Spain CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2026-2034

Spain CCTV Camera Market Overview:

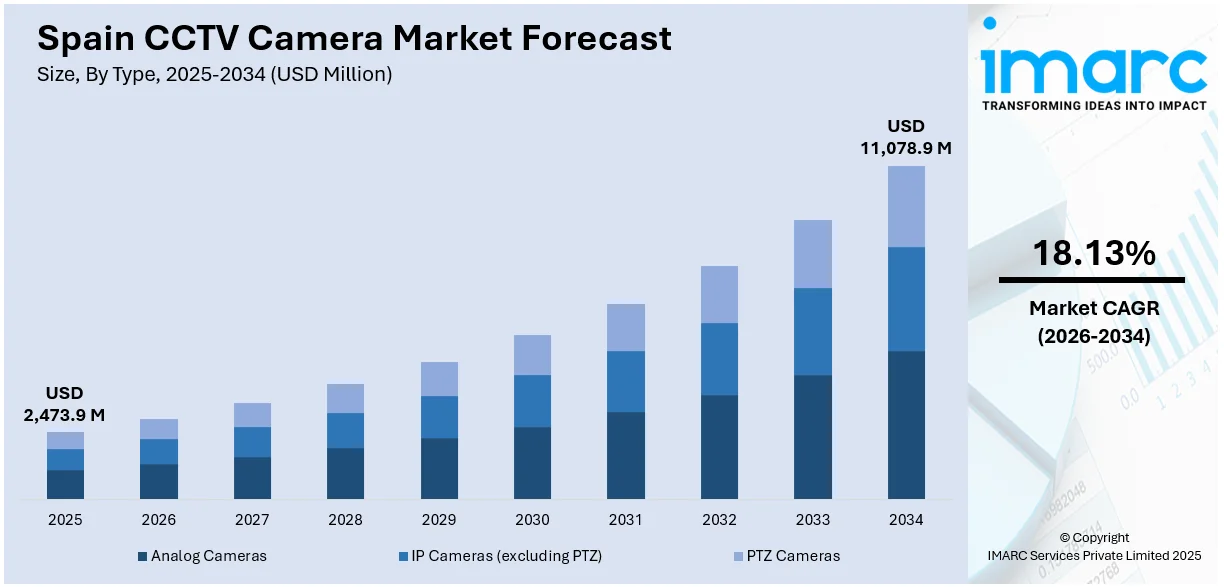

The Spain CCTV camera market size reached USD 2,473.9 Million in 2025. Looking forward, the market is projected to reach USD 11,078.9 Million by 2034, exhibiting a growth rate (CAGR) of 18.13% during 2026-2034. The market is experiencing moderate expansion driven by heightened security awareness, tourism sector demands, and digital transformation in urban planning. Government-led surveillance initiatives in public spaces, transport hubs, and smart city deployments are prompting investments in AI‑enabled and IP‑based CCTV systems. Technological innovation and infrastructure upgrades support competitive offerings and regional growth in the Spain CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,473.9 Million |

| Market Forecast in 2034 | USD 11,078.9 Million |

| Market Growth Rate 2026-2034 | 18.13% |

Spain CCTV Camera Market Trends:

Migration to IP and High-Res Systems

One of the most notable trends influencing the Spain CCTV camera market is the substantial shift from analog systems to IP-based and high-resolution video surveillance technologies. Companies, governmental organizations, and homeowners are increasingly opting for IP and 4K-enabled systems due to their superior image quality, remote monitoring features, and advanced data analytics integration. These systems provide improved digital zoom, wider coverage, and enhanced night vision, making them well-suited for critical infrastructure and high-risk areas. The scalability and interoperability of IP-based cameras also facilitate integration with larger security frameworks, including smart home and city systems. This digital shift corresponds with the nation’s broader digital transformation initiatives and regulatory efforts for smarter urban monitoring. For instance, in June 2025, 360 Vision Technology and Sicuralia Systems partnered to enhance perimeter surveillance in Spain. Utilizing Predator HD PTZ cameras, they provide tailored security solutions for various sectors including energy, military, and government. Their collaboration focuses on delivering reliable detection and superior performance in demanding environments across the Iberian Peninsula. Consequently, this transition is significantly driving Spain CCTV camera market growth, allowing providers to deliver more intelligent, adaptable, and secure surveillance solutions to a rapidly changing customer landscape.

To get more information on this market Request Sample

Tourism and Public Venue Installations

The booming tourism sector in Spain, coupled with high visitor traffic in public areas, has led to increased investment in advanced CCTV systems. Surveillance technology is being widely utilized in major tourist attractions, transportation hubs such as airports and train stations, as well as large venues like stadiums and convention centers. The goal of these installations is to improve crowd management, identify suspicious activities, and enhance emergency response times. Both government and municipal authorities are focusing on video surveillance to bolster public safety, deter minor crimes, and create a secure atmosphere for tourists and locals alike. With the increasing complexity of urban movement and heightened security concerns in crowded public spaces, this trend is becoming crucial to modernizing the country’s security framework, thus facilitating the growth of the Spain CCTV camera market across both public and private sectors.

Collaboration with Local Integrators

Global manufacturers of surveillance equipment are increasingly collaborating with local Spanish integrators to achieve effective market entry and ensure compliance with regulations. These partnerships provide various benefits, such as improved adherence to local data protection laws, cultural relevance, and enhanced after-sales service. By teaming up with local technology companies, international brands can adapt their products to meet regional requirements and address infrastructure challenges. Spanish integrators play a vital role by offering essential expertise in system integration, installation, and maintenance, ensuring that CCTV systems are both scalable and compliant. Additionally, these collaborations foster trust among local customers, who often prefer support from familiar and reliable service providers. Consequently, this collaborative approach not only boosts customer satisfaction but also stimulates innovation and growth in the Spain CCTV camera market through localized knowledge and strategic partnerships.

Spain CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

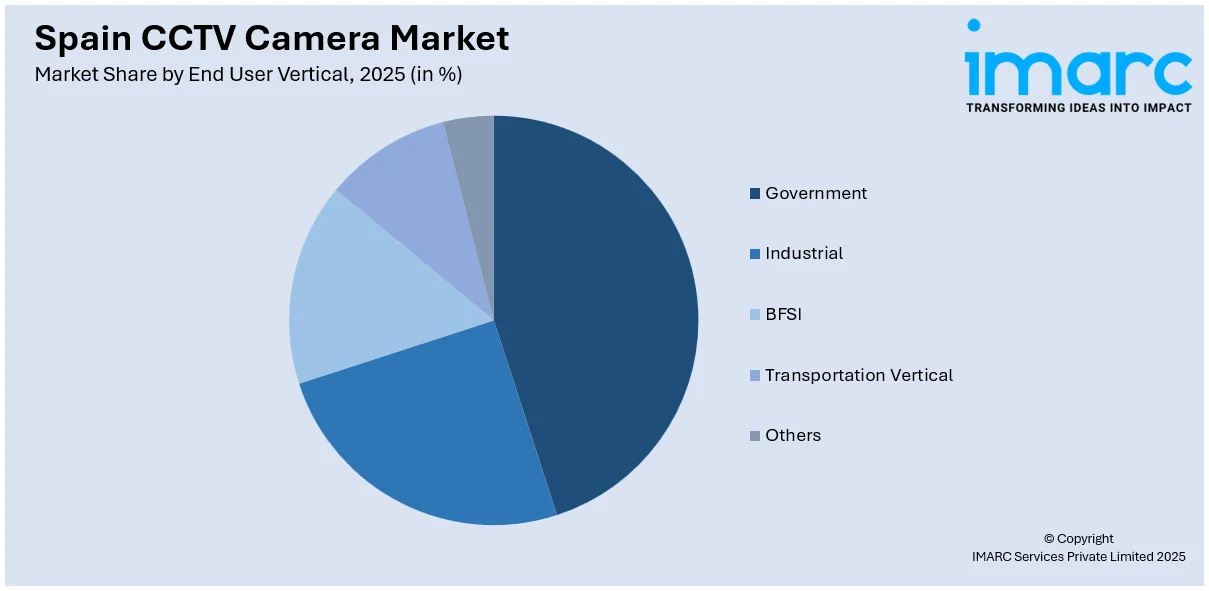

End User Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain CCTV Camera Market News:

- In December 2024, Spain’s Ministry of Interior authorized a €4.12 Million purchase of 20 video surveillance systems for Morocco. This initiative aims to bolster security cooperation in combating terrorism and organized crime. The contract, awarded to Madrid-based Etel 88 S.A., aligns with Spain’s Strategic Grants Plan for 2024-2026.

- In July 2024, ZKTeco Iberia announced a distribution agreement with Araelec to supply advanced IP cameras across Spain. This partnership enhances ZKTeco's market presence and provides Araelec's customers with high-quality security solutions, including features like facial recognition and intrusion detection, catering to various applications from residential to commercial security.

Spain CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain CCTV camera market on the basis of type?

- What is the breakup of the Spain CCTV camera market on the basis of end user vertical?

- What is the breakup of the Spain CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Spain CCTV camera market?

- What are the key driving factors and challenges in the Spain CCTV camera market?

- What is the structure of the Spain CCTV camera market and who are the key players?

- What is the degree of competition in the Spain CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain CCTV camera market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)