Spain Cloud Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2026-2034

Spain Cloud Market Overview:

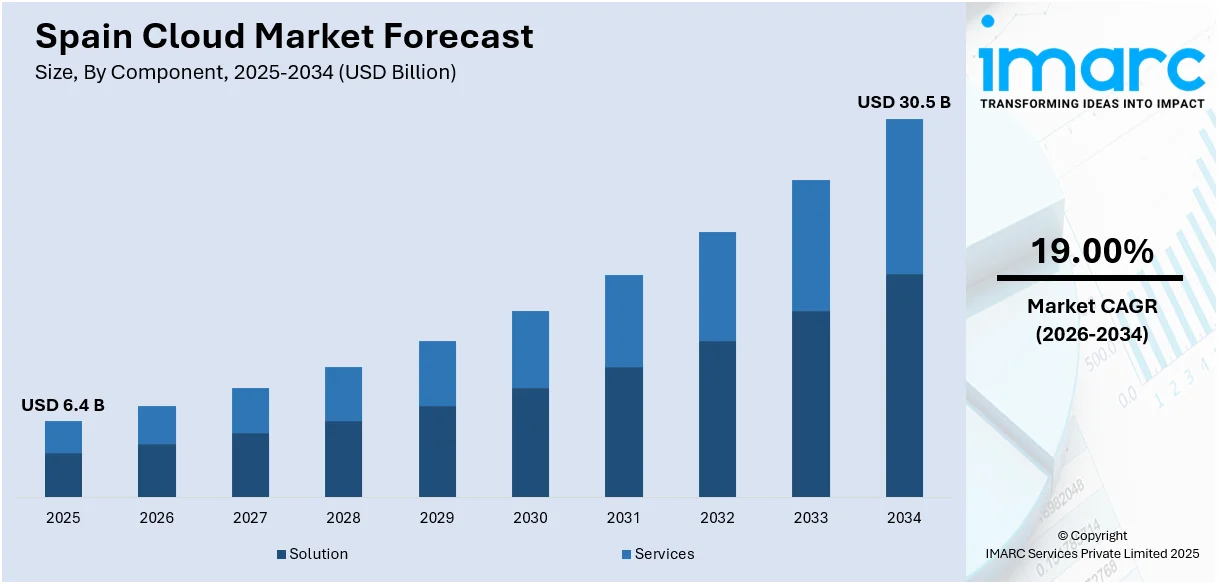

The Spain cloud market size reached USD 6.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 30.5 Billion by 2034, exhibiting a growth rate (CAGR) of 19.00% during 2026-2034. The Spain cloud market is experiencing considerable growth, driven by the increasing adoption of hybrid, multi-cloud, and public cloud solutions, alongside digital transformation initiatives and a rise in remote work. In addition, data sovereignty concerns, advancements in AI, and the demand for scalable, cost-efficient infrastructure are accelerating this shift. The expanding preference for public cloud offerings reflects the need for flexible deployment models that meet evolving business, compliance, and performance requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.4 Billion |

| Market Forecast in 2034 | USD 30.5 Billion |

| Market Growth Rate 2026-2034 | 19.00% |

Spain Cloud Market Trends:

Rising Focus on Cloud Infrastructure

Spain’s cloud services market is experiencing a strong push from enterprises looking to improve data access, operational efficiency, and regulatory compliance. As organizations move away from on-premises systems, they are prioritizing cloud platforms that offer better scalability and regional control. Moreover, local data centers are becoming a key requirement for businesses in finance, healthcare, and government, where data sovereignty laws and fast processing are essential. The need to support large-scale applications and AI models is also contributing to the demand for reliable cloud infrastructure across the country. In line with this, in June 2024, Oracle announced a USD 1 Billion investment to establish its third cloud region in Madrid. The company’s collaboration with Telefónica España plays a significant role in expanding secure, low-latency access to cloud services. This development helps Spanish enterprises run AI workloads, manage sensitive data locally, and adopt hybrid cloud setups that meet industry standards. The added infrastructure also helps organizations transition more easily from legacy systems to modern cloud-native environments. Oracle’s move is reinforcing Spain’s position as a growing technology hub. This reflects the rise of España cloud computing as a key pillar of national digital growth, supported by local investments and regulatory alignment with EU policies.

To get more information on this market Request Sample

Expanding AI-Driven Cloud Investments

Spain is seeing stronger momentum in cloud investment as enterprises seek platforms that can support AI integration, analytics, and real-time processing. Digital transformation across industries, especially telecom, public services, and retail, is pushing the need for faster and more secure cloud-based systems. The shift includes demand for specialized AI tools, model training environments, and infrastructure that meets data residency laws. Cloud providers offering integrated solutions and strong compliance frameworks are increasingly favored in this environment. In June 2024, Microsoft launched its first cloud region in Madrid, supported by a USD 2.1 Billion investment. The initiative aligns with Spain’s digital strategy and is expected to add €10.7 Billion to the national GDP while generating 77,000 jobs by 2030. Microsoft is delivering localized cloud and AI services that meet the operational needs of Spanish companies and government institutions with this development. The new region enables quicker deployment of generative AI applications, secure data cloud storage, and resilient infrastructure for innovation. It also provides cloud access with low latency and better performance for local developers and users. Microsoft’s entry not only strengthens Spain’s digital economy but also highlights a growing trend of AI-focused public cloud market expansion across Southern Europe.

SMEs Turning to Hybrid Cloud for Flexibility

Small and medium-sized businesses across Spain are adopting hybrid and multi-cloud setups. These models give them the flexibility to mix existing on-premise systems with newer cloud infrastructure, without disrupting operations. Local IT providers and consultants are playing a key role by offering customized services that fit the specific needs of these companies. Spanish SMEs prefer this route because it lowers risk and cost while giving them access to scalable resources. Many are also choosing cloud options that let them keep sensitive data local, which helps with compliance. This shift shows how smaller firms are modernizing gradually, choosing practical, manageable steps rather than full cloud overhauls. As part of this transition, the CCaaS market is also drawing attention from businesses seeking modular, cloud-based customer service tools that match their scale and budget.

AI and Analytics Becoming Top Priorities

Cloud investments in Spain are increasingly tied to the demand for advanced analytics and artificial intelligence. Businesses want real-time insights and smarter automation, and cloud platforms are the fastest way to get there. Cloud providers are responding by offering AI-as-a-service tools that can be plugged into existing workflows. This shift is visible in sectors like retail, finance, and healthcare, where customer behavior, risk prediction, and diagnostics all benefit from better data use. Spanish companies aren’t just storing data anymore; they're putting it to work. As more firms recognize the value of AI, demand for market cloud analytics platforms is growing fast.

Local Data Laws Driving Cloud Choices

Data sovereignty has become a major concern for Spanish companies, especially those in regulated sectors. With stricter EU and national rules around where and how data is stored, businesses are making cloud choices based on legal compliance as much as performance. Some are avoiding providers that can’t guarantee data residency in Spain or the EU. This has led to more demand for local data centers and sovereign cloud offerings. Companies want clear control over who can access their data and where it physically resides. As privacy expectations continue to rise, cloud vendors that offer transparency and regulatory alignment have a clear edge in the Spain cybersecurity sector.

Sovereign Cloud Efforts Gaining Momentum

Spain is taking a clear stance on digital independence through sovereign cloud initiatives. A standout example is Virt8ra, the EU’s first sovereign edge cloud platform, which includes Spanish participation. These efforts aim to create a cloud infrastructure that complies fully with European data rules and offers full control over data access and processing. For Spanish institutions, this adds a layer of assurance, especially in sensitive sectors like defense, healthcare, and public services. Sovereign cloud also supports innovation within Europe by reducing reliance on non-EU providers. As governments and companies look for greater data autonomy, Spain is positioning itself as a serious contributor to the region’s SASE market tech ecosystem.

Spain Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component, type, enterprise size, and end user.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Type Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

The report has provided a detailed breakup and analysis of the market based on the type. This includes public cloud, private cloud, and hybrid cloud.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium enterprises.

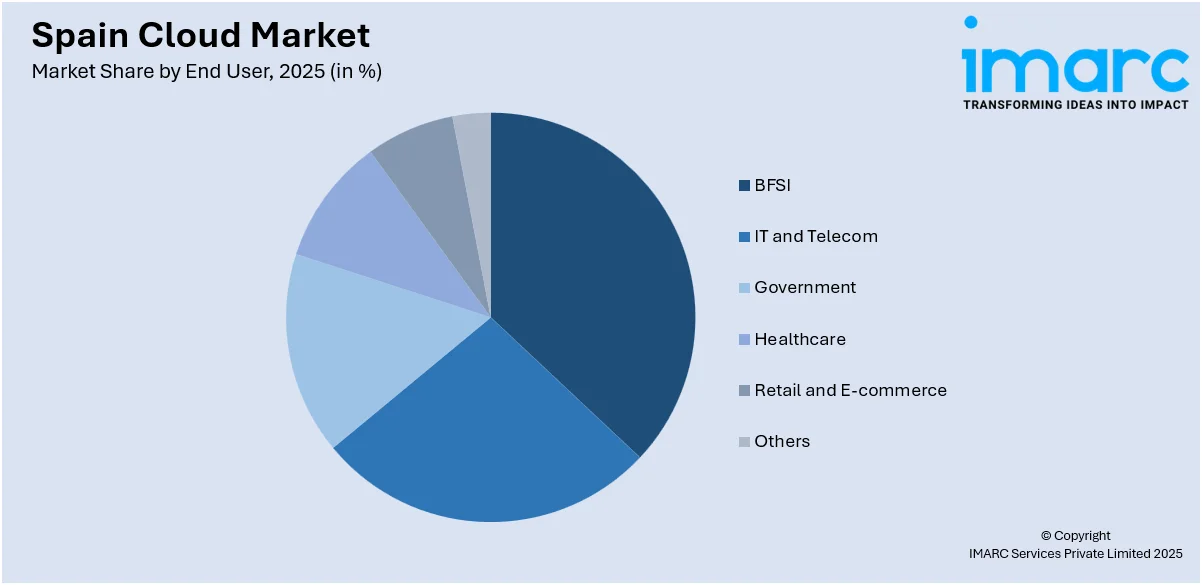

End User Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Healthcare

- Retail and E-commerce

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes BFSI, IT and telecom, government, healthcare, retail and e-commerce, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Cloud Market News:

- May 2025: Evoila opened a new office in Madrid, expanding its European footprint. The move targets Spain's rising demand for cloud technologies, IT security, and automation. Evoila is partnering with Broadcom as a certified VMware Cloud Foundation provider, unlocking direct access to regional clients and projects. Spain's growing reputation for digital innovation and strong economic outlook make it a strategic choice for Evoila’s next phase of cloud-focused growth.

- February 2025: Spain’s OpenNebula Systems led the launch of Virt8ra, the EU’s first sovereign edge cloud. Backed by EUR 3 Billion IPCEI-CIS funding, it enhances cloud independence, supports low-latency applications, and strengthens Europe’s digital sovereignty across six countries, including Spain.

- September 2024: DXC Technology opened a new Center of Excellence in Zaragoza, Spain, to expand AI and cloud adoption. Partnering with AWS, it supports public and private sector modernization, aims to create hundreds of jobs, and strengthens Spain’s position in digital transformation.

- July 2024: Oracle launched a new cloud region in Madrid, strengthening its footprint in Spain’s fast-growing cloud market. According to ISG, this move supports rising demand among European enterprises for cloud and AI solutions aligned with digital transformation, compliance, and sustainability goals. Oracle Cloud Infrastructure now leads hyperscalers in regional presence, while its EU Sovereign Cloud is active in 15 countries, helping firms meet strict EU data residency requirements.

Spain Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT and Telecom, Government, Healthcare, Retail and E-commerce, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain cloud market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud market was valued at USD 6.4 Billion in 2025.

The Spain cloud market is projected to exhibit a CAGR of 19.00% during 2026-2034, reaching a value of USD 30.5 Billion by 2034.

The Spain cloud market is expanding due to strong digital transformation across sectors like finance, healthcare, and manufacturing, rising hybrid and multi-cloud adoption, major hyperscaler data center investments (AWS, Microsoft, Oracle) backed by low energy costs and strategic location, government initiatives (Digital Spain 2025), and growing AI/IoT integration.

Spain’s IT market is growing steadily, driven by digital transformation, cloud adoption, AI integration, and cybersecurity demand. Government initiatives, foreign investment, and skilled talent contribute to expanding infrastructure, especially in sectors like finance, healthcare, retail, and public administration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)