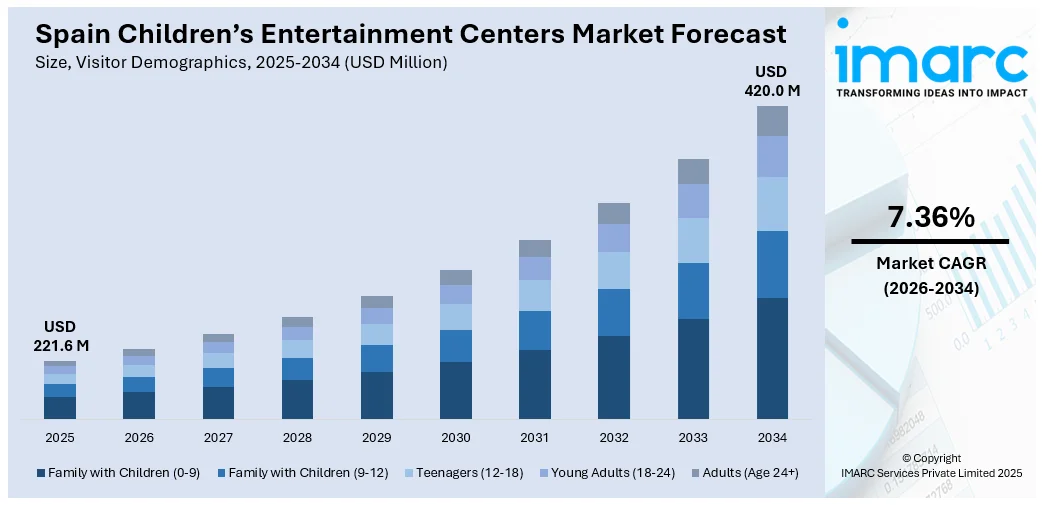

Spain Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2026-2034

Spain Children’s Entertainment Centers Market Overview:

The Spain children’s entertainment centers market size reached USD 221.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 420.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.36% during 2026-2034. Rising disposable incomes, growing tourism, and increasing demand for family-focused leisure activities are some of the factors contributing to the Spain children’s entertainment centers market share. Urbanization, favorable government regulations, and technology-enhanced experiences also drive market growth, attracting investors and operators to expand across Spanish cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 221.6 Million |

| Market Forecast in 2034 | USD 420.0 Million |

| Market Growth Rate 2026-2034 | 7.36% |

Spain Children’s Entertainment Centers Market Trends:

Rise of Edutainment-Driven Spaces

In recent years, children's entertainment centers across Spain have started blending fun with learning. Parents are pushing for more value in outings, and operators are responding with activities that integrate STEM, language, and critical thinking. Centers are designing interactive exhibits, coding zones, and science labs that keep kids engaged while reinforcing school-related topics. This model appeals to families seeking experiences that aren't just physically stimulating but mentally rewarding too. Franchises with international backing are expanding into Spain, customizing their formats for the local market. Bilingual or multilingual programming is also gaining traction, especially in major urban areas like Madrid and Barcelona. These changes aren't limited to upscale areas; municipal centers in smaller towns are piloting similar models with government support. As school curricula become more project-based, there’s a closer alignment between classroom expectations and entertainment offerings. While older arcades and traditional soft-play models still exist, the growth is leaning heavily toward centers that make kids think, experiment, and solve problems. The demand for play with a purpose is moving from niche to mainstream. These factors are intensifying the Spain children’s entertainment centers market growth.

To get more information on this market Request Sample

Surge in Birthday-Focused Micro-Venues

Another clear shift in the Spanish children’s entertainment space is the rise of compact, event-specific centers focused almost entirely on birthdays. These micro-venues operate with lower overhead and tighter space but deliver highly personalized experiences. They're often found in residential neighborhoods rather than retail parks, and they target bookings over footfall. Each party gets exclusive use of the space for a few hours, with tailored themes, decorations, and entertainers. Popular characters, role-play scenarios, and DIY crafting sessions dominate the agenda. The focus is on intimacy and customization, not scale. Parents like the privacy, safety, and low-stress environment compared to big, noisy play zones. Operators benefit from high margins on pre-paid, fixed-time events with minimal staffing. This trend is particularly strong in suburban regions, where traditional entertainment infrastructure is limited. It also caters well to the under-7 demographic, who often find large centers overwhelming. Add-ons like professional photography, cake delivery, or even mobile petting zoos are becoming common. The entire business model revolves around delivering a polished two-hour memory, not a day-long visit. That simplicity is driving rapid replication through franchise kits and local entrepreneurship.

Spain Children’s Entertainment Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on visitor demographics, facility size, revenue source, and activity area.

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes family with children (0-9), family with children (9-12), teenagers (12-18), young adults (18-24), and adults (age 24+).

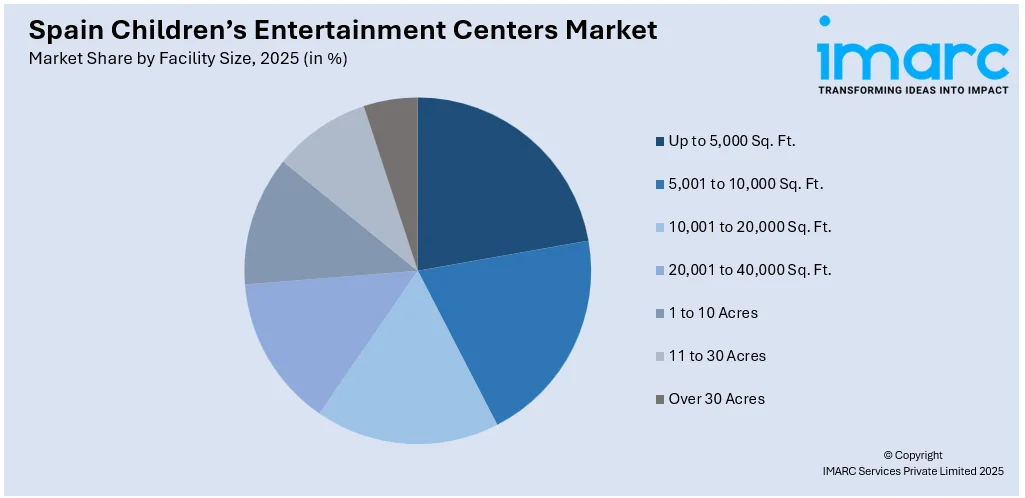

Facility Size Insights:

Access the comprehensive market breakdown Request Sample

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees and ticket sales, food and beverages, merchandising, advertising, and others.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

A detailed breakup and analysis of the market based on the activity area have also been provided in the report. This includes arcade studios, AR and VR gaming zone, physical play activities, skill/competition games, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Children’s Entertainment Centers Market News:

- In September 2024, Otium Leisure expanded its footprint in Spain’s children’s entertainment market through its “Strike” strategy. Aiming to dominate Europe’s family entertainment center segment, Otium now operates nearly 30 multi-activity leisure complexes across France, Belgium, and Spain. The company reported EUR 120 Million in consolidated revenue and continues to grow through seven brands focused on localized leisure experiences. Spain plays a key role in its European consolidation push.

Spain Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family with Children (0-9), Family with Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain children’s entertainment centers market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain children’s entertainment centers market on the basis of visitor demographics?

- What is the breakup of the Spain children’s entertainment centers market on the basis of facility size?

- What is the breakup of the Spain children’s entertainment centers market on the basis of revenue source?

- What is the breakup of the Spain children’s entertainment centers market on the basis of activity area?

- What is the breakup of the Spain children’s entertainment centers market on the basis of region?

- What are the various stages in the value chain of the Spain children’s entertainment centers market?

- What are the key driving factors and challenges in the Spain children’s entertainment centers market?

- What is the structure of the Spain children’s entertainment centers market and who are the key players?

- What is the degree of competition in the Spain children’s entertainment centers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain children’s entertainment centers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain children’s entertainment centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain children’s entertainment centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)