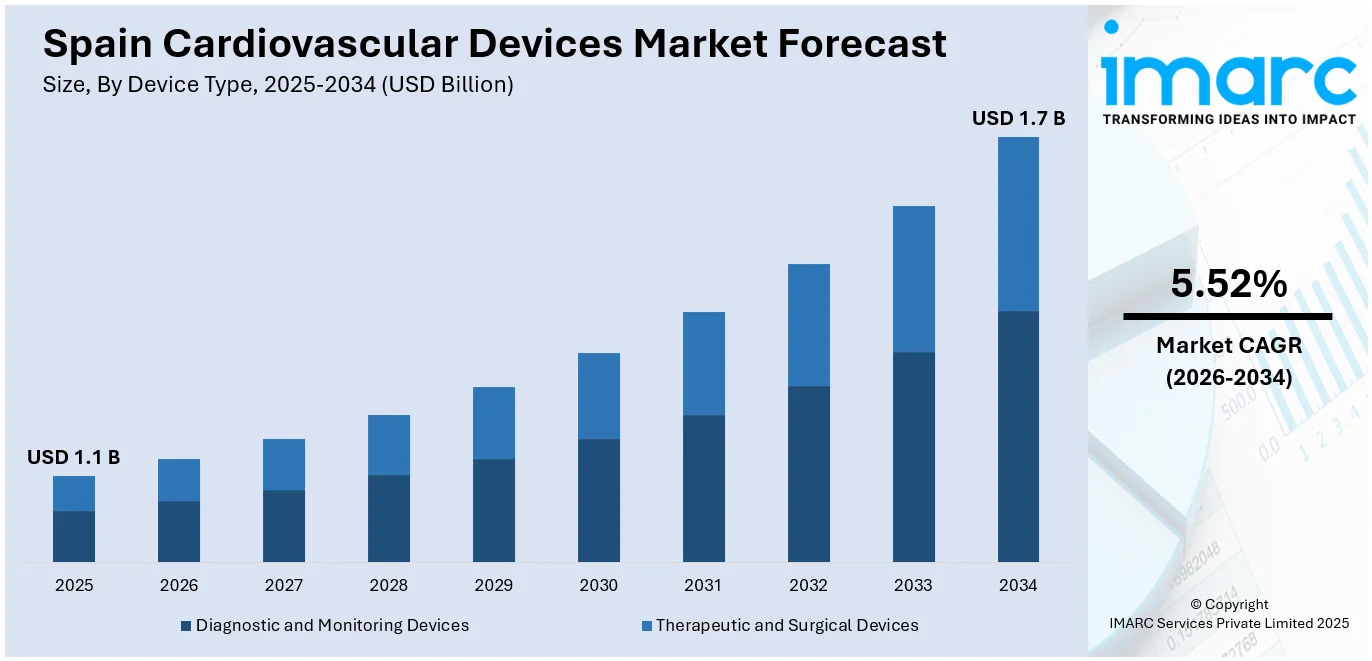

The Spain cardiovascular devices market size reached USD 1.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1.7 Billion by 2034, exhibiting a growth rate (CAGR) of 5.52% during 2026-2034. The market is expanding due to the rising prevalence of cardiovascular diseases, increasing demand for minimally invasive procedures, and advancements in artificial intelligence (AI)-powered monitoring technologies, while government support for digital healthcare and the growth of telemedicine further drive innovation, accessibility, and improved patient outcomes across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.1 Billion |

| Market Forecast in 2034 | USD 1.7 Billion |

| Market Growth Rate 2026-2034 | 5.52% |

Spain Cardiovascular Devices Market Trends:

Rising Adoption of Minimally Invasive Cardiovascular Procedures

The growth of the cardiovascular devices market in Spain is fueled by the rising demand for minimally invasive procedures, driven by advancements in medical technology and patients' preference for shorter recovery times. The implementation of Transcatheter Aortic Valve Replacement (TAVR) and Percutaneous Coronary Intervention (PCI) using catheter-based interventions has cut down the requirement for open-heart surgeries to a significant degree. Moreover, cardiovascular diseases (CVDs) appear more frequently among older people at the same time as population aging creates new opportunities for these medical procedures. For instance, in November 2023, the National Center for Cardiovascular Research (CNIC) and the Health Research Institute of Hospital 12 de Octubre (i+12) co-led a working group as part of the EU's Joint Action on Cardiovascular Diseases and Diabetes (JACARDI). This four-year project aims to reduce the burden of cardiovascular diseases and diabetes across Europe. Spanish medical organizations continue to incorporate robotic surgical systems and artificial intelligence systems into their clinical practices to improve precise cardiovascular treatment procedures. Besides this, government-backed digital healthcare development enables remote cardiac monitoring to detect heart issues at earlier stages, through telemedicine services. This rising trend toward minimally invasive cardiovascular solutions in Spain will become increasingly prominent during the next few years because of continued innovation and rising awareness between healthcare professionals and their patient communities.

To get more information on this market Request Sample

Growing Demand for Smart and AI-Integrated Cardiovascular Devices

The Spain cardiovascular devices market share is expanding due to the rising adoption of AI and smart technology in cardiovascular devices. For example, at the European Society of Cardiology Congress in 2024, Philips unveiled AI-driven applications designed to enhance early detection of cardiotoxicity. Dr. Teresa Lopez from La Paz University Hospital in Madrid highlighted how these tools improve the efficiency and reliability of cardiac assessments. The combination of AI-powered electrocardiograms (ECGs) with wearable heart monitors and implantable cardiac rhythm management (CRM) devices enables early patient diagnosis together with continuous real-time heart condition monitoring. Additionally, continuous data collection through these innovations provides physicians with better abilities to forecast cardiac events before they happen. Spanish healthcare institutions also use cloud-based systems to merge AI-driven diagnostic capabilities with electronic health record platforms which deliver better clinical choices. Furthermore, consumers adopt wearable smartwatches with embedded ECG capabilities because they increasingly monitor their personal health status. In line with this, the adoption of remote patient monitoring solutions receives additional support from two main factors, government backing of digital health programs and expansion initiatives regarding 5G infrastructure technology. Concurrently, healthcare in Spain will receive better cardiovascular disease management while patient outcomes improve because AI-powered devices will further advance over time, thereby enhancing the Spain cardiovascular devices market outlook.

Spain Cardiovascular Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on device type, application, and end user.

Device Type Insights:

- Diagnostic and Monitoring Devices

- Electrocardiogram (ECG)

- Remote Cardiac Monitoring

- Others

- Therapeutic and Surgical Devices

- Cardiac Rhythm Management (CRM) Devices

- Catheter

- Stents

- Heart Valves

- Others

The report has provided a detailed breakup and analysis of the market based on the device type. This includes diagnostic and monitoring devices (electrocardiogram (ECG), remote cardiac monitoring, others), and therapeutic and surgical devices (cardiac rhythm management (CRM) devices, catheters, stents, heart valves, others).

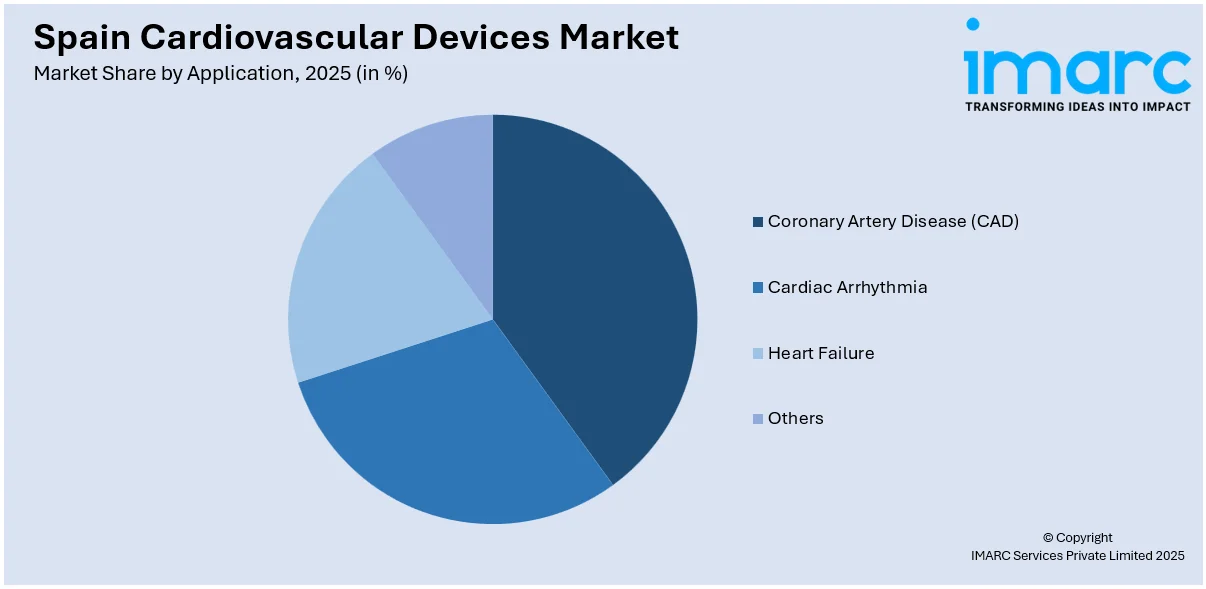

Application Insights:

Access the comprehensive market breakdown Request Sample

- Coronary Artery Disease (CAD)

- Cardiac Arrhythmia

- Heart Failure

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes coronary artery disease (CAD), cardiac arrhythmia, heart failure, and others.

End User Insights:

- Hospitals

- Specialty Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, specialty clinics, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Cardiovascular Devices Market News:

- In September 2024, HLA Santa Isabel Hospital, in collaboration with Neolaser Cardiovascular, enhanced its treatment of complex aortic aneurysms using customized endoprostheses. This minimally invasive approach offers patients quicker recovery times and reduces the need for open-heart surgeries.

- In June 2024, Bexen Cardio, a Spanish cooperative specializing in defibrillators, participated in FIME2024 in Miami. The event provided a platform to present their latest medical solutions and establish international partnerships, highlighting Spain's contributions to global cardiovascular care.

Spain Cardiovascular Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered |

|

| Applications Covered | Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, Others |

| End Users Covered | Hospitals, Specialty Clinics, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain cardiovascular devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain cardiovascular devices market on the basis of device type?

- What is the breakup of the Spain cardiovascular devices market on the basis of application?

- What is the breakup of the Spain cardiovascular devices market on the basis of end user?

- What is the breakup of the Spain cardiovascular devices market on the basis of region?

- What are the various stages in the value chain of the Spain cardiovascular devices market?

- What are the key driving factors and challenges in the Spain cardiovascular devices?

- What is the structure of the Spain cardiovascular devices market and who are the key players?

- What is the degree of competition in the Spain cardiovascular devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain cardiovascular devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain cardiovascular devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain cardiovascular devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)